ID: PMRREP32384| 194 Pages | 4 Feb 2026 | Format: PDF, Excel, PPT* | Healthcare

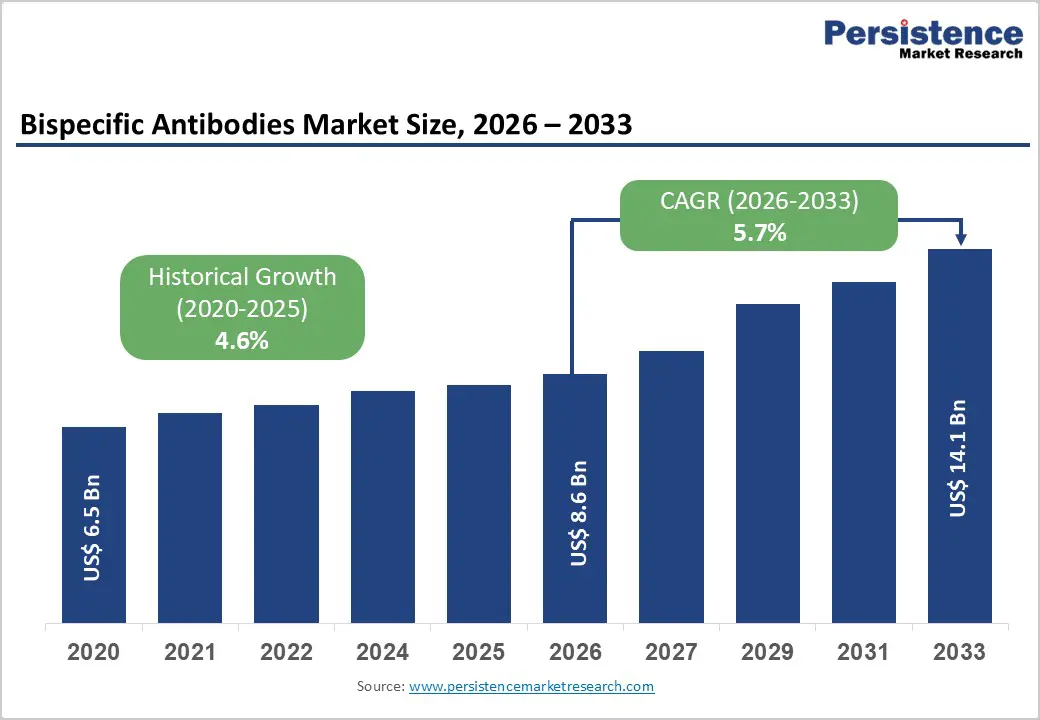

The global bispecific antibodies market size is estimated to grow from US$ 8.6 billion in 2026 to US$ 14.1 billion by 2033 growing at a CAGR of 5.7% during the forecast period from 2026 to 2033.

Global demand for bispecific antibodies is increasing steadily, driven by the rapid expansion of pharmaceutical and biopharmaceutical R&D, heightened regulatory scrutiny of innovative biologics, and the increasing complexity of next-generation antibody formats. The increasing prevalence of cancer, autoimmune disorders, inflammatory diseases, and other chronic conditions is accelerating clinical development pipelines, boosting demand for advanced, targeted immunotherapies such as bispecific antibodies. Strong growth in biologics-focused pipelines, increased R&D investments, and expanding strategic collaborations between pharmaceutical and biotechnology companies further support market expansion.

Continuous innovation in antibody engineering platforms, protein design technologies, and scalable biologics manufacturing is improving clinical success rates and commercialization potential. In addition, regulatory incentives for breakthrough therapies, the increasing emphasis on precision medicine, and global alignment of biologics approval frameworks are strengthening long-term demand for the development and commercialization of bispecific antibodies across the pharmaceutical value chain.

| Key Insights | Details |

|---|---|

| Bispecific Antibodies Market Size (2026E) | US$ 8.6 Bn |

| Market Value Forecast (2033F) | US$ 14.1 Bn |

| Projected Growth (CAGR 2026 to 2033) | 5.7% |

| Historical Market Growth (CAGR 2020 to 2025) | 4.6% |

The bispecific antibodies market is experiencing strong momentum driven by the rapid expansion of oncology and immunology drug pipelines and growing investment in next-generation biologics. Rising global prevalence of cancer, autoimmune disorders, and chronic inflammatory diseases has intensified demand for innovative, highly targeted therapies, positioning bispecific antibodies as a preferred modality due to their enhanced efficacy and dual-target mechanisms. Pharmaceutical and biotechnology companies are increasingly prioritizing bispecific formats in clinical development to address unmet medical needs and improve therapeutic outcomes.

Stringent regulatory oversight by authorities such as the U.S. FDA, EMA, and PMDA is further driving market growth by enforcing rigorous quality, safety, and clinical validation requirements. These standards necessitate extensive preclinical evaluation, clinical trials, and post-marketing surveillance, supporting sustained demand across development stages. Additionally, growing venture capital funding, strategic collaborations, and licensing agreements are accelerating the research and commercialization of bispecific antibodies. Advances in antibody engineering platforms, protein design technologies, and manufacturing scalability are also improving development success rates. Collectively, the expanding disease burden, regulatory-driven validation requirements, and increasing R&D investments are core drivers of the long-term growth of the global bispecific antibodies market.

The bispecific antibodies market faces notable restraints related to technical complexity and high development costs. Bispecific antibody engineering entails sophisticated molecular design, complex manufacturing processes, and stringent quality control, thereby making production more challenging than that of conventional monoclonal antibodies. Maintaining molecular stability, correct chain pairing, and consistent batch-to-batch quality increases production risks and costs, limiting scalability for smaller developers.

High R&D expenditures associated with extended preclinical studies, multi-phase clinical trials, and regulatory compliance further constrain market expansion. Clinical translation challenges, including unexpected toxicity, immunogenicity concerns, and suboptimal efficacy in late-stage trials, can lead to costly delays or program discontinuation. Additionally, limited manufacturing capacity for advanced biologics and dependence on specialized contract manufacturing organizations may create supply bottlenecks. Regulatory complexity across regions adds another layer of difficulty, as developers must navigate varying approval pathways and evolving biologics guidelines. These combined factors increase time-to-market and financial risk, potentially limiting broader participation and slowing commercialization, particularly for early-stage biotech firms.

The bispecific antibodies market presents significant growth opportunities driven by expanding applications beyond oncology into autoimmune, inflammatory, and rare diseases. Increasing clinical evidence supporting the efficacy of bispecific antibodies in immune modulation is opening new therapeutic indications and broadening addressable markets. Innovation in antibody engineering platforms, including novel scaffolds, modular designs, and improved linker technologies, is enhancing manufacturability and safety profiles, enabling next-generation product development.

Strategic partnerships between large pharmaceutical companies and emerging biotech firms are accelerating innovation while reducing development risk. Additionally, the growing adoption of outsourcing models for development and manufacturing is enabling smaller players to enter the market. Emerging pharmaceutical markets in the Asia Pacific, Latin America, and the Middle East offer substantial long-term potential, supported by rising healthcare expenditure, improving regulatory frameworks, and increasing clinical trial activity. Governments in these regions are encouraging biologics manufacturing through policy incentives and infrastructure investments. Together, therapeutic diversification, platform advancements, and geographic expansion are creating strong opportunities for sustained growth in the global bispecific antibodies market.

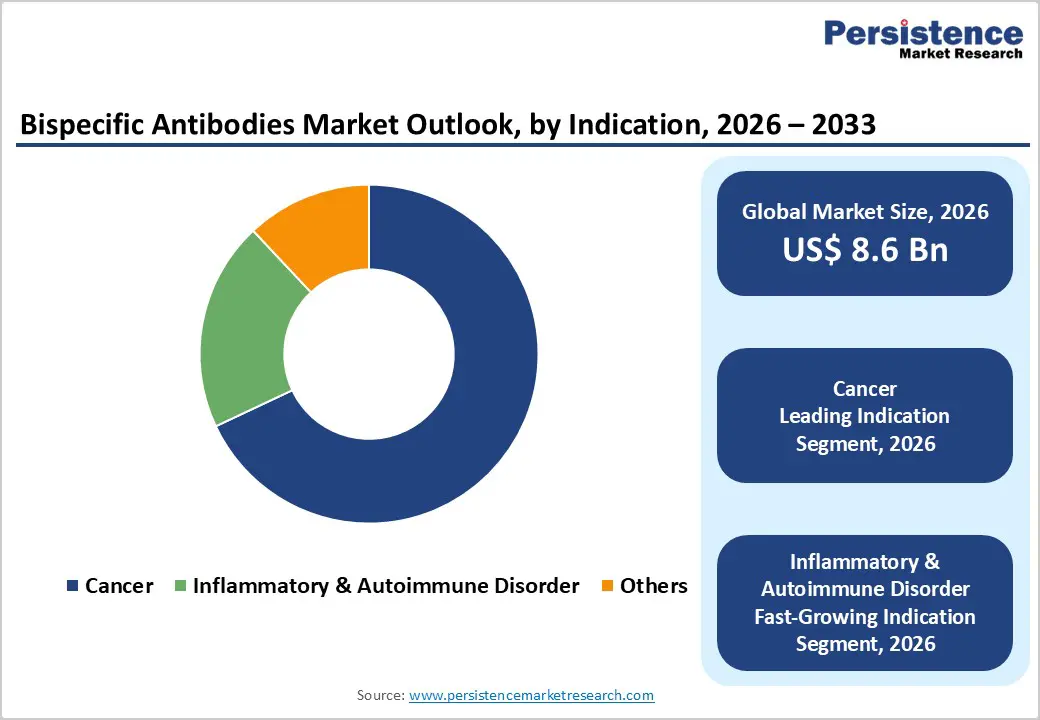

The cancer segment is projected to remain the leading indication in the global bispecific antibodies market in 2026, accounting for 68.0% of revenue. This dominance is primarily driven by the high clinical and commercial focus on oncology, where bispecific antibodies offer distinct mechanisms of action, including dual-target binding, immune cell redirection, and enhanced tumor specificity. These advantages have positioned bispecific antibodies as a key innovation in hematologic malignancies and solid tumors. Rising global cancer incidence, coupled with strong unmet medical needs and resistance to conventional therapies, continues to fuel intensive R&D and clinical trial activity. Regulatory agencies are also prioritizing oncology innovation through accelerated approval pathways, further supporting market growth. Additionally, increasing investment in next-generation antibody engineering platforms and combination immunotherapy strategies is expanding the oncology pipeline. As a result, cancer-focused bispecific antibody products dominate late-stage development and commercialization, reinforcing the segment’s leadership within the global market.

The pharmaceutical companies are projected to account for the largest share of end-user demand in the global bispecific antibodies market in 2026, representing 40.0% of total revenue. Their dominance is driven by strong financial resources, well-established R&D ecosystems, and the capability to execute complex biologics development and commercialization programs. Major pharmaceutical players are actively progressing bispecific antibody candidates across oncology, autoimmune, and inflammatory disease indications, supported by deep clinical pipelines and global market reach. Growing collaboration with biotechnology firms, academic research centers, and CDMOs is accelerating development timelines while sharing technical and financial risk. In parallel, pharmaceutical companies are investing in manufacturing scale-up, process optimization, and lifecycle management to support late-stage clinical trials and regulatory approvals. The increasing focus on targeted and differentiated biologics continues to sustain long-term investment in bispecific antibody platforms, reinforcing pharmaceutical companies’ leadership within the global market.

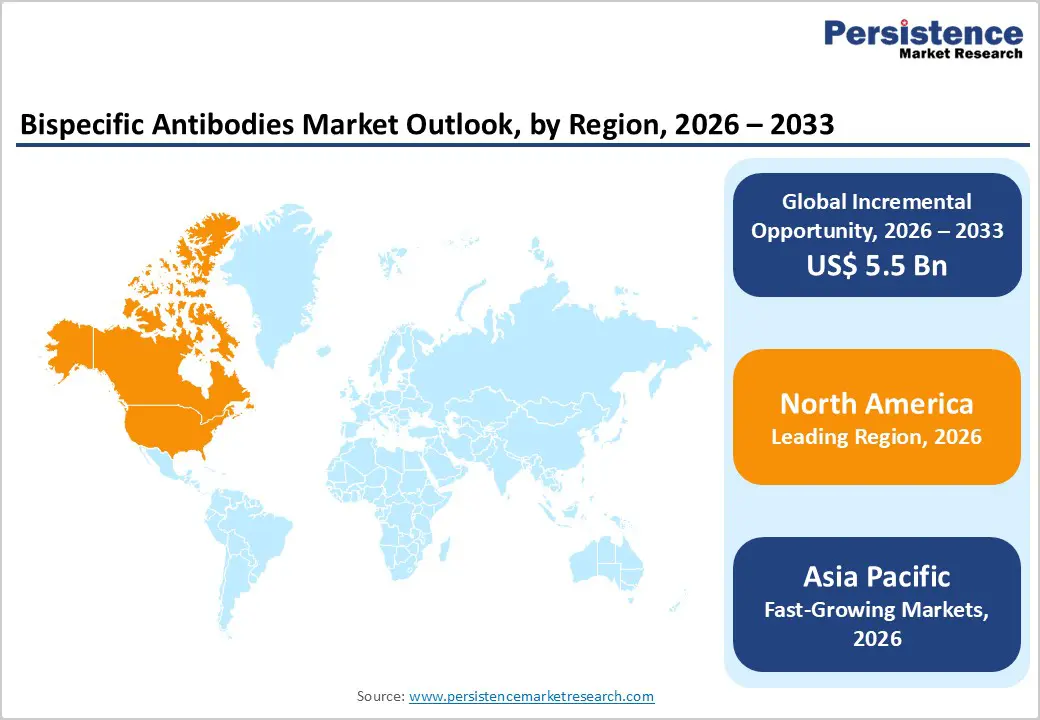

North America is expected to dominate the global bispecific antibodies market with a value share of 48.8% in 2026, led primarily by the United States. The region benefits from a highly mature biopharmaceutical ecosystem supported by strong venture capital funding, advanced research infrastructure, and a high concentration of leading pharmaceutical and biotechnology companies. The U.S. FDA plays a central role in shaping development standards, driving rigorous clinical evaluation and regulatory compliance for bispecific antibody products. High cancer prevalence and strong demand for targeted immunotherapies continue to accelerate clinical trial activity across oncology indications.

North America also demonstrates early adoption of advanced antibody engineering platforms, AI-driven drug discovery, and scalable biologics manufacturing technologies. Strategic collaborations between industry players, academic institutions, and contract manufacturers further strengthen innovation output. Additionally, favorable reimbursement frameworks and expedited approval pathways for breakthrough oncology therapies enhance commercial uptake. Collectively, strong R&D investment, regulatory leadership, and commercialization readiness continue to reinforce North America’s dominant position in the global bispecific antibodies market.

The European bispecific antibody market is expected to grow steadily, supported by a robust regulatory framework, expanding biologics production, and a growing focus on innovative oncology and immunology therapies. Countries including Germany, the U.K., France, Italy, and the Nordic region play a central role due to their well-established pharmaceutical manufacturing bases and active participation in global clinical research. Oversight by the European Medicines Agency (EMA) enforces rigorous clinical development and safety standards, driving consistent demand for advanced biologic therapeutics. European companies are increasingly investing in bispecific antibody platforms, supported by public funding initiatives and cross-border research collaborations.

Growth is further driven by rising biologics and biosimilar production, along with increasing participation in multinational clinical trials. Investments in antibody engineering, translational research, and manufacturing optimization are improving development efficiency. Additionally, strategic licensing agreements and partnerships with U.S. and Asian firms are enhancing Europe’s competitive positioning, supporting sustained growth in the regional bispecific antibodies market.

The Asia-Pacific bispecific antibody market is expected to exhibit a relatively high CAGR of approximately 10.6% between 2026 and 2033, positioning the region as the fastest-growing globally. Rapid expansion of pharmaceutical and biotechnology manufacturing, rising cancer incidence, and increasing clinical trial activity are key growth drivers. Countries such as China, India, Japan, South Korea, and Southeast Asian nations are witnessing accelerated adoption of advanced biologics driven by healthcare infrastructure development and growing domestic innovation capabilities.

Governments across the region are strengthening regulatory frameworks and aligning approval pathways with international standards, supporting faster clinical translation. The expansion of biotechnology ecosystems in China and India is particularly driving demand for novel antibody formats, including bispecifics. Cost-efficient manufacturing, improving technical expertise, and rising investments in biologics R&D are further supporting market expansion. Strategic partnerships with global pharmaceutical companies and increased technology transfer initiatives are positioning the Asia Pacific as a critical growth engine for the global bispecific antibodies market.

The global bispecific antibodies market is highly competitive, with key participation from Amgen, F. Hoffmann-La Roche Ltd, Genentech, Akeso, Inc., and Janssen, supported by strong R&D capabilities, advanced antibody engineering platforms, and extensive clinical pipelines across oncology and immunology.

These players focus on expanding proprietary bispecific technologies, scaling manufacturing, and pursuing strategic collaborations and licensing agreements to accelerate development, regulatory approvals, and commercialization, reinforcing long-term market growth.

The global bispecific antibodies market is projected to be valued at US$ 8.6 Bn in 2026.

Rising cancer and autoimmune disease prevalence, expanding biologics pipelines, advances in antibody engineering, and strong regulatory support for innovative targeted therapies drive global market growth.

The global bispecific antibodies market is poised to witness a CAGR of 5.7% between 2026 and 2033.

Opportunities lie in expanding non-oncology indications, next-generation bispecific platforms, strategic pharma biotech collaborations, and rapid adoption across emerging pharmaceutical markets.

Amgen, F. Hoffmann-La Roche Ltd, Genentech, Akeso, Inc., and Janssen are some of the key players in the bispecific antibodies market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Indication

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author