ID: PMRREP31643| 191 Pages | 3 Sep 2025 | Format: PDF, Excel, PPT* | Food and Beverages

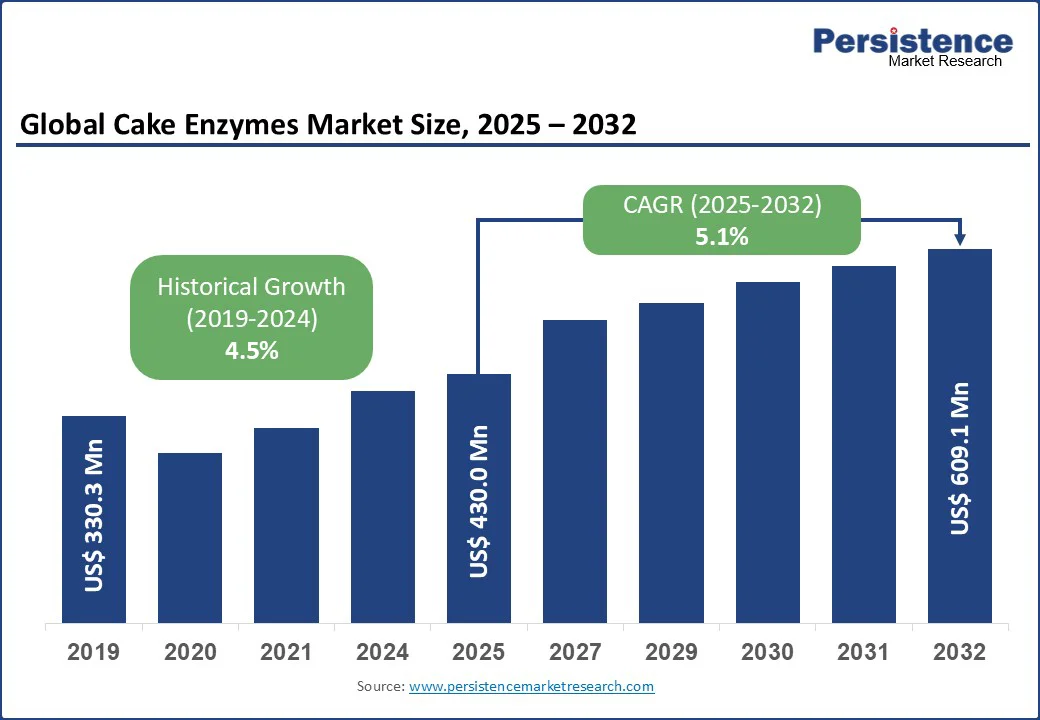

The global cake enzymes market size is likely to value at US$430.0 Mn in 2025 and is expected to reach to US$609.1 Mn by 2032, registering a CAGR of 5.1% during the forecast period from 2025 to 2032.

The cake enzymes market has experienced steady growth, driven by increasing demand for high-quality baked goods, advancements in enzyme technologies, and rising consumer preference for soft, moist cakes with extended shelf life. The expansion of the HoReCa (Hotels, Restaurants, and Cafes) sector and the growing popularity of artisanal and premium baked goods further propel market growth across commercial, industrial, and artisanal baking applications.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Cake Enzymes Market Size (2025E) |

US$430.0 Mn |

|

Market Value Forecast (2032F) |

US$609.1 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

5.1% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.5% |

The global increase in baked goods consumption is driving growth in the cake enzymes market. Rising demand for cakes and pastries, supported by urbanization and evolving consumer preferences, is creating opportunities for high-quality and convenient bakery products. Enzymes such as maltogenic alpha-amylases are widely used to enhance softness, improve texture, and prevent staling, ensuring longer shelf life. With growing interest in premium and clean-label foods, enzymes provide natural solutions for quality improvement, supporting sustained market expansion across both developed and emerging regions.

Technological advancements in enzyme formulations, such as heat-stable and clean-label variants, are fueling growth in the cake enzymes market. For example, Novozymes’ maltogenic alpha-amylase products improve crumb softness and extend freshness, helping reduce food waste compared to traditional methods. The integration of biotechnology for tailored enzyme solutions further enhances baking efficiency, with enzyme-enhanced cakes shown to maintain quality for longer periods. This drives adoption across both large-scale commercial bakeries and artisanal settings.

Government initiatives promoting food innovation and safety also support market expansion. In India, schemes aimed at modernizing food processing are boosting demand for cake enzymes in bakery applications. For instance, in India, the Pradhan Mantri Kisan Sampada Yojana (PM-KISPY) supports the modernization of the food processing sector by funding infrastructure development, such as food processing parks, cold chains, and testing labs. Similarly, in North America, policies such as the FDA’s food safety regulations encourage the use of advanced enzymes, contributing to rising investments and widespread adoption in the bakery sector.

High cost of cake enzymes remains a significant challenge for the cake enzymes market, particularly across emerging economies. Premium enzyme variants, including specialized maltogenic alpha-amylases, are considerably more expensive than conventional bakery additives, which makes them less accessible for small-scale bakeries in regions such as rural India and parts of Latin America.

For example, a high-performance enzyme batch is priced substantially higher than standard baking ingredients, which raises overall production costs. Beyond the purchase price, ongoing expenses linked to sourcing high-quality microbial cultures, maintaining quality certifications, and adhering to global safety standards further increase operational burdens for bakeries and food manufacturers.

Regulatory challenges and supply chain limitations also act as significant barriers. Stringent approval processes under frameworks such as the European Union’s food additive regulations or the FDA’s GRAS requirements introduce additional compliance costs and extend product launch timelines. Compounding this, shortages of specialized microbial strains in certain regions increase dependence on imports, which adds volatility and cost to supply chains. These constraints collectively restrict adoption in highly price-sensitive markets and among smaller enterprises, slowing the pace of wider market expansion.

The development of clean-label and functional cake enzymes presents significant growth opportunities, particularly in premium baking and HoReCa sectors. Clean-label enzymes, such as DSM’s maltogenic alpha-amylases, enable natural staling prevention and texture enhancement, catering to health-conscious consumers and artisanal bakers. The rising demand for additive-free and natural baked goods, with global clean-label bakery sales growing by 12% in 2024, drives adoption in regions with health-focused dietary trends.

The growing popularity of functional and specialty baked goods, such as gluten-free and low-sugar cakes, offers another growth avenue. Enzymes such as maltotetrahydrolases improve digestibility and crumb structure, supporting innovation in health-oriented products. Industry studies indicate that functional enzymes can enhance baking consistency by 20%, making them ideal for premium and specialty applications. The expansion of e-commerce platforms for ingredient sales, with companies such as Advanced Enzymes offering digital distribution, enhances market accessibility. Online enzyme sales surged by 15% in 2024, improving reach for SMEs and artisanal bakers.

The cake enzymes market is segmented into Maltogenic alpha-amylases and Maltotetrahydrolases. Maltogenic alpha-amylases dominate, holding approximately 56.7% share in 2025, due to their critical role in maintaining cake softness, improving texture, and extending shelf life. Advanced formulations, such as those from Novozymes, are widely adopted for their reliability and efficiency in commercial baking.

Maltotetrahydrolases are the fastest-growing segment, driven by increasing demand for enzymes that enhance crumb structure and digestibility in specialty cakes. Innovations in high-efficiency variants, such as DuPont Nutrition & Health’s offerings, improve baking quality, boosting adoption in artisanal and premium baking applications.

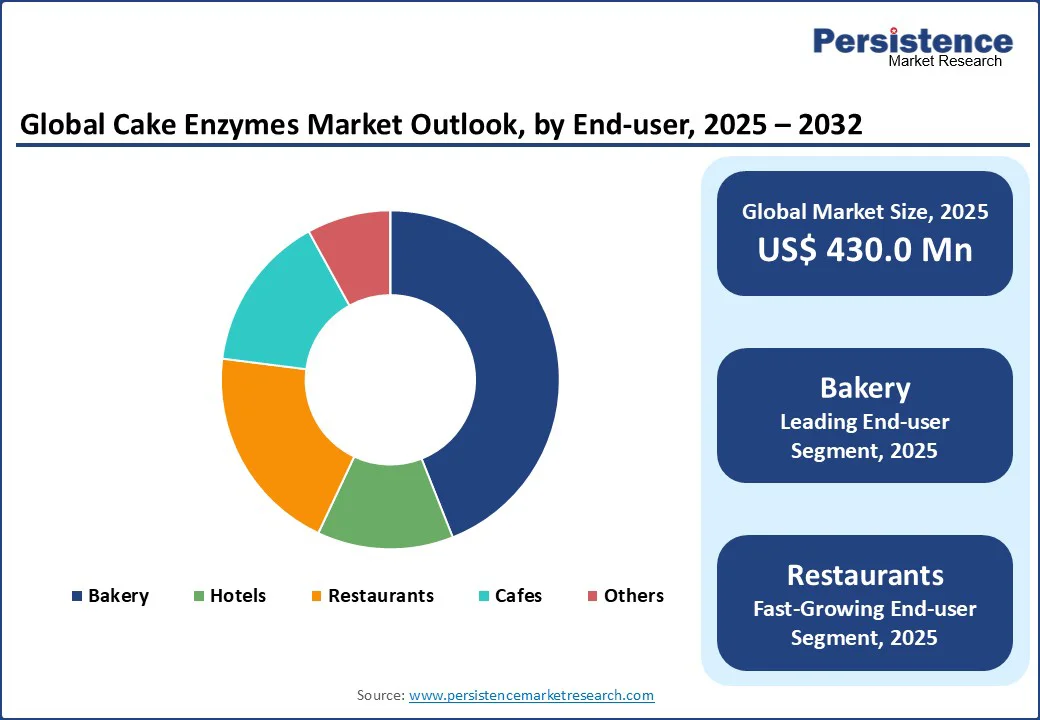

The cake enzymes market is divided into bakery, hotels, restaurants, and cafes. Bakery leads with a 44% share in 2025, driven by high global demand for enzyme-enhanced cakes, with millions of units produced annually for their improved texture and extended shelf life in commercial and retail settings.

Restaurants are the fastest-growing segment, fueled by rising demand for premium and customized cake offerings in dining establishments. The success of functional enzymes in creating high-quality, specialty cakes drives adoption in the HoReCa sector across diverse markets.

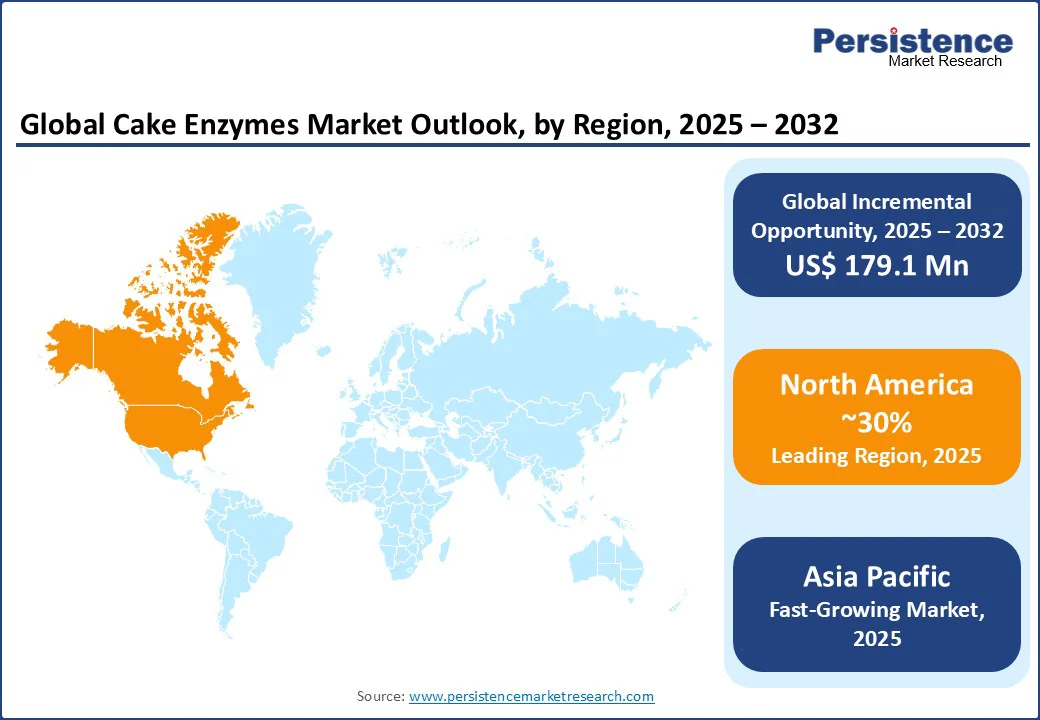

In North America, the U.S. dominates the global market, expected to account for 30% market share in 2025, driven by advanced baking infrastructure, high consumer demand for premium baked goods, and strong adoption of innovative enzyme solutions. The demand for maltogenic alpha-amylases is surging, fueled by the growing popularity of soft, long-shelf-life cakes in retail and commercial bakeries. Leading brands such as DuPont Nutrition & Health and DSM Nutritional Products AG are introducing biotechnology-integrated enzyme platforms tailored to enhance texture and freshness.

Preferences are shifting toward clean-label and functional enzymes, with companies such as Advanced Enzymes leveraging biotechnology to improve baking performance and meet consumer demand for natural products. Regulatory support from the FDA ensures high safety and quality standards, promoting validated enzyme solutions. Government initiatives encouraging food innovation have driven a 10% increase in bakery-related enzyme adoption in 2024, shaping a competitive and innovation-driven market landscape.

Europe’s cake enzymes market is dominated by Germany, the U.K., and France, each benefiting from strong regulatory support and rising demand for premium baked products. Germany leads the region with a substantial market share, where established players such as AB Enzymes and Stern Enzyme are actively addressing demand for maltogenic alpha-amylases in large-scale commercial baking. European Union’s comprehensive food safety regulations, combined with sustainability-focused initiatives, encourage the development of clean-label and environmentally friendly enzyme solutions, strengthening innovation and consumer trust.

In the U.K., market expansion is driven by the growing adoption of functional enzyme formulations, with companies such as Amano Enzymes introducing advanced solutions that appeal to both premium and artisanal bakers. Meanwhile, France demonstrates strong growth in HoReCa applications, where firms such as Dyadic International Inc. provide specialized enzyme offerings tailored to professional kitchens and food service industries. Supportive policies promoting natural and sustainable food ingredients further enhance regional opportunities, creating a diverse and competitive landscape that underpins long-term market growth across Europe.

Asia Pacific represents the fastest-growing region in the cake enzymes market, led by key economies such as China, India, and Japan. In China, the rapid expansion of retail bakery chains, coupled with the rising middle-class population’s preference for premium baked goods, significantly boosts demand for advanced enzyme formulations. Leading companies such as Novozymes are customizing their offerings to meet local bakery requirements, strengthening adoption across commercial baking segments.

India’s market is driven by increasing consumer preference for western-style baked products, alongside supportive government initiatives such as the Pradhan Mantri Kisan Sampada Yojana, which promotes modernization in food processing. Domestic players such as Advanced Enzymes are capitalizing on this trend by offering cost-effective, high-performance enzyme solutions to serve a diverse consumer base.

In Japan, the focus is on high-tech and functional enzyme applications catering to premium cake production, where companies such as Amano Enzymes are gaining strong traction. Additionally, the growth of e-commerce platforms and digital ingredient sales channels enhances product accessibility, supporting steady and sustained market expansion across the region.

The global cake enzymes market is highly competitive, with global and regional players competing on innovation, affordability, and compliance with food safety standards. The rise of clean-label and functional enzymes intensifies competition, as companies strive to meet stringent regulatory requirements and consumer demands for natural and high-quality baked goods. Strategic partnerships, acquisitions, and technological advancements are key differentiators in this dynamic market.

The Cake Enzymes market is projected to reach US$430.0 Mn in 2025.

Rising demand for high-quality baked goods, advancements in enzyme technology, and government food innovation initiatives are key drivers.

The Cake Enzymes market is poised to witness a CAGR of 5.1% from 2025 to 2032.

Innovation in clean-label and functional enzymes presents significant growth opportunities.

DSM Nutritional Products AG, Novozymes, and DuPont Nutrition & Health are among the key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 – 2024 |

|

Forecast Period |

2025 – 2032 |

|

Market Analysis |

Value: US$ Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

|

By Enzyme Type

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author