ID: PMRREP4358| 170 Pages | 15 Oct 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

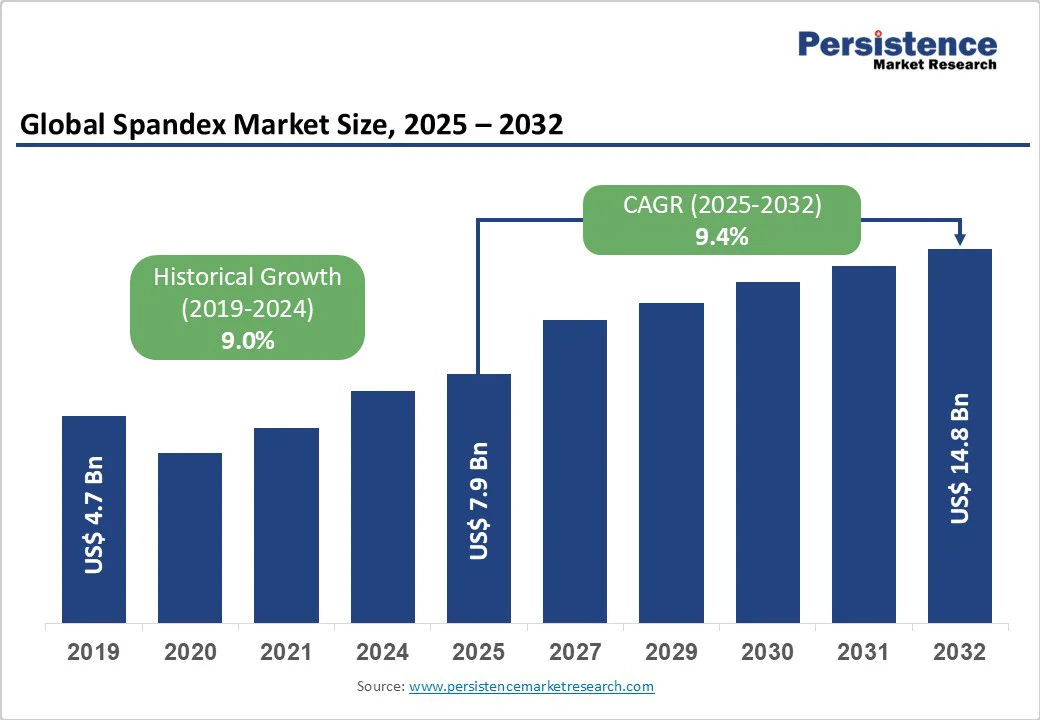

The global spandex market size is expected to reach US$7.9 billion by 2025. It is estimated to reach US$14.8 billion by 2032, growing at a CAGR of 9.4% during the forecast period from 2025 to 2032, driven by a rising preference for comfortable and stretchable clothing across sportswear, activewear, and everyday fashion. Brands are incorporating spandex into yoga wear and leggings to enhance flexibility and durability.

| Key Insights | Details |

|---|---|

| Spandex Market Size (2025E) | US$7.9 Bn |

| Market Value Forecast (2032F) | US$14.8 Bn |

| Projected Growth (CAGR 2025 to 2032) | 9.4% |

| Historical Market Growth (CAGR 2019 to 2024) | 9.0% |

The rising preference for athleisure and performance wear has significantly increased demand for spandex. Consumers now seek clothing that combines comfort, flexibility, and style, making spandex a preferred material owing to its superior elasticity and durability. This trend is evident in the rise of brands such as Lululemon and Nike, which have broadened their product lines to include a variety of spandex-based activewear.

The shift toward remote work and active lifestyles has further accelerated this demand, as individuals prioritize versatile clothing suitable for both exercise and daily activities. Consequently, manufacturers are investing in novel spandex technologies to meet evolving consumer demands, ensuring products that provide improved performance and comfort.

Government initiatives aimed at developing textile clusters are pushing growth in the market for spandex. For instance, the Government of India has launched a US$1.2 billion initiative to support eco-friendly textile production, focusing on reducing water consumption and energy use. Such policies encourage spandex manufacturers to adopt sustainable practices, complying with global environmental standards.

Investments in infrastructure and technology within these clusters also improve production efficiency and competitiveness. Hence, spandex producers benefit from improved resources and support, enabling them to broaden operations and meet the increasing demand for high-quality, sustainable products.

Environmental organizations are intensifying their campaigns against microplastic pollution, highlighting synthetic textiles like spandex as key contributors. Studies indicate that laundering synthetic garments can release up to 700,000 microplastic fibers per wash, with the first few washes shedding the most. These microfibers infiltrate ecosystems, affecting marine life and entering the human food chain.

Regulatory bodies in Europe and North America are implementing strict guidelines on microfiber emissions, compelling manufacturers to adopt low-shedding or biodegradable spandex alternatives. Brands are now under pressure to innovate, incorporating eco-friendly materials and technologies to mitigate environmental impact and cater to consumer demand for sustainable products.

The production of spandex relies heavily on petrochemical feedstocks such as polytetramethylene ether glycol (PTMEG) and methylene diphenyl diisocyanate (MDI), whose prices are subject to constant fluctuations due to factors such as crude oil price volatility, geopolitical tensions, and trade policies. For instance, in 2025, China's ethane imports from the U.S. surged as China-based petrochemical companies sought to lower costs amid shrinking profits.

Such volatility leads to unpredictable production costs, challenging spandex manufacturers to maintain profitability while ensuring a stable supply chain. To mitigate these challenges, some companies are exploring alternative feedstocks and diversifying their supply sources, aiming to reduce dependency on fluctuating petrochemical markets.

Developments in bio-based diisocyanates are creating new opportunities for spandex companies. Companies such as Hyosung are investing in fermentation technologies to produce 1,4-butanediol (BDO) from renewable sources, aiming to improve sustainability in spandex production.

This shift toward bio-based feedstocks not only reduces reliance on fossil fuels but also caters to rising consumer demand for eco-friendly products. Such developments are paving the way for more sustainable manufacturing practices in the textile industry.

The integration of seamless knitting technology is changing spandex garment production. This method eliminates the requirement for traditional cutting and sewing, resulting in garments with fewer seams, reduced waste, and improved comfort.

Brands such as Lululemon have embraced this technology, providing products that cater to the modern consumer's preference for functional and stylish activewear. The rising adoption of seamless knitting is setting new standards in garment manufacturing, emphasizing efficiency and consumer-centric design.

Four-way stretch spandex is speculated to capture approximately 67.2% of the market share in 2025, as it provides flexibility in both lengthwise and crosswise directions, giving wearers complete freedom of movement and a superior fit.

This property makes it ideal for sportswear, yoga pants, shapewear, and swimwear, where unrestricted motion and comfort are essential. The rising popularity of athleisure and performance apparel has made four-way stretch fabrics a standard choice for Nike and Adidas, which use them to improve muscle support and fabric recovery.

Two-way stretch spandex remains significant as it provides controlled elasticity in one direction, delivering better structural stability and fabric recovery for specific applications. It is widely used in denim, uniforms, and customized apparel, where moderate stretch improves comfort without distorting shape.

For example, Levi’s Flex Jeans and Wrangler’s U-Shape Denim rely on two-way stretch spandex to balance flexibility with firmness, ensuring that the fabric retains its silhouette after prolonged wear.

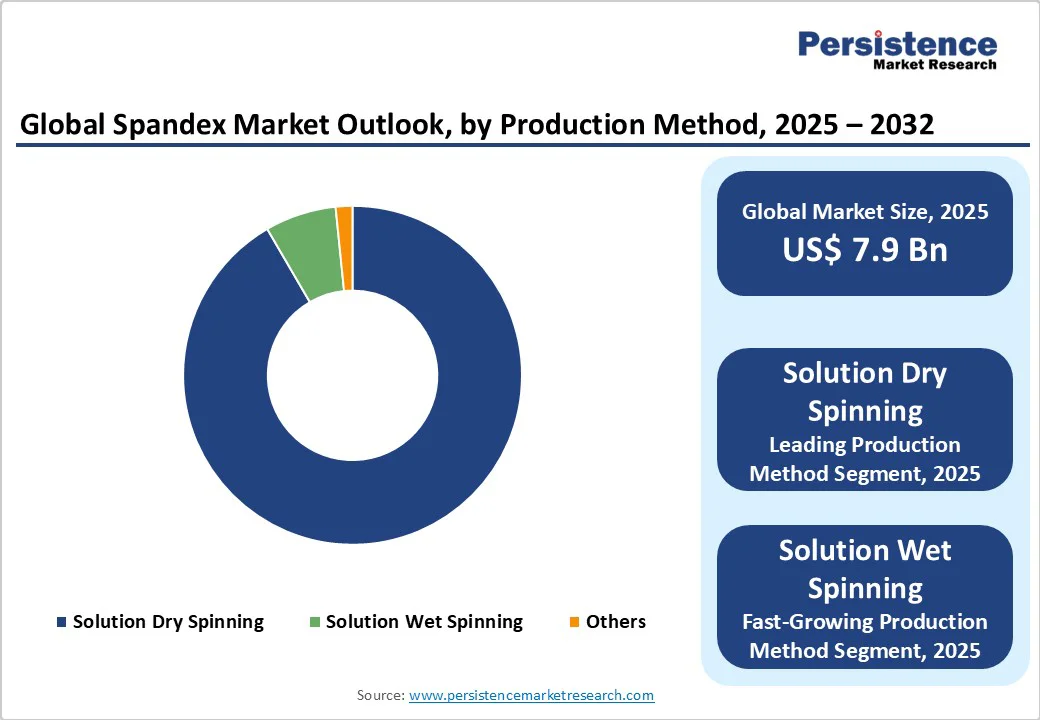

Solution dry spinning is expected to hold a market share of nearly 91.6% in 2025, as it delivers superior fiber uniformity, elasticity, and strength compared to other techniques.

The process allows for better control over polymer concentration, solvent evaporation, and filament thickness, resulting in high-quality fibers suited for performance wear and medical textiles. It is also highly efficient; up to 90% of spandex fibers globally are made using this technique, according to the LYCRA Company.

Solution wet spinning is anticipated to witness a substantial CAGR through 2032, as it enables the use of polymers with very high molecular weights that cannot be processed by dry spinning.

This makes it valuable for producing specialty spandex grades with improved chemical resistance, heat stability, or unique cross-sectional shapes used in industrial and medical applications. The process involves extruding the polymer solution into a coagulation bath, allowing precise control over fiber structure and porosity.

Apparel is predicted to capture a market share of around 81.9% in 2025, as the material’s stretch, recovery, and comfort characteristics comply perfectly with the requirements of modern clothing.

The rise of athleisure, activewear, and body-hugging fashion has made spandex indispensable in leggings, denim, sportswear, lingerie, and swimwear. Unlike other stretch fibers, spandex retains its elasticity even after repeated washes, which is essential for high-performance garments.

Spandex plays a key role in medical textiles due to its high elasticity, skin-friendliness, and ability to maintain consistent compression. It is widely used in compression stockings, orthopedic braces, bandages, and post-surgical garments, where controlled stretch supports circulation and recovery.

The increasing prevalence of chronic conditions such as varicose veins and lymphedema has spurred the requirement for compression therapy products made with spandex-based fabrics.

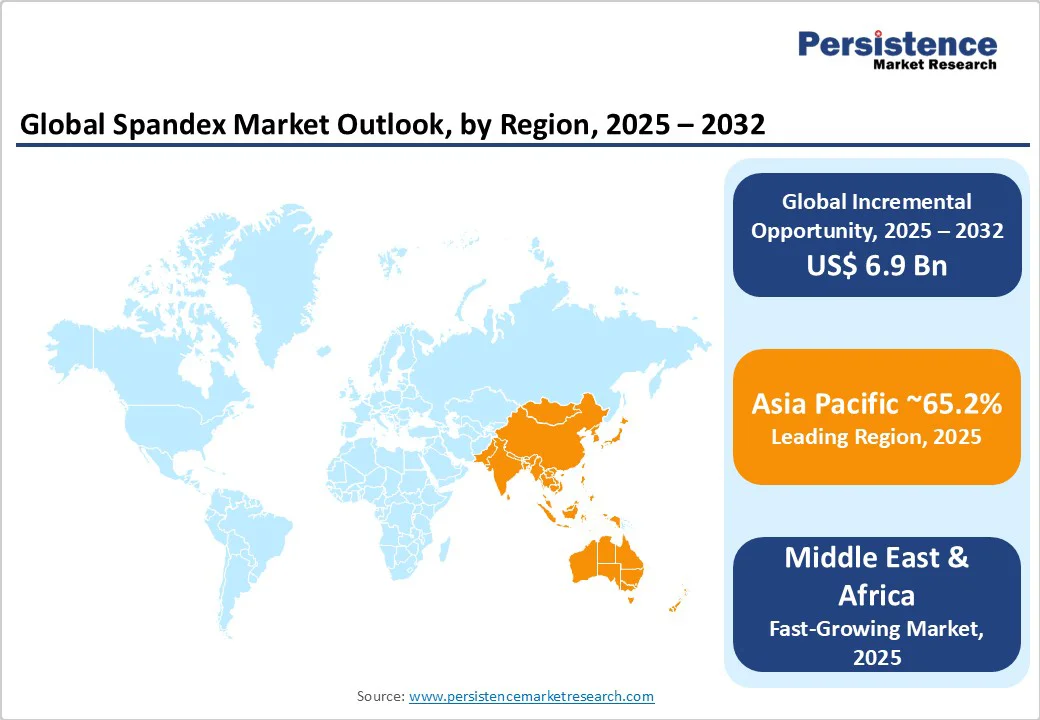

In 2025, Asia Pacific is estimated to account for approximately 65.2% of the market share. The region is dominated by China, which accounts for nearly half of the world’s production. The country’s superior manufacturing base, from petrochemical feedstock to finished textiles, gives it a competitive advantage.

South Korea focuses more on development, with companies such as Hyosung introducing novel spandex varieties such as creora® regen, made from 100% recycled materials, and creora bio-based, derived from renewable feedstocks.

India is rapidly expanding its domestic spandex capacity to meet rising demand in denim, sportswear, and lingerie manufacturing, reducing reliance on imports. Manufacturers across China, Vietnam, and South Korea are investing in bio-based and low-emission production methods. Hyosung recently announced plans to build a bio-BDO plant in Vietnam to produce eco-friendly spandex, while Indorama in India launched recycled spandex fibers using pre-consumer waste.

In the Middle East & Africa, the market is still developing but showing steady growth, mainly boosted by the rising popularity of fitness and athleisure wear. Urban markets such as Dubai, Riyadh, and Johannesburg are witnessing rising consumer demand for stretchable and high-performance fabrics.

The UAE’s Dubai Fitness Challenge and Saudi Arabia’s efforts under Vision 2030 to spur local textile manufacturing are encouraging investment in performance-oriented fabrics such as spandex. Several regional textile producers are partnering with Asia Pacific-based suppliers to introduce new elastic fabrics for sportswear and swimwear.

Local manufacturing remains limited, and the majority of spandex used across the region is imported from China, South Korea, and India. Egypt and South Africa are beginning to explore opportunities in medical and compression wear production due to the rising healthcare awareness and demand for post-surgical garments.

Sustainability is slowly gaining traction in Africa’s fashion hubs such as Nairobi and Lagos, where designers are experimenting with recycled stretch materials, although cost and infrastructure remain barriers.

In North America, the market is propelled by the high demand for premium activewear, medical compression garments, and shapewear. Consumers in the U.S. and Canada are now seeking high-performance fabrics that combine comfort, durability, and sustainability. Lululemon, Nike, and Under Armor are integrating spandex blends into their new collections, emphasizing moisture control, stretch recovery, and eco-friendly materials.

Local production of spandex, however, remains limited, and most fibers are imported from Asia Pacific. But companies are exploring nearshoring and recycling initiatives to reduce dependency on imports and carbon emissions. The U.S. is also tightening environmental standards, specifically regarding microfiber pollution and synthetic waste, pushing manufacturers to adopt green technologies and traceable supply chains.

The global spandex market is marked by strategic collaborations, sustainability initiatives, and technological developments. Companies such as Triarchy and Yulex are pioneering plant-based alternatives to traditional spandex.

Triarchy's Coreva technology and Yulex's Yulastic, both derived from natural rubber, provide biodegradable and compostable options. These materials are currently best suited for denim but are being explored for sportswear applications. Under Armor and Lululemon are also investing in alternative materials such as recyclable thermoplastics and bio-based nylon to reduce their environmental footprint.

The spandex market is projected to reach US$7.9 Billion in 2025.

Rising demand for athleisure and growth in fitness culture are the key market drivers.

The spandex market is poised to witness a CAGR of 9.4% from 2025 to 2032.

Expansion of stretchable casual wear and development of compression garments are the key market opportunities.

Asahi Kasei Corporation, HYOSUNG, and Huafon Chemical Co., Ltd. are a few key market players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Spandex Type

By Production Method

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author