ID: PMRREP34668| 187 Pages | 26 Aug 2025 | Format: PDF, Excel, PPT* | Healthcare

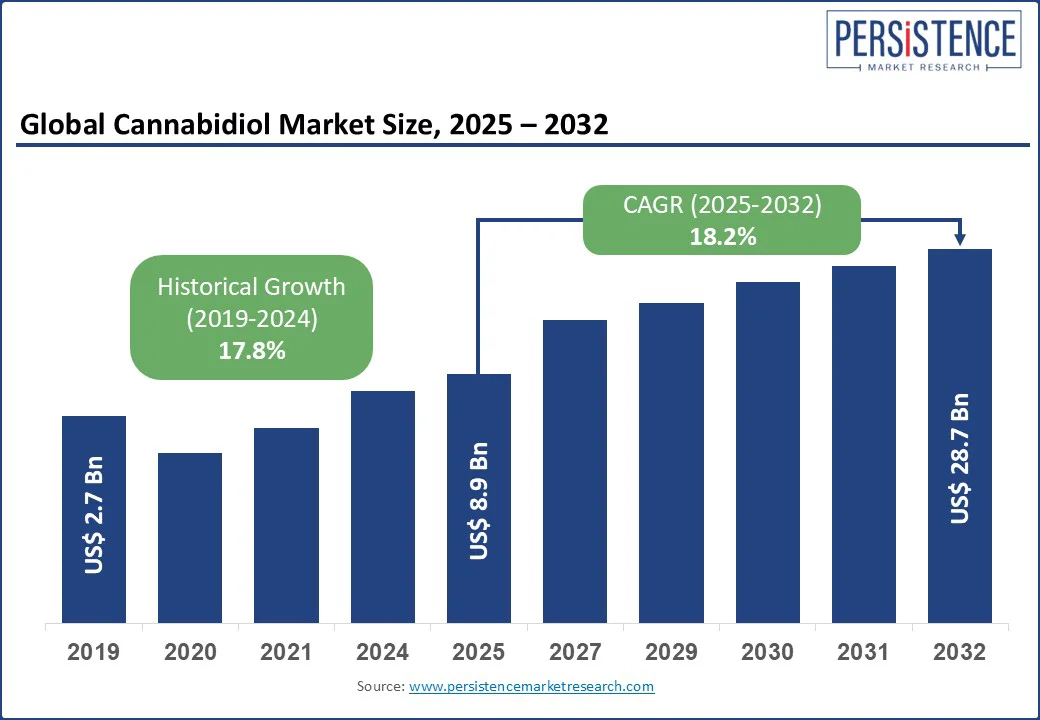

The global cannabidiol market size is likely to be valued at US$8.9 Bn in 2025 and is expected to reach US$28.7 Bn by 2032, achieving a CAGR of 18.2% during the forecast period 2025 - 2032.

Increasing consumer interest in wellness, nutraceuticals, and personal care products drives the growth of the cannabidiol industry. Rising consumer awareness of natural and plant-based solutions is boosting adoption. Regulatory developments and growing legalization in multiple regions continue to create opportunities for market expansion.

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

Cannabidiol Market Size (2025E) |

US$8.9 Bn |

|

Market Value Forecast (2032F) |

US$28.7 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

18.2% |

|

Historical Market Growth (CAGR 2019 to 2024) |

17.8% |

The cannabidiol market is propelled by several key factors, with a significant focus on increasing legalization and consumer awareness of CBD benefits, driving demand for CBD products, cannabidiol supplements, and CBD extract. The global CBD market saw 25% growth in legal markets in 2025, increasing demand for CBD oil for anxiety and stress relief and hemp CBD supplements.

A 2025 survey noted that 65% of consumers recognize CBD for pain management and wellness products for their therapeutic benefits, boosting CBD tinctures, capsules, and gummies by 15%. The rise in wellness trends, with 40% of North American consumers using CBD edibles for health purposes, fuels demand for cannabidiol-infused food and beverages market and functional beverages with cannabidiol, with 20% growth in CBD skincare and cosmetics.

The legalization of CBD, with 30 countries legalizing hemp-derived CBD by 2025, supports the market forecast for hemp-derived CBD. The global wellness market, valued at US$1.5 Tn in 2025, drives CBD in pharmaceuticals and wellness, with 50% of new wellness products incorporating phytocannabinoid oil and medical cannabis.

Regulatory uncertainty and high production costs pose significant restraints to the cannabidiol market, impacting CBD products and cannabidiol supplements adoption. Regulatory inconsistencies, with 20% of U.S. states imposing strict CBD regulations in 2025, limit the scalability of CBD tinctures and CBD edibles.

High production costs for hemp CBD supplements, with extraction processes costing US$5,000 per kg, affect the affordability of CBD for pain management. Compliance with stringent standards, such as FDA regulations for CBD in pharmaceuticals and wellness, increased costs by 12%, restricting the growth of functional beverages with cannabidiol.

Limited consumer awareness in emerging markets, with 30% of consumers unaware of CBD skincare and cosmetics benefits, constrains CBD wellness products adoption in regions such as parts of the Asia Pacific and Latin America.

The rise of CBD wellness products and e-commerce channels presents significant opportunities for the Cannabidiol Market. The global wellness market is projected to grow at a CAGR of 10% through 2032, increasing demand for CBD capsules and gummies, as well as CBD skincare and cosmetics. E-commerce is poised to witness 30% growth in CBD edibles, and enhances accessibility for hemp CBD supplements and phytocannabinoid oil.

Companies such as Canopy Growth Corporation are investing US$150 Mn in R&D for CBD for pain management and CBD in pharmaceuticals and wellness, targeting B2C markets. Emerging markets, with 2 Bn wellness-focused consumers by 2030, offer opportunities for CBD tinctures and market forecast for hemp-derived CBD, positioning legalization impact on CBD market expansion as a key growth driver.

Hemp holds approximately 70% of the industry share in 2025 due to its legal status in CBD products, with 75% adoption in wellness. This legal clarity has enabled manufacturers to scale production without facing major regulatory hurdles associated with marijuana. Brands leverage hemp CBD for stress relief, pain management, sleep support, and overall well-being, driving strong demand in both retail and e-commerce platforms.

Marijuana is driven by hemp CBD supplements and phytocannabinoid oil, which is believed to offer enhanced therapeutic benefits through the “entourage effect.” Although marijuana faces stricter legal constraints compared to hemp, increasing legalization for medical and recreational use in North America, Europe, and parts of Latin America is fueling market growth, with 20% growth in 2025

B2C commands a 60% market share in 2025, driven by CBD edibles and CBD capsules and gummies, with 65% adoption. These product formats are convenient, discreet, and cater to the growing consumer demand for easy-to-use wellness solutions. E-commerce platforms, health stores, and pharmacies play a key role in boosting B2C sales, as they offer consumers direct access to a wide range of CBD wellness products.

CBD wellness products fuel B2C; these products appeal to health-conscious consumers seeking natural alternatives for stress relief, anxiety management, better sleep, and improved overall well-being, with 18% growth in 2025. The trend toward personalized wellness solutions such as customized CBD dosages and subscription-based delivery models adds momentum to the trajectory.

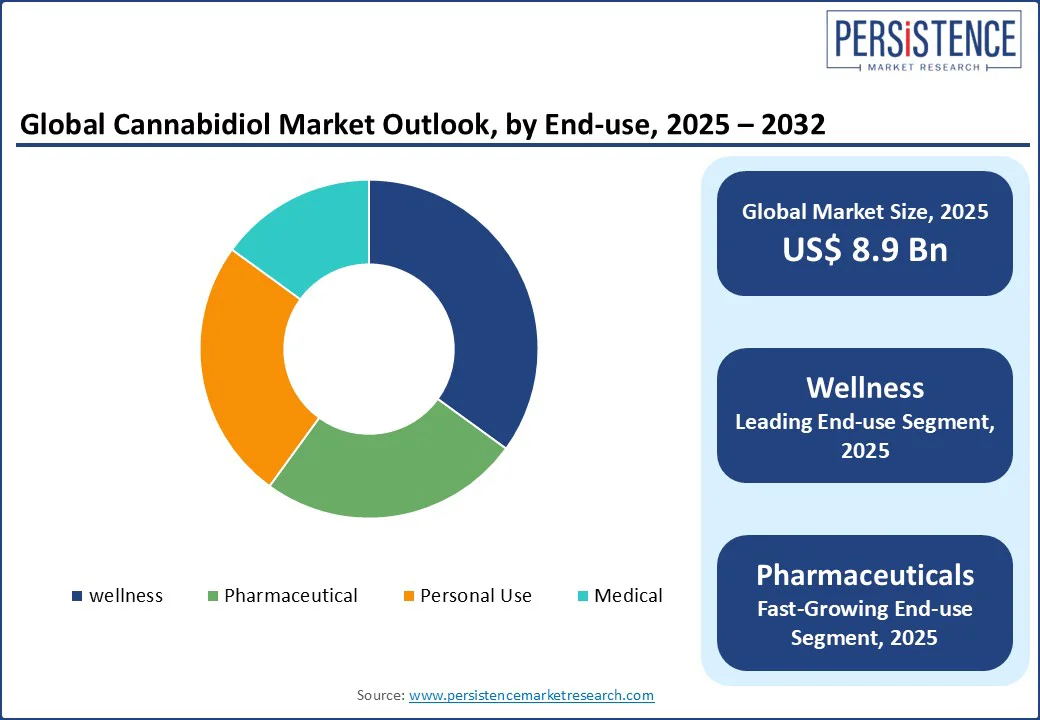

Wellness holds a 40% market share in 2025, driven by CBD skincare and cosmetics, with 50% adoption. CBD is widely recognized for its anti-inflammatory, antioxidant, and soothing properties, making it a popular ingredient in beauty creams, serums, and bath products. This growth is supported by the rising demand for clean beauty products and the perception of CBD as a premium wellness ingredient. Influencer-driven marketing campaigns, celebrity endorsements, and e-commerce expansion.

Pharmaceuticals are fueled by CBD in pharmaceuticals and wellness, chronic pain, epilepsy, anxiety, and neurological disorders. Pharmaceutical companies are investing in clinical research and product development to ensure compliance with regulatory standards and to introduce prescription-based CBD formulations, with 20% growth in 2025.

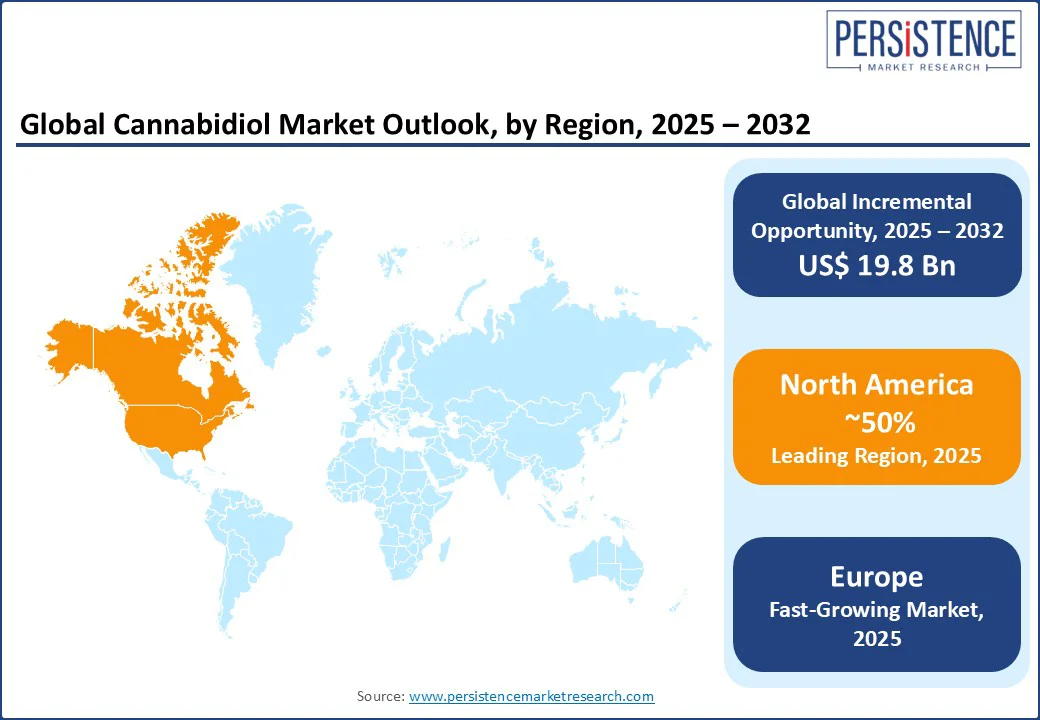

In North America, the cannabidiol market holds a dominant position, commanding a 50% global market share in 2025. The U.S. dominates due to its progressive legalization, with US$4.5 Bn in CBD sales in 2025. The U.S. market is driven by CBD oil for anxiety and stress relief and hemp CBD supplements, with 70% of consumers using CBD edibles in 2025.

Legalization's impact on CBD market expansion grew by 15%, supported by Canopy Growth Corporation. CBD skincare and cosmetics, and functional beverages with cannabidiol experience12% growth. ENDOCA and NuLeaf Naturals LLC drive 25% of regional revenue, leveraging CBD for pain management.

In Europe, the cannabidiol market accounts for a 25% global share, led by Germany, the UK, and France. Germany’s market grows at a CAGR of 20.0%, driven by CBD wellness products and CBD tinctures, with 60% of retailers stocking hemp CBD supplements in 2025.

The UK’s cannabidiol-infused food and beverages market supports a CAGR of 19.5%, with CBD capsules and gummies adopted by Boots UK. France’s CBD for pain management drives 15% growth in phytocannabinoid oil. EU regulatory advancements boost 12% growth in market forecast for hemp-derived CBD, with €100 Mn in funding for CBD research in 2025, enhancing CBD in pharmaceuticals and wellness. PharmaHemp leads with 10% market share.

Asia Pacific is the fastest-growing region, with a CAGR of 21.0%, led by Japan, Australia, and South Korea. Japan holds a 40% regional market share, driven by a marginal increase in wellness product adoption in 2025, boosting CBD skincare, cosmetics, and wellness products.

Australia’s market is fueled by CBD oil for anxiety and stress relief and hemp CBD supplements, with 85% of urban retailers stocking CBD edibles in 2025. South Korea’s functional beverages with cannabidiol drive 15% growth in CBD tinctures. Elixinol and The Cronos Group lead, supported by US$5 Bn in wellness industry investments by 2030.

The global cannabidiol market is highly competitive, with CBD companies competing on innovation, quality, and regulatory compliance. ENDOCA and Canopy Growth Corporation dominate in hemp CBD supplements, while Elixinol leads in CBD skincare and cosmetics. CBD in pharmaceuticals and wellness, cannabidiol-infused food and beverages market, and CBD for pain management add a competitive layer. Strategic partnerships and R&D investments in market forecast for hemp-derived CBD are key differentiators.

The cannabidiol market is projected to reach US$ 8.9 Bn in 2025, driven by CBD products and cannabidiol supplements.

Legalization, consumer awareness, and CBD oil for anxiety and stress relief are key drivers.

The cannabidiol market grows at a CAGR of 18.2% from 2025 to 2032, reaching US$ 28.7 Bn by 2032.

Opportunities include CBD wellness products, cannabidiol-infused food and beverages market, and e-commerce.

Key players include ENDOCA, Canopy Growth Corporation, Elixinol, NuLeaf Naturals LLC, and PharmaHemp.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Source Type

By Sales Type

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author