ID: PMRREP19846| 229 Pages | 27 Jan 2026 | Format: PDF, Excel, PPT* | Healthcare

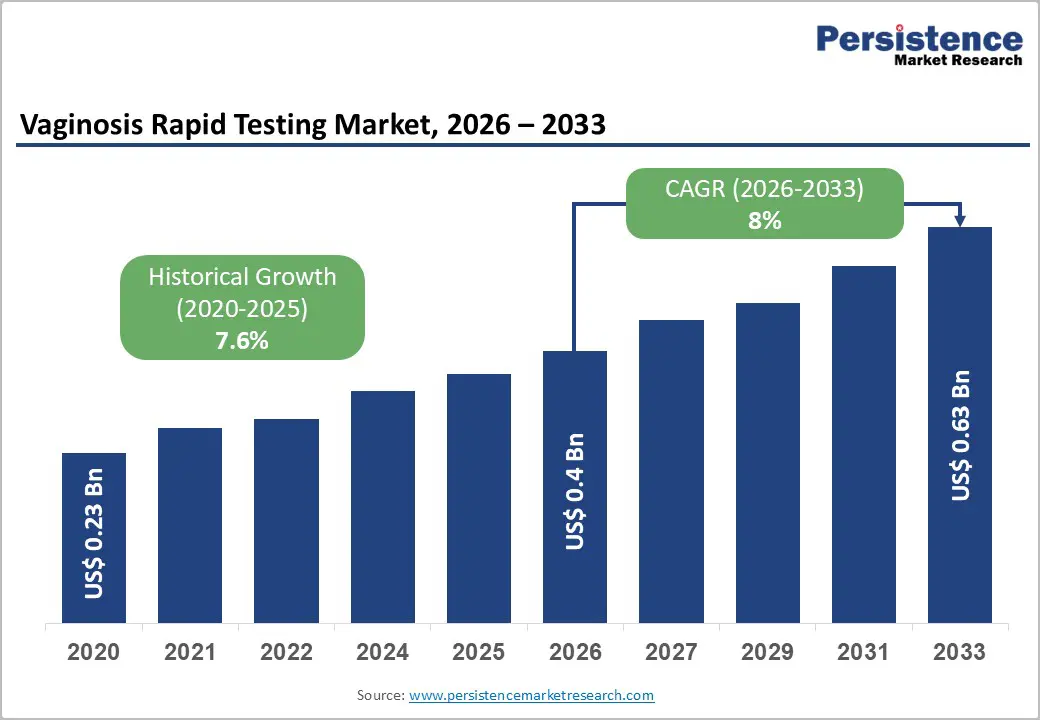

The global vaginosis rapid testing market size is projected to be valued at US$ 0.4 billion in 2026 and is projected to reach US$ 0.6 billion by 2033, growing at a CAGR of 8% during the forecast period between 2026 and 2033. The transition from traditional microscopy and Nugent scoring toward molecular-based rapid diagnostic tests (RDTs) and Point-of-Care (POC) platforms represents the primary catalyst for market value appreciation. Increasing healthcare expenditure and a shift toward patient-centric diagnostic models are optimizing the clinical workflow for gynecological infections.

| Key Insights | Details |

|---|---|

| Global Vaginosis Rapid Testing Market Size (2026E) | US$ 0.4 Bn |

| Market Value Forecast (2033F) | US$ 0.6 Bn |

| Projected Growth (CAGR 2026 to 2033) | 8% |

| Historical Market Growth (CAGR 2020 to 2025) | 7.6% |

The vaginitis rapid testing market is structurally driven by the rising prevalence of vulvovaginal infections, particularly bacterial vaginosis, candidiasis, and trichomoniasis, across reproductive-age and peri-menopausal populations. Elevated disease incidence, reinforced by hormonal transitions, urban lifestyle factors, and uneven access to preventive gynecological care, is intensifying diagnostic demand at the primary-care and outpatient levels. This epidemiological pressure is translating into sustained expansion of screening protocols, positioning rapid diagnostic formats as essential tools for early differentiation and clinical workflow efficiency.

From a market dynamics perspective, higher consultation volumes are reinforcing test utilization intensity across hospitals, diagnostic laboratories, and decentralized care settings. However, delayed or missed diagnosis continues to impose downstream cost burdens through adverse pregnancy outcomes and repeat clinical visits, compressing payer efficiency and amplifying regulatory focus on early detection. As a result, rapid testing adoption is increasingly framed as a cost-containment and outcomes-optimization lever rather than discretionary diagnostics spend, strengthening its role within women’s health value chains.

Social stigma surrounding vaginal health and sexually transmitted infections remains a persistent structural headwind for the vaginitis rapid testing market, particularly across underrepresented and culturally conservative demographics. Despite technological advancement, privacy concerns, social taboos, and limited health literacy continue to suppress proactive screening behavior, delaying clinical engagement and distorting true disease incidence. This behavioral friction weakens early diagnostic penetration, especially in primary-care and community health settings, where rapid testing could otherwise deliver high clinical and economic value.

From a market-efficiency standpoint, widespread reliance on over-the-counter antifungal self-medication further compresses professional diagnostic utilization by obscuring bacterial etiologies and delaying appropriate treatment pathways. This dynamic contributes to systemic underdiagnosis, fragmented care cycles, and reduced test kit throughput, constraining addressable demand despite favorable epidemiology. As regulators and public health systems intensify focus on antimicrobial stewardship and diagnostic accuracy, overcoming stigma-driven access barriers remains critical to unlocking latent market potential and improving utilization normalization.

High recurrence rates in bacterial vaginosis are structurally reshaping diagnostic priorities, with repeat infections reinforcing the limitations of single-pathogen detection models. Persistent recurrence is elevating clinical interest in microbiome-informed diagnostics that extend beyond binary detection toward longitudinal risk stratification. Probiotic-integrated and microbiome-focused testing panels are increasingly positioned as differentiated solutions capable of supporting treatment personalization, recurrence monitoring, and improved therapeutic adherence, creating a defined incremental revenue opportunity within advanced vaginitis diagnostics.

On the regulatory front, emerging policy pathways in Europe are strengthening the commercial viability of these next-generation formats. Accelerated review mechanisms and conditional approvals are compressing time-to-market for innovative assays, particularly those supported by targeted clinical trials in high-risk populations. This regulatory momentum is reinforcing investment flows into efficacy-driven panel expansion, aligning diagnostic innovation with antimicrobial stewardship objectives and outcome-based care models across developed healthcare systems.

The molecular PCR assay segment is expected to remain the dominant revenue contributor within the vaginitis rapid testing market, accounting for approximately 45% of total share, underpinned by superior analytical sensitivity and specificity for multi-pathogen detection. Its structural advantage is driven by regulatory alignment, laboratory workflow integration, and clinical preference for definitive BV diagnosis aligned with gold-standard scoring frameworks. This technological reliability reinforces adoption across centralized laboratories and hospital settings, translating into reduced empirical treatment rates and improved antimicrobial stewardship outcomes. However, high capital requirements for instrumentation continue to constrain penetration in cost-sensitive and decentralized care environments, limiting broader volume scalability despite clinical superiority.

In contrast, point-of-care antigen tests are projected to represent the fastest-growing segment. Growth is structurally driven by demand for portable, low-complexity diagnostics delivering rapid turnaround times, particularly within OB/GYN clinics and telehealth-enabled care models. Lower per-test costs and minimal infrastructure dependency are accelerating adoption in outpatient and community settings, positioning this segment to capture incremental volume growth while improving time-to-treatment efficiency and supporting decentralized diagnostic strategies.

Diagnostic laboratories are expected to remain the leading end-user segment in the vaginitis rapid testing market, supported by high-throughput infrastructure, automation compatibility, and stable reimbursement frameworks. Centralized laboratories continue to process the largest testing volumes due to their ability to scale molecular PCR workflows efficiently, enabling cost optimization through batch processing and standardized protocols. This structural advantage reinforces revenue stability and pricing discipline, despite longer turnaround times relative to decentralized alternatives, and positions diagnostic laboratories as the backbone of confirmatory and population-scale screening within the care continuum.

Telehealth kits and home-based testing are projected to represent the fastest-growing end-user segment, driven by sustained behavioral shifts toward privacy, convenience, and remote care delivery. Advances in self-collection accuracy and digital platform integration are accelerating clinical acceptance, enabling decentralized monitoring and earlier intervention. As payer recognition and validation data improve, this segment is expected to capture incremental share from traditional settings, strengthening its role in long-term disease management and recurrent infection surveillance.

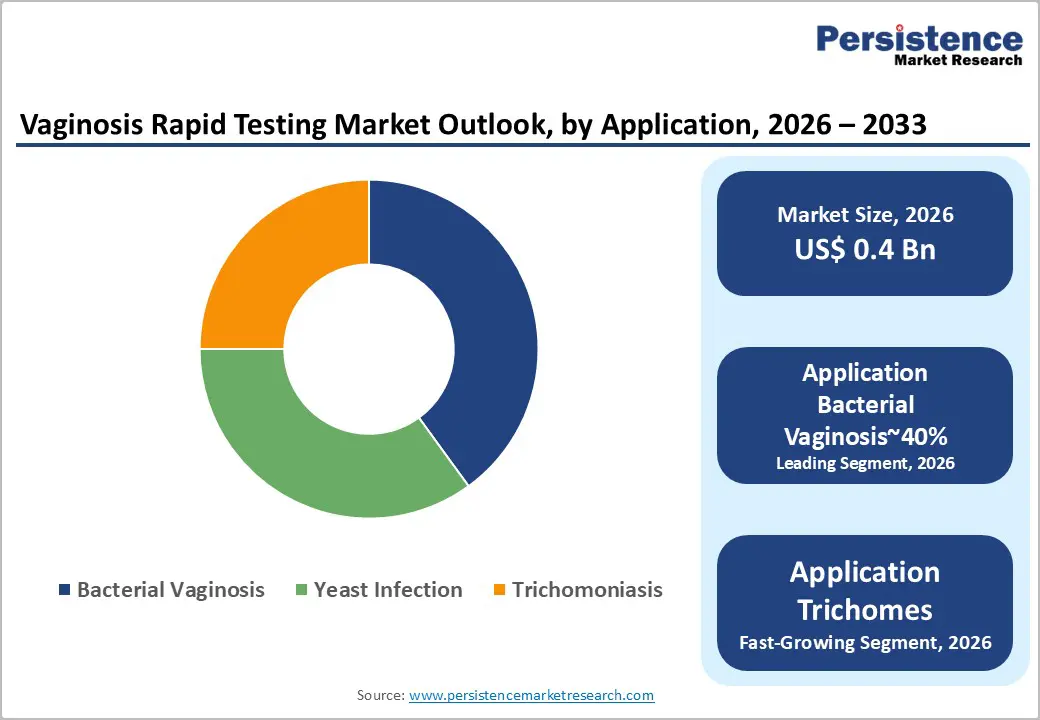

Bacterial vaginosis is expected to remain the leading application segment within the vaginitis rapid testing market, accounting for approximately 40% of the total revenue in 2026, supported by its high global prevalence and disproportionate contribution to symptomatic and asymptomatic vaginal infections. Clinical prioritization of BV screening, particularly in pregnancy and pre-procedural settings, is reinforcing sustained test demand, as targeted molecular assays enable earlier intervention and reduction of downstream obstetric and gynecological complications. This structural dominance is further strengthened by guideline-backed screening protocols, although high asymptomatic incidence continues to constrain optimal detection coverage and testing frequency.

Trichomoniasis is projected to be the fastest-growing application segment, driven by rising recognition of its STI burden and its frequent co-occurrence with bacterial vaginosis. Expanding awareness campaigns and public health screening initiatives are accelerating inclusion of Trichomonas detection within multiplex rapid testing panels, particularly in emerging markets with historically low diagnostic penetration. This integration is positioning trichomoniasis testing as a critical growth lever within syndromic vaginitis diagnostics, supporting incremental revenue expansion through improved case identification and routine screening adoption.

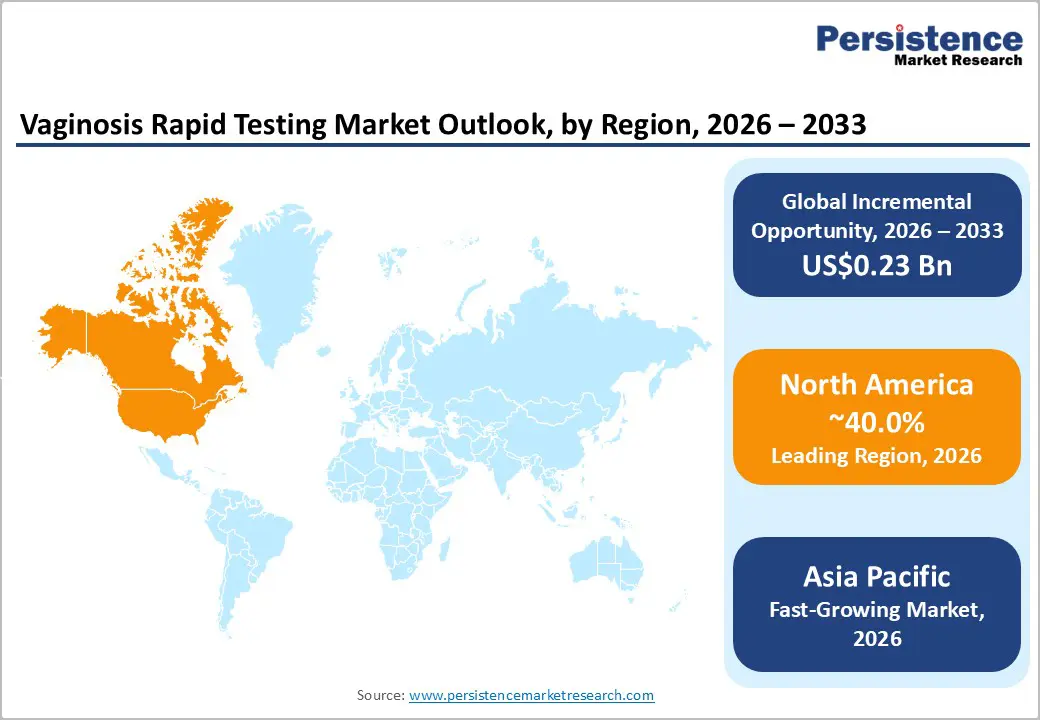

North America is expected to remain the leading regional market for vaginitis rapid testing, accounting for approximately 40% of global revenue, supported by a mature diagnostic ecosystem and advanced regulatory oversight. The United States anchors regional dominance through widespread adoption of molecular diagnostics, strong compliance alignment, and stable public and private reimbursement systems that support routine screening. Regulatory clarity under FDA and CLIA frameworks continues to reinforce market confidence, positioning the region as the primary revenue stabilizer within the global landscape.

From an infrastructure perspective, North America benefits from high laboratory automation intensity and strong integration of molecular platforms across centralized and decentralized settings. Ongoing investments in AI-enabled diagnostics, CLIA-waived point-of-care systems, and high-throughput workflows are reinforcing operational resilience amid workforce constraints. These structural advantages are expected to sustain premium pricing, accelerate technology refresh cycles, and preserve regional leadership despite comparatively moderate growth rates relative to emerging markets.

Europe is projected to remain the second-largest regional market for vaginitis rapid testing, led by Germany, the U.K., and France, with growth anchored in harmonized regulatory frameworks under the EU In Vitro Diagnostic Regulation (IVDR). This regulatory oversight ensures consistent diagnostic quality and safety, reinforcing adoption across public healthcare systems that prioritize preventive screening and standardized clinical pathways. Regulatory rigor also supports payer confidence, stabilizing market share for both centralized laboratories and decentralized testing initiatives.

The region’s growth dynamics are further shaped by the expansion of community-based sexual health clinics and decentralized testing in rural areas, particularly in the U.K. and France. Rising activity from domestic biotech firms specializing in rapid lateral flow assays is intensifying competitive pressure while facilitating technology diffusion. Investment in portable and point-of-care diagnostics is expected to complement infrastructure maturity, enabling broader population coverage and reinforcing Europe’s position as a policy-driven yet steadily expanding market within the global vaginitis testing landscape.

Asia Pacific is projected to be the fastest-growing regional market for vaginitis rapid testing, driven by structural factors including rapid urbanization, rising healthcare expenditure, and expanding diagnostic infrastructure in China and India. ASEAN nations contribute through increasing healthcare access and growing population density, reinforcing demand for standardized, scalable diagnostic solutions. The region’s cost-competitive manufacturing capabilities, particularly in China, support operational efficiency and facilitate the localization of advanced molecular and point-of-care testing platforms.

Market growth is further accelerated by a clinical transition from traditional culture-based methods to rapid diagnostic kits within modernized urban healthcare centers. Regulatory streamlining in China and Japan is enhancing approval timelines for women’s health diagnostics, enabling international technology transfers, joint ventures, and capacity expansion. These structural enablers position Asia Pacific as a high-velocity market with significant adoption potential, allowing global and regional players to leverage scale, cost efficiency, and policy momentum to capture incremental market share.

The global diagnostic testing market is moderately consolidated, led by BD, Hologic, QuidelOrtho, Roche, and Cepheid, which shape competition through scale, innovation, and clinical adoption. BD maintains leadership via broad distribution and molecular diagnostics strength, while Hologic and Roche emphasize high-sensitivity PCR platforms, and QuidelOrtho and Cepheid balance speed with workflow efficiency. Competitive intensity is highest in North America and Europe, supported by clear regulation and reimbursement. Industry strategies are split between innovation-led PCR development and cost-driven antigen testing, with emerging entrants targeting niche technologies, keeping rivalry balanced and forward competition innovation-focused.

Key Market Developments

The global vaginosis rapid testing market is valued at US$0.4 billion in 2026 and is projected to reach US$0.6 billion by 2033.

Demand is increasing due to the shift toward point-of-care and molecular diagnostics, rising awareness of women’s reproductive health, and the need for faster, accurate detection of gynecological infections.

The global vaginosis rapid testing market is expected to grow at a CAGR of 8.0% between 2026 and 2033, supported by expanding adoption of PCR-based and rapid antigen testing platforms.

Strong opportunities are emerging in telehealth diagnostic kits, clinic-based OB/Gyn testing, and decentralized point-of-care platforms across developed and emerging healthcare markets.

Key players include Becton, Dickinson and Company, Hologic, Roche, Danaher, Abbott Laboratories, Thermo Fisher Scientific, QuidelOrtho, QIAGEN, Seegene, DiaSorin, and Sekisui Diagnostics.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

Test Type

End-user

Application

By Regional Analysis

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author