ID: PMRREP32328| 215 Pages | 6 Jan 2026 | Format: PDF, Excel, PPT* | Food and Beverages

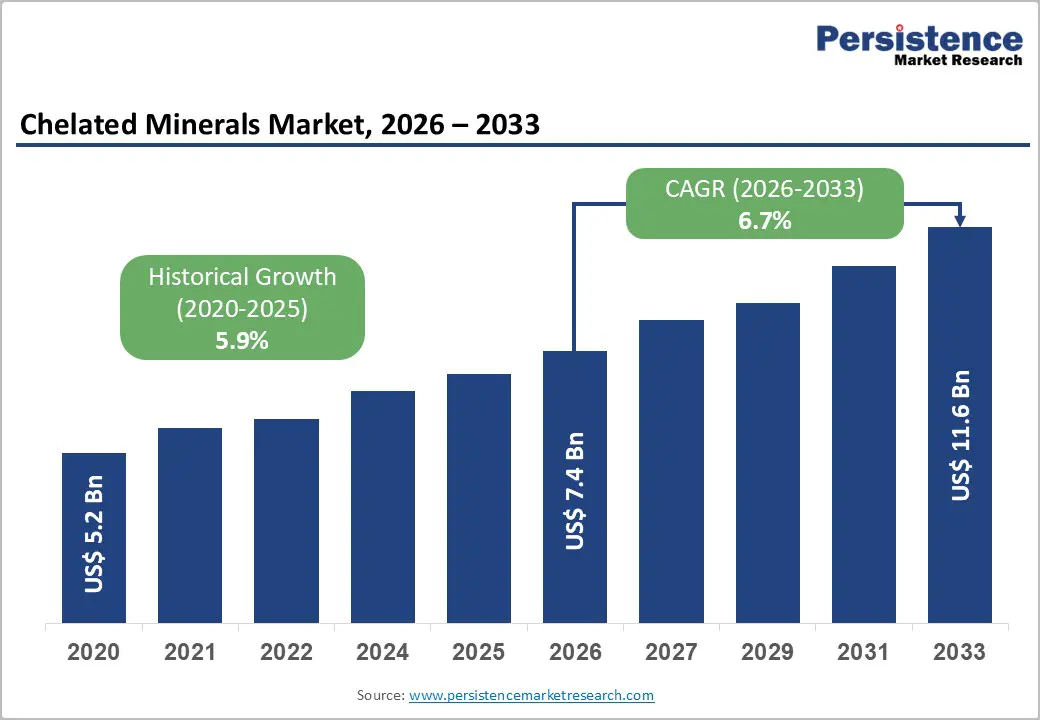

The Global Chelated Minerals Market size was valued at US$7.4 billion in 2026 and is projected to reach US$11.6 billion by 2033, growing at a CAGR of 6.7% between 2026 and 2033. Market expansion is fundamentally driven by escalating awareness of bioavailability advantages over conventional mineral sources, accelerating demand for precision animal nutrition formulations, and intensifying regulatory emphasis on feed safety and nutritional efficacy.

The Chelated Minerals Market demonstrates sustained growth momentum as livestock producers, human nutrition manufacturers, and pharmaceutical formulators increasingly recognize that chelated mineral complexes deliver superior absorption rates while simultaneously reducing environmental contamination risks associated with mineral excretion.

| Key Insights | Details |

|---|---|

| Chelated Minerals Market Size (2026E) | US$ 7.4 Bn |

| Market Value Forecast (2033F) | US$ 11.6 Bn |

| Projected Growth (CAGR 2026 to 2033) | 6.7% |

| Historical Market Growth (CAGR 2020 to 2025) | 5.9% |

Growth Drivers

Chelated mineral complexes demonstrate scientifically validated bioavailability advantages substantially exceeding conventional inorganic mineral sources, establishing fundamental competitive differentiation within the Market.

Research demonstrates that chelated minerals exhibit 2-3 times higher bioavailability compared to non-chelated equivalents, with amino acid chelates and proteinate complexes achieving bioavailability improvements through protective encapsulation mechanisms that shield minerals from dietary inhibitors, including phytates, phosphates, and hydroxide compounds that ordinarily render minerals unavailable for absorption.

The chelation process attaches minerals to organic ligands amino acids, peptides, polysaccharides, or protein hydrolysates creating stable complexes with enhanced water and lipid solubility, enabling absorption across variable pH environments encountered throughout the gastrointestinal tract. Scientific validation published in peer-reviewed research indicates that zinc bisglycinate demonstrates 10-fold greater bioaccessibility in gastric environments and 5-fold superiority in intestinal absorption compared to zinc oxide, establishing quantifiable performance differentiation that justifies premium pricing within the Chelated Minerals Market.

This bioavailability advantage translates directly into improved nutrient utilisation, reduced mineral wastage, and enhanced metabolic functionality, creating a compelling value proposition for manufacturers formulating human nutrition, animal feed, and pharmaceutical applications where absorption efficiency directly influences therapeutic efficacy.

Flexible wearable electronic sensors enabling real-time monitoring of physiological parameters, including heart rate, blood glucose, respiration, and muscle movement, with non-invasive skin-adhered sensors that users can comfortably wear continuously without the device degradation or skin irritation experienced with rigid alternatives. This healthcare imperative directly translates to sustained demand for stretchable sensor technologies, flexible power solutions, and advanced wearable form factors that balance monitoring capability with user comfort and acceptance.

Consumer demand for high-efficacy dietary supplements and fortified nutritional products has catalysed the rapid expansion of chelated mineral applications within human nutrition and digestive health formulations, with dietary supplements representing the fastest-growing end-use segment within the Chelated Minerals Market.

Chelated mineral formulations address critical mineral deficiency challenges where conventional oxide and carbonate supplements demonstrate inadequate absorption, creating enhanced health outcomes in digestive health support, immune function optimisation, enzyme activity support, and gut barrier integrity maintenance. Scientific research demonstrates that chelated zinc, iron, magnesium, and calcium formulations improve nutrient absorption while simultaneously reducing gastrointestinal side effects such as nausea, constipation associated with conventional mineral supplementation, enabling consumer adoption among sensitive populations and driving repeat purchase behaviour within premium supplement market segments. The emerging personalised nutrition and functional foods segment demonstrates pronounced receptivity to chelated mineral formulations commanding 30-50% price premiums relative to conventional alternatives, validating consumer willingness to pay for documented efficacy improvements.

Regulatory approvals across major jurisdictions including European Food Safety Authority (EFSA) authorization of iron milk caseinate and magnesium L-threonate as novel food ingredients establish credibility foundations that accelerate adoption within regulated nutritional product categories within the Market.

Market Restraining Factors

Development of proprietary chelation technologies, validation of bioavailability claims, and achievement of regulatory compliance across diverse jurisdictions impose substantial R&D costs and manufacturing infrastructure investments that create barriers to market entry within the Chelated Minerals Market. Quality assurance requirements mandate advanced analytical testing, including HPLC (high-performance liquid chromatography), atomic absorption spectroscopy, and chelation assay validation to confirm mineral content, chelation stability, and bioavailability characteristics, substantially elevating manufacturing costs relative to conventional mineral supplement production.

Regulatory approval processes require scientific documentation of efficacy, safety profiles, and manufacturing consistency, necessitating clinical studies, stability testing, and supply chain documentation that extend product development timelines by 2-5 years and increase capital requirements.

Smaller manufacturers, unable to absorb these compliance costs, face competitive disadvantages relative to multinational organisations with established quality infrastructure, effectively consolidating market share concentration within the Chelated Minerals Market among better-capitalised competitors.

Key Market Opportunities

The Chelated Minerals Market demonstrates emerging opportunities within functional digestive health supplements integrating chelated minerals with complementary functional ingredients such as sodium butyrate, probiotics, and prebiotic fibers to create synergistic health benefits addressing gastrointestinal dysfunction, nutrient malabsorption, and immune dysregulation. Research demonstrates that chelated zinc and magnesium formulations enhance intestinal barrier integrity through tight junction protein optimisation and support mucosal immune function through enhanced absorption and localised bioavailability, creating a therapeutic value proposition differentiated from conventional mineral supplementation.

Strategic manufacturers investing in clinical research substantiation and functional ingredient partnerships can capture expanding digestive health market opportunities where consumers demonstrate pronounced willingness to invest in comprehensive gastrointestinal wellness solutions.

The development of condition-specific formulations addressing leaky gut syndrome, irritable bowel syndrome, and inflammatory bowel conditions creates opportunities to establish premium market positioning and build loyalty within health-conscious consumer segments seeking evidence-based solutions to functional digestive challenges. Within the Chelated Minerals Market, integration of digestive health applications represents an emerging revenue stream with limited current competitive saturation, establishing first-mover advantage potential for organisations investing in clinical validation and consumer education initiatives.

Regulatory frameworks across North America and European jurisdictions increasingly mandate organic certification, sustainable sourcing, and environmental impact reduction within animal feed and food supplement applications, creating a competitive opportunity for manufacturers developing certified sustainable chelation processes and ethical supply chains within the Chelated Minerals Market. European regulatory developments, including EU Deforestation Regulation compliance requirements and RSPO (Roundtable on Sustainable Palm Oil) certification mandates, create market preference for manufacturers demonstrating supply chain transparency and environmental stewardship commitment.

Manufacturers establishing certified organic chelation processes, implementing sustainable mineral sourcing practices, and developing carbon-neutral production methodologies can command premium pricing while simultaneously ensuring long-term regulatory compliance and market access protection. Within the Market, the emerging sustainability premium positioning differentiates commodity-focused competitors while enabling value-capture among environmentally conscious institutional buyers and premium consumer segments willing to invest in sustainably produced nutritional products.

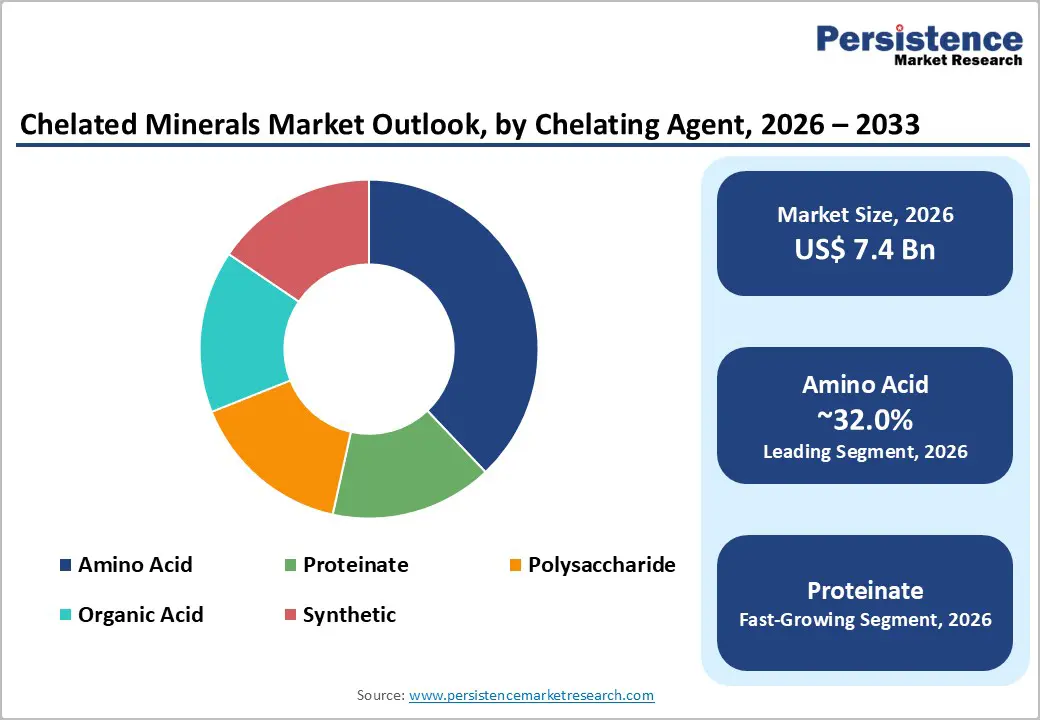

Amino acid chelated minerals command a dominant market share of around 32%, positioning within the Market due to cost-effectiveness advantages, established manufacturing scalability, and comprehensive research validation demonstrating superior bioavailability relative to conventional mineral sources. Amino acid chelation involves the formation of coordinate covalent bonds between mineral ions and amino acids such as glycine, methionine, lysine, and histidine, creating stable complexes with molecular weights not exceeding 800 Daltons that enable efficient intestinal absorption and cellular uptake.

The amino acid segment dominates due to multiple strategic advantages: reduced acid concentration requirements enabling lower manufacturing costs, enhanced crop yields in agricultural applications, extended shelf-life characteristics, and diminished pesticide residues compared to alternative chelating agents.

Proteinate chelated minerals, wherein mineral ions complex with partially hydrolysed protein sources represents fastest-growing segment within the Chelated Minerals Market due to emerging evidence demonstrating superior bioavailability, enhanced consumer acceptance of protein-based formulations, and application suitability in premium functional food and pharmaceutical formulations.

Animal feed applications command a dominant share of around 35% end-use positioning within the Chelated Minerals Market, reflecting livestock production expansion, increasing feed efficiency requirements, and regulatory mandates for precision trace mineral supplementation supporting animal health and productivity optimisation.

Regulatory frameworks, including FDA guidance on trace minerals in animal feeds and EFSA feed additive authorisation requirements, establish mandatory mineral bioavailability standards that effectively mandate chelated mineral adoption in premium feed formulations. Quality control requirements, including validation of mineral content, prevention of feed additive fraud through advanced analytical testing, and traceability compliance throughout supply chains, have elevated competitive positioning for manufacturers with advanced quality assurance capabilities, establishing structural advantages within the Market for industry leaders, including Zinpro, Alltech, and DSM Nutritional Products.

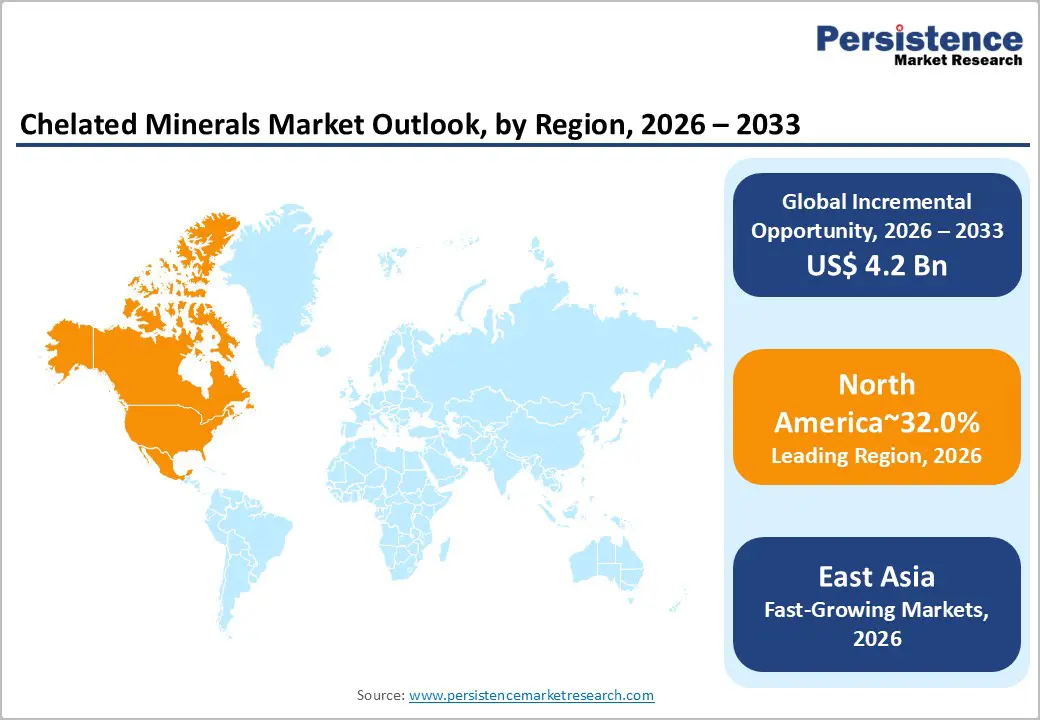

North America commands 32% of global Chelated Minerals Market share, reflecting the region's leadership in intensive livestock agriculture, advanced nutritional science infrastructure, and regulatory frameworks establishing stringent trace mineral requirements within animal feed and human nutrition products. The United States represents the largest North American market component, characterized by highly concentrated livestock operations requiring precision mineral supplementation and established consumer preferences for science-validated dietary supplements commanding premium pricing relative to global markets.

The region's regulatory environment establishes world-leading standards for feed additive safety and efficacy validation through FDA oversight of animal feed mineral content, bioavailability substantiation requirements, and traceability systems designed to prevent feed contamination and product adulteration. North American livestock operations have systematically integrated chelated mineral supplementation as standard practice, recognising that feed conversion efficiency improvements and animal health optimization directly impact profitability in intensive production environments. Industry leadership in precision livestock nutrition has established North America as innovation hub within the Chelated Minerals Market, with major R&D investments by companies including Zinpro, Alltech, and DSM focused on advancing chelation technology and validating bioavailability claims through rigorous scientific research.

East Asia represents 22% of global Chelated Minerals Market share with pronounced growth potential exceeding mature market trajectories, reflecting region-specific factors including rapid livestock production expansion, rising meat and dairy consumption, and increasing adoption of advanced feed formulation technologies aligned with intensive animal agriculture practices. China and India represent particularly significant opportunity markets within the Chelated Minerals Market, as accelerating urbanization, rising middle-class demographics, and consumption pattern evolution toward protein-rich diets drive increased livestock production output and corresponding mineral supplementation demand.

Regulatory harmonization with international standards is progressively occurring across East Asian jurisdictions, establishing favorable operating environment for multinational suppliers with established quality assurance systems. Investment in regional manufacturing capacity and distribution infrastructure by global suppliers indicates confidence in sustained growth prospects, while emerging regional competitors are progressively establishing positions through localised product development and competitive pricing strategies within the Chelated Minerals Market. Early market penetration during growth phase positions organizations to establish brand loyalty foundations and competitive moats ahead of market maturation.

Europe commands 28% of the global Chelated Minerals Market share, characterised by stringent regulatory frameworks, premium product positioning, and pronounced emphasis on sustainable sourcing and environmental impact reduction within animal feed and human nutrition applications. European regulatory environment, through EFSA oversight and EU feed additive authorisation requirements, establishes the world's most comprehensive performance standards for chelated mineral products, including mandatory bioavailability validation, safety documentation, and supply chain traceability requirements.

The European livestock industry's emphasis on reduced-input production systems and environmental sustainability has elevated the importance of feed efficiency optimisation through enhanced mineral bioavailability, creating sustained demand acceleration for premium chelated formulations. Market concentration among multinational suppliers with established regulatory compliance infrastructure and sustainability credentials creates competitive barriers limiting emerging competitor market access within the Chelated Minerals Market, while established players maintain market leadership through continuous innovation and regulatory expertise.

The Global Chelated Minerals Market exhibits a moderately consolidated, oligopolistic structure, dominated by a few large multinational players with extensive R&D, production, and distribution capabilities. Archer Daniels Midland (ADM), Cargill, Inc., BASF SE, Koninklijke DSM N.V., Alltech, Inc., and Kemin Industries, Inc. lead the market with broad product portfolios and strong presence across animal nutrition and human supplements. These companies leverage proprietary formulations, validated chelation technologies, and regulatory compliance to maintain competitive advantages. While smaller and regional players like Zinpro Corporation and Novus International, Inc. add innovation and niche solutions, the top players largely influence pricing, quality standards, and technological advancements.

The global Chelated Minerals Market is projected to be valued at US$ 7.4 Bn in 2026.

Amino Acid Segment is expected to account for approximately 32% of the global Chelated Minerals Market by Chelating Agent in 2026.

The market is expected to witness a CAGR of 6.7% from 2026 to 2033.

The Chelated Minerals Market growth is driven by superior bioavailability and absorption efficiency of chelated minerals, rising demand in dietary supplements and human nutrition, and regulatory approvals enabling premium, high-efficacy formulations.

Key market opportunities in the Chelated Minerals Market lie in functional and therapeutic mineral formulations for digestive health applications and sustainable, organically sourced chelated minerals enabling premium positioning and regulatory compliance.

The key players in the Chelated Minerals Market include Archer Daniels Midland (ADM), Cargill, Inc., BASF SE, Koninklijke DSM N.V., Alltech, Inc., and Kemin Industries, Inc.

| Report Attribute | Details |

|---|---|

| Forecast Period | 2026 to 2033 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value |

| Region Covered |

|

| Key Companies Covered |

|

| Report Coverage |

|

By Chelating Agent

By Mineral Source

By End Use Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author