ID: PMRREP21775| 210 Pages | 24 Dec 2025 | Format: PDF, Excel, PPT* | Energy & Utilities

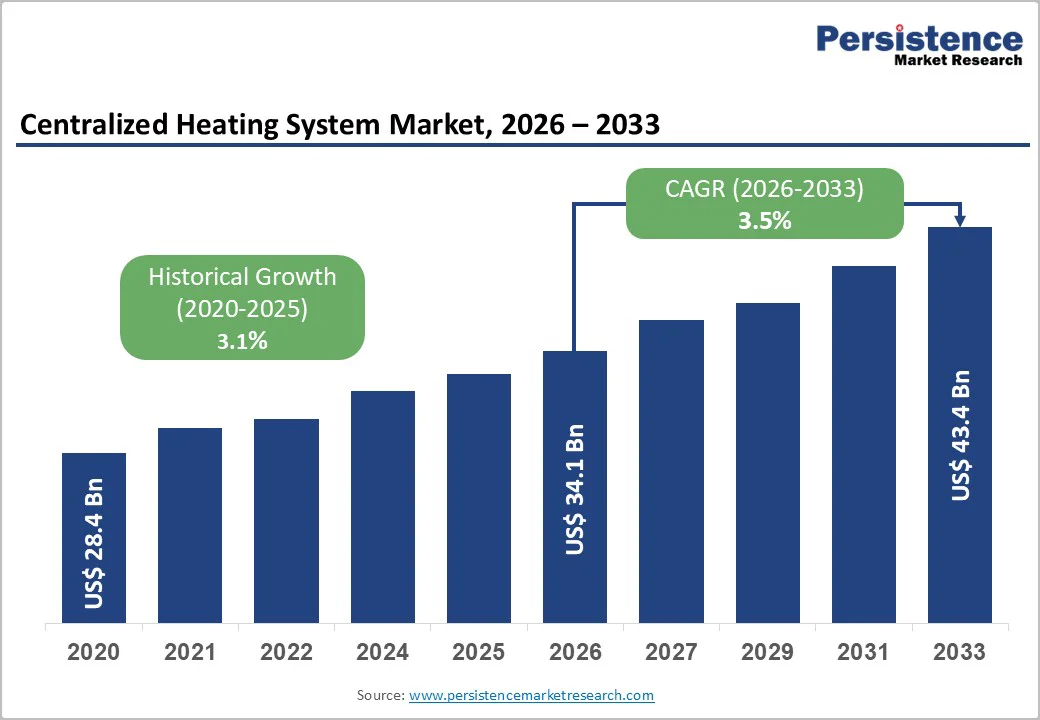

The global centralized heating systems market size is likely to be valued at US$ 34.1 billion in 2026, and is projected to reach US$ 43.4 billion by 2033, growing at a CAGR of 3.5% during the forecast period 2026-2033. This growth trajectory reflects sustained demand for energy efficient heating solutions, accelerated urban infrastructure development, and policy momentum toward sustainable heat generation. The core growth drivers include environmental regulations, technological innovation in boiler systems, and rising demand across residential and commercial end use sectors, shaping long term market resilience.

| Report Attribute | Details |

|---|---|

|

Centralized Heating System Market Size (2026E) |

US$ 34.1 Bn |

|

Market Value Forecast (2033F) |

US$ 43.4 Bn |

|

Projected Growth (CAGR 2026 to 2033) |

3.5% |

|

Historical Market Growth (CAGR 2020 to 2025) |

3.1% |

The government-led decarbonisation in 2025, mandates and long-term funding commitments have seemingly strengthened the demand for centralized heating systems, particularly across Europe and the U.K. At the European Union (EU) level, the discontinuation of financial incentives for new standalone fossil fuel boilers from January 2025 has redirected public funding toward hybrid, renewable, and network-based heating solutions, reinforcing centralized systems as compliance-ready infrastructure for large residential and commercial buildings. This regulatory shift aligns with Europe’s long-term objective of achieving a climate-neutral building stock by 2050, where centralized and low-carbon heat delivery plays a critical role.

In the U.K., market momentum is being underpinned by a £ 6 billion capital funding package allocated for 2025–2028, announced as part of the government’s building decarbonisation strategy. Within this, the £485 million Green Heat Network Fund is specifically designed to support the development and retrofit of low-carbon heat networks, enabling up to 60,000 homes and buildings to access centralized heating. Complementing this, regulatory reforms introduced in May 2025 removed key planning barriers for heat pump installations, coinciding with a 56% year-on-year increase in Boiler Upgrade Scheme activity in H1 2025. These sustained funding visibility and regulatory simplification are structurally accelerating investment in centralized, low-carbon heating infrastructure across residential and commercial segments.

The deployment of centralized heating systems continues to face resistance primarily due to high upfront capital requirements linked to network construction, heat generation assets, and system integration. In practical terms, centralized and district heating projects typically require capital investments of approximately €4,000–€8,000 per connected dwelling, depending on network density and heat source configuration. Heat distribution piping alone accounts for nearly 40–60% of total project costs, while the installation of underground heat networks in urban European projects approved during 2024–2025 commonly exceeds €1 million per kilometer, excluding heat generation plants and digital control systems. These cost structures materially exceed the upfront investment required for decentralized heating alternatives, creating adoption resistance among private developers and municipalities operating under constrained budgets or shorter payback expectations.

A large installed base of centralized systems remains exposed to fossil fuel price volatility, particularly natural gas. In 2025, European gas prices continue to remain structurally elevated compared to pre-2020 levels, while carbon pricing mechanisms under emissions trading schemes add further cost pressure to fossil-fuel-based heat generation. For system operators and municipal buyers, especially in markets with regulated heat tariffs, this combination of price volatility and regulatory cost escalation introduces financial uncertainty. As a result, reliance on non-renewable energy sources not only elevates compliance risk but also slows investment decisions, constraining the pace of large-scale centralized heating adoption until renewable integration becomes more economically predictable at scale.

In 2025, centralized heating systems benefited from clear policy decisions that actively promoted renewable and hybrid heat integration. At the EU level, the revised Renewable Energy Directive (RED III) requires member states to increase the share of renewable energy in heating and cooling by at least 1.1 percentage points annually through 2030, explicitly recognizing district and centralized heating networks as key delivery mechanisms. In parallel, the updated Energy Performance of Buildings Directive (EPBD) mandates lower-emission heating solutions in new and renovated large buildings, accelerating the adoption of centralized systems capable of integrating biomass, geothermal, solar thermal, and waste heat at scale.

The aging heat infrastructure across Europe and North America offers a substantial retrofit-driven growth opportunity for centralized heating systems. Many district networks installed before 1990 operate at higher temperatures with lower efficiency, prompting policy-backed modernization efforts in 2025. Public funding and municipal investment programs target network upgrades, condensing boiler replacement, digital control deployment, and low-temperature conversion to meet stricter efficiency and emissions standards. In the U.K., Heat Network Zones under the Energy Act mandate selected buildings to connect to low-carbon networks, accelerating retrofit and expansion activity. Across Europe and North America, decarbonisation strategies now prioritize upgrading existing networks, creating sustained demand for modernized, energy-efficient centralized heating solutions.

Condensing combination boilers are projected to lead with an estimated 32% of the centralized heating systems market revenue share in 2026, driven by strong energy performance and dual heating/hot water functionality. A notable 2025 launch is the Viessmann Vitodens 025 W combi boiler, introduced for tight fit residential applications, offering up to 98% seasonal efficiency and class A energy rating, which supports lower operating costs and compliance with emission norms. This new boiler’s small footprint and integrated hot water capability make it compelling for multi unit residential and renovation projects where space and performance both matter. Its 24–28 kW outputs suit light commercial and larger residential segments alike. The continuous innovation in this category reinforces its dominant position as building owners prioritize efficiency, regulatory compliance, and reliability.

System boilers are expected to register the highest CAGR of 5.2% through 2033, supported by demand in larger buildings and commercial spaces that require robust integrated heating infrastructure. The manufacturers have responded with expanded system boiler platforms featuring enhanced digital control interfaces and modular integration, enabling improved energy analytics and remote operation, key requirements in larger residential complexes and institutional projects. These platforms are increasingly specified where scalability and performance consistency are critical, especially in smart building infrastructures that align with sustainability targets. As energy codes tighten and demand for integrated system solutions grows, system boilers’ advanced functionality supports accelerating adoption across broader product portfolios.

Gas heating systems are poised to retain the largest source share at approximately 38% in 2026, supported by entrenched gas infrastructure in Europe and North America and continued commercial and residential reliance for peak load support. Gas boilers represent a major portion of installed heating capacity in mature markets, and product updates from the past year focused on low emissions and high efficiency gas technologies to meet stricter local emissions standards without compromising performance. Innovations such as expanded low NOx gas boiler lines enable centralized systems to deliver compliance oriented performance while utilizing existing energy networks. These developments sustain gas heating’s leading role, particularly where grid gas remains the most accessible, cost predictable solution and where hybrid systems combine gas with complementary renewables for transitional decarbonisation.

Renewable and environmental heating sources are forecast to grow at a 6.8% CAGR through 2033, driven by emissions reduction policies and decarbonisation targets. In 2025, the European Commission awarded a €13.5 million grant to Mijnwater Warmte Infra B.V. in the Netherlands to significantly expand its sustainable district heating and cooling network, which repurposes geothermal resources and deep mine tunnel heat storage to supply clean heat to thousands of connections and displace fossil fuel use. This project, backed by the Just Transition Mechanism and the European Investment Bank, exemplifies how centralized renewable heat sources attract investment and scale infrastructure that would otherwise be cost prohibitive.

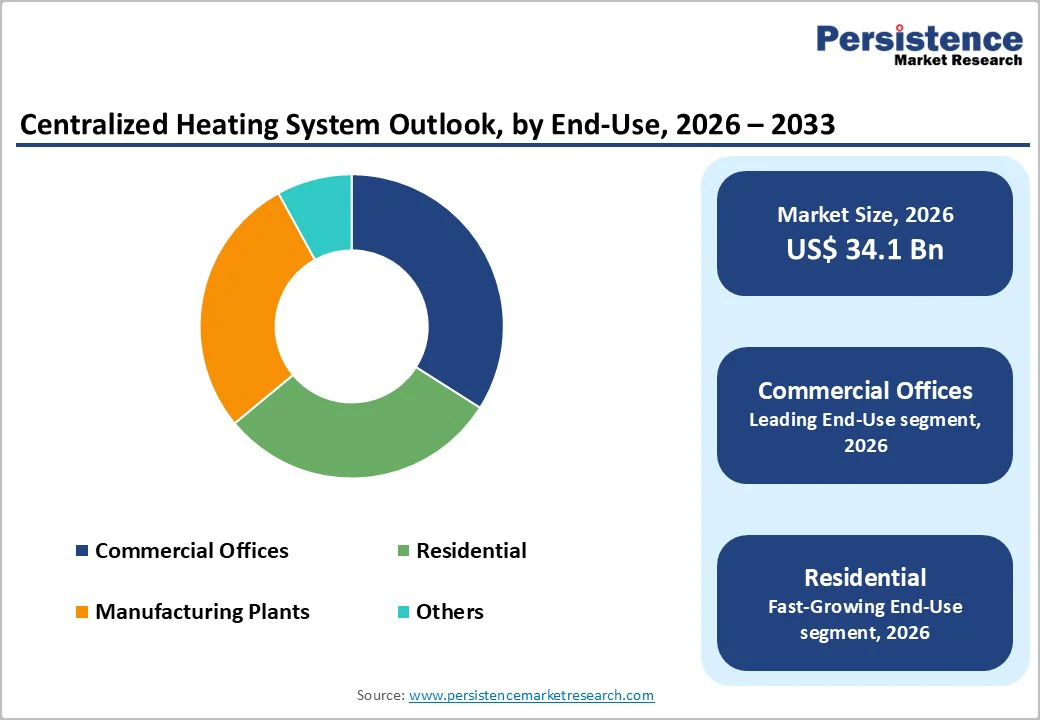

Commercial offices and institutional buildings are projected to command approximately 34% of the end use revenue share in 2026, driven by high occupancy heating loads, stringent energy codes, and long term infrastructure planning. These facilities increasingly adopt systems that integrate advanced control and monitoring to support building energy management strategies, reduce lifecycle costs, and meet sustainability benchmarks. Large office campuses and mixed use developments prioritize centralized heating platforms that can interface with digital analytics and optimize performance across peak and off peak conditions. The scalability and operational stability of centralized systems make them especially attractive for landlords and facility managers focused on long term asset performance.

The residential segment is expected to grow at an estimated 6.1% CAGR through 2033, buoyed by urban housing expansion, renovation projects, and enhanced financing options. In 2025, enhanced government financial support such as Boiler Upgrade Scheme grants of up to £ 7,500 for low carbon heating installations has bolstered residential uptake of efficient heating solutions. This has stimulated interest in hybrid and renewable ready configurations in multi unit residential projects, where centralized heating combined with heat pumps or efficient boilers delivers reduced operating costs and improved thermal comfort. Strong growth in this segment reflects broader shifts toward sustainable living spaces and policy alignment with net zero commitments.

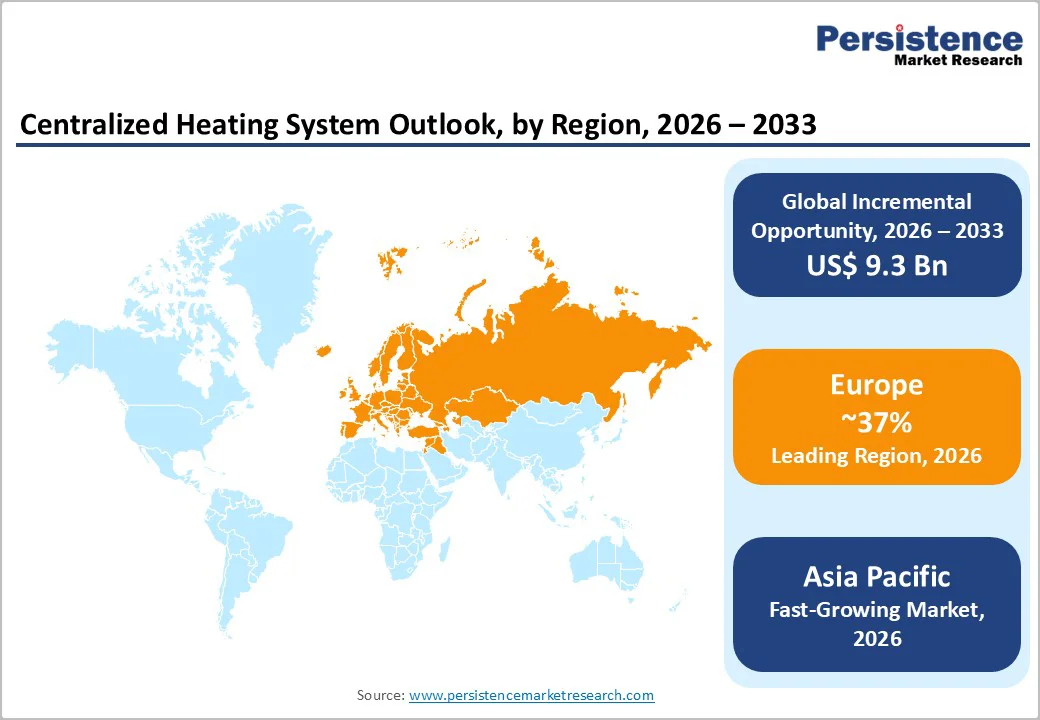

North America is expected to continue its hold a substantial portion of the centralized heating systems market share in 2026. The federal and state policies have notably supported energy efficiency upgrades that benefit centralized systems. For example, in 2025, the New York State Energy Research and Development Authority (NYSERDA) announced a US$ 5 million initiative to support innovative clean energy solutions, including ground source heat pumps and hybrid heating systems, creating early stage demand for integrated, centralized clean heat technologies. Such funding enables pilot deployments and performance demonstrations that help justify broader centralized heating investments.

The incentive frameworks under the federal Energy Efficient Home Improvement Credit (Section 25C), providing up to 30% tax credits for qualifying upgrades through 2025, are encouraging property owners and developers to adopt high efficiency and hybrid heating solutions that can be integrated into centralized architectures. These financial measures are complemented by local utility rebate programs in key states that lower effective equipment and integration costs. Increasing collaboration between utilities, technology providers, and local governments around smart control systems and predictive maintenance is streamlining deployment. With strong policy support and rising retrofit activity in commercial and multi family residential projects, North America maintains stable demand and a resilient growth outlook through 2033.

Europe is poised to capture a dominating 37% of the centralized heating systems market revenues in 2026, underpinned by extensive district heating networks and robust policy frameworks. A key development includes the European Commission (EC)’s launch of the LIFE 2025 funding call, which offers up to 95% co funding for innovative low carbon district heating and cooling projects that integrate renewable energy, waste heat valorization, and digital system optimization. This substantial funding pool, part of a broader € 600 million clean energy transition effort, is directly mobilizing investment in advanced centralized heating technologies and scalable solutions across member states.

At the national and local levels, governments are also catalyzing adoption through targeted support and planning mandates. In Slovenia, for instance, a € 43.5 million EU Cohesion Fund allocation was approved in mid 2025 to co finance construction and restructuring of renewable energy based district heating systems, increasing the share of clean heat in community supply. Combined with regulatory frameworks such as the Renewable Energy Directive and the Energy Performance of Buildings Directive, these initiatives accelerate the deployment and retrofit of centralized heating networks across Europe. Competitive innovation is centered on renewable heat integration, network electrification, and advanced energy management tools, sustaining Europe’s position as the market leader in both adoption scale and policy driven transformation.

Asia Pacific is emerging as the fastest growing regional market, supported by rapid urbanization, infrastructure investment, and government initiatives emphasizing energy efficiency. The district heating pipeline network market in China, a key regional driver, is among the fastest expanding globally, contributing to the centralized heating systems market growth. National policies, such as the heat pump expansion mandates introduced by the Chinese State Council and broader heat pump action plans, are accelerating clean heating deployment and supporting centralized solutions that integrate renewable sources.

India and Southeast Asian economies are also enhancing urban heating infrastructure as part of smart city and energy efficiency programs, driving broader adoption of centralized heating systems in residential and commercial developments. Domestic manufacturing advantages and lower production costs strengthen the competitive position of Asia Pacific, attracting foreign partnerships and technology transfer. Expanding district heating in colder northern regions and emerging renewable heat projects contribute to a dynamic, high growth landscape. Combined with supportive policy frameworks and infrastructure modernization, Asia Pacific stands out as the fastest growing regional market for centralized heating solutions in the medium to long term.

The global centralized heating systems market structure is moderately consolidated, with leading players such as Viessmann, Bosch Thermotechnology, Ariston Thermo, Daikin, and Vaillant holding nearly 45–50% of market revenue in 2025. These companies leverage extensive distribution networks and integrated product-service offerings, spanning condensing boilers, hybrid systems, and renewable heat solutions. The continuous R&D investments ensure leadership in high-efficiency systems, smart controls, and IoT-enabled energy management. Established relationships with utilities and commercial developers enhance deployment capabilities. Their focus on compliance and performance optimization sustains competitive advantage in both residential and commercial sectors.

Regional and niche players, including Nibe, Mitsubishi Electric, and Grundfos, target specialized segments like district heating, heat pumps, and low-carbon solutions. High infrastructure costs and system integration complexity remain barriers for new entrants. Digitalization trends, such as cloud monitoring and predictive maintenance, allow software-centric firms to collaborate via integration partnerships. Market consolidation is expected to increase as global leaders pursue strategic acquisitions and geographic expansion. Focus on renewable integration and smart energy management continues to shape competitive dynamics.

The global centralized heating systems market is projected to reach US$ 34.1 billion in 2026.

Government incentives for energy efficiency, decarbonisation policies, infrastructure modernization, and growing adoption of smart and hybrid heating technologies across residential and commercial sectors are driving the market.

The market is poised to witness a CAGR of 3.5% from 2026 to 2033.

Retrofitting aging heat networks, integrating renewable energy sources, hybrid heating systems, and digital smart control solutions driven by regulatory mandates and public funding programs can generate excellent opportunities.

Viessmann, Bosch Thermotechnology, Ariston Thermo, Daikin, Vaillant, Nibe, Mitsubishi Electric, and Grundfos are some of the key players in the market.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 – 2025 |

|

Forecast Period |

2026 – 2033 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Source

By End-Use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author