ID: PMRREP34666| 191 Pages | 26 Aug 2025 | Format: PDF, Excel, PPT* | Packaging

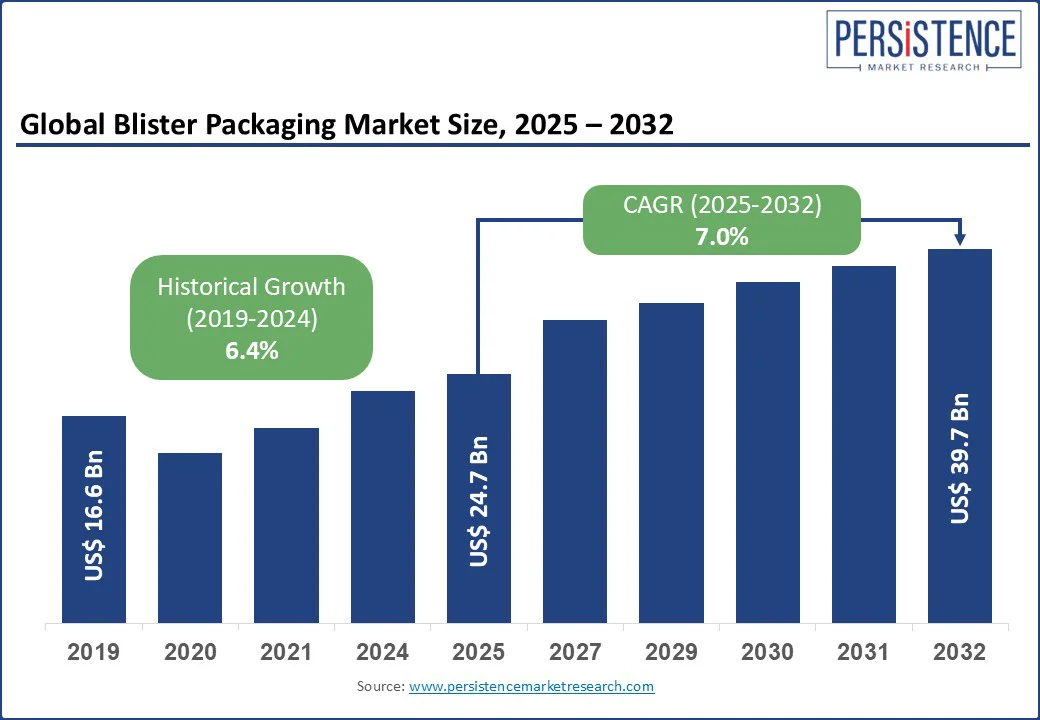

The global blister packaging market size is likely to be valued at US$24.7 Bn in 2025 and is estimated to reach US$39.7 Bn by 2032, growing at a CAGR of 7.0% during the forecast period 2025 - 2032.

The blister packaging industry is driven by the growing demand for protective, tamper-evident, and visually appealing packaging across pharmaceuticals, healthcare, and consumer goods. Innovations in automation, barrier technologies, and eco-friendly materials continue to shape market growth, making blister packaging a preferred choice for a wide range of products.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Blister Packaging Market Size (2025E) |

US$24.7 Bn |

|

Market Value Forecast (2032F) |

US$39.7 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

7.0% |

|

Historical Market Growth (CAGR 2019 to 2024) |

6.4% |

The blister packaging market is propelled by several key factors, with a significant focus on rising demand for secure and regulatory-compliant packaging, driving demand for pharmaceutical packaging, food packaging, and medical packaging. The global pharmaceutical packaging market grew by 10% in 2025, driven by increased demand for blister packs for capsules, tablets, and medical devices, as well as tablet blister packaging.

A 2025 survey noted that 70% of pharmaceutical companies prioritize tamper-evident packaging and medicine packaging solutions for safety, boosting Alu-Alu blister packs and healthcare packaging products by 15%. The rise in food safety regulations, with 50% of food manufacturers adopting protective packaging in 2025, fuels demand for strip packaging and barrier films for blister packs, with 12% growth in food packaging.

Regulatory compliance in blister packaging, driven by standards such as FDA and EU GMP, grew by 18%, supporting the market forecast for medical and food blister packs. The global packaging market, valued at US$1 Tn in 2025, drives automated blister packaging machinery and technology and packaging machinery for tablets and capsules, with 60% of new packaging lines incorporating blister packaging material innovations.

High production costs and environmental concerns pose significant restraints to the Blister packaging market, impacting pharmaceutical packaging and food packaging adoption. The cost of advanced packaging machinery for tablets and capsules increased by 12% in 2025, affecting the affordability of Alu-Alu blister packs.

Environmental regulations, such as the EU’s single-use plastics directive, restricted plastic films, raising compliance costs by 10%, limiting the scalability of barrier films for blister packs. 40% of consumers prefer sustainable alternatives to plastic films, which impacts the adoption of protective packaging.

Limited infrastructure for blister packaging material innovations in emerging markets, with 25% of manufacturers lacking automated systems, constrains healthcare packaging products and strip packaging growth in regions such as Africa and parts of Latin America.

The rise of automated blister packaging machinery and technology, and sustainable materials, presents significant opportunities for the blister packaging market.

The global packaging automation market is projected to grow at a CAGR of 9% through 2032, driven by the increasing demand for packaging machinery for tablets and capsules, as well as blister packs for medical devices. An online survey indicated that 20% of new packaging launches incorporate blister packaging material innovations, boosting tamper-evident packaging by 15%.

The growth of the blister packaging market in emerging economies, with 30% growth in medical packaging, enhances demand for healthcare packaging products.

Companies such as Amcor plc are investing US$150 Bn in R&D for barrier films for blister packs and medicine packaging solutions, targeting healthcare and food. Emerging markets, with 2 Bn urban consumers by 2030, offer opportunities for Alu-Alu blister packs and strip packaging, positioning regulatory compliance in blister packaging as a key growth driver.

Carded holds approximately 60% of the market share in 2025 due to its use in tablet blister packaging, with 65% adoption in healthcare. Carded packaging attaches items to a cardboard backing sealed with a plastic cover, offering protection, tamper evidence, and clear product visibility, making it ideal for pharmaceuticals, vitamins, and small personal care items. Its cost-effectiveness, ease of labelling, and retail-friendly design further contribute to its widespread adoption.

Clamshell is driven by consumer goods and protective packaging, with 12% growth in 2025. This type features two hinged plastic halves that enclose products securely, providing excellent protection against damage while allowing consumers to view the product. Its tamper-evident design and sturdy structure make it suitable for electronics, toys, hardware, and food items, with growth fueled by e-commerce demand and the need for safe, attractive retail packaging.

Thermoforming commands a 70% market share in 2025, The growth is largely fueled by automated blister packaging machinery and modern thermoforming technologies that increase production efficiency, reduce labor costs, and allow high-speed packaging for large-scale manufacturing. with 75% adoption in 2025. Thermoforming also supports customization in size, shape, and packaging design, making it popular for both retail-facing and industrial applications.

Cold Forming is fueled by Alu-Alu blister packs, with 15% growth in 2025. This creates a completely sealed and rigid pack that protects contents from moisture, light, and oxygen, making it ideal for highly sensitive pharmaceuticals. Though slower and more costly than thermoforming, cold forming is essential for products that cannot tolerate even minimal exposure to environmental factors, such as probiotics, effervescent tablets, and certain antibiotics.

Plastic Films holds a 65% market share in 2025, Their dominance is largely due to the development of barrier films that effectively protect pharmaceuticals, nutraceuticals, and other sensitive products from moisture, oxygen, and light, which can degrade product quality. with 70% adoption in 2025. Advanced plastic films also allow for custom cavity shapes, high transparency, and excellent printability, supporting both protection and consumer appeal.

Paper & paperboard is fueled by blister packaging material innovations, with 12% growth in 2025. Innovations in paperboard blister backing cards and cartons allow strong structural support, high-quality printing, and branding opportunities, making them an attractive alternative to plastic-heavy packaging. Paper & paperboard also reduce environmental impact, as they are recyclable, biodegradable, and often sourced from renewable materials.

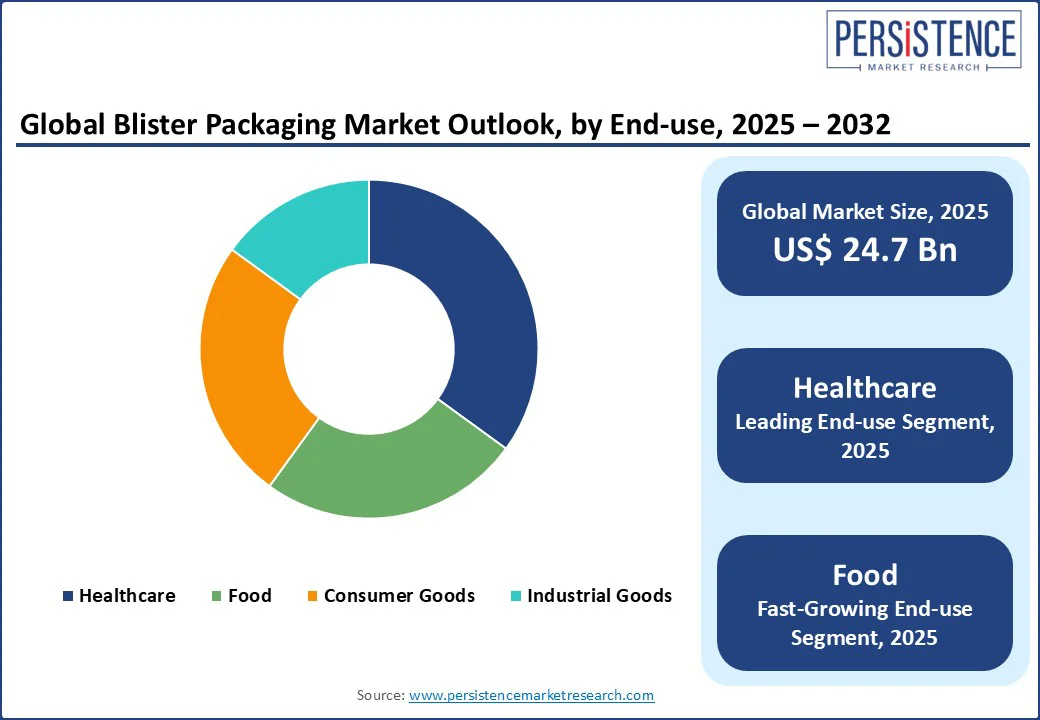

Healthcare holds a 45% market share in 2025, driven by pharmaceutical packaging and medicine packaging solutions, with 50% adoption in 2025. Blister packs also support dosage compliance, with weekly or monthly layouts helping patients manage their medication schedules accurately. Advances in automated packaging machinery, such as high-speed thermoforming and cold forming systems, further enhance efficiency and reduce labor costs.

Food is fueled by food packaging and strip packaging, with 15% growth in 2025. Blister packs for food provide hygiene, tamper-evidence, and protection from moisture, oxygen, and contamination, which helps extend shelf life and maintain quality. The segment benefits from innovations in flexible films, barrier materials, and eco-friendly packaging solutions, making it suitable for retail and e-commerce markets.

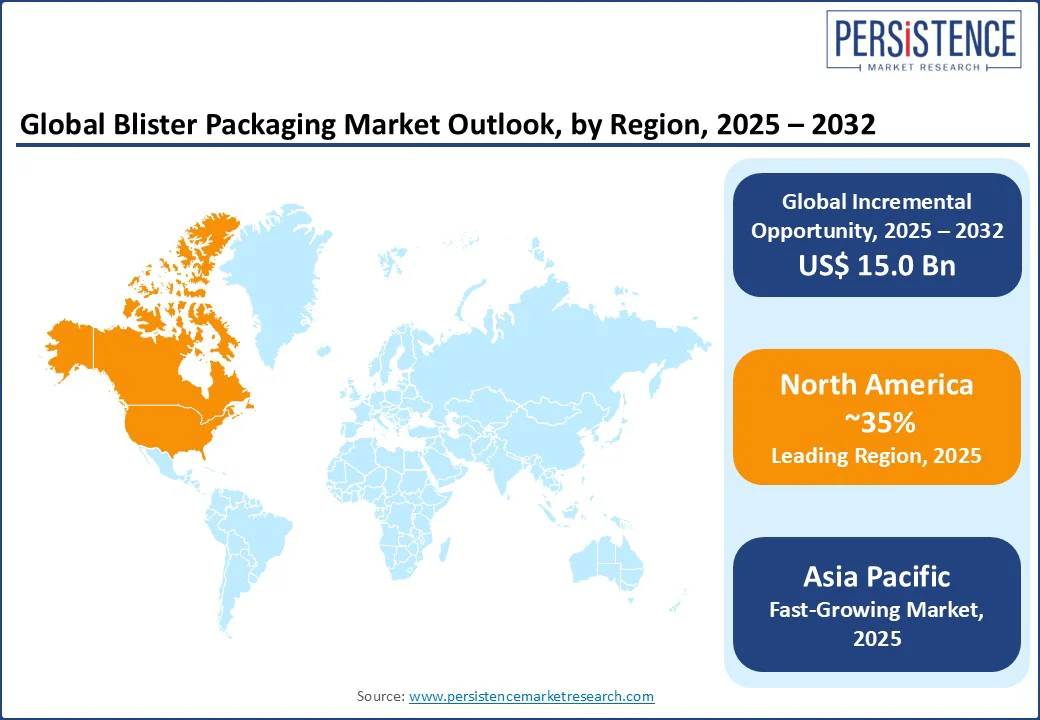

North America, commands a 35% global market share in 2025. The U.S. dominates due to its robust pharmaceutical industry, with US$ 8.6 Bn in blister packaging sales in 2025.

The U.S. market is driven by pharmaceutical packaging and tablet blister packaging, with 70% of pharmaceutical companies using blister packs for capsules, tablets, and medical devices in 2025. Regulatory compliance in blister packaging grew by 15%, supported by Amcor plc. Sonoco Products Company and WestRock Company drive 25% of regional revenue, leveraging medicine packaging solutions.

In Europe, the Blister Packaging Market accounts for a 30% global share, led by Germany, the UK, and France. Germany’s market is driven by medical packaging and Alu-Alu blister packs, with 60% of manufacturers using barrier films for blister packs in 2025. The UK’s food packaging supports the strip packaging adopted by Tesco.

France’s healthcare packaging products drive 10% growth in packaging machinery for tablets and capsules. EU sustainability regulations boost 12% growth in blister packaging material innovations, with €100 Mn in funding for eco-friendly packaging in 2025, enhancing protective packaging. Constantia Flexibles leads with 10% market share.

Asia Pacific is the fastest-growing region, with a CAGR of 8.2%, led by China, India, and Japan. China holds a 45% regional market share, driven by a 20% increase in pharmaceutical production in 2025, boosting pharmaceutical packaging and tablet blister packaging.

India’s market is fueled by the growth of the blister packaging market in emerging economies and medicine packaging solutions, with 85% of manufacturers using Alu-Alu blister packs in 2025. Japan’s food packaging drives 15% growth in strip packaging. UFlex Limited and ACG lead, supported by US$10 Bn in packaging industry investments by 2030.

The global blister packaging market is highly competitive, with packaging companies competing on innovation, sustainability, and automation. Amcor plc and Constantia Flexibles dominate in pharmaceutical packaging, while UFlex Limited leads in food packaging.

Healthcare packaging products, tamper-evident packaging, and automated blister packaging machinery and technology add a competitive layer. Strategic partnerships and R&D investments in blister packaging material innovations are key differentiators.

The blister packaging market is projected to reach US$ 24.7 Bn in 2025, driven by pharmaceutical packaging and food packaging.

Secure packaging, regulatory compliance in blister packaging, and automated blister packaging machinery and technology are key drivers.

The blister packaging market grows at a CAGR of 7.0% from 2025 to 2032, reaching US$ 39.7 Bn by 2032.

Opportunities include blister packaging material innovations, growth of blister packaging market in emerging economies, and food packaging.

Key players include Amcor plc, Constantia Flexibles, UFlex Limited, Sonoco Products Company, and WINPAK LTD.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Packaging Type

By Technology

By Material Type

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author