ID: PMRREP36130| 264 Pages | 13 Feb 2026 | Format: PDF, Excel, PPT* | Industrial Automation

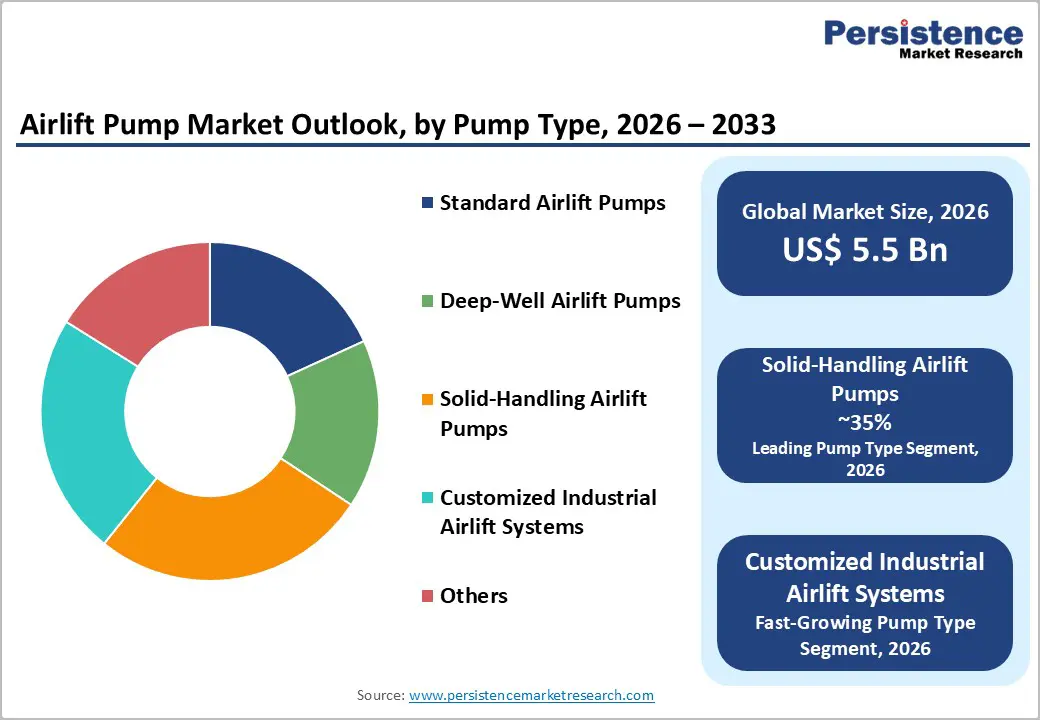

The global airlift pump market size is expected to be valued at US$ 5.5 billion in 2026 and projected to reach US$ 7.3 billion by 2033, growing at a CAGR of 4.2% between 2026 and 2033.

Airlift pumps are gaining strong demand due to their energy-efficient operation, low maintenance requirements, and ability to handle solids and slurries effectively. Their adoption is increasing across wastewater treatment, mining, and industrial fluid-transfer applications, driven by stricter environmental regulations worldwide. Growing investments in water infrastructure projects and expanding offshore oil & gas activities further support market growth, as airlift pumps are widely used in deep wells and under challenging operating conditions.

| Key Insights | Details |

|---|---|

| Airlift Pump Market Size (2026E) | US$ 5.5 billion |

| Market Value Forecast (2033F) | US$ 7.3 billion |

| Projected Growth CAGR (2026 - 2033) | 4.2% |

| Historical Market Growth (2020 - 2025) | 3.6% |

Stringent environmental regulations, particularly in regions such as the European Union, are accelerating the adoption of airlift pumps in wastewater management. These pumps are widely used for sludge circulation, scum removal, and aeration support in treatment plants. Their ability to handle solids-laden fluids efficiently while consuming lower energy makes them well-suited for sustainable operations. Municipal utilities increasingly prefer airlift systems due to reduced clogging risks and simpler maintenance needs.

Airlift pumps are also gaining traction in aeration tanks, grit chambers, and biological treatment processes, where continuous-flow reliability is essential. Compared to mechanical pumping solutions, they offer lower operational downtime and improved efficiency in handling wastewater solids. As governments invest in modernizing sewage infrastructure, airlift pumps remain a preferred choice for cost-effective and environmentally compliant wastewater treatment.

The expansion of global mining activities and mineral processing operations is driving demand for airlift pumps capable of transporting abrasive slurries and sediments. These pumps provide an effective solution for underground drainage and slurry transport, as they operate without internal moving parts and therefore do not experience mechanical wear. Their solid-handling capability makes them suitable for harsh mining environments in which conventional pumps often encounter clogging or abrasion.

Airlift pumps are also increasingly applied in dredging projects, particularly offshore and riverbed sediment removal operations. Their low-maintenance design and ability to reliably mix water and solids support long-term use under demanding conditions. With mining and dredging activities increasing in countries such as China and India, the deployment of airlift pumps continues to strengthen across these sectors.

A key restraint for the airlift pump market is the high energy demand associated with compressed air generation. In applications requiring higher lift or pressure, overall efficiency declines significantly, making airlift systems less competitive compared to centrifugal or mechanical pumps. Since performance depends heavily on optimal air injection, improper system design can lead to increased energy waste and higher operational costs. This limits adoption, particularly in industries where electricity costs constitute a significant share of pumping budgets.

Energy-intensive sectors often hesitate to deploy airlift pumps because they may require continuous compressor operation to maintain flow stability. In cost-sensitive regions, the additional cost of air-supply infrastructure reduces market attractiveness. As industries prioritize energy-efficient pumping alternatives, airlift pumps face challenges in expanding beyond niche applications where low maintenance outweighs efficiency drawbacks.

Airlift pumps are also unsuitable for large-scale, high-volume pumping operations. Their dependence on air compressors limits their ability to maintain consistent performance over extended periods, particularly when flow demand exceeds the optimal operating range. Beyond certain air and liquid flow ratios, pump efficiency drops sharply, reducing throughput and making them less effective for continuous industrial-scale lifting requirements.

In remote or rural environments, compressor reliability and inconsistent power supply further reduce operational stability. Sectors such as agriculture and irrigation often experience downtime more frequently than submersible pump alternatives. These limitations hinder broader uptake of airlift pumps in applications that require steady, high-capacity water transfer under variable field conditions.

Technological improvements in hybrid airlift pump systems are creating strong growth opportunities across water-intensive industries. The integration of venturi-based designs, optimized riser geometries, and smart monitoring solutions enhances pumping efficiency while reducing maintenance needs. These next-generation systems are increasingly being tested in aquaculture, water recycling, and municipal desludging operations where reliable solids transport is essential. Smart sensors and automation further support stable operation and energy optimization in complex environments.

As global focus intensifies on sustainable water management and reuse, hybrid airlift pumps align well with long-term infrastructure goals. Their ability to operate with fewer mechanical components makes them attractive for regions investing heavily in wastewater modernization and water scarcity solutions. Continued innovation in design and digital control is expected to expand adoption across advanced treatment facilities.

Offshore oil and gas development presents another major opportunity for airlift pumps, particularly in deep-water extraction environments. Their non-mechanical pumping approach makes them suitable for corrosive and high-sediment conditions in which traditional pumps experience wear. Airlift systems are increasingly used in subsea dredging, deep-well fluid lifting, and enhanced recovery operations due to their durability and reduced risk of clogging in harsh offshore environments.

The growing deployment of IoT-enabled airlift pumps also supports predictive maintenance and improved operational reliability in aging oilfields. As offshore projects expand globally, demand for robust pumping technologies that minimize downtime is increasing. This trend positions airlift pumps as a valuable solution for long-term offshore production and subsea infrastructure support.

Solid-handling airlift pumps accounted for 35% market share in 2025, leading the pump type segment due to their widespread use in mining, dredging, and sediment-heavy operations. These systems are highly effective in transporting abrasive slurries and three-phase mixtures without internal mechanical wear, making them ideal for harsh industrial environments. Their durability and low risk of clogging continue to increase demand across heavy-duty fluid transfer applications.

The fastest-growing category within pump types is hybrid and advanced-design airlift systems, supported by innovations in venturi integration and optimized riser structures. These newer models are gaining attention in aquaculture and water recycling projects where efficiency improvements and smart monitoring are critical. Rising demand for low-maintenance pumping solutions in modern infrastructure is expected to accelerate the adoption of next-generation airlift technologies.

Wastewater and sewage treatment dominated the application landscape, accounting for 38% of the market in 2025, driven by stringent regulatory mandates for sludge circulation, scum removal, and grit handling in municipal plants. Airlift pumps are widely preferred in aeration tanks due to their gentle, low-shear pumping and strong solids-handling capability. Increasing urban wastewater volumes and treatment plant upgrades continue to reinforce this segment’s leadership globally.

The fastest-growing application area is industrial water reuse and recycling, where airlift pumps are being adopted for sustainable fluid management in manufacturing and chemical processing. As industries focus on reducing discharge and improving operational efficiency, airlift systems are gaining traction for handling contaminated and solids-laden streams. This shift toward circular water systems is opening new avenues for growth beyond municipal treatment.

Mining and mineral processing accounted for 30% of the market in 2025, making it the leading end-use industry for airlift pumps. These pumps are widely used for underground drainage, slurry transfer, and sediment transport in exploration and production sites. Their ability to operate without abrasion-sensitive moving parts provides a reliable advantage in mineral-rich environments, where conventional pumps often experience rapid wear and clogging.

The fastest-growing end-use segment is offshore oil and gas operations, where airlift pumps are increasingly applied in deep-well lifting and subsea dredging. Their corrosion-resistant, non-mechanical design makes them suitable for challenging offshore conditions. Growing offshore development and enhanced recovery activities are expected to expand the role of airlift pumps across marine energy infrastructure.

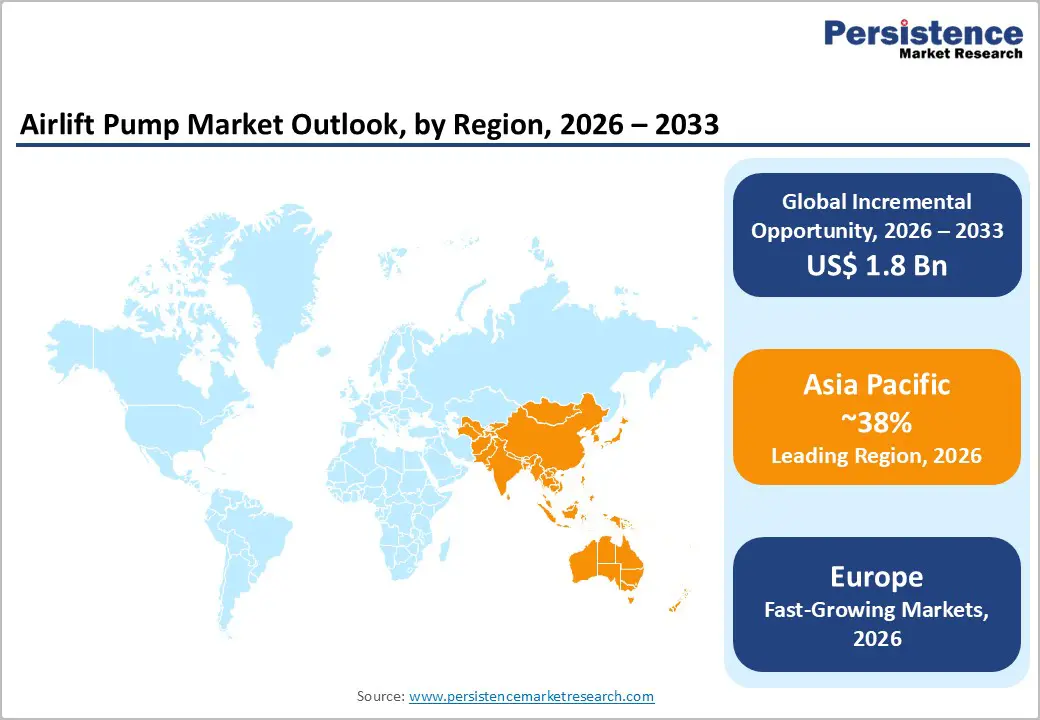

North America holds a significant position in the airlift pump market, accounting for around 35% share in 2025, supported by strong demand from wastewater treatment upgrades, offshore oil & gas operations, and mining applications. The region benefits from strict environmental compliance requirements and ongoing investments in municipal sludge-handling infrastructure. Airlift pumps are widely adopted due to their low-maintenance design and their effectiveness in transferring solids-laden fluids.

The fastest-growing opportunity in North America lies in offshore deep-water projects and industrial water reuse systems. The increasing emphasis on sustainable pumping technologies, combined with advances in compressor efficiency and smart monitoring, is expected to accelerate adoption across utilities and heavy industrial sectors.

Europe remains a stable and regulation-driven market for airlift pumps, supported by strong wastewater treatment mandates, carbon reduction initiatives, and increasing focus on water reuse. The region is projected to expand at a CAGR of 4.6%, reflecting steady adoption in municipal sewage systems, irrigation recycling, and industrial effluent transport. Airlift pumps are preferred in applications requiring gentle, low-shear pumping and reliable sludge movement.

The fastest-growing trend in Europe is the modernization of treatment infrastructure through hybrid and energy-optimized airlift systems. Utilities are increasingly shifting toward sustainable pumping alternatives that reduce operational complexity while aligning with EU circular water management and long-term environmental goals.

Asia-Pacific is one of the most dynamic regions, accounting for approximately 38% of the global market in 2025, driven by rapid urbanization, expanding industrial output, and large-scale investments in wastewater infrastructure. Demand is rising strongly in municipal treatment plants, mining slurry handling, and aquaculture operations, where airlift pumps provide cost-effective solids transport with minimal clogging risk.

The fastest-growing opportunity in the Asia Pacific lies in industrial water recycling, rural irrigation expansion, and ongoing mining development. Governments across the region are prioritizing access to clean water and advanced treatment facilities, thereby creating strong demand for durable, low-maintenance pumping technologies such as airlift systems.

The global airlift pump market is highly fragmented, with numerous specialized manufacturers focusing on niche solutions and customizations rather than large-scale consolidation. Companies differentiate through innovation in hybrid pump designs, venturi optimization, and IoT-enabled monitoring, enhancing energy efficiency and solids-handling performance. Continuous investment in R&D allows manufacturers to offer advanced systems tailored for municipal, industrial, and offshore applications.

Expansion strategies in the market emphasize collaborations and partnerships to support large infrastructure and offshore projects. Emerging models highlight modular and skid-mounted designs, enabling quick deployment and flexible integration in wastewater treatment, mining, and aquaculture operations, meeting growing demand for low-maintenance, reliable pumping solutions.

The global Airlift Pump Market is expected to reach US$ 5.5 billion in 2026.

Stringent wastewater regulations and U.S. infrastructure investments drive demand for low-maintenance sludge-handling solutions.

Asia Pacific leads with 38% share in 2025, driven by China and India’s water and mining infrastructure investments.

Hybrid airlift technologies in oil & gas offer 15% energy savings, particularly in offshore and deep-well applications.

Key players include Flowserve Corporation, Grundfos, Sulzer Ltd., KSB SE & Co. KGaA, and ITT Inc.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Mn/Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Pump Type

By Application

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author