ID: PMRREP23014| 198 Pages | 13 Oct 2025 | Format: PDF, Excel, PPT* | Healthcare

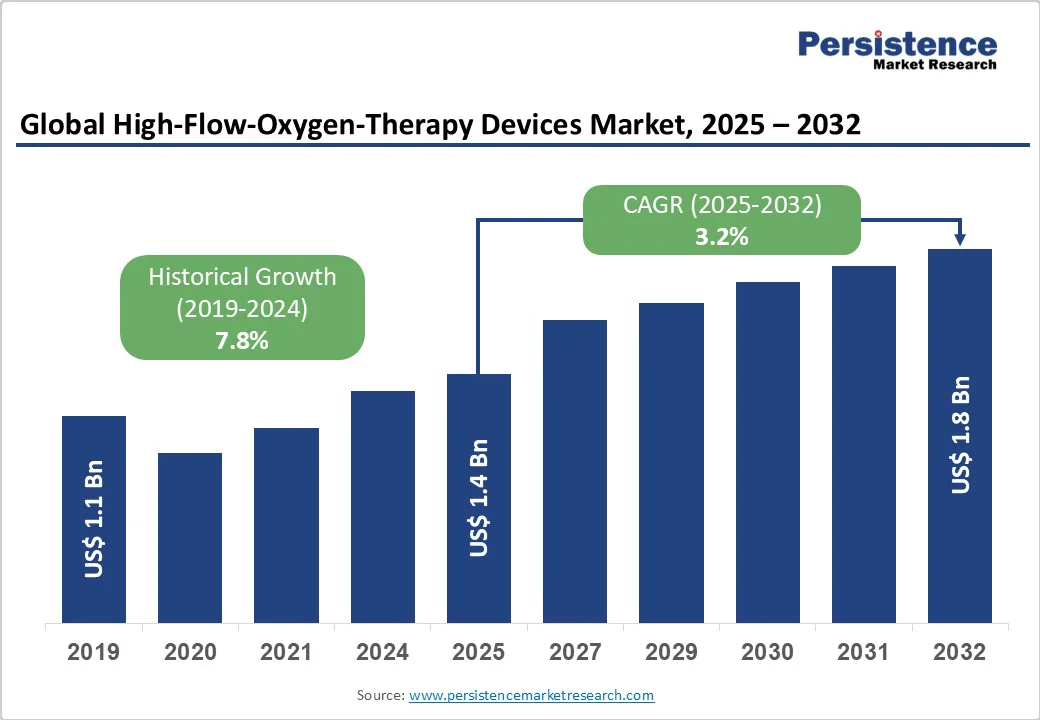

The global high-flow oxygen therapy devices market size is expected to be valued at US$1.4 billion in 2025. It is projected to reach US$1.8 billion by 2032, growing at a CAGR of 3.2% during the forecast period from 2025 to 2032.

The high-flow oxygen therapy (HFOT) devices market is witnessing significant growth due to the rising prevalence of respiratory disorders such as COPD, pneumonia, and COVID-19-related hypoxemia. These devices deliver heated, humidified oxygen at high flow rates, improving patient comfort and oxygenation compared to conventional methods.

| Key Insights | Details |

|---|---|

|

High-Flow-Oxygen-Therapy Devices Market Size (2025E) |

US$1.4 Bn |

|

Market Value Forecast (2032F) |

US$1.8 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

3.2% |

|

Historical Market Growth (CAGR 2019 to 2024) |

7.9% |

After initially being used in pre-term infants and for pediatric care, high-flow nasal cannula oxygen therapy (HFNC) is now being employed in adult critical care units (ICUs) as the first-line treatment for respiratory distress syndrome and premature apnea. Recent physiological, pilot investigations, and controlled trials have highlighted the potential function of HFNC in adults. HFNC offers good comfort by delivering a humidified and warm gas flow using nasal prongs.

Furthermore, HFNC appears to be better tolerated than non-invasive ventilation (NIV) and regular oxygen, despite having a high oxygen flow rate. Given its physiological effects in patients with hypoxemic acute respiratory failure (ARF) for whom non-invasive ventilation indications are still debated, HFNC can be considered an alternative to NIV for ARF, despite its use having steadily grown over the past 20 years. Keeping in view the factors as mentioned earlier, manufacturers are presented with opportunities for the introduction of novel devices to address patient-specific needs, which will aid the growth of the high flow oxygen therapy devices market over the forecasted years.

The occurrence of product limitations and recalls, which can undermine patient safety and erode trust in manufacturers, creates market challenges. For instance, in August 2023, the FDA issued a Class I recall—the most serious type for several Philips Respironics ventilators, including the Trilogy Evo, Evo O2, EV300, and Evo Universal models. This action was prompted by the discovery of dust and dirt in the air path, which could potentially reduce airflow and pose serious risks to patients.

Additionally, in May 2024, another Class I recall was initiated due to a software-related power malfunction in the Trilogy Evo ventilators. This issue could cause the device to issue false "Battery Depleted" or "Loss of Power" alarms, leading to sudden loss of ventilation support, even when sufficient power remains. Such recalls not only disrupt patient care but also highlight the critical need for rigorous quality control and post-market surveillance in the development and deployment of high-flow oxygen therapy devices.

Hybrid Ventilator-HFOT Systems represent a significant innovation in critical care, combining the capabilities of traditional mechanical ventilators with high-flow oxygen therapy. These devices enable healthcare providers to seamlessly transition between invasive ventilation and non-invasive high-flow oxygen delivery, providing flexibility in intensive care units (ICUs) and emergency settings. The hybrid approach helps optimize patient outcomes by delivering precise oxygen flow while reducing the risk of ventilator-associated complications.

It is particularly beneficial for patients with acute respiratory distress syndrome (ARDS), post-operative respiratory support, and COVID-19-related hypoxemia. With rising demand for versatile, multi-functional respiratory devices, hybrid systems enable hospitals to improve ICU efficiency, reduce equipment redundancy, and cater to diverse patient needs, making them a high-growth segment.

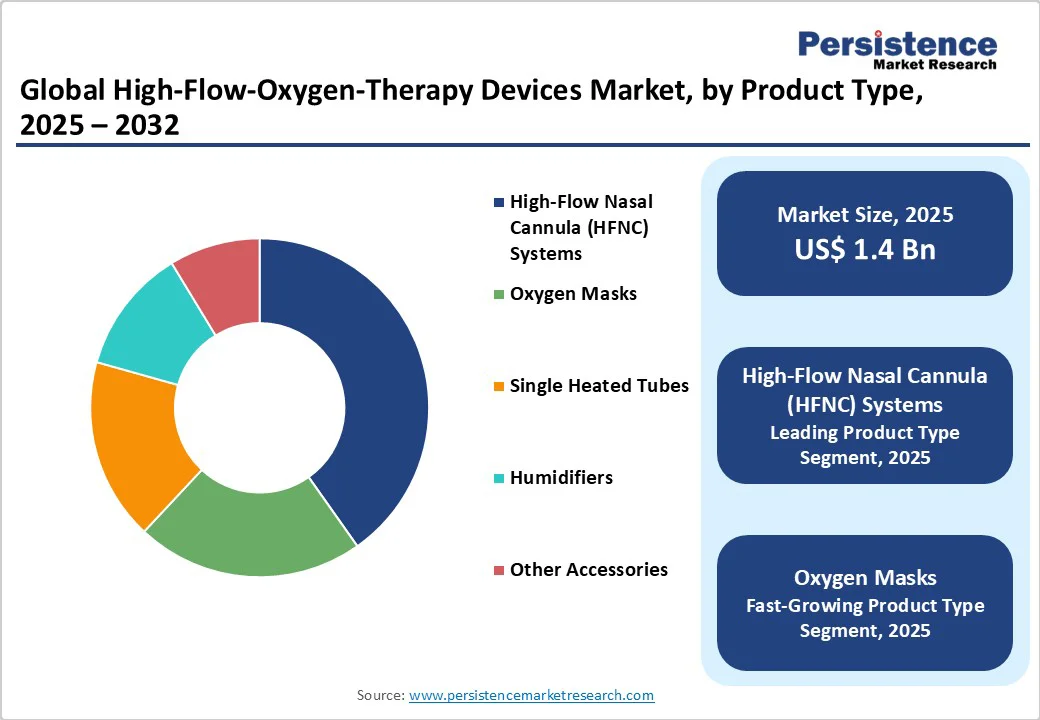

High-Flow Nasal Cannula (HFNC) Systems dominate the high-flow oxygen therapy market due to their ability to deliver precise, heated, and humidified oxygen at high flow rates while ensuring patient comfort. Unlike conventional oxygen delivery methods, HFNC reduces the need for invasive ventilation and lowers the risk of ventilator-associated complications. Its wide applicability in managing COPD, pneumonia, acute hypoxemia, and COVID-19-related respiratory distress drives hospital and homecare adoption. Continuous technological advancements, ease of use, and strong clinical recommendations make HFNC systems the preferred choice among healthcare providers, securing their position as the leading product type segment globally.

Hospitals are the primary end users of high-flow oxygen therapy devices due to their ability to handle high patient volumes and complex respiratory cases. Intensive care units (ICUs) and emergency departments frequently require non-invasive oxygen support for patients with COPD, pneumonia, ARDS, and COVID-19-related hypoxemia. Hospitals have the necessary infrastructure, trained respiratory therapists, and monitoring equipment to operate advanced HFOT systems, including HFNC and hybrid ventilator devices. Additionally, hospitals can invest in multiple devices to ensure continuous patient care, making them the largest revenue-generating segment. Their critical care focus and adoption of technologically advanced devices solidify their leading position globally.

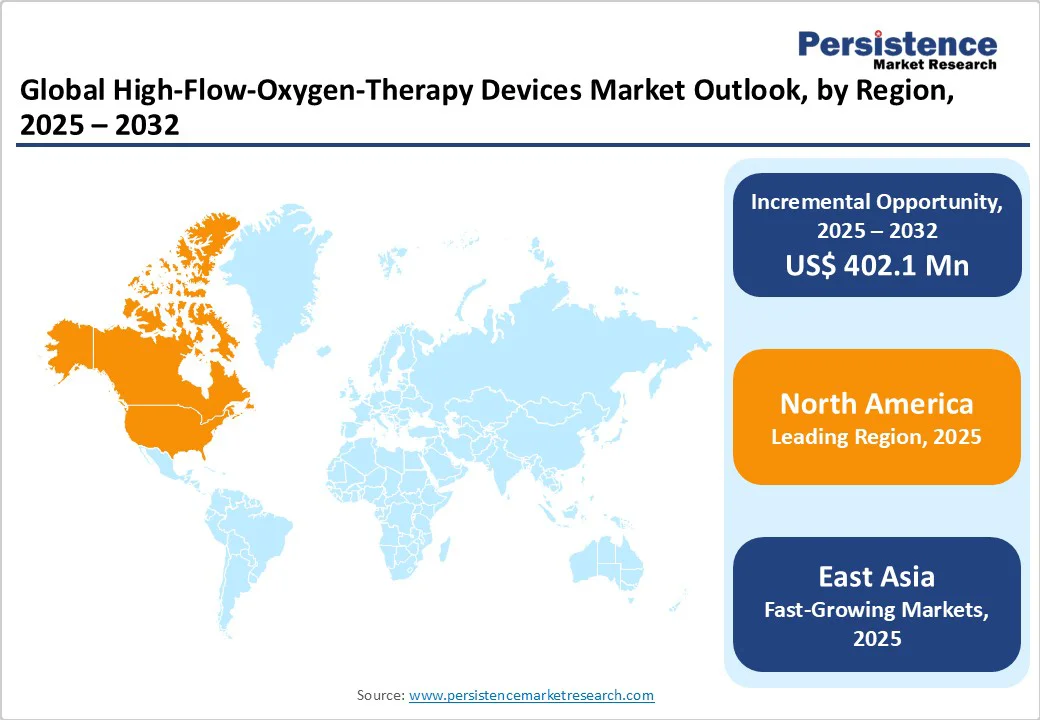

In 2023, the United States represented around 62% of global Acute Respiratory Distress Syndrome (ARDS) cases, with around 591,000 new cases reported. This reflects a notable increase compared to previous years, underscoring the growing burden of respiratory illnesses. Pneumonia has now become the leading cause of ARDS, overtaking COVID-19-related cases.

Despite the rising incidence, hospital mortality rates for ARDS have decreased, with projections suggesting a continued gradual decline (ATS Journals). This improvement is largely driven by advancements in medical technology, particularly high-flow oxygen therapy devices, which play a key role in managing ARDS and other acute respiratory failures while minimizing the need for invasive ventilation. Given the increasing prevalence of respiratory disorders and wider adoption of advanced therapies, the U.S. market for high-flow oxygen therapy devices is expected to grow steadily in the coming years.

Asia Pacific High-Flow Oxygen Therapy Devices Market is rapidly emerging due to rising hospitalizations from acute respiratory failure, pneumonia, and post-COVID complications. India and China account for the largest share, driven by increasing ICU bed capacity and adoption of high-flow nasal cannula (HFNC) systems in tertiary hospitals. Japan and South Korea are witnessing the adoption of hybrid ventilator-HFOT devices for advanced critical care. The region is also seeing growing investment in portable and home-use HFOT devices, addressing gaps in semi-urban healthcare infrastructure. Key players are expanding their presence through partnerships with local distributors and introducing cost-effective, compact HFOT solutions. These factors are positioning Asia-Pacific as one of the fastest-growing markets for high-flow oxygen therapy globally.

The global high-flow oxygen therapy devices market is highly competitive, with several global and regional players vying for market share. Philips, Fisher & Paykel Healthcare, ResMed, Dräger, and Smiths Medical dominate due to their advanced HFNC systems, hybrid ventilator-HFOT devices, and innovative humidifiers. Companies are increasingly focusing on product innovation, strategic partnerships, and geographic expansion to strengthen their presence. In emerging markets like Asia-Pacific, local distributors and cost-effective device manufacturers are intensifying competition. Mergers, acquisitions, and collaborations are common strategies to enhance product portfolios and expand market reach.

The global high-flow oxygen therapy devices market is projected to be valued at US$1.4 Bn in 2025.

Increasing cases of COPD, pneumonia, ARDS, and post-COVID respiratory complications are driving demand for non-invasive oxygen therapy.

The global market is poised to witness a CAGR of 3.2% between 2025 and 2032.

Devices combining ventilator support with high-flow therapy for ICU flexibility.

Draegerwerk AG & Co. KGaA, Teleflex Medical GmBH, Vapotherm, Inc., ResMed, Fisher & Paykel Corporation Ltd., and others.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Mn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Application

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author