ID: PMRREP2894| 202 Pages | 8 Jan 2026 | Format: PDF, Excel, PPT* | Healthcare

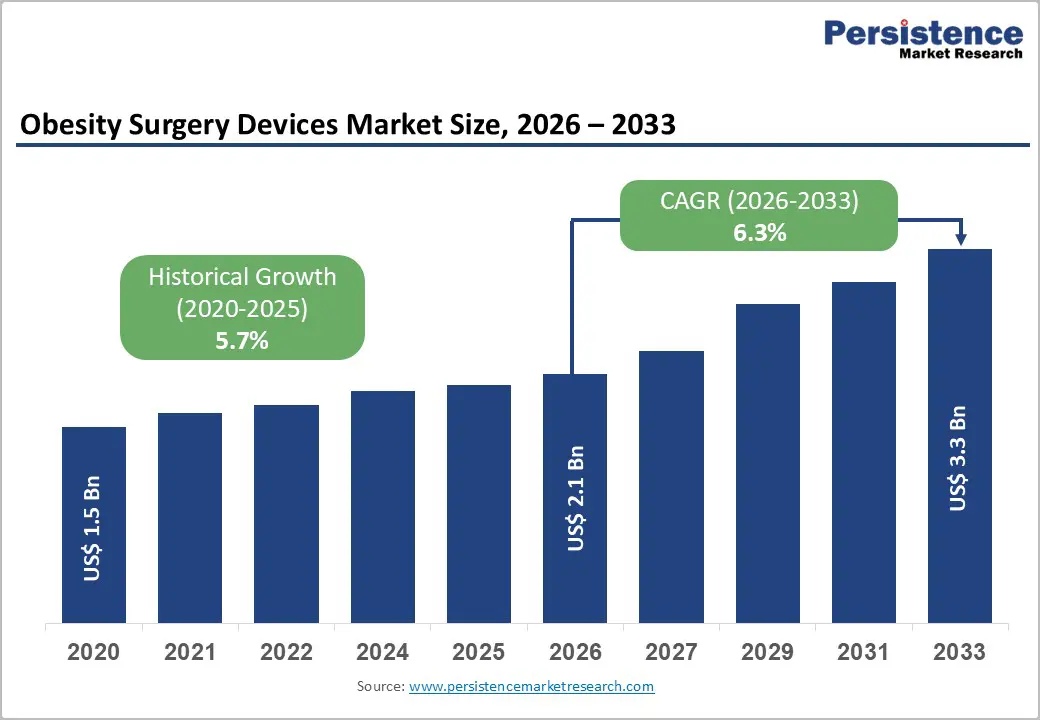

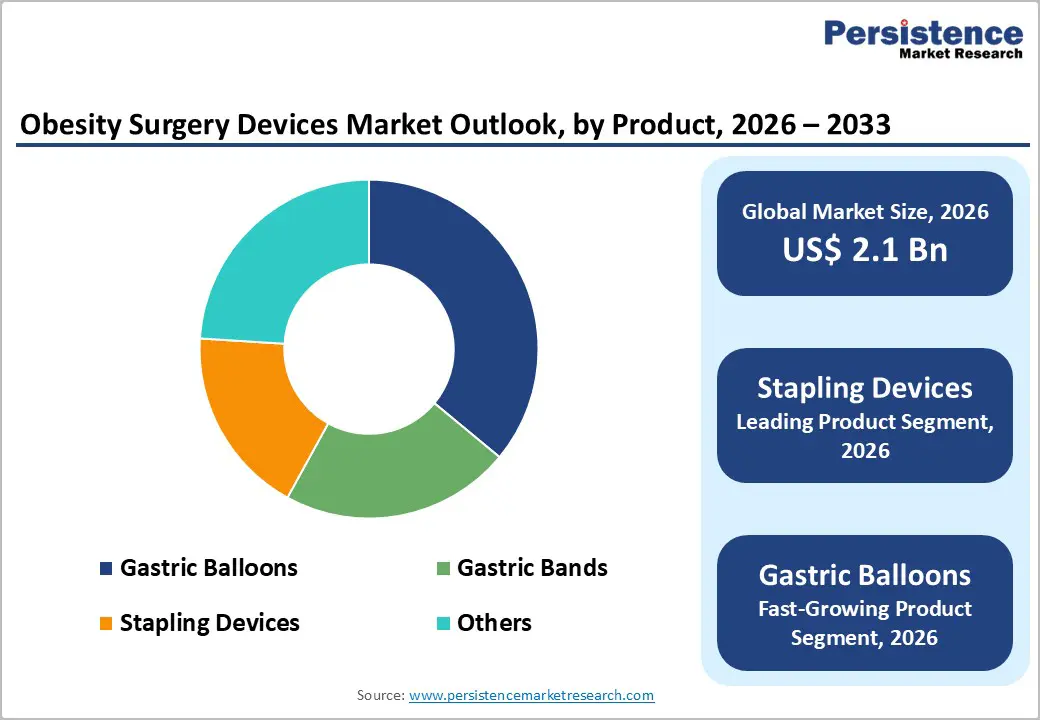

The global obesity surgery devices market size is expected to be valued at US$ 2.1 billion in 2026 and projected to reach US$ 3.3 billion by 2033, growing at a CAGR of 6.3% between 2026 and 2033.

Rising prevalence of obesity, expanding access to bariatric surgery, and advances in minimally invasive technologies such as robotic-assisted systems, energy devices, and stapling platforms are accelerating adoption of obesity surgery procedures worldwide. Demand is further supported by favorable clinical evidence showing sustained weight loss and remission of type 2 diabetes, hypertension, and sleep apnea after bariatric procedures, which encourages payers and health systems to expand coverage and referral pathways. In parallel, product innovation from leading players such as Medtronic, Johnson & Johnson (Ethicon), and Intuitive Surgical in stapling, energy devices, and robotic systems is enhancing surgical precision, reducing complications, and improving procedural consistency, which together strengthen the long-term growth outlook for obesity surgery devices.

| Global Market Attributes | Key Insights |

|---|---|

| Obesity Surgery Devices Market Size (2026E) | US$ 2.1 billion |

| Market Value Forecast (2033F) | US$ 3.3 billion |

| Projected Growth CAGR (2026-2033) | 6.3% |

| Historical Market Growth (2020-2025) | 5.7% |

Market Growth Drivers

Rising global obesity burden and metabolic disease prevalence

Acmajor growth driver for obesity surgery devices is the rapidly increasing global burden of obesity and associated metabolic disorders. According to the World Health Organization (WHO), more than 1 billion people worldwide are living with obesity, including over 650 million adults, and the prevalence has nearly tripled since 1975, with particularly steep increases in children and adolescents. Obesity is strongly associated with type 2 diabetes, cardiovascular disease, and certain cancers, driving health systems to prioritize effective weight-loss interventions when lifestyle modification and pharmacotherapy fail. Bariatric procedures such as sleeve gastrectomy and gastric bypass demonstrate substantial and durable weight loss and improvement or remission of diabetes in a large proportion of patients, which motivates clinicians to refer eligible patients and encourages investment in advanced stapling devices, energy platforms, and gastric balloons that support these surgeries.

Clinical evidence and guideline support for bariatric surgery

Another key driver is the strengthening evidence base and guideline endorsement for metabolic and bariatric surgery as a treatment for severe obesity and obesity-related diabetes. International societies such as the American Society for Metabolic and Bariatric Surgery (ASMBS) and the International Federation for the Surgery of Obesity and Metabolic Disorders (IFSO) highlight surgery as the most effective long-term therapy for severe obesity, particularly when body mass index (BMI) ≥ 40 kg/m² or ≥ 35 kg/m² with comorbidities. Recent benchmark studies in robotic bariatric surgery have shown that robotic Roux-en-Y gastric bypass and sleeve gastrectomy can achieve reduced hospital stays and lower bleeding and ulceration compared with historical laparoscopic cohorts, although at higher procedural cost, reinforcing clinical confidence in these interventions. As guidelines evolve to recommend metabolic surgery at lower BMI thresholds for patients with type 2 diabetes, the eligible patient pool expands, thereby increasing demand for stapling devices, energy systems, and gastric balloons integrated into the obesity surgery devices ecosystem.

Market Restraints

High procedure and device costs limiting accessibility

Despite strong clinical evidence, high upfront costs of bariatric procedures and associated devices remain a significant barrier, particularly in low- and middle-income countries. Robotically assisted bariatric procedures are estimated to cost approximately 2.3 times more per patient than laparoscopic procedures, reflecting higher capital investments and per-procedure expenses. Limited reimbursement, out-of-pocket payment requirements, and uneven insurance coverage restrict access for many eligible patients, reducing procedure volumes in underfunded health systems. This cost barrier can slow adoption of advanced stapling platforms and robotic systems, particularly in price-sensitive markets, and creates reliance on older-generation devices with lower margins for manufacturers.

Surgical capacity constraints and workforce limitations

The availability of trained bariatric surgeons and adequately equipped centers also constrains market expansion. Data from the Metabolic and Bariatric Surgery Accreditation and Quality Improvement Program (MBSAQIP) show that robotic adoption in bariatric surgery is growing but remains concentrated in specialized centers, with robotic utilization for sleeve gastrectomy and Roux-en-Y gastric bypass increasing annually by around 2.0–2.4% between 2015 and 2020, indicating gradual rather than universal uptake. Many regions face limited operating room capacity, long waiting lists, and shortages of multidisciplinary teams required for pre- and post-operative care, which restricts the number of surgeries performed each year. These constraints slow the scale-up of advanced devices and can reduce the speed at which new technologies such as innovative gastric balloons or next-generation staplers penetrate wider clinical practice.

Market Opportunities

Expansion of minimally invasive and robotic-assisted bariatric procedures

The accelerating shift toward minimally invasive and robotic-assisted bariatric surgery creates a major opportunity for device manufacturers to provide specialized stapling, energy, and visualization solutions. The da Vinci robotic platform from Intuitive Surgical supports sleeve gastrectomy, gastric bypass, and related metabolic procedures with 3D high-definition visualization, tremor filtration, and wristed instruments, enabling precise dissection in anatomically complex regions. Recent studies using the MBSAQIP database show that robotic bariatric procedures exhibit lower rates of certain complications and shorter hospital stays in selected settings, even though operative time is often longer and costs higher. As hospitals seek to differentiate their bariatric programs and attract high-acuity patients, investments in robotic systems and compatible staplers and energy devices are expected to grow, creating attractive revenue opportunities in the fastest-growing technology-driven segment of the obesity surgery devices market.

Innovation in stapling platforms and gastric balloons

Continuous innovation in core bariatric tools such as stapling devices and gastric balloons presents another high-potential opportunity. Medtronic has introduced specialized bariatric instruments, including the GastriSail™ gastric positioning system that standardizes sleeve creation, decompresses the pouch, and tests for leaks, aiming to reduce complications and improve consistency in sleeve gastrectomy. Johnson & Johnson’s Ethicon has advanced its portfolio with products like the ECHELON FLEX™ GST System and the ETHICON™ 4000 Stapler, which are designed to reduce tissue slippage and staple-line bleeding, cutting staple-line interventions by about 23% in testing compared with traditional designs. In parallel, companies such as Allurion Technologies and ReShape Lifesciences focus on novel gastric balloons and endoscopic devices that provide less invasive weight-loss options, expanding the addressable patient population and offering stepped-care pathways before or instead of surgery. These innovations, supported by clinical data and regulatory approvals, open new profitability pockets and strengthen the value proposition for hospitals seeking improved outcomes and workflow efficiencies.

Product Analysis

The Stapling Devices segment is the leading product category, accounting for about 36% of the market share in 2025, driven by its central role in sleeve gastrectomy and gastric bypass procedures. Staplers are critical for creating and securing staple lines across variable gastric and intestinal tissues, where reliability directly influences leak rates and post-operative complications. Major players such as Medtronic and Ethicon have developed advanced powered stapling systems with features like Gripping Surface Technology (GST) and enhanced staple-line integrity to reduce bleeding and tissue slippage, with some platforms showing up to 4-times less tissue slippage compared with competing reloads in testing. Clinical focus on reducing anastomotic leaks and reoperation rates keeps demand for sophisticated stapling devices high, making this segment the backbone of the obesity surgery devices market across high-volume bariatric centers globally.

Procedure Analysis

Within procedures, Sleeve Gastrectomy is the leading segment, capturing an estimated market share of around 40% in 2025, reflecting its status as the most commonly performed bariatric operation in many regions, including the United States. Sleeve gastrectomy involves resecting a large portion of the stomach to create a narrow gastric tube, which is technically less complex than Roux-en-Y gastric bypass and avoids intestinal rerouting while delivering significant weight loss and metabolic benefits. National registries and accreditation databases report that sleeve gastrectomy has steadily increased as a proportion of bariatric surgeries over the past decade, supported by favorable risk–benefit profiles and shorter operative times compared with more complex bypass procedures. This high procedure volume directly drives usage of stapling devices, energy instruments, and adjunct technologies such as positioning systems and leak-testing tools tailored to sleeve creation.

End User Analysis

Among end users, Hospitals represent the leading segment, accounting for an estimated 65–70% of obesity surgery device utilization in 2025, as most bariatric procedures are concentrated within accredited hospital-based bariatric centers. Hospitals typically host multidisciplinary teams including surgeons, anesthesiologists, endocrinologists, dietitians, and psychologists, aligning with accreditation requirements from bodies such as ASMBS and enabling comprehensive perioperative care. High-complexity cases, revisional surgeries, and robot-assisted procedures are predominantly performed in tertiary and academic hospitals that can justify investments in advanced stapling platforms, robotic systems, and integrated operating room solutions. As hospitals compete to become regional centers of excellence in obesity management, they increasingly adopt cutting-edge devices, contributing to higher device turnover and premium product uptake relative to specialty clinics and ambulatory surgical centers.

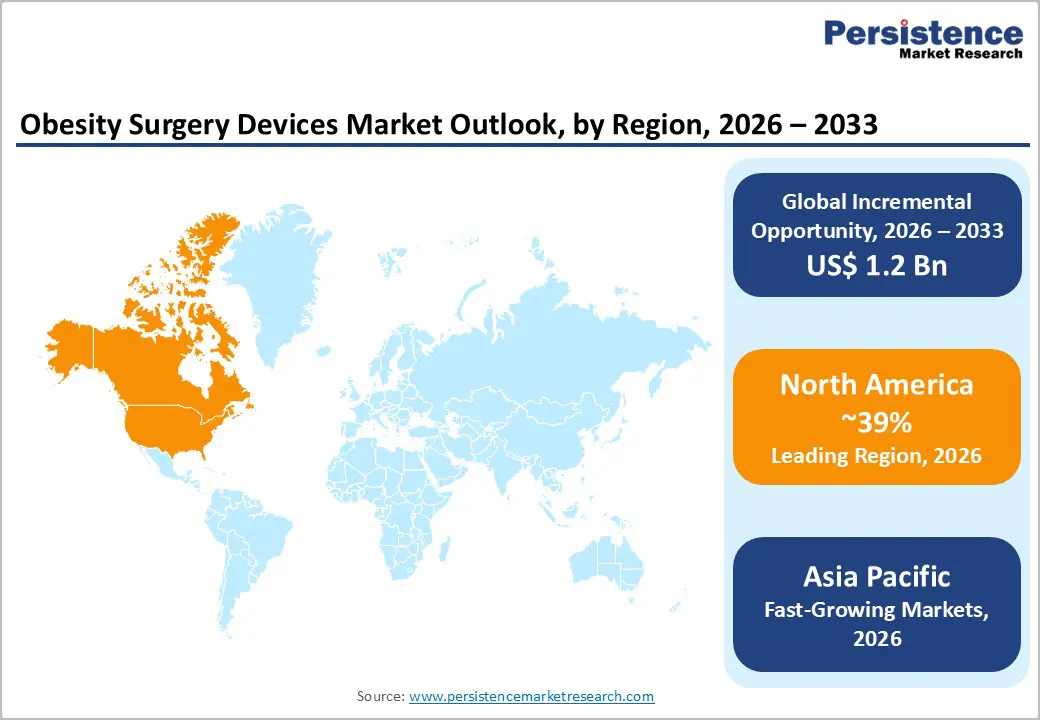

North America Obesity Surgery Devices Market Trends and Insights

North America, led by the United States, is the largest regional market, accounting for roughly 39% of the global obesity surgery devices market in 2025, underpinned by high obesity prevalence and strong procedural infrastructure. The Centers for Disease Control and Prevention (CDC) reports that adult obesity prevalence in the U.S. exceeds 40%, which creates a substantial addressable patient base for bariatric interventions. A mature reimbursement environment, widespread availability of accredited bariatric centers, and early adoption of robotic surgery drive substantial utilization of stapling systems, advanced energy devices, and robotic platforms such as da Vinci.

Technological innovation and regulatory oversight from the U.S. Food and Drug Administration (FDA) shape the competitive landscape, with new devices undergoing rigorous evaluation for safety and effectiveness before market entry. Companies like Medtronic and Ethicon frequently launch next-generation staplers, positioning systems, and energy tools in the U.S. first, using local clinical data and surgeon feedback to refine their offerings. The innovation ecosystem is further supported by large clinical databases such as MBSAQIP, which provide detailed outcomes data that guide device enhancements and evidence-based guideline updates, reinforcing North America’s leadership position in the obesity surgery devices market.

Asia Pacific Obesity Surgery Devices Market Trends and Insights

Asia Pacific is the fastest growing regional market for obesity surgery devices, supported by rapid increases in obesity and metabolic syndrome across China, India, Japan, and ASEAN countries. Urbanization, sedentary lifestyles, and dietary changes have accelerated weight gain, while the region experiences a high prevalence of type 2 diabetes at relatively lower BMI levels compared with Western populations, making metabolic surgery particularly relevant. As awareness of bariatric surgery benefits spreads among clinicians and patients, procedure volumes are rising from a relatively low base, producing strong double-digit growth potential for device manufacturers.

Asia Pacific also benefits from significant manufacturing and cost advantages, with several global and regional firms operating production and R&D facilities in countries such as China and India. Governments in markets like India and China are gradually expanding health insurance coverage and promoting medical tourism, which encourages private hospitals to invest in advanced stapling and robotic systems to attract domestic and international bariatric patients. Collaborative training partnerships with North American and European bariatric centers are improving surgical expertise and accelerating technology transfer. These dynamics position Asia Pacific as a key growth frontier for obesity surgery devices, with rising demand for both cost-effective and premium technology solutions.

Market Structure Analysis

The obesity surgery devices market is highly competitive, driven by rapid technological advancements and rising demand for effective weight-loss solutions. Market players focus on differentiating through innovation in minimally invasive and endoscopic devices, expanding product portfolios, and enhancing safety and patient outcomes. Strategic initiatives such as partnerships, clinical trials, and geographic expansion are common to capture market share in emerging regions.

Key Market Developments

The global obesity surgery devices market is expected to reach about US$ 2.1 billion in 2026.

A major demand driver is the escalating global obesity and type 2 diabetes burden, with more than 1 billion people living with obesity and strong evidence that bariatric surgery delivers sustained weight loss and metabolic improvements.

North America leads the market, underpinned by high obesity prevalence in the U.S., robust reimbursement, widespread availability of accredited bariatric centers, and early adoption of advanced stapling and robotic surgery platforms.

Key opportunities include expanding robotic-assisted bariatric surgery and next-generation stapling and energy devices that enhance precision, reduce complications, and support value-based partnerships with high-volume bariatric centers globally.

Leading companies include Medtronic plc, Johnson & Johnson (Ethicon), Intuitive Surgical, Inc., Olympus Corporation, Boston Scientific Corporation, eyc.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis Units | Value: US$ Mn/Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

Product

Procedure

End User

Regions

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author