ID: PMRREP32936| 198 Pages | 14 Nov 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

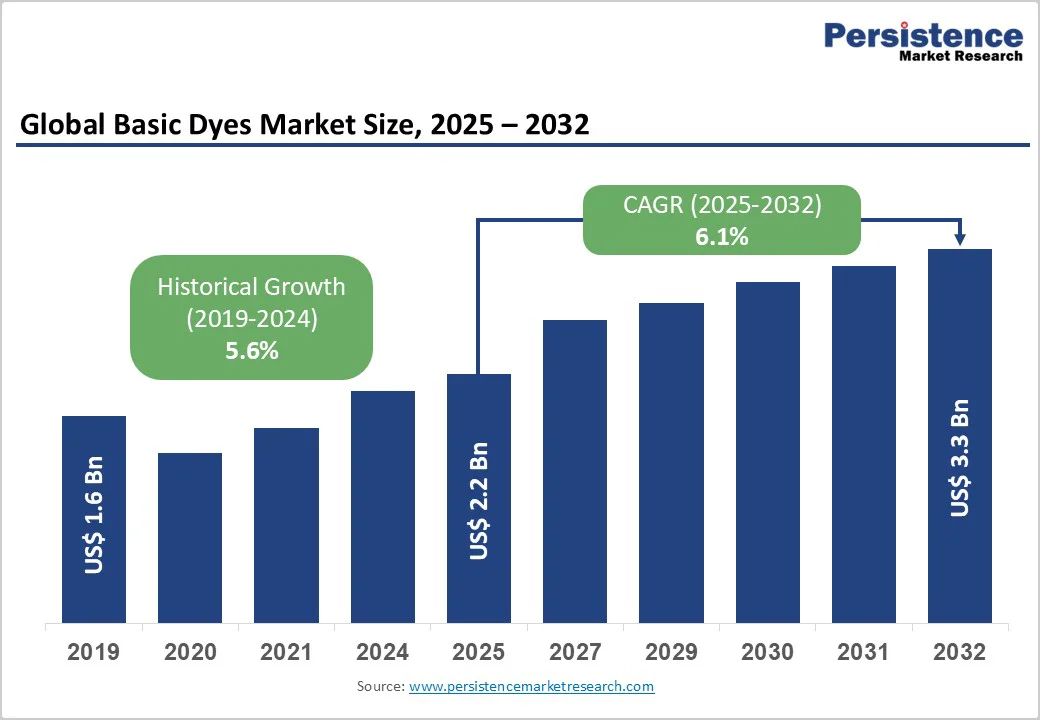

The global basic dyes market size is likely to be valued US$2.2 Billion in 2025, forecasted to US$3.3 Billion by 2032, growing at a CAGR of 6.1% during the forecast period from 2025 to 2032, driven by the increasing prevalence of textile manufacturing, rising demand for vibrant colorants in cosmetics, and advancements in dye formulations. The need for high-affinity and cost-effective dyes, particularly in textiles, has significantly boosted the adoption of basic dyes across various demographics. The market is further propelled by innovations in azo and anthraquinone-based dyes, catering to preferences for bright and stable options. The growing acceptance of basic dyes as essential for leather and paper coloring, particularly in industrial applications, is a key growth factor.

| Key Insights | Details |

|---|---|

| Basic Dyes Market Size (2025E) | US$2.2 Bn |

| Market Value Forecast (2032F) | US$3.3 Bn |

| Projected Growth (CAGR 2025 to 2032) | 6.1% |

| Historical Market Growth (CAGR 2019 to 2024) | 5.6% |

Rising Prevalence of Textile Manufacturing and Demand for Vibrant Colorants

The rising prevalence of textile manufacturing and the growing demand for vibrant colorants are key factors driving the expansion of the basic dyes market. As global textile production continues to surge particularly in countries such as China, India, and Bangladesh the need for affordable, high-intensity dyes has increased significantly. Basic dyes are widely used in colouring acrylic fibers, silk, wool, and blended fabrics due to their bright shades, strong affinity, and cost-effectiveness.

The global fashion industry’s emphasis on aesthetic appeal and color diversity further accelerates this demand. Consumers increasingly favor bold, long-lasting hues, encouraging textile producers to adopt advanced dye formulations that ensure superior color fastness and consistency. Rapid urbanization and rising disposable incomes in developing nations are also boosting demand for colored fabrics in apparel, home textiles, and accessories.

High Development and Environmental Compliance Costs

The high costs associated with development and environmental compliance of basic dyes pose a significant restraint on market growth. The production of dyes involves complex chemical processes and the use of synthetic raw materials that must meet strict environmental and safety standards. Manufacturers face increasing regulatory pressures from agencies such as the EPA and REACH, requiring adherence to emission control, wastewater treatment, and hazardous substance management protocols.

Developing eco-friendly and compliant dye formulations demands extensive R&D investment, testing, and certification, significantly raising production expenses. Smaller producers often struggle to afford these costs, limiting their ability to compete with larger multinational companies that have the resources to upgrade facilities and implement green technologies. The shift toward sustainable and biodegradable dyes necessitates reengineering existing manufacturing lines and adopting new raw materials, further driving up operational costs.

Advancements in Eco-Friendly and High-Fastness Blends

Advancements in eco-friendly and high-fastness blends present significant growth opportunities for the basic dyes market. Eco-dyes reduce pollution, making them preferred for green applications. Traditional dyes often posed environmental and durability challenges, but modern innovations focus on biodegradable and low-toxicity formulations that meet global environmental standards. These eco-friendly blends are developed using renewable raw materials and cleaner synthesis processes, significantly reducing water pollution and chemical waste during dyeing operations.

High-fastness blends, designed to improve resistance to light, washing, and perspiration, enhance color longevity and fabric durability critical for textiles, leather, and cosmetics applications. The integration of nanotechnology and advanced chemical engineering has allowed manufacturers to create dyes with better molecular bonding, ensuring stable coloration even under harsh conditions.

Type-Based Insights

Azo Dyes dominates the market, accounting for 35% of the share in 2025. Its dominance is driven by brightness, cost-effectiveness, and versatility, making it preferred for textiles. Azo dyes, such as those from Bayer, provide vivid colors, ensuring compatibility. Its affinity and range make it preferred for manufacturers.

Natural Dyes is the fastest-growing segment, driven by sustainability and increasing adoption in cosmetics. Natural dyes offer mildness, appealing for skin care. Focus on plant-based innovation accelerates adoption in Asia Pacific and Europe.

Application Insights

Textiles lead the market, holding 40% of the share in 2025, driven by extensive use in fabric coloring and easy accessibility in dyeing processes. The sector benefits from rising fashion trends and increasing textile production worldwide. Strong demand for vibrant, durable colors continues to reinforce textiles as the dominant application segment.

Cosmetics is the fastest-growing segment, fueled by evolving makeup trends and rising use in lipsticks and hair products. Demand for vibrant, long-lasting shades and safe, skin-compatible formulations drives adoption. Growing consumer preference for bold aesthetics and innovation in dye safety standards further accelerates this segment’s expansion.

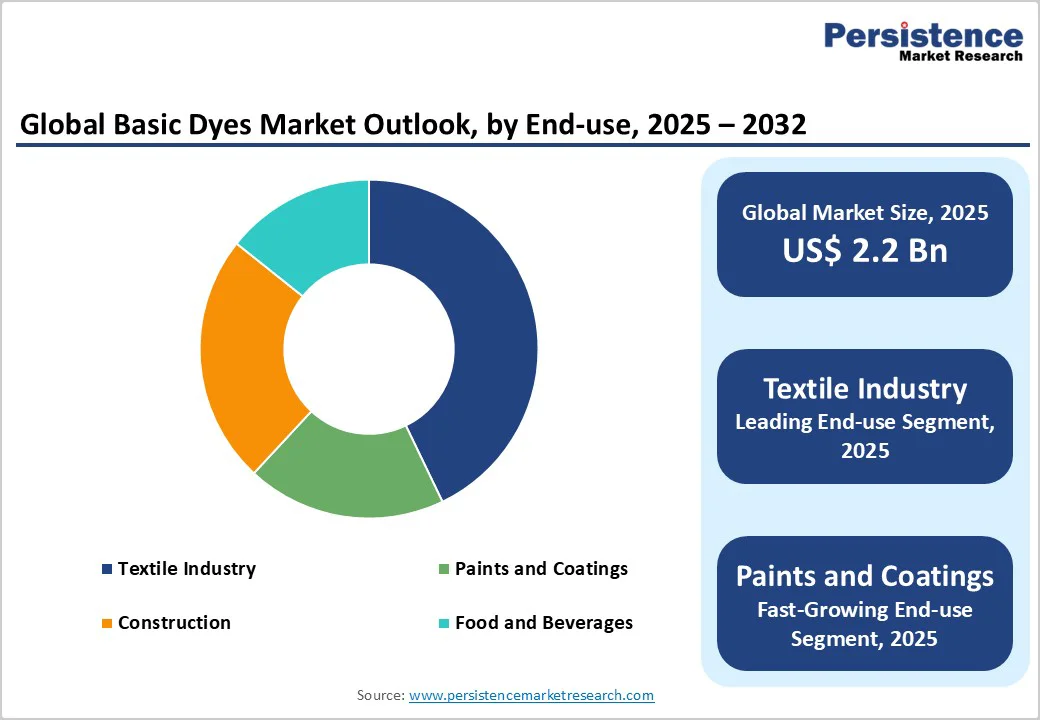

End-use Insights

Textile Industry dominates the market, contributing 45% of revenue in 2025. Its leadership stems from extensive use in apparel and fabric dyeing, where vibrant coloration and cost efficiency are crucial. The industry’s versatility, large-scale production, and continuous demand for bright, durable shades further reinforce its dominant market position.

Paints and Coatings is the fastest-growing segment, driven by rising decorative applications and rapid construction activities. Demand for vibrant, durable, and high-adhesion dye formulations boosts adoption in both residential and commercial projects. Enhanced color stability and surface performance further support this segment’s accelerating growth globally.

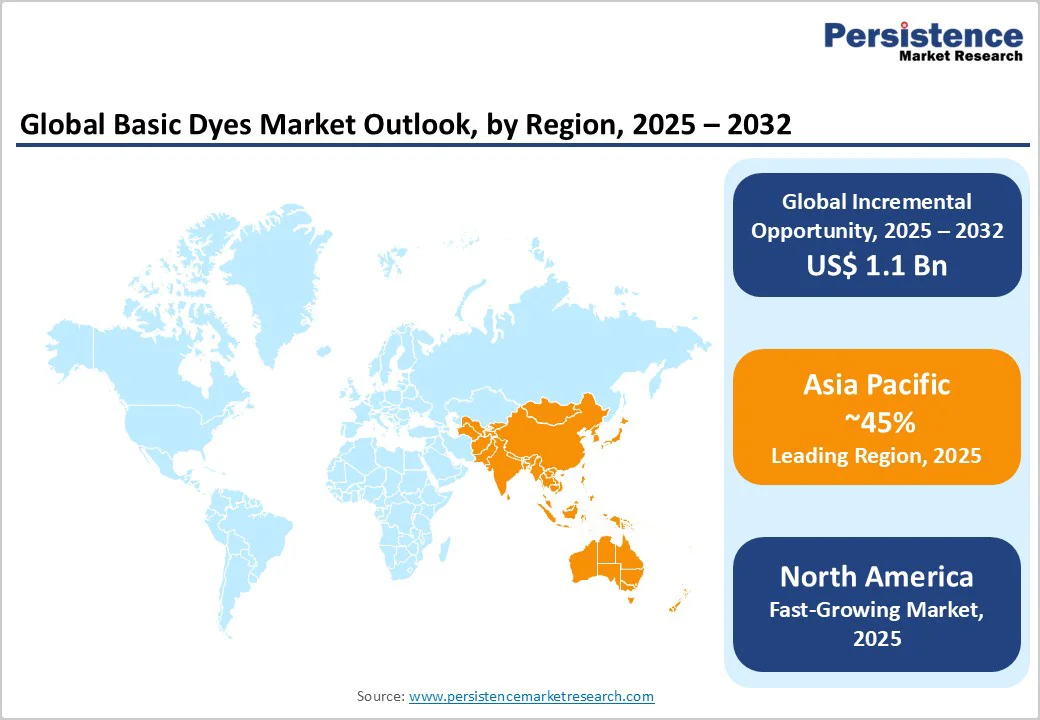

Asia Pacific Basic Dyes Market Trends

Asia Pacific is dominate the sector, accounts 45% share in 2025, driven by rapid industrialization and the booming textile and leather sectors in China and India. China leads the regional growth with large-scale dye manufacturing and continuous investment in cost-effective production technologies by companies such as Zhejiang Longsheng. These advancements enable competitive pricing and high-volume output to meet global demand.

India benefits from expanding textile production and a strong manufacturing base, fueling demand for affordable and efficient basic dyes. The region’s abundant raw material availability and lower labor costs further strengthen its competitive position. The rising adoption of disperse dyes in synthetic fiber processing and increasing use of dyes in the leather finishing industry create new growth avenues. Government initiatives promoting sustainable chemical production and export-oriented dye manufacturing are further accelerating market expansion.

North America Basic Dyes Market Trends

North America is fastest growing, commanding 25% of the global basic dyes market in 2025, driven by technological advancements, strong industrial infrastructure, and rising demand from textile, paper, and leather sectors. The United States dominates the regional market, supported by the presence of leading chemical producers and consistent investments in sustainable dye chemistry. Companies such as Huntsman and BASF SE are focusing on high-purity, performance-oriented dyes that cater to specialized applications such as packaging, coatings, and synthetic fibers.

Environmental sustainability has become a key trend, with manufacturers adopting cleaner production technologies and low-emission processes to comply with stringent EPA regulations. The region also witnesses increasing adoption of eco-friendly and water-efficient dyeing methods, reducing waste and improving cost efficiency. Collaborations between chemical suppliers and textile producers are fostering innovation in customized dye formulations for high-end fashion and industrial applications.

Europe Basic Dyes Market Trends

Europe holds 20% share in 2025, supported by advanced manufacturing technologies, stringent environmental regulations, and rising demand for sustainable dye solutions. The region’s strong textile, paper, and leather industries continue to drive consumption, particularly in countries such as Germany, Italy, and the U.K. European manufacturers focus heavily on eco-friendly formulations, investing in low-toxicity, biodegradable dye alternatives to meet regulatory standards such as REACH.

Leading companies, including BASF SE and Huntsman, are enhancing their R&D capabilities to develop high-performance and energy-efficient production processes. The shift toward circular economy practices and reduced carbon emissions is encouraging innovation in bio-based dyes and recycling of dye effluents. Additionally, collaborations between chemical producers and textile manufacturers are improving supply chain efficiency and product customization. The growing trend of premium and sustainable fashion, along with the resurgence of European textile manufacturing, supports market stability.

The global basic dyes market is highly competitive, comprising both established chemical giants and specialized regional manufacturers. In developed regions such as North America and Europe, companies such as BASF SE and Huntsman dominate through extensive R&D capabilities, strong distribution networks, and diversified product portfolios catering to multiple end-use industries. Their focus on technological advancements and sustainable production practices reinforces market leadership.

In the Asia Pacific region, firms such as Atul Ltd. have achieved a strong presence by offering cost-effective and localized dye solutions tailored to regional textile, paper, and leather industries. The market is increasingly witnessing a shift toward natural and eco-friendly dye innovations in response to environmental regulations and consumer demand for sustainable materials. Strategic collaborations, mergers, and acquisitions are becoming key growth strategies among players seeking to expand global reach and product innovation.

Key Industry Developments

The global basic dyes market is projected to reach US$ 2.2 Billion in 2025.

The rising prevalence of textile manufacturing and demand for vibrant colorants are key drivers.

The market is poised to witness a CAGR of 6.1% from 2025 to 2032.

Advancements in eco-friendly and high-fastness blends are key opportunities.

BASF SE, Bayer, Atul, Huntsman, and Zhejiang Longsheng are key players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 – 2024 |

| Forecast Period | 2025 – 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Type-Based

By Application

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author