ID: PMRREP32441| 205 Pages | 15 Nov 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

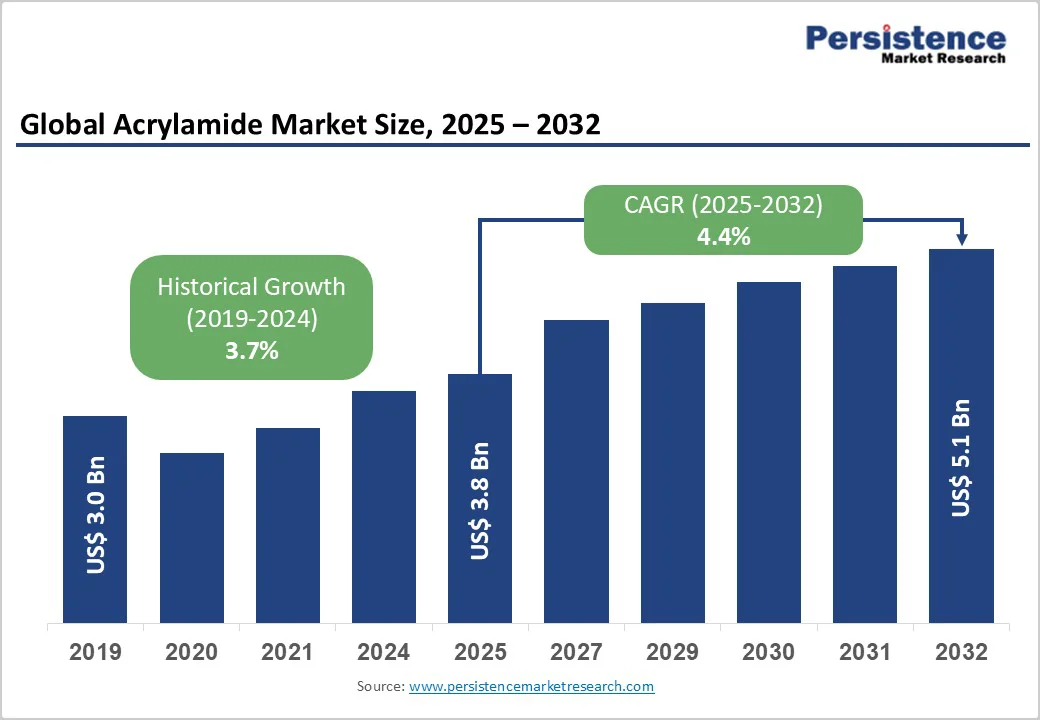

The global acrylamide market size is likely to be valued US$3.8 Billion in 2025, projected to US$5.1 Billion by 2032, growing at a CAGR of 4.4% during the forecast period from 2025 to 2032, driven by the increasing prevalence of water treatment needs, rising demand for flocculants in wastewater, and advancements in polymer applications. The need for effective coagulation and enhanced oil recovery, particularly in industrial processes, has significantly boosted the adoption of acrylamide across various sectors. The market is further propelled by innovations in aqueous solutions and crystal forms, catering to preferences for efficient and stable options. The growing acceptance of acrylamide as a key chemical intermediate, particularly in mining, is a key growth factor.

| Key Insights | Details |

|---|---|

| Acrylamide Market Size (2025E) | US$3.8 Bn |

| Market Value Forecast (2032F) | US$5.1 Bn |

| Projected Growth (CAGR 2025 to 2032) | 4.4% |

| Historical Market Growth (CAGR 2019 to 2024) | 3.7% |

The rising global demand for efficient water treatment is a key driver of the acrylamide market. Acrylamide-based polyacrylamides provide 20–30% higher flocculation efficiency than conventional agents, making them essential in coagulation and sedimentation processes. Their superior performance in removing suspended solids and impurities enhances water clarity, benefiting both municipal and industrial wastewater treatment systems. Increasing environmental regulations further accelerate adoption worldwide.

The growing adoption of aqueous solutions, such as those from SNF Group, has gained traction due to proven efficacy in trials, with over 85% particle removal. The rise in regulations and availability of acrylamide in supply chains have boosted access, further driving expansion. The surge in demand for polymer systems, coupled with innovations in crystal forms, continues to propel the market forward, particularly in developing regions with infrastructure growth.

The high costs associated with development and toxicity management of acrylamide pose a significant restraint on market growth. Developing acrylamide requires advanced polymerization, rigorous safety testing, and controlled handling to minimize exposure. These processes involve substantial financial investment, often exceeding millions of dollars, which can be a barrier for smaller companies.

Regulatory bodies impose stringent requirements for health and environmental safety. Compliance with these standards, along with the need for specialized facilities, increases overall costs and extends development timelines. For instance, mitigating neurotoxicity risks in production can take years, with costs escalating due to multiple phases of monitoring. Smaller firms struggle against players such as BASF SE. Complexity of low-residue grades adds to production challenges, deterring innovation in regulated regions.

Advancements in bio-based and low-toxicity polymers present significant growth opportunities for the acrylamide market. Traditional acrylamide production involves petrochemical-based raw materials and poses toxicity challenges, prompting manufacturers to develop sustainable alternatives derived from renewable feedstocks such as plant-based sugars and biogenic monomers. These innovations aim to reduce carbon footprints, improve biodegradability, and enhance worker safety.

Companies such as BASF SE and Kemira Oyj are investing heavily in green chemistry and polymer research to create eco-friendly acrylamide derivatives with comparable or superior performance in water treatment, paper, and oil recovery applications. Bio-based polymers also offer enhanced stability and reduced environmental persistence, aligning with global sustainability goals and regulatory frameworks such as REACH and EPA standards.

Aqueous acrylamide solution dominates the market, expected to account for approximately 60% of the share in 2025. Its dominance is driven by handling ease, solubility, and versatility, making it preferred for water treatment. Aqueous solutions, such as those from Ashland, provide uniform dosing, ensuring compatibility. Its convenience and efficiency make it preferred for manufacturers.

Acrylamide crystals is the fastest-growing segment, driven by storage stability and increasing adoption in oil recovery. Crystals offer high concentration, appealing for EOR. Focus on dry-form innovation accelerates adoption in Asia Pacific and Middle East.

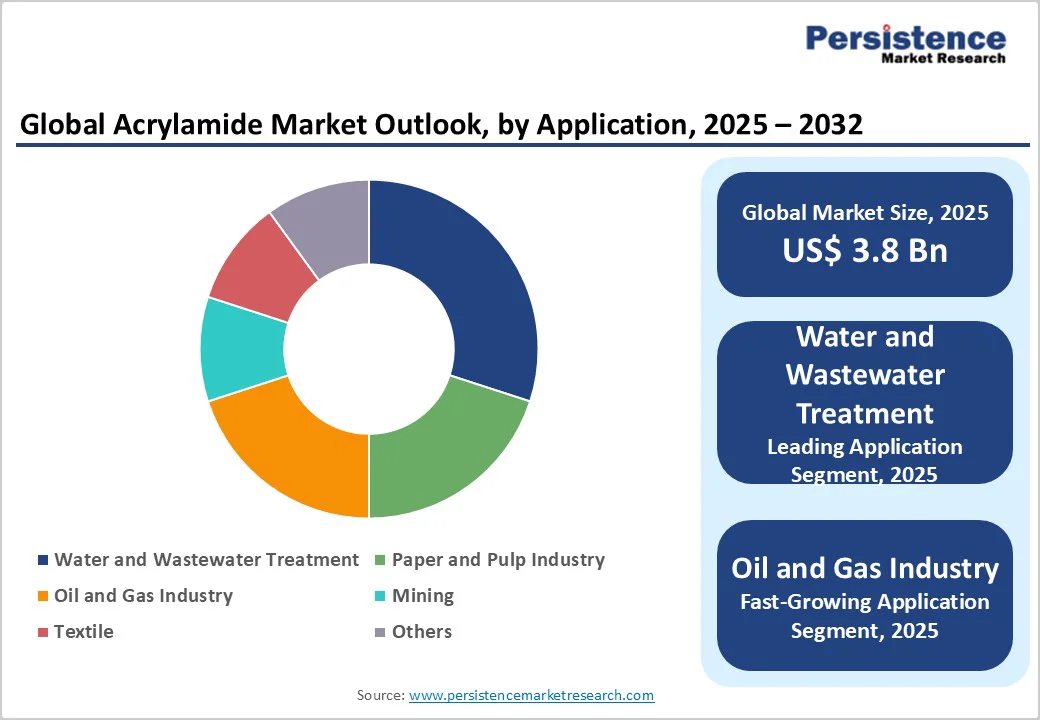

Water and wastewater treatment lead the market, holding 45% of the share in 2025, driven by its crucial role in flocculation and purification processes. Acrylamide-based polyacrylamides are extensively used in municipal and industrial plants for efficient water clarification. Rising global demand for clean water continues to strengthen this segment’s dominance.

Oil and gas industry is the fastest-growing segment, fueled by its use in Enhanced Oil Recovery (EOR) techniques and drilling fluids. Acrylamide-based polymers offer superior viscosity control, improving fluid stability and oil extraction efficiency. Their effectiveness in optimizing recovery rates makes them vital for modern energy operations.

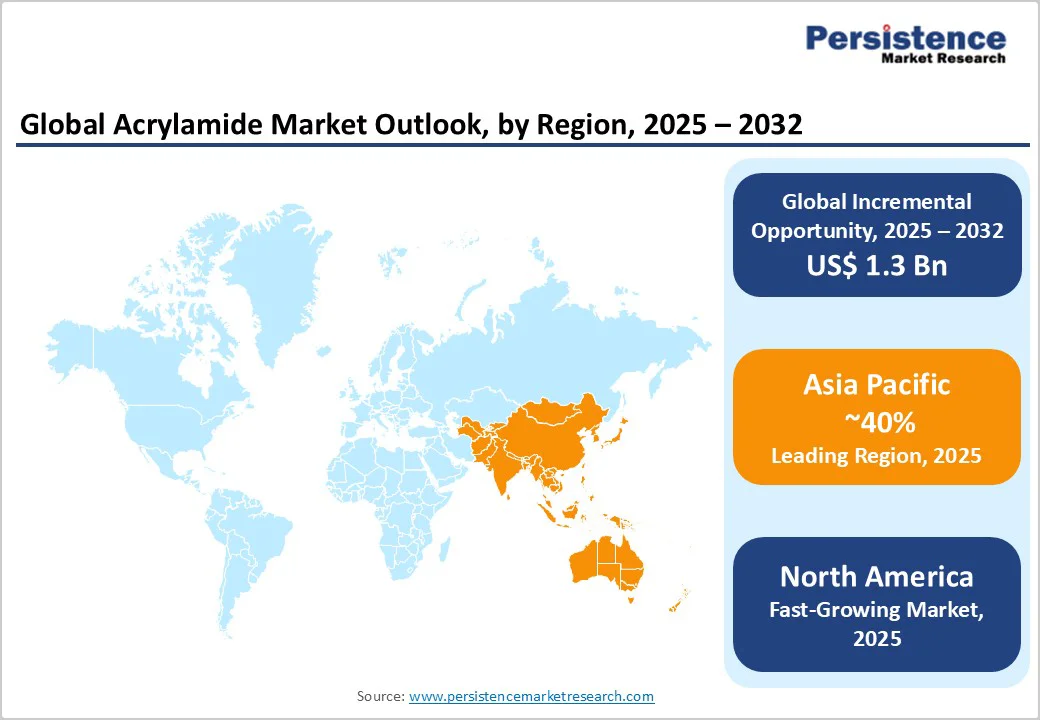

Asia Pacific is the dominates with 40% market share in 2025, driven by rapid industrialization, urbanization, and expanding wastewater treatment infrastructure across major economies such as China, India, and Japan. Increasing environmental regulations and government initiatives for clean water management have significantly boosted the demand for polyacrylamide-based flocculants, which are derived from acrylamide. The region also benefits from a strong presence of local manufacturers and low production costs, making it a global hub for acrylamide production and export.

The growing paper and pulp, textile, and oil recovery industries are contributing to steady consumption. Countries such as China and South Korea are investing heavily in modern water treatment facilities, while Japan focuses on developing bio-based and low-toxicity acrylamide variants to address environmental and health concerns. Strategic collaborations and capacity expansions by regional players such as Mitsui Chemicals Inc. and Beijing Hengju strengthen market competitiveness.

North America is the fastest-growing, driven by rising demand from the water treatment, oil and gas, and paper industries. The United States leads the regional market, supported by robust regulatory frameworks and substantial investments in wastewater management and infrastructure modernization. Acrylamide, primarily used in the production of polyacrylamide, plays a crucial role in municipal and industrial water purification processes, making environmental regulations a key growth catalyst.

Major industry players such as SNF Group, Ashland, and The Dow Chemical Company are focusing on product innovation and sustainability to enhance competitiveness. The region is witnessing increased adoption of eco-friendly and low-toxicity acrylamide formulations, driven by environmental and health safety awareness. Technological advancements in enhanced oil recovery (EOR) techniques are fueling demand from the energy sector. Strategic collaborations, capacity expansions, and R&D in greener chemical alternatives further strengthen market development.

Europe accounts 25% market share in 2025, driven by stringent environmental regulations, technological innovation, and increasing demand for sustainable water treatment solutions. Countries such as Germany, France, and the United Kingdom are leading in the adoption of polyacrylamide-based flocculants for municipal and industrial wastewater treatment, supported by the European Union’s focus on reducing water pollution and improving resource efficiency.

The paper and pulp industry also represents a key application area, where acrylamide derivatives are used to enhance product strength and retention properties. European companies, including BASF SE and Kemira Oyj, emphasize R&D investments to develop low-toxicity and bio-based acrylamide alternatives, aligning with the region’s strict environmental and safety standards. The market is also witnessing increasing partnerships and strategic collaborations aimed at improving production efficiency and expanding sustainable product portfolios.

The global acrylamide market is highly competitive, featuring a blend of major chemical corporations and specialized producers. In developed regions such as North America and Europe, key players such as SNF Group and BASF SE dominate through extensive research and development capabilities, advanced manufacturing processes, and strong distribution networks. Their focus on product innovation and sustainability helps them maintain leadership in stringent regulatory environments. In contrast, Asia Pacific is emerging as the fastest-growing market, with companies such as Mitsui Chemicals Inc. leveraging localized production strategies and customized solutions to meet rising demand from water treatment and industrial sectors.

The industry’s competitive edge increasingly depends on developing low-toxicity, eco-friendly acrylamide derivatives to align with environmental standards and consumer safety concerns. Strategic partnerships, mergers, and acquisitions are frequent as companies expand their global footprint and diversify application portfolios.

The global acrylamide market is projected to reach US$3.8 Billion in 2025.

The rising prevalence of water treatment needs and demand for flocculants are key drivers.

The market is poised to witness a CAGR of 4.4% from 2025 to 2032.

Advancements in bio-based and low-toxicity polymers are a key opportunity.

SNF Group, BASF SE, Mitsui Chemicals Inc., Kemira Oyj, and The Dow Chemical Company are key players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 – 2024 |

| Forecast Period | 2025 – 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author