ID: PMRREP14818| 189 Pages | 4 Aug 2025 | Format: PDF, Excel, PPT* | Healthcare

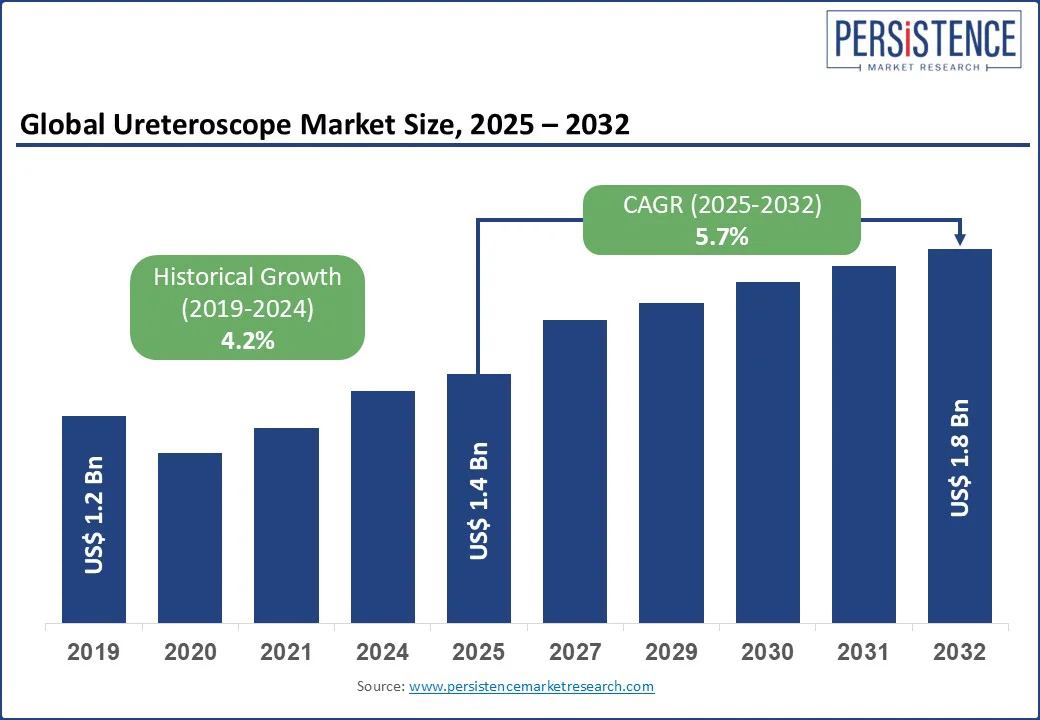

The ureteroscope market size is likely to be valued at US$ 1.4 Bn in 2025 and is estimated to reach US$ 1.8 Bn in 2032, growing at a CAGR of 5.7% during the forecast period 2025-2032. The ureterescope market is undergoing a transformative shift, propelled by rising procedural volumes in urolithiasis and urothelial cancer diagnostics. The integration of innovative imaging and laser technologies is also pushing growth. As healthcare systems prioritize minimally invasive solutions, ureteroscopes are becoming standard instruments in endourology suites worldwide. This clinical landscape is spurring investments in novel optics, steerability, and disposable platforms. It is further creating a competitive environment where technological precision and cost-efficiency are significant differentiators.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Ureteroscope Market Size (2025E) |

US$ 1.4 Bn |

|

Market Value Forecast (2032F) |

US$ 1.8 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

5.7% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.2% |

Increasing prevalence of kidney stones in the adults is directly propelling the ureteroscope market growth with high demand for flexible and disposable variants. It is attributed to their effectiveness in endoscopic stone removal procedures such as ureteroscopy. Worldwide, kidney stone disease affects around 10 to 15% of the population, with recurrence rates exceeding 50% within a decade, according to the National Institutes of Health (NIH). In the U.S. alone, the number of annual emergency department visits for kidney stones exceeded 1.3 Mn in 2023.

The surge is translating into a rising number of endoscopic interventions, positioning ureteroscopy as a preferred treatment method over shock wave lithotripsy and open surgery. Countries with rapid urbanization and dietary shifts are witnessing an increase in stone disease burden. In North India, for example, the prevalence of urolithiasis has crossed 15% in certain states, significantly increasing the procedural load on hospitals and specialty clinics. Hence, flexible kidney stone removal scopes are in high demand to accommodate the rise in lower pole and mid-ureter stone cases that require complex navigation and precision.

Despite the adoption of ureteroscopes for stone removal procedures, concerns around postoperative complications such as infection, bleeding, and injury to the urinary tract continue to act as deterrents. A 2023 multicenter study published in The Journal of Urology found that postoperative infection rates following ureteroscopy ranged from 3.5% to 6.2%. The risk increased significantly in patients with pre-existing urinary tract infections or indwelling catheters. Infections not only lead to extended hospitalization and increased antibiotic use but also raise concerns about the spread of resistant uropathogens.

Bleeding complications, though generally rare, are more common in patients with coagulopathies or those undergoing stone fragmentation. According to a 2024 retrospective cohort analysis from South Korea’s Asan Medical Center, around 1.4% of ureteroscopy cases experienced clinically significant hematuria requiring intervention. Injury to the urinary tract is another hindrance to wide adoption. A 2023 European Urology report noted that ureteral perforation occurred in 0.5 to 1.3% of ureteroscopy procedures, with a higher incidence observed in rigid scope use.

The emergence of enhanced laser technologies, specifically Thulium Fiber Lasers (TFL), has extended the utility of ureteroscopes in endourological stone treatment. TFL offers low pulse energy with a high frequency, which enables fine stone dusting and reduces retropulsion. This results in short procedure times and complete stone clearance. In 2023, a clinical comparison published in the Journal of Endourology involving 348 patients found that TFL-assisted ureteroscopy achieved a 94% stone-free rate, compared to 83% with Holmium:YAG laser.

The technological leap is impactful for the management of multiple or complex renal calculi. Urologists now pair flexible digital ureteroscopes with laser systems that allow simultaneous fragmentation and real-time visualization. The combination of enhanced lasers and single-use ureteroscopes is also opening new clinical and business models. The role of laser innovations in reducing thermal injury during lithotripsy is creating avenues.

Based on product type, the market is trifurcated into flexible, semi-flexible, and rigid. Among these, flexible ureteroscopes are anticipated to hold around 57.1% of the ureteroscope market share in 2025 owing to their superior deflection capabilities, which enable urologists to access all parts of the upper urinary tract. Increasing integration of digital imaging into flexible ureteroscopes is another significant factor boosting their use. Modern digital models feature chip-on-tip cameras with high-definition visualization that help improve intraoperative accuracy. These digital scopes also enhance the identification of stone fragments, mucosal abnormalities, and small tumors.

Semi-flexible urinary endoscopic devices are gaining impetus because of their ability to balance maneuverability with structural stability. This makes them ideal for mid-ureteral stone removal and diagnostic procedures in resource-constrained settings. These models further provide a cost-effective alternative with sufficient deflection to access most of the ureter. Increasing durability compared to fully flexible devices is another key factor augmenting their adoption.

In terms of application, the market is divided into urolithiasis, urothelial cancer, and others. Out of these, urolithiasis will likely account for nearly 55.6% of the share in 2025 owing to its high global prevalence and the procedural efficacy of ureteroscopy in managing renal and ureteral calculi. According to the Global Burden of Disease Study 2024, urolithiasis affected over 85 Mn individuals worldwide. This surging prevalence has accelerated the demand for minimally invasive treatment methods. Hence, ureteroscopy has emerged as a preferred approach owing to its high stone clearance rates and low morbidity.

Urothelial cancer is considered a key application due to the rising incidence of Upper Tract Urothelial Carcinomas (UTUCs), especially among aging populations in developed countries. Flexible ureteroscopy allows direct visualization, biopsy, and even laser ablation of tumors located in the renal pelvis and ureter. This makes it indispensable for diagnosis and treatment in patients who are poor candidates for radical surgery. Another driver is the shift toward kidney-sparing approaches in low-grade, non-invasive UTUC cases.

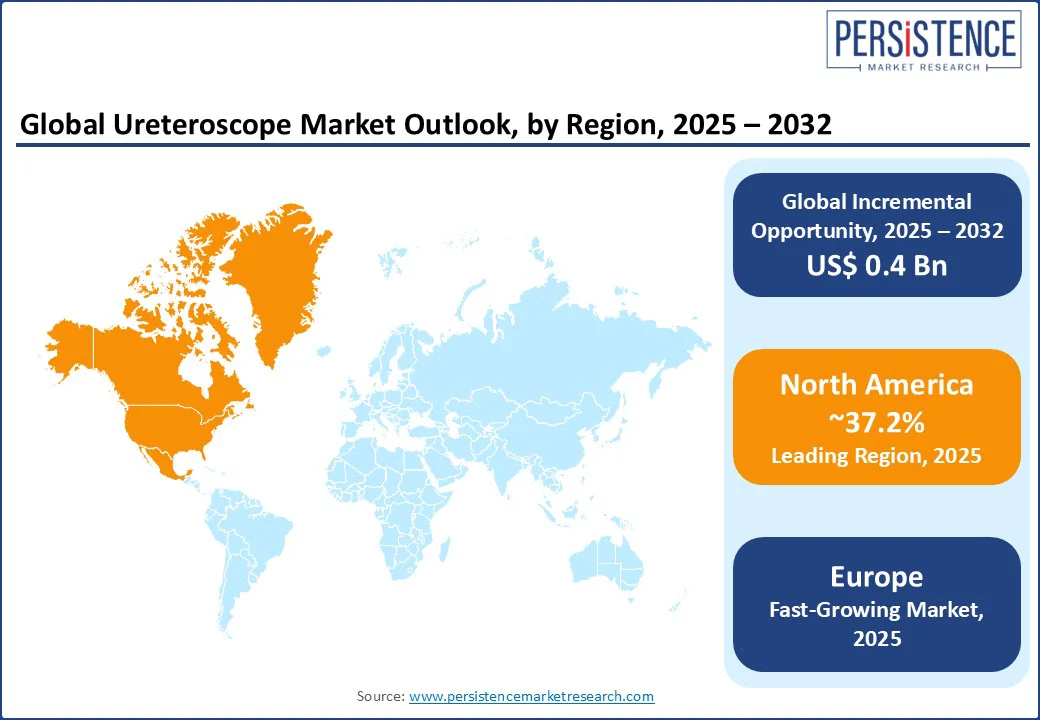

In 2025, North America is poised to account for approximately 37.2% of the share owing to the increasing prevalence of urolithiasis and surging preference for minimally invasive procedures. As per the National Kidney Foundation, nearly 1 in 10 individuals in the U.S. will experience kidney stones in their lifetime, with recurrence rates as high as 50% within 5 to 7 years, directly fueling procedural volume. The U.S. ureteroscope market remains the dominant contributor in the region, supported by favorable reimbursement models.

Technological innovation continues to redefine clinical practice across the country. Boston Scientific’s LithoVue Elite, launched in 2023, integrates real-time intrarenal pressure monitoring and digital visualization. It enables urologists to manage intrapelvic pressure during procedures, which is a significant step toward reducing postoperative complications. Outpatient Ambulatory Surgical Centers (ASCs) are also becoming key growth hubs due to fast patient turnaround and cost-efficiency, with ureteroscopy now being one of the most commonly performed urology procedures in ASCs.

Europe is experiencing a gradual shift toward single-use devices, bolstered by rising infection control requirements and hospitals preference for minimally invasive solutions. Flexible disposable ureteroscopes are gaining impetus in the region owing to increasing concerns over cross-contamination across hospitals. Germany is predicted to dominate the market as it serves as a regional innovation hub, with domestic players such as KARL STORZ and Richard Wolf consistently launching new models.

Despite technological progress, the adoption of disposable scopes varies significantly across countries due to differences in reimbursement policies. Public hospitals in Italy and France are slow to transition due to the high per-case cost of single-use scopes, that reaches around €1,000 per procedure, compared to €500 to 600 with reusable systems. However, the gap is narrowing as clinical trials and hospital data increasingly validate the long-term cost benefits of disposables in terms of reduced reprocessing and equipment damage.

Asia Pacific is currently undergoing rapid expansion, spurred by rising urolithiasis prevalence, increasing access to healthcare infrastructure, and a strong push toward minimally invasive urological procedures. Flexible single-use ureteroscopes dominate owing to their clinical efficiency, maneuverability, and low cross-contamination risk. While total adoption is still lower than in North America or Europe, year-on-year growth in procedural volumes is outpacing global averages, mainly in India, Japan, and Southeast Asia.

One of the defining characteristics of Asia Pacific is the rise of ambulatory surgical centers and specialized urology clinics. They are adopting single-use scopes to manage patient throughput and reduce sterilization downtime. Hospitals still account for most procedures, but day-care facilities are exhibiting a prominent growth rate in device procurement. Japan and South Korea, with their established outpatient systems, are conducive to this transition.

The global ureteroscope market houses several medtech giants and specialized endoscopy manufacturers. Key companies are dominating with broad product portfolios, research and development investments, and well-established distribution networks. They continue to refine digital flexible endoscopes for urology with features such as single-use designs, enhanced optics, and improved deflection capabilities. Small-scale players are entering the market with cost-effective alternatives and gaining traction in price-sensitive countries across Latin America, Africa, and Southeast Asia. They often leverage government contracts or public hospital networks to establish a foothold.

The ureteroscope market is projected to reach US$ 1.4 Bn in 2025.

The rising number of urology-specialized ASCs and increasing awareness of urinary tract conditions are the key market drivers.

The ureteroscope market is poised to witness a CAGR of 5.7% from 2025 to 2032.

Increasing clinical trials in precision lithotripsy and technological developments in digital imaging are the key market opportunities.

Stryker, Richard Wolf GmbH, and PENTAX Medical are a few key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Application

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author