ID: PMRREP35783| 198 Pages | 28 Oct 2025 | Format: PDF, Excel, PPT* | Food and Beverages

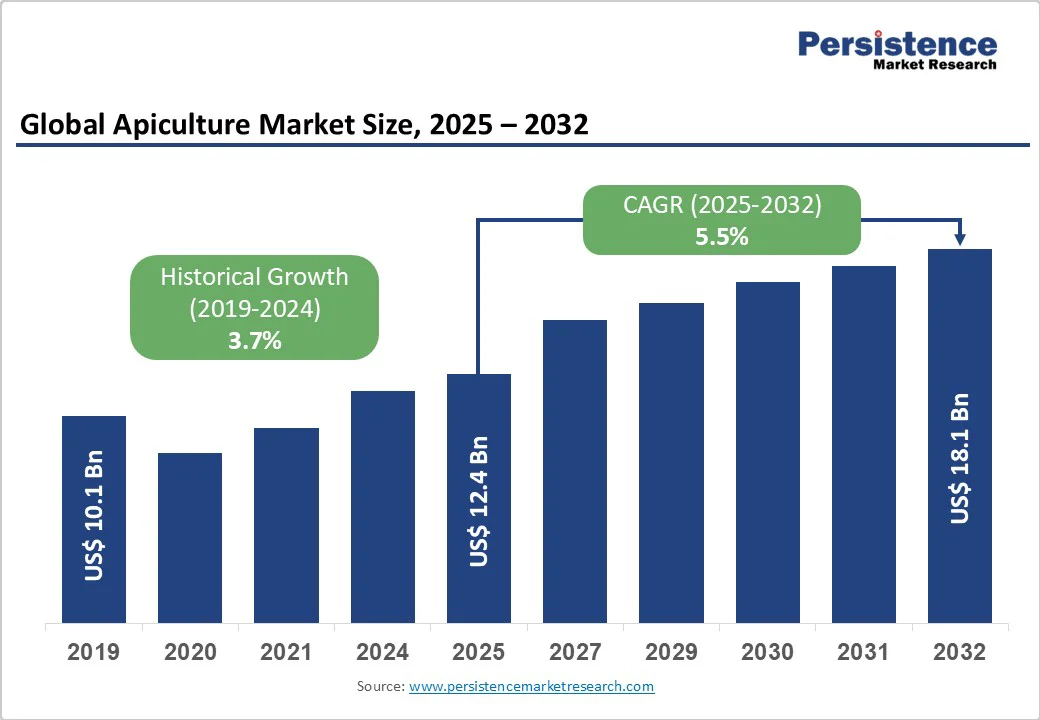

The global apiculture market is expected to reach US$12.4 billion in 2025. It is expected to reach US$18.1 billion by 2032, growing at a CAGR of 5.5% during the forecast period from 2025 to 2032, driven by rising consumer demand for natural and functional bee-derived products such as honey, propolis, royal jelly, and beeswax.

Regulatory focus on traceability and authentication is raising market standards and prices. Advances in precision beekeeping enhance productivity and consistency, while rising urbanization and demand for cosmetic and nutraceutical products drive growth.

| Key Insights | Details |

|---|---|

| Market Size (2025E) | US$12.4 Bn |

| Market Value Forecast (2032F) | US$18.1 Bn |

| Projected Growth (CAGR 2025 to 2032) | 5.5% |

| Historical Market Growth (CAGR 2019 to 2024) | 3.7% |

Increasing awareness of healthy diets and clean-label food has driven global consumption of bee-derived products. Honey is replacing refined sugars in both household and industrial applications. Nutraceutical and cosmetic applications are expanding, with products such as propolis and royal jelly gaining clinical and consumer attention.

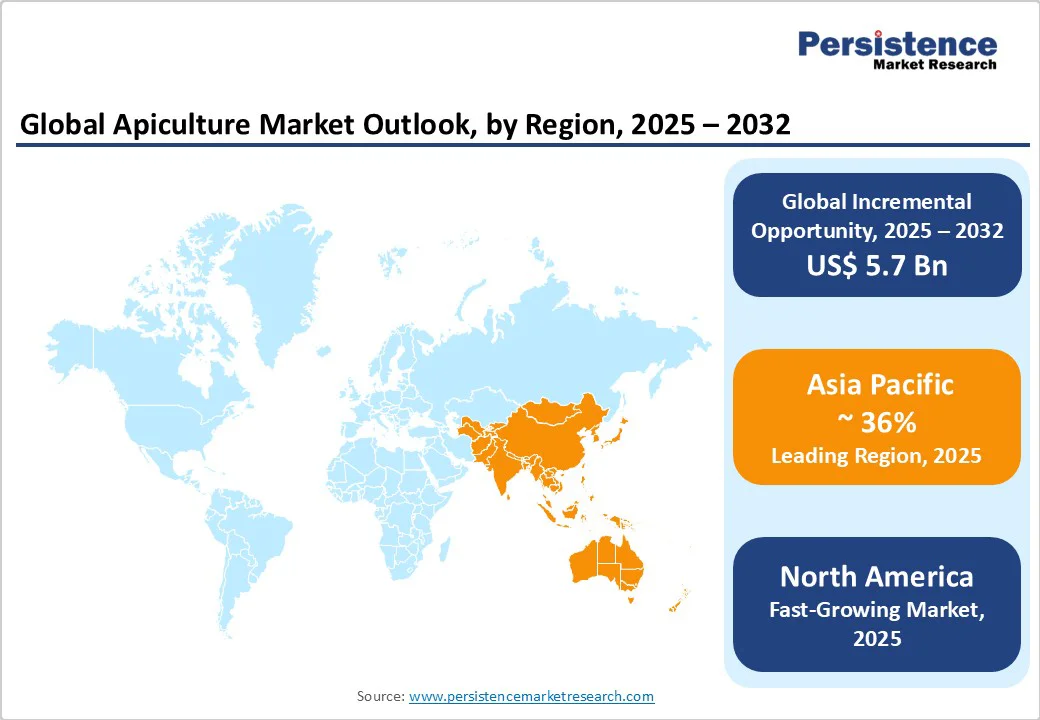

This consumer shift has contributed to a steady mid-single-digit CAGR in global apiculture revenue, with urban populations in Asia Pacific, North America, and Europe driving demand for premium, functional products. The growing trend of wellness-focused diets continues to reinforce market expansion.

Recent global regulatory measures emphasize authenticity, origin labeling, and quality verification for honey. These include stricter rules on adulteration, standardized labeling, and certification programs. Such regulations increase compliance costs but create a premium segment for authenticated products, encouraging investment in chain-of-custody and traceability systems.

Producers that comply with these standards can achieve higher pricing and improved market access, particularly in Europe and North America, where consumer trust and safety are paramount. Regulatory alignment supports growth in certified monofloral and medical-grade honey.

Precision apiculture, including IoT-enabled hive sensors, automated extraction, and queen-rearing technologies, is driving higher yields and improved colony health. These technological tools allow beekeepers to monitor temperature, humidity, and disease conditions in real time, reducing losses and optimizing productivity.

The adoption of such innovations is particularly strong in developed markets, enabling commercial operators to scale efficiently, deliver consistent quality, and support high-value premium segments. Technology adoption also opens service-based revenue opportunities in analytics, hive monitoring, and contract pollination services.

Colony collapse disorder, pesticide exposure, and climate-driven forage variability are major supply-side constraints. Seasonal fluctuations and colony losses affect honey yields and the availability of live bees, leading to price volatility. These challenges require investment in colony management, diversified sourcing, and disease-prevention measures. Market stability is closely tied to environmental factors, making risk management essential for sustainable production.

Adulteration of honey with syrups and other non-bee substances remains a persistent issue. Combating fraud requires sophisticated laboratory testing and traceability systems, increasing costs for producers and processors. Smaller operators may struggle with compliance, potentially limiting supply in certain markets. The need for consistent quality verification drives investments in authentication technologies but can also create barriers to entry for new participants.

The monofloral and medical-grade honey segments offer high-margin opportunities. Products such as Manuka honey, certified propolis, and royal jelly are commanding premium prices in international markets. Expansion into certified, functional, or clinically validated products allows producers to capture higher revenue per unit. These segments are growing faster than traditional bulk honey, driven by consumer preference for authenticity and traceable quality, especially in Europe, North America, and Oceania.

Commercial pollination services create recurring revenue streams. Contracting hives to orchards and large-scale agricultural producers enhances value per colony. Increasing recognition of pollination’s contribution to crop yields and government initiatives supporting pollinator protection further strengthen this market. Integrating pollination services with premium honey production or bee-derived product offerings can enhance profitability and diversify revenue streams.

Service models centered around precision apiculture, including hive monitoring, data analytics, and advisory services, represent a growing business opportunity. Companies can offer data-driven solutions to optimize yield, monitor colony health, and provide predictive insights. The adoption of technology-enabled services is particularly lucrative in developed markets with high-value honey and significant commercial pollination activity.

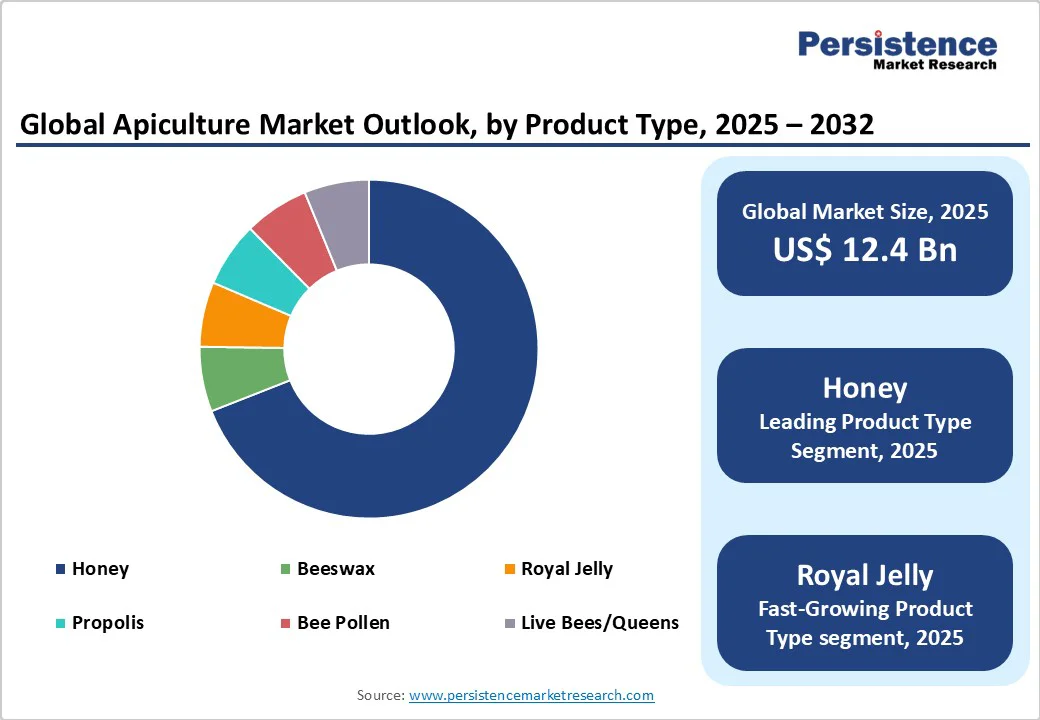

Honey remains the cornerstone of the market, accounting for roughly 78% of the total revenue. Its broad applications across culinary, industrial, and retail sectors ensure sustained demand. Beyond traditional household use, honey is increasingly incorporated into beverages, baked goods, sauces, and confectionery, driving volume growth.

Premium and monofloral varieties, including Manuka from New Zealand, Sidr from Yemen, and Acacia from Europe, command higher prices due to unique properties, geographical indications, and claimed medicinal benefits. Brands such as Comvita and Capilano Honey have successfully captured the premium segment by leveraging these high-value products. The growing consumer shift toward natural sweeteners as alternatives to refined sugar continues to support market expansion.

Royal jelly is the fastest-growing segment in apiculture, driven by its growing use in nutraceutical, cosmetic, and pharmaceutical applications. Rich in bioactive compounds, proteins, peptides, and fatty acids, royal jelly is positioned as a premium ingredient for functional foods, dietary supplements, and anti-aging skincare products.

Consumer preference for natural, science-backed wellness solutions has driven demand in key markets, including Japan, South Korea, China, and parts of Europe. Pharmaceutical companies are investing in royal jelly-based formulations targeting wound healing, immune modulation, and menopausal health, supported by emerging clinical evidence.

The segment growth is further strengthened by online retail availability, premium pricing, and sustainability and traceability certifications, which boost consumer confidence. These factors position royal jelly to outpace other apiculture products in revenue growth through 2032.

The food and beverage sector is the largest application segment in the apiculture market, contributing 57% of revenue across key regions. Honey serves as a natural sweetener, functional ingredient, and flavor enhancer in bakery items, beverages, and processed foods. Bee pollen and propolis are increasingly added to energy drinks, protein bars, and fortified beverages for their health benefits.

In Japan, functional drinks often include pollen to boost stamina and immunity, while European confectionery brands use honey for sweetness and texture. This growth is supported by the global trend toward clean-label, natural ingredients, with consumers favoring transparency, quality, and wellness-focused products.

Pharmaceutical and nutraceutical applications are also expanding rapidly, driven by growing clinical validation of bee-derived compounds. Honey-based wound dressings, propolis extracts for oral health, and royal jelly supplements for anti-inflammatory benefits are gaining traction.

Companies such as Dabur India and Y.S. Eco Bee Farms supply immune-support formulations, while pharmaceutical firms explore bee venom for arthritis and skin therapies. Growth is the strongest in high-income markets, driven by premium consumer demand for functional, natural, and clinically backed products.

Traditional beekeeping, practiced predominantly in China, India, Africa, and parts of Eastern Europe, accounts for the majority of global honey production. Smallholder operations utilize conventional hives and manual extraction methods, providing bulk honey for domestic consumption and export.

Despite limited mechanization, these operations maintain cultural significance and provide livelihoods for millions of rural households. For example, India’s Khadi honey cooperatives emphasize organic, small-batch production, while African communities rely on forest honey collection. The lack of standardized quality certification can restrict access to premium export markets.

Modern beekeeping, incorporating mechanized hives, automated extraction, and IoT-enabled monitoring systems, is the fastest-growing production method. These innovations allow commercial operators to optimize colony health, reduce losses, and improve yield predictability.

For example, Mann Lake Ltd. and Dadant & Sons provide precision monitoring systems that track temperature, humidity, and hive activity, enabling proactive disease management. This method is particularly valuable for high-value segments such as monofloral honey and certified organic products. Modern techniques also support service-based models, including pollination contracts and data-driven hive management, generating additional revenue streams.

The North American apiculture market is mature, with the U.S. serving as the largest contributor. By 2032, the market is projected to reach approximately US$2.3 billion, driven by premiumization and technological adoption. Consumer preference for natural and functional foods, coupled with growing interest in artisanal honey, supports market growth.

Government programs aimed at pollinator protection, such as the USDA’s Pollinator Health Task Force initiatives, further strengthen industry resilience. Regulatory frameworks, including stringent food safety and traceability standards, reinforce product quality and facilitate premium positioning for verified honey.

The competitive landscape is characterized by mid-sized branded honey companies, specialized equipment suppliers, and contract packers. Leading players are investing in automation, advanced processing technologies, and traceable supply chains. For example, Bee Maid Honey in Canada has expanded cold-chain logistics to maintain product quality. At the same time, Dutch Gold Honey in the U.S. has developed premium blended honey products for retail channels.

Europe represents a significant value-added market for apiculture, supported by domestic production and imports. Countries such as Germany, France, the U.K., and Spain are major contributors. The revised Honey Directive and other regulatory initiatives enhance transparency in labeling, authentication, and product traceability, creating opportunities for premium honey products. Consumer preference for organic and locally-sourced honey, along with demand for natural cosmetics and nutraceutical applications, continues to drive growth.

The market is fragmented, with cooperatives, small branded companies, and consolidators operating alongside larger players. Investments are concentrated in authentication laboratories, cold-chain logistics, and certified monofloral honey production.

For instance, Comvita in New Zealand exports certified Manuka honey to Europe, while European cooperatives are developing regional monofloral brands that appeal to quality-conscious consumers. Regulatory harmonization across the EU countries also enables standardized quality, facilitating cross-border trade and premium product positioning.

Asia Pacific accounts for approximately 36% of the global apiculture revenue, with China and India leading production. Oceania, including New Zealand and Australia, dominates the premium export segment. Rapid urbanization, expanding retail channels, and rising domestic demand are driving market expansion across the region. High production capacity, combined with government-supported colony management programs and certification initiatives, ensures both volume and quality improvements.

Premium monofloral honey, such as New Zealand Manuka honey, continues to see robust export demand. The competitive landscape is marked by consolidation among honey packers, expansion of processing facilities, and adoption of precision apiculture technologies.

Companies such as Capilano Honey have invested in automated extraction lines, while Indian cooperatives such as Dabur leverage large-scale beekeeping operations to meet the growing domestic and export demand. The region’s focus on certified and export-ready honey provides both growth opportunities and higher-margin product positioning.

The global apiculture market is moderately fragmented at the production level due to numerous smallholders, but more concentrated in branded processing. Top players control a significant shelf presence, while bulk trade remains widely distributed. The top 10-20 branded companies dominate premium segments, reflecting ongoing consolidation and vertical integration.

Market leaders focus on premiumization, vertical integration, technology adoption, and geographic expansion. Differentiation is achieved through traceability, monofloral specialization, and wellness positioning backed by clinical evidence.

The apiculture market size was valued at US$12.4 Billion in 2025.

The apiculture market is projected to reach US$18.1 Billion by 2032, reflecting growth driven by premium honey, nutraceutical applications, and technological adoption in beekeeping.

Key trends include rising consumer demand for natural and functional honey products and premiumization and growth of certified monofloral honey.

Honey is the dominant product, contributing 78% of market revenue, supported by culinary, nutraceutical, and cosmetic applications.

The apiculture market is expected to grow at a CAGR of 5.5% between 2025 and 2032.

Some of the major players include Comvita Ltd., Capilano Honey Ltd., Dabur India Ltd., Bee Maid Honey, and Dutch Gold Honey, Inc.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By Production Method

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author