ID: PMRREP35160| 197 Pages | 16 Jul 2025 | Format: PDF, Excel, PPT* | Food and Beverages

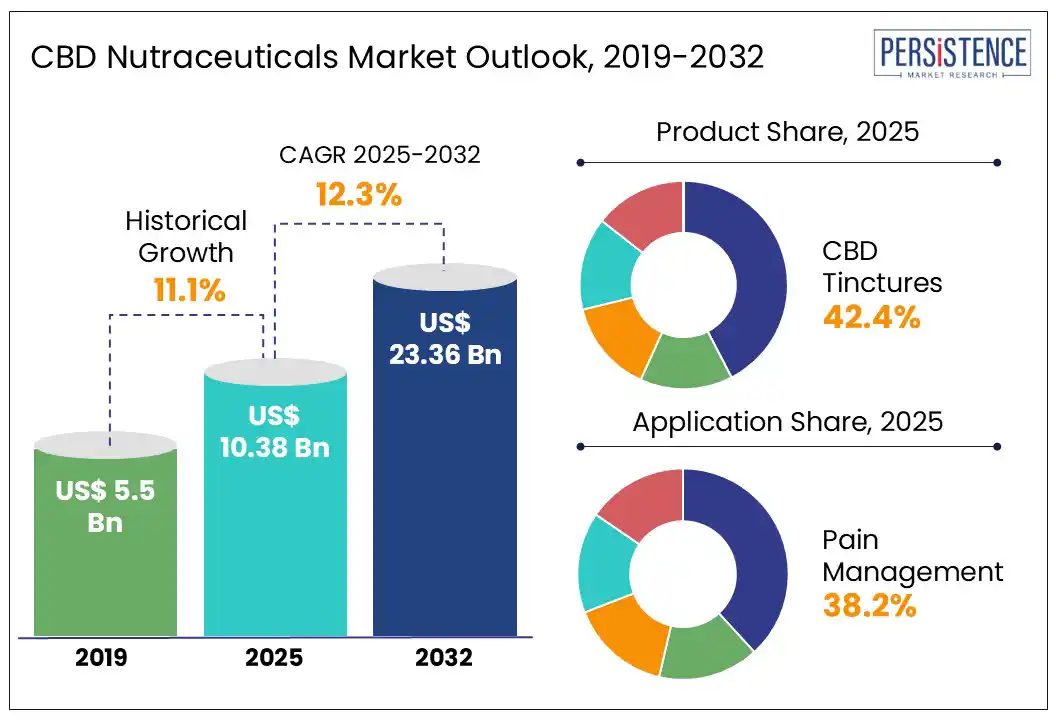

The global CBD nutraceuticals market size is likely to be valued at US$ 10.4 Bn in 2025 and is estimated to reach US$ 23.4 Bn in 2032, at a CAGR of 12.3% during the forecast period 2025 - 2032.

CBD nutraceuticals represent a rapidly growing segment within the wellness industry and are gaining immense popularity among various stakeholders. These products combine the therapeutic benefits of cannabidiol (CBD) with the nutritional value of supplements. Ranging from CBD-infused capsules, gummies, and beverages to topical applications, these products are designed to support overall health, relieve stress, improve sleep quality, and manage pain without the psychoactive effects of THC. The market is also witnessing innovations in product formats, delivery mechanisms, and targeted formulations, positioning CBD nutraceuticals as a favored component in the functional health products space. The CBD nutraceuticals market growth is driven by increasing consumer awareness of natural wellness solutions offered by CBD, favorable regulatory shifts, and the growing acceptance of cannabidiol as a mainstream health supplement.

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

CBD Nutraceuticals Market Size (2025E) |

US$ 10.4 Bn |

|

Market Value Forecast (2032F) |

US$ 23.4 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

12.3% |

|

Historical Market Growth (CAGR 2019 to 2024) |

11.1% |

A prominent driver for the CBD nutraceuticals market growth is the rapid evolution of CBD delivery methods. Innovations in formulation and delivery technologies are making CBD more accessible, effective, and user-friendly. From fast-acting oral solutions to more convenient forms, these advancements are improving bioavailability and enhancing the overall consumer experience. As wellness-conscious consumers increasingly seek personalized and efficient health solutions, the development of novel CBD delivery systems is playing a pivotal role in expanding market reach and driving sustained growth. This trend reflects a broader shift toward innovation-led differentiation in the competitive landscape of CBD nutraceuticals.

The CBD nutraceuticals market is likely to experience restrained growth due to lack of clear and consistent regulatory frameworks across global markets. Regulatory ambiguity, mainly observed around labeling, dosage, and health claims, continues to hinder broader adoption by consumers and investments by companies. This uncertainty has created barriers for manufacturers, stymied product innovation, and eroded consumer trust. Concerns about the quality of CBD products among consumers present another challenge for the market.

Plant-based CBD solutions are becoming increasingly popular as consumers opt for natural remedies over traditional medications. A global trend toward functional foods and supplements has spurred innovation in CBD-infused goods, including drinks, gummies, and capsules, to meet a range of customer demands, as per Glanbia Nutritionals. A study published by Harvard Health highlights a growing interest in cannabinoids beyond CBD, such as cannabigerol (CBG) and cannabinol (CBN). These compounds are being explored for their potential anti-inflammatory and neuroprotective benefits. This scientific support helps boost consumer confidence, leading to greater adoption of CBD nutraceuticals. Increased investments in clinical research and product innovation are opening up possibilities for the development of plant-based CBD products.

By application, the CBD nutraceutical market segments include pain management, sleep support, skin health & beauty, and workout supplements. In 2025, pain management is projected to dominate the application segment of the CBD nutraceuticals market, holding a 38.2% share. The rising prevalence of chronic pain conditions such as arthritis and migraines, is fueling the demand for specialized supplements and therapies.

According to the Centers for Disease Control and Prevention (CDC), an estimated 51.6 million U.S. adults suffer from chronic pain, increasing the need for natural and alternative pain management solutions. The preference for non-pharmaceutical approaches, including herbal supplements, CBD-based products, and functional foods, is driving market expansion. Advancements in formulation technologies are enhancing the efficacy and bioavailability of pain relief supplements, boosting their adoption among consumers seeking safer, long-term solutions.

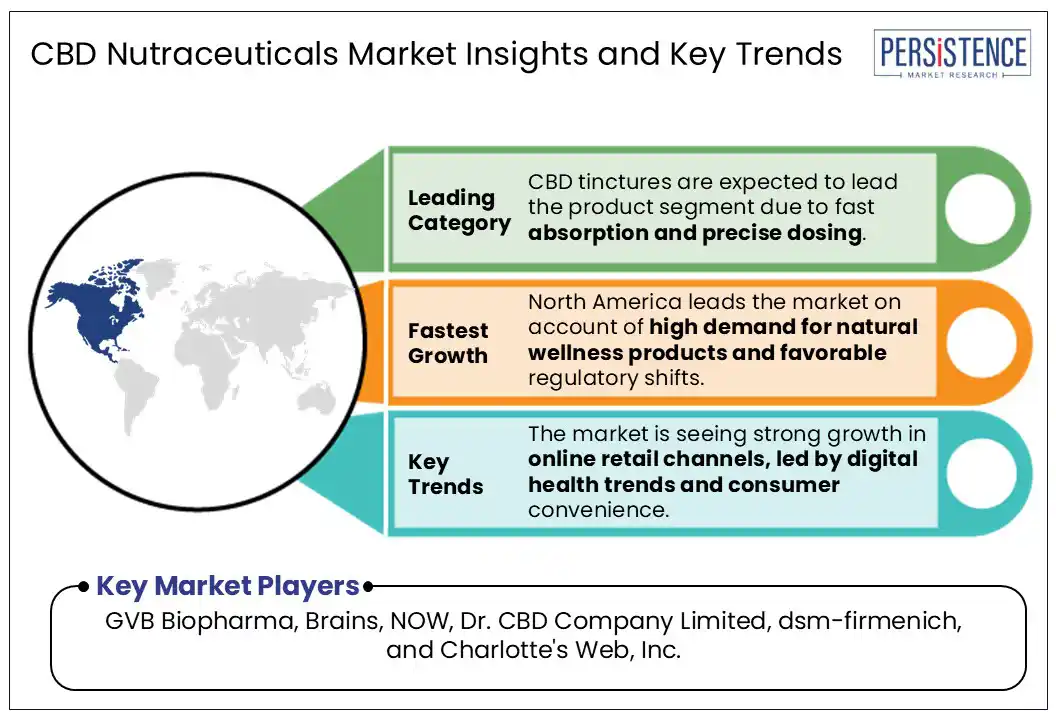

Based on product, the market has been divided into CBD gummies, CBD tinctures, capsules & softgels, and salves & balms. CBD tinctures are expected to lead the market in 2025, representing 42.4% of total sales. This growth is attributed to their rapid absorption, precise dosing, and versatility. Consumers are likely to favor tinctures due to their high bioavailability, which allows for a faster onset of effects compared to other CBD formats.

The acceptance of CBD for pain relief, anxiety, and sleep disorders is fueling demand, with Lazarus Naturals and CBDistillery leading innovation by offering full-spectrum and broad-spectrum tinctures with enhanced efficacy. The FDA's evolving guidelines on CBD are encouraging investments in product standardization and quality assurance, which is increasing customer trust in wellness products made from hemp. As more consumers seek plant-based wellness solutions, CBD tinctures are anticipated to remain a preferred choice in the expanding natural health and wellness market.

North America is projected to capture 54.7% of the CBD nutraceuticals market share in 2025, solidifying its leadership position. The expansion of the market here is fueled by a rising consumer interest in natural wellness products, favorable regulatory reforms in the U.S. and Canada, and a well-established healthcare infrastructure that supports cannabinoid research and product innovation. The demand for plant-based pain relief and holistic health solutions is augmenting the adoption of CBD-infused nutraceuticals, including dietary supplements, functional foods, and therapeutic cosmetics.

Key players such as PAO Group, Inc. are capitalizing on this momentum with targeted product launches such as RelaxRX CBD, catering to consumers seeking stress relief and improved well-being. The market is expected to grow at a high CAGR through 2032, with a strong backing of advancements in delivery formats such as CBD gummies, softgel capsules, and infused beverages. These innovations are enhancing product accessibility and appeal across diverse demographics.

Asia Pacific is anticipated to exhibit strong growth in the CBD nutraceuticals market share in 2025, due to legalization and increasing research on CBD's medicinal benefits.

Countries including India and China, with favorable climatic conditions for cannabis cultivation, are emerging as key players in the market. In India, companies such as Awshad are actively organizing medical cannabis workshops to educate healthcare professionals on CBD applications, boosting its acceptance in therapeutic sectors. Japan, South Korea, and China are implementing regulatory changes to promote CBD-based health products, while China is expanding its CBD industry for pharmaceutical and wellness purposes.

As demand for plant-based health solutions grows, Asia Pacific is expected to see a surge in investments and product innovations in CBD nutraceuticals, positioning the region as a major contributor to the global industry.

The market for CBD nutraceuticals in Europe is anticipated to showcase a high CAGR from 2025 to 2032, making it one of the fastest-growing regions in the world. This increase is attributed to chronic health issues, growing consumer awareness, and product availability. The demand for plant-based health remedies is rising in the region, especially for sleep issues, anxiety, and pain management.

After the Cannabis Act was put into effect in April 2024, legalizing select cannabis products for both personal and medicinal use, Germany, the biggest market in Europe, is expected to see substantial growth. This legislative move is projected to increase investment in CBD nutraceuticals while driving sector innovation.

Consumer confidence in CBD-based products is increasing due to ongoing clinical research in the medicinal potential of cannabinoids. To expand their market reach in the coming years, companies are launching new delivery forms, such as CBD-infused edibles and softgels.

Market players in the global CBD nutraceuticals market are actively pursuing a variety of innovative business growth strategies to enhance their market presence and drive expansion. Companies are adopting strategies such as diversifying their product portfolios; forging strategic partnerships and collaborations to leverage complementary strengths; engaging in mergers and acquisitions to consolidate resources; and expanding their geographic footprint to tap into new markets. This multifaceted approach aims to capitalize on the growing demand for CBD-based products and strengthen their competitive advantage within the global cannabinoid industry.

The CBD Nutraceuticals market is projected to be valued at US$ 10.4 Bn in 2025.

Evolving CBD delivery methods are expanding product accessibility and driving the market.

The CBD nutraceuticals market is expected to witness a CAGR of 12.3% from 2025 to 2032.

Consumers are increasingly favoring plant-based, non-pharmaceutical alternatives, driving innovation in CBD-enriched gummies, capsules, beverages, and topicals.

The key players in the global CBD nutraceuticals market include GVB Biopharma, Brains, and NOW.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product

By Form

By Application

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author