ID: PMRREP26095| 190 Pages | 30 Apr 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

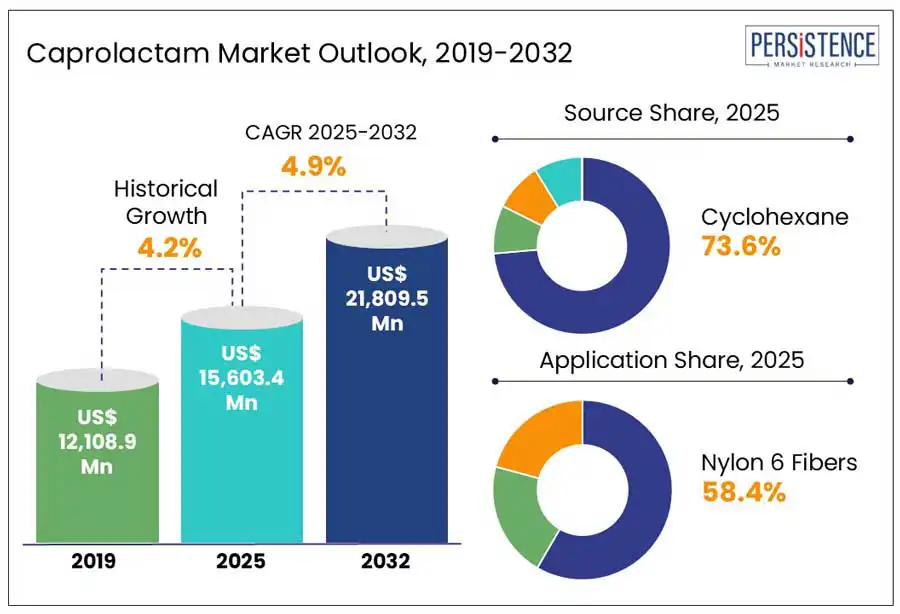

According to the Persistence Market Research report, the global caprolactam market is poised to reach US$ 15,603.4 Mn and is forecast to achieve a valuation of US$ 21,809.5 Mn, expanding at a CAGR of 4.9% by 2032. This expansion is driven by the strong demand for Nylon 6 fibers and resins across major industries.

Nylon 6 fibers are widely used in textiles, carpets, and industrial yarn segments. India’s textiles industry, a cornerstone of its economy, is expected to grow at a CAGR of 10% and reach US$ 350 billion by 2030. The sector contributes 2.3% to India's GDP and 13% to industrial production. On the resin side, usage in automotive parts, electrical & electronics, engineering plastics, and films contributes significantly to overall demand. Global car sales reached 74.6 million units in 2024, up 2.5% from the previous year, with key markets such as Europe, the U.S., and India exhibiting notable resilience. In India alone, passenger vehicle sales grew by 4.8%, driven by festive season demand and competitive pricing.

The global shift toward lightweight, durable engineering plastics in automotive manufacturing, followed by continued consumption in consumer goods and packaging, is expected to keep demand momentum strong across the forecast period.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Caprolactam Market Size (2024A) |

US$ 14,874.5 Million |

|

Estimated Market Size (2025E) |

US$ 15,603.4 Million |

|

Projected Market Value (2032F) |

US$ 21,809.5 million |

|

Value CAGR (2025 to 2032) |

4.9% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.2% |

The market continues to witness a steady growth, propelled by the resurgence in nylon production across domestic markets. In August 2024, AdvanSix reported a 6% year-over-year sales increase in Q2 2024, driven primarily by higher nylon sales and strong demand for feedstocks. Integration among producers boosts supply chain reliability and feedstock efficiency, particularly in regions with mature demand. AdvanSix’s performance demonstrates market resilience, especially where nylon fulfills essential roles in the automotive and consumer goods sectors. The consistent rise in downstream nylon utilization amplifies production throughput of core feedstocks, reinforce their strategic importance in the global polymers value chain.

Structural shifts in the production landscape weigh heavily on supply dynamics as key players withdraw from traditional manufacturing hubs. In January, 2025, UBE Corporation announced it would cease production activities in Japan by March 2027, aligning with its Vision 2030 strategy to prioritize specialty products. This move reflects a broader trend, where Japan’s domestic competitiveness has declined due to global overcapacity and rising environmental compliance costs.

Earlier, in April, 2022, Sumitomo Chemical exited operations at Ehime Works, responding to similar pressures. These decisions reduce regional production capacity and disrupt localized feedstock supply chains. While global output may offset the volume shortfall, the closures limit production diversity, constrain logistical agility, and pressure dependent regional nylon sectors, particularly across Asia.

The drive toward sustainability is creating new growth channels through innovations in recycled and bio-based feedstocks. In March, 2023, Aquafil commissioned a chemical separation demo plant in Slovenia to enhance nylon recycling, reinforcing circular integration within production chains. These innovations provide a clear path to reduce carbon intensity and strengthen environmentally aligned supply chains. Also, in March 2022, Aquafil initiated the “Effective” project with Genomatica to produce renewable, plant-based inputs. A demonstration facility at the AquafilSLO plant now highlights the commercial viability of bio-based solutions for polymer applications.

Sustainability-focused innovation is reshaping product development in textiles. On December 13, 2024, EcoLactam® by Fibrant B.V. (Highsun Group) secured the Product Innovation Award at the 2024 Innovative Textile Awards by WTiN for achieving a 70% carbon footprint reduction compared to conventional feedstocks. This advancement is attracting increased attention from apparel, carpet, and technical textile manufacturers seeking low-emission raw materials.

EcoLactam® proves both technical feasibility and strong climate impact reduction potential, aligning with sustainability objectives in Europe and North America. This momentum is prompting producers to invest in cleaner technologies and pursue certifications that confirm environmental performance, strengthening product appeal across downstream textile applications.

Technology dissemination is emerging as a key trend as companies aim to globalize efficient production methods. In November, 2025, HighChem Co., Ltd. acquired Sumitomo Chemical’s intellectual property for the vapor-phase Beckmann rearrangement process. This acquisition enables HighChem to license the technology worldwide while supporting licensees through proprietary catalysts, thereby broadening access to energy-efficient production systems.

These initiatives help more producers shift toward cost-effective and low-emission operations. Global licensing of advanced processes ensures technical know-how reaches new regions, empowering emerging markets to scale domestic capacity while aligning with environmental and efficiency benchmarks. This trend promotes decentralized production and strengthens overall supply chain resilience.

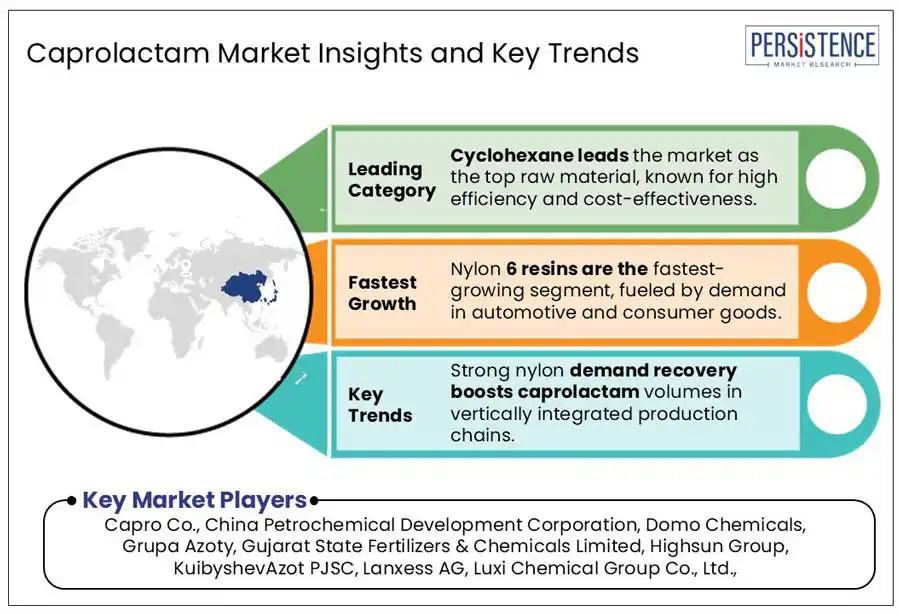

Cyclohexane is expected to account for 74.4% of the Caprolactam market share in 2025, attributed to its critical role in the production of cyclohexanone, a key intermediate in Caprolactam synthesis. Strong demand from integrated nylon manufacturing and improved production economics support its position.

The price increase announced by BASF in February and April 2024, along with the permanent shutdown of a Caprolactam line at China Petrochemical Development Corporation’s Toufen plant, tightened regional supply, strengthening cyclohexane-based production economics. Its widespread availability, lower processing complexity, and compatibility with existing chemical routes reinforce its dominance in the feedstock landscape.

Nylon 6 fibers secure 58.4% market share in 2024, driven by sustained demand across automotive, textiles, and industrial yarn sectors. Continuous innovation in nylon recycling, such as the collaboration between Toray Industries and Honda Motor Co. for depolymerizing nylon 6 from end-of-life vehicles, supports circular value chains while ensuring high-quality fiber recovery.

This trend aligns with rising eco-regulatory pressure and a shift toward sustainable textiles and high-performance engineering applications. Price revisions in the upstream Caprolactam supply chain also reflect value retention in downstream fiber production, enhancing the competitiveness of Nylon 6-based end-use solutions.

East Asia commands a 40.2% share of global consumption in 2024, driven by its strong nylon 6 production base and rapid manufacturing expansion in China. In September 2024, Luxi Chemical Group began operations at its new integrated facility, targeting an annual output of 300,000 tons each for Caprolactam and nylon 6. This move addresses rising domestic demand while reducing reliance on imports.

In December, 2023, China Petrochemical Development Corporation decommissioned a Caprolactam line at its Toufen plant in Taiwan, signaling regional consolidation and efforts to streamline operations. Manufacturers across East Asia continue to leverage vertically integrated systems, access to competitively priced feedstocks, and strong government support for industrial growth. These structural advantages solidify the region’s leadership position, anchoring its dominance in the global value chain.

Europe holds an estimated 18.9% share of global consumption in 2024. Although the region has maintained historical strength in Caprolactam and nylon derivatives, it now faces structural changes due to shrinking demand and elevated operational costs. On January 2025, Spolana in the Czech Republic announced its decision to exit Caprolactam and PVC production by mid-2025, citing prolonged market weakness. This move impacts around 500 jobs and underscores broader petrochemical sector headwinds across the region.

Even as contraction unfolds, sustainability remains a strategic focus. Since February 10, 2021, LANXESS has operated a nitrous oxide reduction unit at its Antwerp facility, cutting 150,000 tons of CO?-equivalent emissions annually. A second phase targets a further 300,000-ton reduction, reinforcing Europe’s alignment with decarbonization goals. These dynamics highlight a dual-track scenario rationalization of legacy capacity alongside a determined shift toward low-emission production pathways.

The global caprolactam market reflects a semi-consolidated and regionally oligopolistic structure, shaped by high capital intensity, complex licensing frameworks, and vertically integrated operations. Key players such as DOMO Chemicals, Lanxess AG, and UBE Corporation maintain long-term production leadership in Europe by advancing technologies, strengthening backward integration, and aligning with sustainability objectives. These companies continue to invest in cleaner production systems, brand-specific engineering plastics, and high-value applications, reinforcing their position in premium segments.

In East Asia, the industry demonstrates capacity concentration but remains strategically fragmented. Companies including Luxi Chemical Group, China Petrochemical Development Corporation, and Highsun Group are expanding aggressively through scale and deeper integration.

Grupa Azoty and Aquafil differentiate their strategies by advancing circular practices and developing upstream recycling infrastructure to meet regulatory expectations. In North America, BASF and AdvanSix prioritize value retention through price discipline and supply chain resilience. This strategic divergence underscores an evolving industry where legacy producers scale down while sustainability-focused companies scale up.

The global industry is valued at US$ 15,603.4 Million in 2025.

The cyclohexane segment is set to capture 74.4% of the market in 2025, driven by the rise in solar installations.

The market is poised to witness a CAGR of 4.9% from 2025 to 2032.

Strong nylon demand recovery across key sectors, coupled with rising sustainability initiatives, is driving Caprolactam volume growth and boosting investment in circular, low-carbon production technologies.

Advances in circular and bio-based caprolactam offer new growth pathways while the increasing focus on sustainable production technologies presents opportunities for eco-friendly innovations and partnerships.

Capro Co., China Petrochemical Development Corporation, Domo Chemicals, Grupa Azoty, Gujarat State Fertilizers & Chemicals Limited, Highsun Group, KuibyshevAzot PJSC, Lanxess AG, Luxi Chemical Group Co., Ltd., and others.

|

Report Attribute |

Details |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2024 |

|

Market Analysis |

USD Million for Value, Tons for Volume |

|

Key Regions Covered |

|

|

Key Companies Covered |

|

|

Report Coverage

|

|

|

Customization and Pricing |

Available upon request |

By Raw Material

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author