ID: PMRREP12376| 313 Pages | 7 Feb 2026 | Format: PDF, Excel, PPT* | Chemicals and Materials

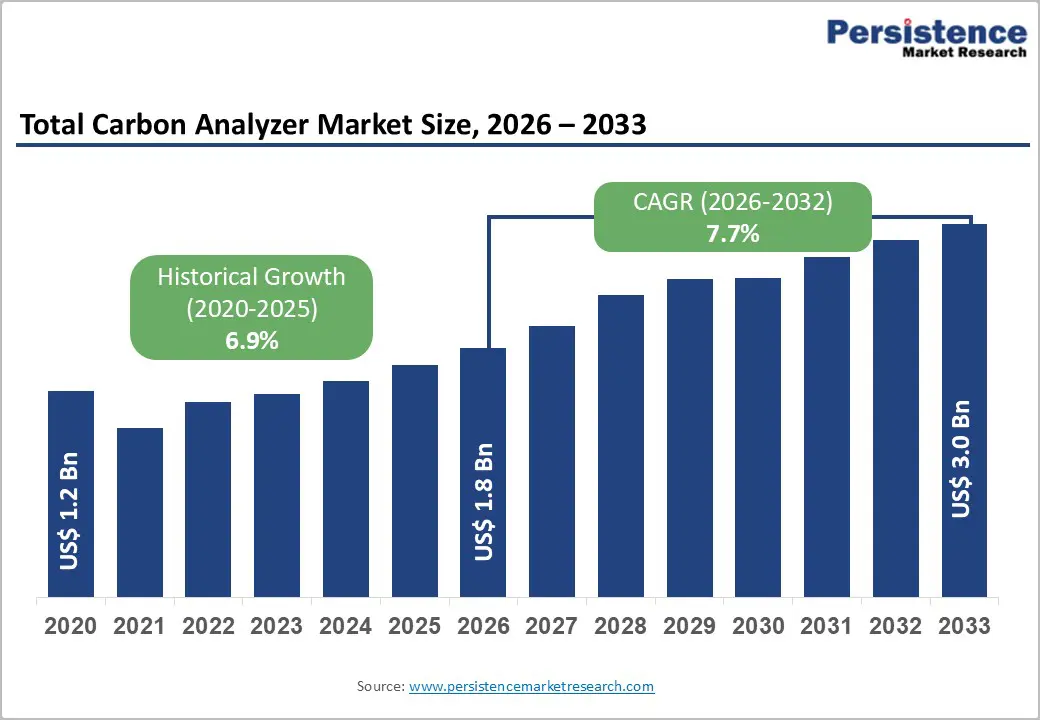

The global total carbon analyzer market size was valued at US$ 1.8 billion in 2026 and is projected to reach US$ 3.0 billion by 2033, growing at a CAGR of 7.7% between 2026 and 2033. The market expansion is primarily driven by stringent environmental regulations mandating water quality monitoring across industries, combined with the rise in demand from the pharmaceutical and semiconductor sectors requiring ultra-pure water systems.

Technological advancements in online total carbon analyzers with real-time monitoring capabilities and integration with IoT platforms are significantly enhancing operational efficiency and driving wider adoption across process control applications.

| Report Attribute | Details |

|---|---|

|

Global Total Carbon Analyzer Market Size (2026E) |

US$ 1.8 Bn |

|

Market Value Forecast (2033F) |

US$ 3.0 Bn |

|

Projected Growth CAGR (2026-2033) |

7.7% |

|

Historical Market Growth (2020-2025) |

6.9% |

Drivers - Stringent Environmental and Regulatory Compliance Requirements

Regulatory frameworks established by the United States Environmental Protection Agency (EPA), European Union Water Framework Directive, and various international standards are compelling industries to implement rigorous water quality monitoring systems. EPA Method 9060A requires total organic carbon testing for groundwater, surface water, and wastewater. The United States Pharmacopoeia (USP), European Pharmacopoeia (EP), and Japanese Pharmacopoeia (JP) have recognized TOC as a mandatory analytical parameter for purified water and water for injection.

Under the Safe Drinking Water Act, approximately 150,000 public water systems in the United States serve more than 300 million people, necessitating continuous monitoring to prevent harmful disinfection byproducts. This extensive regulatory landscape creates sustained demand for accurate and reliable total carbon analyzers across municipal water treatment facilities, pharmaceutical manufacturing plants, and industrial wastewater treatment operations.

Growing Demand from Semiconductor and Pharmaceutical Manufacturing

The semiconductor and pharmaceutical industries require extremely pure water that meets specifications typically below 1 ppb organic carbon for manufacturing processes. Microelectronic manufacturers depend on ultrapure water for silicon wafer cleaning and fabrication, where even trace organic contamination can cause circuit-printing defects and reduce product yields. The pharmaceutical sector requires TOC analyzers to monitor purified water systems and validate cleaning procedures between batches, ensuring compliance with FDA regulations and protecting product integrity.

As global semiconductor production expands, particularly in the Asia-Pacific region, including China, South Korea, and Taiwan, and pharmaceutical manufacturing continues to scale its capacities, demand for advanced total carbon monitoring systems is increasing substantially.

Restraints - High Capital Investment and Technical Complexity

Advanced total carbon analyzers, particularly online laboratory-grade and real-time process monitoring systems, require significant upfront capital investments ranging from thousands to hundreds of thousands of dollars, depending on analytical specifications and integration requirements. Smaller treatment facilities and industrial operations may delay equipment purchases due to budget constraints.

Operating and maintaining these sophisticated instruments demands skilled technical personnel trained in analytical chemistry, instrumental maintenance, and data interpretation. The shortage of qualified operators in developing regions, combined with ongoing calibration requirements and periodic maintenance costs, creates operational barriers that restrict market penetration in resource-constrained sectors.

Limited Awareness and Slow Adoption in Emerging Markets

Many developing nations, particularly in South Asia and Southeast Asia, lack comprehensive environmental monitoring infrastructure and regulatory enforcement mechanisms. Industrial facilities in emerging economies may not prioritize total organic carbon testing due to limited regulatory pressure, inadequate environmental enforcement, and competing financial priorities.

Knowledge gaps regarding the importance of TOC analysis in preventing operational problems and ensuring product quality persist in small and medium enterprises. These adoption barriers, particularly in price-sensitive markets, slow market growth rates despite underlying demand potential.

Opportunity - Expansion of Industrial Wastewater Treatment and Circular Economy Initiatives

Governments worldwide, particularly the European Union, China, and India, are implementing aggressive wastewater treatment mandates to address water scarcity and pollution. China has committed to treating 95% of urban sewage by 2025 through ambitious infrastructure programs. India's Central Pollution Control Board identified significant treatment gaps, with only 37% of the 62,000 million liters per day of urban sewage receiving treatment. Japan operates approximately 470,000 km of wastewater collection infrastructure requiring modernization with advanced monitoring technologies.

These expansion initiatives create substantial demand for portable TC analyzers and online monitoring systems that optimize treatment processes and enable real-time process control. The integration of total carbon analysis with treatment optimization algorithms offers operators means to reduce chemical usage, minimize energy consumption, and achieve regulatory compliance more efficiently.

Integration of AI-Driven Predictive Analytics and Industry 4.0 Connectivity

Next-generation total carbon analyzers incorporating artificial intelligence, machine learning algorithms, and cloud-based data management represent transformative opportunities. Shimadzu Corporation introduced advanced TOC-V series online analyzers featuring AI-driven predictive maintenance capabilities and secured Industry 4.0 connectivity, reducing analysis time by 30% compared to previous generations. These intelligent systems enable operators to predict maintenance requirements before failures occur, optimize sampling protocols, and correlate TOC measurements with other process parameters for comprehensive quality assurance.

The ability to integrate total carbon data with enterprise resource planning systems and automated reporting mechanisms appeals particularly to large-scale operations seeking digital transformation. This technological convergence creates opportunities for vendors offering comprehensive solutions combining hardware, software, data analytics, and professional services.

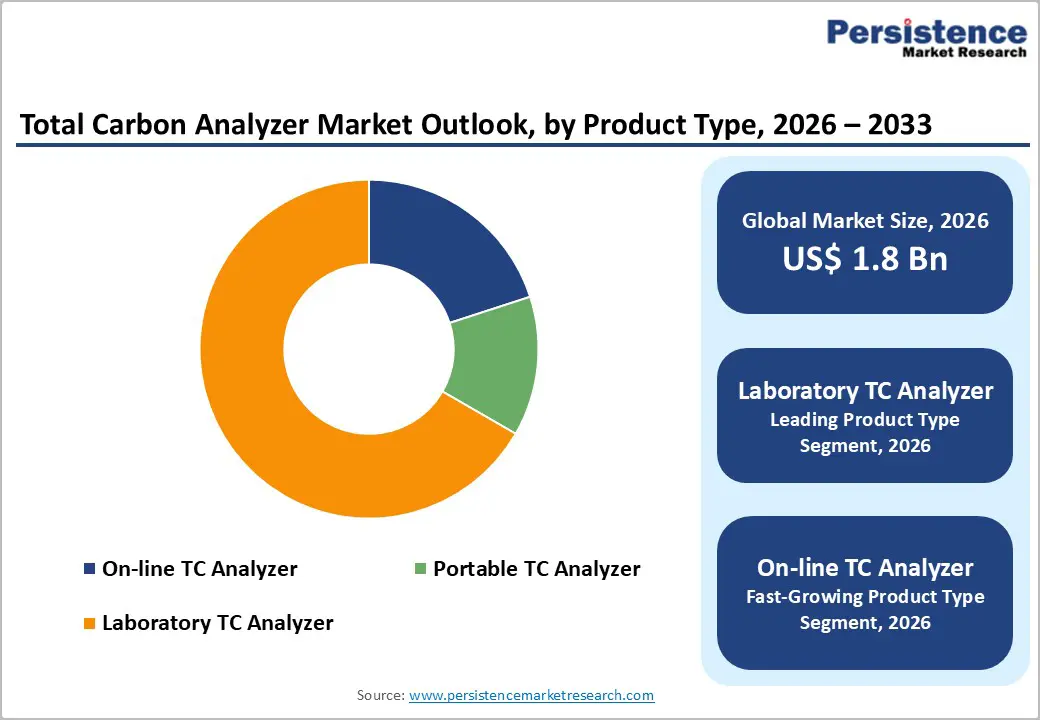

Product Type Insights

Laboratory total carbon analyzers command the largest market segment, representing approximately 47% of global market share. Laboratory-grade instruments provide superior analytical accuracy with detection limits reaching 0.03 ppb and measurement ranges extending to 50,000 ppm, meeting rigorous requirements of pharmaceutical quality assurance, environmental testing laboratories, and semiconductor manufacturing facilities. The strong market position reflects their essential role in regulatory compliance, research applications, and quality control procedures where high precision measurements directly influence product safety and regulatory acceptance.

Laboratories across pharmaceutical facilities, water-testing facilities, and environmental monitoring organizations rely on laboratory total carbon analyzers for their advanced analytical capabilities, multiple detection methods, and comprehensive data-reporting functions that support both routine monitoring and investigative analyses.

Sample Type Insights

Liquid sample analysis accounts for approximately 72% of the market share of total carbon analyzers, reflecting its predominant application in water quality monitoring across pharmaceutical manufacturing, wastewater treatment, drinking water systems, and industrial process water monitoring. Liquid samples require sophisticated UV-persulfate oxidation methods or high-temperature catalytic combustion techniques to completely oxidize organic carbon compounds and accurately quantify total carbon content.

The widespread use of online liquid total carbon analyzers in continuous monitoring applications, particularly in pharmaceutical purified water systems and municipal wastewater treatment plants, reinforces the dominance of liquid-sample analysis. Advanced membrane conductometric detection methods and infrared analysis enable reliable measurement of organic carbon in complex water matrices containing dissolved salts, suspended solids, and varying pH conditions encountered in practical field applications.

Application Insights

Wastewater treatment operations account for the largest share of carbon analyzer applications, at approximately 38%. Municipal and industrial wastewater treatment facilities require continuous TOC monitoring to evaluate treatment effectiveness, optimize biological treatment processes, comply with discharge regulations, and prevent equipment fouling from inadequately treated organic matter. The EPA regulates effluent quality through multiple parameters, including total organic carbon limits, creating mandatory monitoring requirements.

Industrial applications, including pharmaceutical manufacturing, chemical processing, food and beverage production, and semiconductor fabrication operations, employ total carbon analyzers to monitor process water quality, validate cleaning procedures, and prevent product contamination. Environmental monitoring applications for surface water, groundwater, and drinking water systems require regular TOC analysis to detect sources of organic pollution and to track water quality trends, thereby driving continued demand from environmental agencies and municipal utilities.

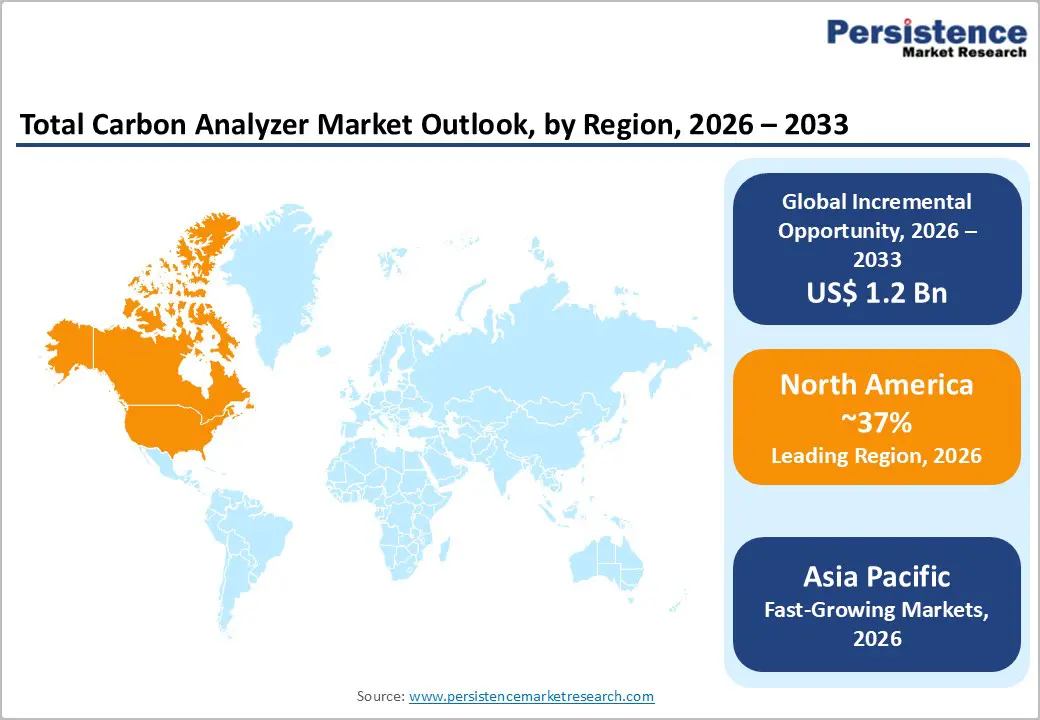

North America Total Carbon Analyzer Market Trends

North America maintains the largest market share, representing approximately 36.7% of global total carbon analyzer market revenue, driven by stringent regulatory frameworks and advanced analytical capabilities. The United States dominates regional demand, accounting for approximately 88.9% of the North American market, supported by the EPA's comprehensive water quality regulations requiring TOC testing in drinking water, surface water, and wastewater applications. Major pharmaceutical companies concentrated in the United States, including facilities operated by industry leaders, require sophisticated total carbon analyzers for validating purified water systems and ensuring FDA compliance throughout manufacturing operations.

Technological innovation centers in North America drive product development and industry advancement, with companies such as Teledyne Analytical Instruments, Hach Company (subsidiary of Danaher Corporation), and GE Analytical Instruments headquartered in the region. The presence of advanced semiconductor manufacturing facilities and research institutions creates sustained demand for high-precision total carbon analysis equipment. Investment in water infrastructure modernization, particularly in aging municipal systems, and the expansion of treated wastewater reuse initiatives support growing adoption of analytics across the region.

Europe Total Carbon Analyzer Trends

Europe maintains the second-largest market share, accounting for approximately 28.3% of global revenue, and is characterized by strict environmental regulations and advanced analytical standards. The European Union Water Framework Directive requires member states to achieve and maintain good qualitative status for all water bodies, necessitating comprehensive monitoring infrastructure across drinking water systems, wastewater treatment facilities, and surface water monitoring networks. Germany, the United Kingdom, France, and Spain operate among the most advanced water quality monitoring systems globally, employing sophisticated total carbon analyzers throughout their water infrastructure.

European pharmaceutical manufacturing, cosmetics production, and specialty chemicals industries impose stringent specifications for purified water quality, driving adoption of advanced laboratory total carbon analyzers and online monitoring systems. The European Pharmacopoeia requirements for TOC testing in water for injection systems create mandatory analyzer specifications for facilities manufacturing injectable pharmaceuticals. Regulatory harmonization across the EU and adoption of standardized analytical methods through ISO and DIN standards support market consolidation and drive technological standardization across the region.

Asia Pacific Total Carbon Analyzer Trends

Asia Pacific represents the fastest-growing regional market, projected to expand at a CAGR of 6.5% through 2032, driven by rapid industrialization, urbanization, and expanding pharmaceutical manufacturing capacity. China, the world's largest wastewater generator, has launched ambitious treatment initiatives committing to 95% urban sewage treatment by 2025, creating substantial demand for wastewater monitoring systems including total carbon analyzers. India's expanding pharmaceutical manufacturing sector and growing semiconductor production capabilities, particularly in southern regions, drive demand for water quality monitoring systems meeting international standards.

Japan operates a mature water infrastructure with approximately 470,000 km of wastewater collection systems requiring modernization with advanced monitoring technologies. South Korea's semiconductor industry concentration and pharmaceutical manufacturing exports create strong demand for sophisticated total carbon analysis equipment. Growing manufacturing facilities throughout ASEAN countries, including Vietnam, Thailand, and Indonesia, require basic analytical capabilities, creating market opportunities for mid-range portable total carbon analyzers and at-line monitoring systems capable of supporting quality control procedures in developing industrial ecosystems.

The total carbon analyzer market exhibits a moderately concentrated competitive structure with Shimadzu Corporation, Xylem Inc., Hach Company, Teledyne Analytical Instruments, and Analytik Jena AG controlling approximately 60-65% of global market share collectively. Shimadzu Corporation maintains market leadership with estimated 18-22% global share, leveraging advanced product portfolios including laboratory instruments, online analyzers, and process control systems. Market leaders employ differentiation strategies emphasizing technological innovation, expanded analytical capabilities, and comprehensive service ecosystems rather than competing on price alone.

Competitive dynamics increasingly emphasize research and development investments in AI-enabled predictive analytics, IoT connectivity, and automation rather than traditional analytical method improvements. Mergers and acquisitions consolidate the market, with Danaher Corporation's acquisition of Hach Company creating integrated water quality solutions combining total carbon analyzers with complementary analytical instruments and software platforms. Emerging competitors from Asia-Pacific regions, including Chinese manufacturers, target price-sensitive segments with simplified portable total carbon analyzers and at-line monitoring systems. Strategic partnerships between analyzer manufacturers and software companies enable integrated digital solutions appealing to large industrial operators seeking comprehensive data management platforms.

Key Market Developments

The global total carbon analyzer market is likely to be valued at US$ 1.8 Bn in 2026 and is projected to reach US$ 3.0 Bn by 2033, representing a compound annual growth rate of 7.7% throughout the forecast period, driven by stringent environmental regulations and growing demand from pharmaceutical and semiconductor industries.

The primary demand drivers include stringent EPA, EU Water Framework Directive, and USP/EP/JP pharmacopeial regulatory requirements for water quality monitoring, growing pharmaceutical and semiconductor manufacturing requiring ultra-pure water systems below 1 ppb organic carbon specifications, and expanding wastewater treatment infrastructure particularly in Asia-Pacific regions targeting environmental compliance and operational optimization.

Laboratory total carbon analyzers command the largest market share at approximately 47%, reflecting their essential role in pharmaceutical quality assurance, environmental testing laboratories, and semiconductor manufacturing requiring superior analytical accuracy with detection limits as low as 0.03 ppb and measurement ranges extending to 50,000 ppm.

North America maintains the largest market share at 36.7% of global revenue through 2033, driven by stringent EPA water quality regulations, extensive municipal water infrastructure serving 300 million people, and concentrated pharmaceutical and semiconductor manufacturing facilities requiring advanced analytical systems.

Integration of artificial intelligence, machine learning algorithms, Industry 4.0 connectivity, and cloud-based data management represents the primary growth opportunity. Shimadzu Corporation's TOC-V series demonstrating 30% analysis time reduction and AI-driven predictive maintenance exemplifies how intelligent systems enable comprehensive digital solutions appealing to large-scale industrial operations seeking automated monitoring and integrated data management platforms.

Shimadzu Corporation leads the market with 18-22% global share, followed by Teledyne Analytical Instruments with 14-18%, Hach Company with 12-16%, and Analytik Jena AG with 10-14%, collectively controlling approximately 60-65% of global market share through advanced product portfolios, technological innovation, and comprehensive service ecosystems.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 - 2025 |

|

Forecast Period |

2026 - 2033 |

|

Market Analysis Units |

Value: US$ Mn Volume: Units |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Sample Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author