ID: PMRREP2828| 197 Pages | 13 Aug 2025 | Format: PDF, Excel, PPT* | Healthcare

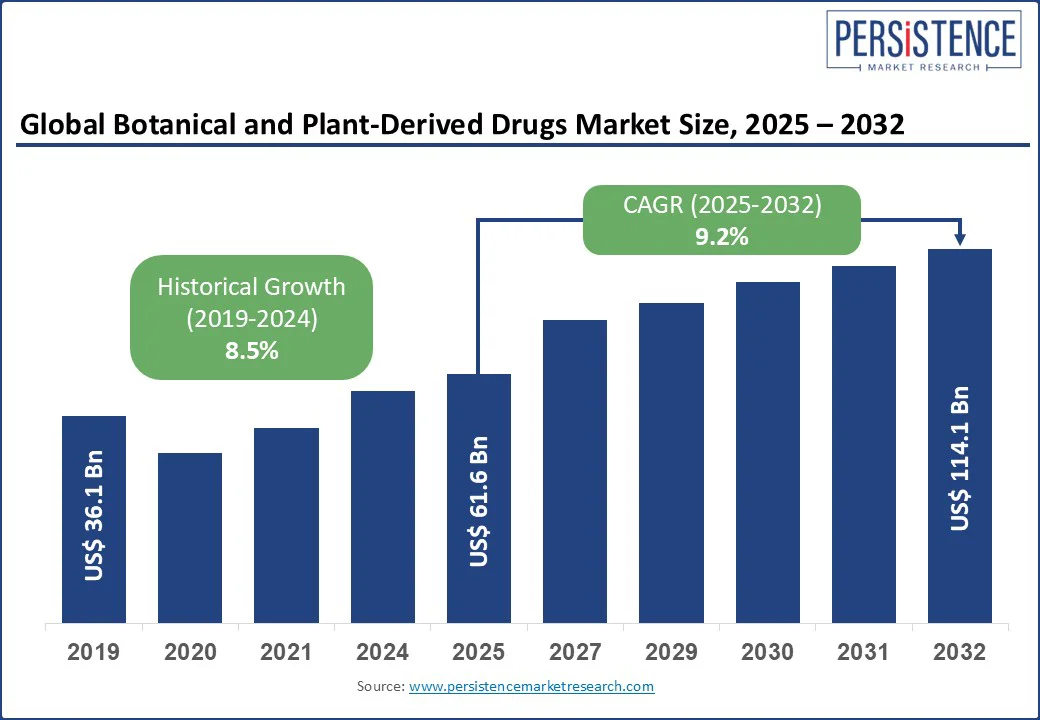

The global Botanical and Plant-Derived Drugs Market is projected to grow from US$ 61.6 Bn in 2025 to US$ 114.1 Bn by 2032, achieving a CAGR of 9.2% during the forecast period.

Botanical and plant-derived drugs industry growth is driven by increasing consumer preference for natural and sustainable health solutions, advancements in extraction and formulation technologies, and the rising prevalence of chronic diseases necessitating alternative treatments.

The sector's expansion is further supported by growing acceptance of plant-based therapies in mainstream healthcare and the integration of botanicals in cosmetics and nutraceuticals. The sector benefits from the versatility of botanical sources, which cater to diverse Forms across pharmaceuticals, food and beverages, and animal health.

Key Industry Highlights:

|

Key Insights |

Details |

|

Botanical and Plant-Derived Drugs Market Size (2025E) |

US$ 61.6 Bn |

|

Market Value Forecast (2032F) |

US$ 114.1 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

9.2% |

|

Historical Market Growth (CAGR 2019 to 2024) |

8.5% |

The growing consumer shift toward natural and sustainable healthcare solutions is significantly driving the botanical and plant-derived drugs market. Heightened awareness of the long-term side effects and chemical load associated with synthetic pharmaceuticals has led many individuals to seek safer, plant-based alternatives that offer holistic healing.

These products are perceived as gentler on the body and often align with preventive wellness approaches. Furthermore, the global rise in chronic conditions such as diabetes, arthritis, and cardiovascular disorders has increased interest in long-term, natural treatment options. Plant-derived therapeutics are often more cost-effective, making them attractive in both developed and emerging economies where healthcare costs are escalating.

For instance, plant-based drugs such as Mytesi® have received FDA approval for managing chronic diarrhea in HIV patients, showcasing the potential of natural formulations in regulated medicine. Additionally, government institutions are increasingly supporting research in this domain. The U.S. National Center for Complementary and Integrative Health (NCCIH) promotes the scientific evaluation of herbal and plant-based medicines to ensure safety and efficacy. This rising demand for clean-label, eco-conscious products is also encouraging pharmaceutical companies to innovate with sustainable, plant-based drug formulations.

Regulatory and standardization challenges pose a significant restraint on the botanical and plant-derived drugs market. The complex chemical composition of plant-based compounds makes it difficult to ensure batch-to-batch consistency in quality, potency, and efficacy, which is a key requirement for drug approval. Regulatory agencies such as the U.S. FDA and European Medicines Agency (EMA) impose stringent testing and documentation protocols, often requiring full clinical trial data, manufacturing controls, and toxicology assessments under Good Manufacturing Practice (GMP) guidelines.

This significantly increases development costs and timelines; according to an FDA presentation, only four prescription botanical drugs have been approved in the U.S. to date, highlighting the high regulatory bar for such therapies.

For instance, Filsuvez®, a birch bark extract used to treat epidermolysis bullosa, received FDA approval only after extensive Phase III trials and detailed characterization of its active triterpenes, underlining the complexity and cost of bringing botanical drugs to market.

Furthermore, the lack of global harmonization in regulatory standards further complicates the situation. In regions with underdeveloped systems, such as parts of Africa and South Asia, inconsistent quality control and limited pharmacovigilance mechanisms further constrain market growth, particularly for small and mid-sized enterprises looking to scale.

Technological advancements in extraction and formulation present a significant opportunity for the botanical and plant-derived drugs market. Innovations such as supercritical CO2 extraction and nanoencapsulation enhance the bioavailability, stability, and efficacy of plant-based compounds, enabling manufacturers to develop high-potency, targeted therapies. These methods also minimize the use of harmful solvents, aligning with the global push for sustainable and clean-label production, while reducing waste and energy consumption.

Emerging technologies such as ultrasound-assisted extraction, microwave-assisted extraction, and enzymatic extraction offer improved yield and selectivity, especially for delicate phytochemicals that degrade under traditional methods. These techniques help preserve the pharmacological integrity of bioactive compounds, making them suitable for clinical-grade Forms.

For instance, researchers have used microwave-assisted extraction to successfully isolate heat-sensitive flavonoids from Ginkgo biloba, achieving higher yields and reduced processing time compared to conventional methods, demonstrating the potential of these innovations in pharmaceutical-grade botanical drug development.

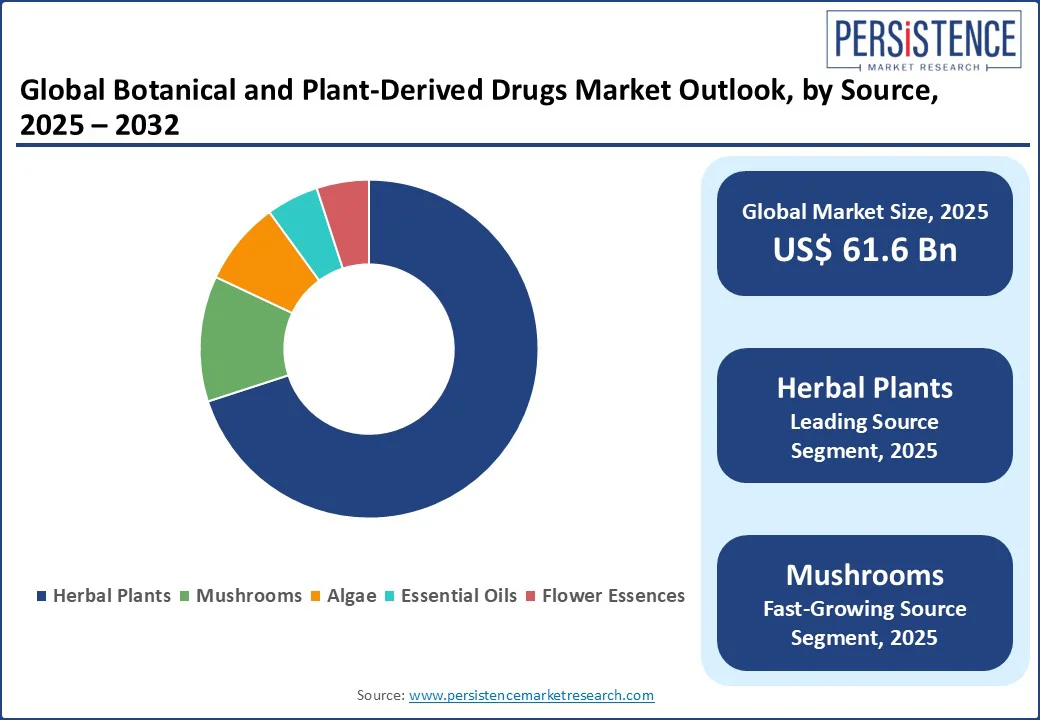

Herbal Plants dominate the sector, expected to account for approximately 70% of the industry share in 2025. Their dominance is driven by their extensive use in traditional medicine systems, such as Ayurveda, TCM, and Unani, as well as their versatility in pharmaceutical and nutraceutical Forms. Herbal plants such as ginseng, echinacea, and ashwagandha are widely used for their therapeutic properties, supported by a growing body of clinical research validating their efficacy.

Mushrooms are the fastest-growing segment from 2025 to 2032, driven by increasing demand for functional mushrooms such as reishi, chaga, and lion’s mane in nutraceuticals and pharmaceuticals. Their immune-boosting and neuroprotective properties have gained attention, particularly in North America and Europe, where mushroom-based supplements. Advancements in cultivation and extraction technologies are further accelerating the adoption of mushrooms in high-value Forms.

Capsules hold the largest botanical and plant-derived drugs industryt share, accounting for approximately 35% of revenue in 2025. Their popularity is driven by ease of consumption, precise dosing, and widespread use in pharmaceuticals and nutraceuticals. Capsules are favored for delivering concentrated plant-based compounds, such as curcumin and CBD, to consumers seeking convenient health solutions.

Liquid Extracts are the fastest-growing segment, fueled by their high bioavailability and versatility in Forms ranging from pharmaceuticals to cosmetics. The rise of personalized medicine and the demand for fast-acting formulations, particularly in anti-anxiety and pain relief products, are driving the adoption of liquid extracts.

Pharmaceuticals lead the domain, holding a 60% share in 2025. The segment’s dominance is driven by the increasing integration of plant-derived drugs in mainstream healthcare, particularly for managing chronic conditions such as diabetes and cardiovascular diseases. Regulatory approvals for drugs such as Epidiolex (CBD-based) and Veregen (green tea extract) have bolstered market growth.

Nutraceuticals are the fastest-growing segment, driven by rising consumer demand for preventive healthcare and natural supplements. In 2023 and 2024, around 55% of newly launched products in the global nutraceutical market featured plant-based and functional ingredients, highlighting a clear move toward natural, clean-label health solutions in line with evolving consumer preferences.

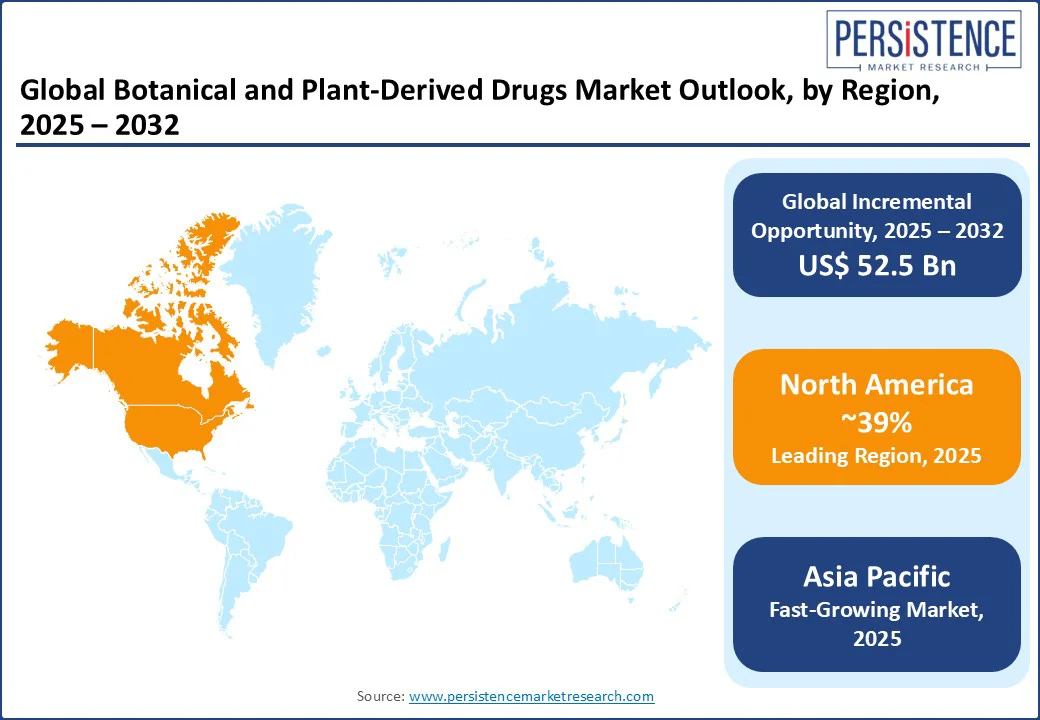

The North American botanical and plant-derived drugs market is poised for substantial growth, expected to capture a 39% market share in 2025. This dominance is largely attributed to the region's advanced healthcare infrastructure, strong regulatory frameworks, and increasing consumer interest in natural and alternative medicines.

The United States leads the industry, supported by significant R&D investments from both pharmaceutical companies and academic institutions, focusing on the development and clinical validation of plant-based therapeutics. Growing awareness of the side effects of synthetic drugs is also prompting a shift toward botanical alternatives, particularly in chronic disease management and wellness Forms.

Additionally, supportive regulatory pathways, such as the U.S. FDA’s Botanical Drug Development Guidance, are accelerating product approvals. Canada is also witnessing rising demand, driven by a health-conscious population and increasing use of herbal supplements. Overall, the North American market is well-positioned for continued growth, fueled by innovation, consumer trust, and strong market access infrastructure.

The Latin America botanical and plant-derived drugs market is growing steadily, driven by consumer preference for natural remedies, supportive biodiversity, and rising R&D investments. Brazil leads the region due to its strong regulatory framework and rich medicinal plant resources, while Argentina and Mexico are emerging as high-growth markets.

Herbal medicines, plant extracts, and plant-based APIs are gaining traction across the pharmaceutical and wellness sectors. Government support for traditional medicine integration and innovations such as personalized herbal formulations further accelerate adoption.

However, regulatory inconsistencies, environmental degradation, and counterfeit products pose challenges. Despite these hurdles, Latin America remains a promising region for botanical and plant-derived drugs, with strong potential for both domestic use and international export, supported by rising health awareness and demand.

The Asia Pacific botanical and plant-derived drugs market is experiencing robust growth, propelled by rapid healthcare advancements, rising consumer awareness, and increasing demand in key countries such as China and India. Traditional medicine systems such as Ayurveda, Traditional Chinese Medicine (TCM), and Kampo play a significant role in healthcare delivery across the region, driving both domestic consumption and international interest.

Governments in countries such as India and China are actively promoting plant-based remedies through supportive policies, research funding, and integration into public healthcare frameworks. Additionally, the region's vast biodiversity and long-standing cultural reliance on medicinal plants make it a natural hub for botanical drug development.

Growing concerns over the side effects of synthetic drugs and a shift toward preventive healthcare are further boosting demand. With expanding urban populations, rising incomes, and improving regulatory frameworks, the Asia Pacific is emerging as a key growth engine for the global botanical and plant-derived drugs market.

The Global botanical and plant-derived drugs market is highly competitive, with a mix of global pharmaceutical giants and specialized firms. In developed regions such as North America and Europe, companies such as Bayer AG, Novartis AG, and Pfizer Inc. dominate through scale, advanced R&D, and strategic partnerships with nutraceutical and cosmetic brands. In the Asia Pacific, rapid industrialization and growing demand for herbal products are attracting investments from both local and international players.

Companies are focusing on sustainability, innovation in extraction technologies, and product differentiation to gain a competitive edge. Strategic alliances and acquisitions are intensifying the competitive landscape.

The Botanical and Plant-Derived Drugs market is projected to reach US$ 61.6 Bn in 2025.

The surge in demand for natural and sustainable health solutions is a key driver.

The Botanical and Plant-Derived Drugs market is poised to witness a CAGR of 9.2% from 2025 to 2032.

Advancements in extraction and formulation technologies are a key opportunity.

Bayer AG, Bristol-Myers Squibb, Sanofi S.A., Novartis AG, and GlaxoSmithKline plc are key players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Source

By Form

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author