ID: PMRREP31086| 199 Pages | 21 Nov 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

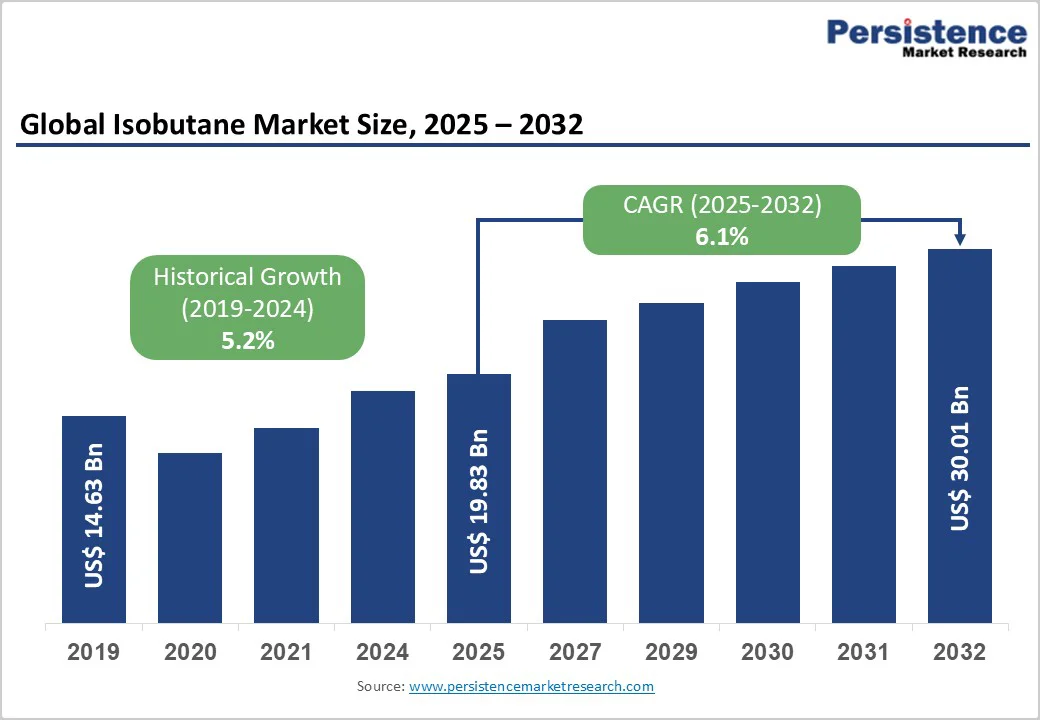

The global isobutane Market size is supposed to be valued at US$19.8 billion in 2025 and is projected to reach US$30.0 billion, growing at a CAGR of 6.1% between 2025 and 2032. This growth is primarily driven by the increasing demand for eco-friendly refrigerants and feedstocks in the chemical industry, supported by stringent environmental regulations phasing out high-GWP substances under the Montreal Protocol.

The rising adoption of isobutane in aerosol propellants and plastic production further accelerates expansion, as industries seek low-emission alternatives amid global sustainability goals. For instance, the shift towards hydrocarbon-based refrigerants has boosted usage in cooling systems, with production efficiencies improving through advanced refining techniques.

| Key Insights | Details |

|---|---|

|

Isobutane Market Size (2025E) |

US$19.8 Bn |

|

Market Value Forecast (2032F) |

US$30.0 Bn |

|

Projected Growth CAGR (2025-2032) |

6.1% |

|

Historical Market Growth (2019-2024) |

5.2% |

The isobutane market is primarily driven by the global shift to low-global warming potential (GWP) refrigerants, replacing hydrofluorocarbons (HFCs) to comply with environmental regulations. Isobutane, with a GWP of less than 1, serves as a natural hydrocarbon alternative in domestic and commercial refrigeration systems, aligning with the Kigali Amendment to the Montreal Protocol, which mandates HFC phase-downs starting in 2019. This shift has led to a surge in adoption, particularly in emerging markets where cooling demand rises with urbanization. For example, the International Energy Agency (IEA) reports that refrigerant demand in the Asia Pacific could double by 2030, directly benefiting isobutane usage.

Manufacturers are investing in compatible compressor technologies to mitigate flammability risks, ensuring safe integration and enhancing market penetration. The result is sustained volume growth, as isobutane's superior heat-transfer efficiency outperforms synthetic alternatives in energy savings, reducing end-user operational costs by up to 20% in lifecycle assessments. This driver not only supports immediate demand but also fosters long-term innovation in sustainable cooling solutions.

Isobutane is increasingly used as a feedstock for petrochemical derivatives, particularly for producing isobutylene in synthetic rubbers and fuel additives. With the automotive and packaging industries expanding, isobutane's use in alkylation processes for high-octane gasoline has increased, driven by rising vehicle production. The U.S. Energy Information Administration (EIA) indicates global gasoline demand will increase by 1.5% annually through 2030, necessitating greater use of isobutane-derived octane boosters.

Isobutane serves as the critical feedstock in alkylation units where it reacts with light olefins (C3-C4) to produce alkylate, a high-octane gasoline component with research octane numbers (RON) ranging from 94 to 99 and motor octane numbers (MON) of 88 to 94. This process is strategically important as refineries phase out lead-based octane enhancers and minimize benzene content to comply with environmental regulations. India's expanding refining network under its National Policy on Biofuels and Cleaner Fuels has similarly increased procurement of isobutane for alkylation. In contrast, new alkylation units are being commissioned across Asia and the Middle East to satisfy growing gasoline demand in these high-growth markets.

A major restraint for the isobutane market is the fluctuation in crude oil prices, which directly impacts production costs as isobutane is primarily derived from petroleum refineries. Since isobutane is derived mainly as a byproduct from atmospheric distillation units, catalytic cracking, and natural gas liquids extraction, any disruptions in refinery operations or natural gas supply chains directly impact isobutane availability and pricing. The U.S. operable atmospheric crude oil distillation capacity totaled 18.3 million barrels per calendar day as of 2023, but capacity adjustments, planned turnarounds, and unplanned outages create supply uncertainties.

In 2024, oil price swings between $70 and $ 90 per barrel, influenced by geopolitical tensions and OPEC+ production cuts, led to inconsistent feedstock availability, raising manufacturing costs by 10-15% in affected regions. This volatility discourages long-term investments in expansion, particularly for smaller producers reliant on imported crude, resulting in supply bottlenecks during peak demand periods. The EIA forecasts continued price instability through 2025, exacerbating margin pressures and slowing market growth in oil-dependent segments like solvents and feedstocks. Consequently, end-users face higher product prices, potentially leading them to switch to costlier alternatives and hindering overall adoption.

Isobutane's high flammability poses significant safety challenges, limiting its use in certain applications and imposing strict handling regulations. As a highly flammable gas (flash point -11.7°C), it requires specialized storage and transport infrastructure, increasing compliance costs.

The European Chemicals Agency (ECHA) enforces rigorous labeling and risk assessments under REACH, with non-compliance fines exceeding €1 million in recent cases. Incidents, such as the 2023 Texas refinery leak reported by the U.S. Chemical Safety Board (CSB), highlight explosion risks, leading to heightened scrutiny and insurance premiums rising 20% for handlers. These factors deter adoption in densely populated areas and delay product launches, thereby negatively impacting market momentum despite the product's environmental benefits.

A promising opportunity lies in developing bio-based isobutane production, offering a sustainable alternative to synthetic sources amid rising carbon-neutrality goals. Fermentative processes using renewable feedstocks such as sugarcane and biomass can achieve yields of up to 90% in pilot plants, as demonstrated by research from the National Institutes of Health (NIH) on microbial conversion pathways.

With global bioeconomy investments reaching $500 billion by 2025, according to the IEA, companies can capitalize on subsidies such as the EU's Renewable Energy Directive, which targets 32% renewables by 2030, to scale production. Driven by demand in the Methyl Tertiary Butyl Ether Market for cleaner fuel additives, reducing reliance on fossil fuels and opening revenue streams in eco-conscious markets like Europe. Early adopters report cost reductions of 15% through integrated biorefineries, positioning bio-isobutane as a high-potential area for innovation and market differentiation.

Market participants can leverage the expanding aerosol and foam sectors in the Asia Pacific, where urbanization drives demand for personal care and insulation products. The ASEAN region's consumer goods market is projected to grow 7% annually, according to the United Nations Industrial Development Organization (UNIDO) data, boosting isobutane use as a non-ozone-depleting propellant in sprays and polyurethane foams.

Recent policy shifts, such as India's Swachh Bharat initiative promoting hygienic products, have increased propellant needs by 12% in 2024. With low penetration rates currently at 20% in developing economies, companies investing in localized manufacturing can capture share, supported by partnerships with firms like Unilever for sustainable formulations. This opportunity promises significant volumes, enabling diversified portfolios and resilience against traditional restraints.

The synthetic source segment leads the isobutane market, holding approximately 95% market share due to its cost-effectiveness and established production infrastructure from natural gas processing and petroleum refineries. Synthetic isobutane benefits from abundant feedstock availability, with the EIA reporting U.S. natural gas liquids output exceeding 6 million barrels per day in 2024, enabling high-volume, low-cost extraction via fractionation.

This dominance is justified by the segment's scalability, supporting applications like refrigerants where purity consistency is critical. For instance, refinery processes yield grades suitable for immediate industrial use, reducing downstream processing needs. In contrast, bio-based sources remain niche but are gaining traction for their lower carbon footprint, aligning with sustainability mandates. Overall, the synthetic's reliability ensures its leadership, backed by investments in efficient technologies like catalytic dehydrogenation.

The technical grade dominates the isobutane market with about 70% share, driven by its versatility and affordability for large-scale industrial applications such as solvents and feedstocks. Technical grade, with purity levels around 95-99%, meets the requirements for propellant and plastic production without the premium costs of higher grades.

Data from the American Petroleum Institute (API) shows it comprises the bulk of refinery outputs, facilitating widespread adoption in cost-sensitive sectors. Its justification stems from robust supply chains, where natural gas processing yields consistent volumes, supporting the Synthetic Rubber Market through isobutylene derivation. Pure and research grades serve specialized needs like pharmaceuticals, but technical's broad utility and lower price point, often 20% below pure, solidify its position, as evidenced by surging demand in emerging economies.

Refineries represent the leading application segment, accounting for approximately 48% of isobutane consumption, positioning petroleum refining as the single largest end-use market. This dominance stems from isobutane's indispensable role in alkylation processes, where it reacts with C3-C4 olefins under sulfuric acid or hydrofluoric acid catalysis to produce alkylate, a high-octane gasoline component essential for meeting fuel quality standards. The alkylation process requires maintaining high isobutane-to-olefin ratios typically ranging from 7:1 to 12:1 to optimize reaction selectivity and maximize alkylate research octane numbers.

The refrigerant application segment is experiencing the fastest growth trajectory, propelled by environmental concerns regarding ozone depletion and the widespread adoption of isobutene (R-600a) in domestic refrigeration systems. The Methyl Tertiary Butyl Ether Market also represents a connected application ecosystem, as isobutane-derived isobutylene serves as a precursor for MTBE production used in gasoline oxygenation, though this application has declined in regions phasing out MTBE due to groundwater contamination concerns.

North America leads the isobutane market in technological innovation, with the U.S. being the primary producer due to its abundant shale gas resources. The EIA reports U.S. output surpassing 1.5 million tons in 2024, driven by advanced refining in Texas and Louisiana, supporting refrigerant applications under EPA low-GWP mandates. ExxonMobil's expanded Beaumont refinery added 240,000 barrels per calendar day capacity in 2023. These facilities incorporate sophisticated alkylation units consuming substantial isobutane volumes, with ExxonMobil's proprietary ALKEMAX sulfuric acid alkylation technology operating at cumulative capacity exceeding 250,000 barrels per stream day across multiple installations.

Canada contributes through natural gas processing, with exports rising 10% in 2024 per Natural Resources Canada, enhancing regional supply resilience. Investments in carbon capture align with sustainability, positioning North America as a hub for high-purity grades.

Europe's isobutane market emphasizes regulatory harmonization, with Germany and France leading adoption in eco-refrigerants via EU F-Gas Regulation, which cut HFC use by 79% since 2015. The REACH framework ensures safe flammability management, spurring innovations in aerosol propellants. The UK production grew 8% in 2024, according to BEIS statistics, amid post-Brexit supply adjustments.

Spain excels in feedstock applications, leveraging petrochemical clusters for MTBE production, with harmonized standards facilitating cross-border trade. Developments such as Air Liquide's 2024 plant upgrades enhance purity for research grades, supporting the refrigerants market.

Asia Pacific represents the fastest-growing regional market for isobutane, capturing approximately 40% of global market share, driven by rapid industrialization, expanding petrochemical production capacity, and surging refrigeration demand across emerging economies. China dominates regional consumption as the world's largest manufacturing hub, with Sinopec (China Petroleum & Chemical Corporation) operating as a leading integrated energy company and having extensive isobutane production capabilities. The country is significantly expanding ethylene cracker complexes, including Sinopec's Zhenhai facility with 1.5 million tonnes per year capacity by 2025, supporting downstream petrochemical operations consuming substantial isobutane volumes.

India's automotive and refrigeration markets are experiencing explosive growth, propelling demand for butyl rubber and refrigerant-grade isobutane. The Indian government's efforts to promote eco-friendly refrigerants supporting the Kigali Amendment commitments drive manufacturers to increase production facilities making isobutane affordable and accessible. This positions Asia Pacific as the fastest-growing area, with policies like China's 14th Five-Year Plan promoting clean chemicals.

The isobutane market exhibits a consolidated structure, with top players controlling more than half of the market, through integrated refineries and global supply chains. Companies pursue expansion via capacity upgrades and R&D in low-emission processes, such as catalytic improvements for higher yields. Key differentiators include a sustainability focus, like bio-based initiatives, and strategic acquisitions for feedstock security. Emerging models emphasize circular economy partnerships, reducing waste in petrochemical loops. This concentration fosters innovation but challenges smaller entrants, driving mergers for scale.

The Isobutane Market is valued at US$ 19.8 Bn in 2025 and expected to reach US$ 30.0 Bn by 2032, growing at 6.1% CAGR.

Key drivers include the shift to low-GWP refrigerants under international protocols and rising petrochemical feedstock needs for synthetic rubbers and fuels.

The synthetic source leads with a 95% share, due to efficient production from refineries and natural gas, supporting cost-effective industrial supply.

Asia Pacific leads, driven by China's manufacturing dominance and India's consumer demand, holding over 40% share through robust production capacities.

Bio-based production presents a major opportunity, with advancements in fermentation enabling sustainable alternatives and accessing green subsidies.

Major players include Sinopec, Linde LLC, and ConocoPhillips, leading through integrated operations, R&D, and global supply chains.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Source

By Grade

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author