ID: PMRREP15088| 190 Pages | 18 Nov 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

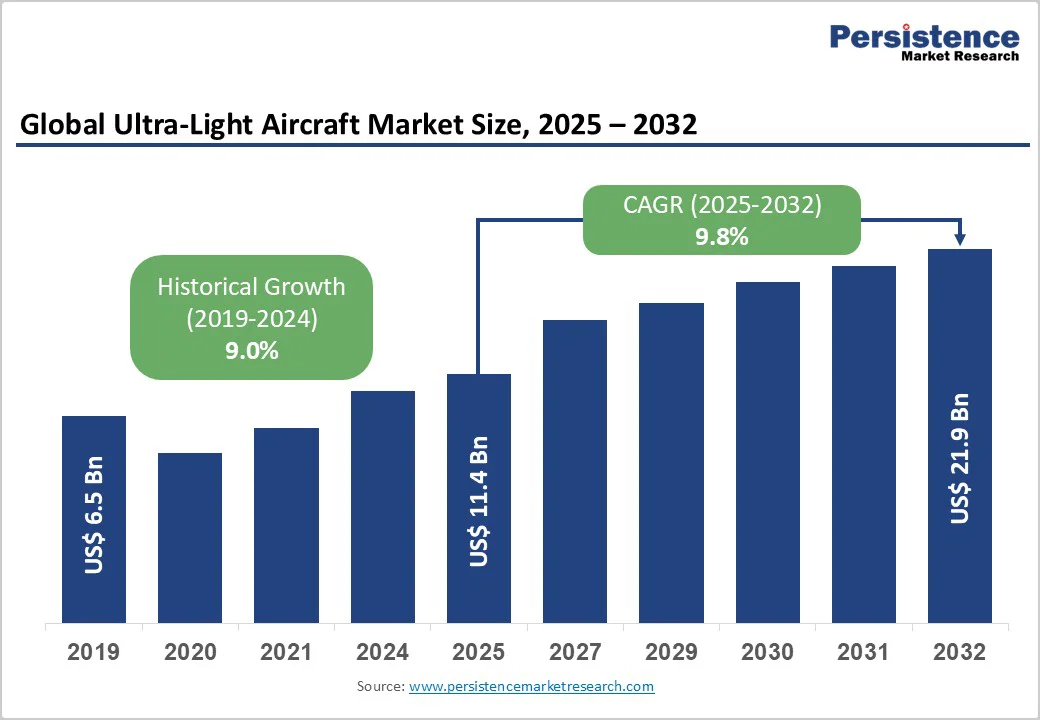

The global ultra-light aircraft market size is likely to be valued US$ US$11.4 billion in 2025, anticipated to reach US$21.9 billion by 2032, growing at a CAGR of 9.8% during the forecast period from 2025 to 2032, driven by the increasing prevalence of recreational flying, rising demand for affordable aviation, and advancements in lightweight materials.

The need for low-cost training and personal mobility, particularly in emerging economies, has significantly boosted the adoption of ultra-light aircraft across various demographics. The market is further propelled by innovations in electric engines and fixed-wing designs, catering to preferences for eco-friendly and versatile options. The growing acceptance of ultra-light aircraft as essential for flight schools and adventure sports, particularly in civil applications, is a key growth factor.

| Key Insights | Details |

|---|---|

|

Ultra-light Aircraft Market Size (2025E) |

US$11.4 Bn |

|

Market Value Forecast (2032F) |

US$21.9 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

9.8% |

|

Historical Market Growth (CAGR 2019 to 2024) |

9.0% |

The increasing prevalence of recreational flying globally is a primary driver of the ultralight aircraft Market. Ultra-light aircraft offer low operating costs, typically 70% less than general aviation planes, making them ideal for hobbyists and training. This is particularly critical for flight schools facing high fuel prices.

The growing adoption of fuel-engine fixed-wing models, such as those from Cub Crafters, Inc., has gained traction due to proven reliability in trials and over 90% customer retention in the recreational market. The rise in adventure tourism and the availability of ultralights in rental fleets have boosted access, further driving market expansion. The surge in demand for personal mobility, coupled with innovations in electric propulsion, continues to propel the market forward, particularly in developed regions with strong aviation infrastructure.

The high costs associated with regulatory compliance and certification of ultra-light aircraft pose a significant restraint on market growth. Aviation authorities impose strict safety, environmental, and operational standards to ensure airworthiness and pilot safety. Meeting these requirements involves rigorous testing, documentation, and compliance procedures, which are both time-consuming and expensive. Manufacturers must invest heavily in research, design validation, and certification approvals before launching new models.

Smaller and emerging companies face financial strain due to the high costs of certification, including obtaining approvals from agencies such as the FAA (Federal Aviation Administration) or EASA (European Union Aviation Safety Agency). Variations in regional regulatory frameworks further complicate the process, requiring multiple certifications for international operations. These expenses often increase the final product price, limiting affordability for consumers.

Advancements in electric propulsion and composite materials present significant growth opportunities for the ultra-light aircraft market. Electric propulsion systems offer quieter operation, lower emissions, and lower maintenance costs compared to conventional engines, aligning with global efforts to advance greener aviation. These systems also enable smoother power delivery and reduced vibration, improving the overall flight experience. As battery technology advances, with higher energy densities and faster charging capabilities, the feasibility of longer-range and high-endurance ultralight aircraft continues to improve.

Innovations in lightweight composite materials such as carbon fiber and advanced polymers have revolutionized aircraft design. These materials provide exceptional strength-to-weight ratios, improving aerodynamics, fuel efficiency, and maneuverability while maintaining structural integrity. The use of composites also enables manufacturers to develop more customizable and ergonomic airframes.

Fuel Engine dominates the market, expected to account for approximately 65% of the market share in 2025. Its dominance is driven by proven technology, ease of refueling, and range, making it preferred for recreation. Fuel engines, such as those from American Legend Aircraft Company, provide reliable power and ensure compatibility. Its infrastructure and performance make it preferred for manufacturers.

The Electric Engine is the fastest-growing segment, driven by sustainability and increasing adoption in training. Electric offers zero emissions, appealing for urban. Focus on battery innovation accelerates adoption in the Asia Pacific and Europe.

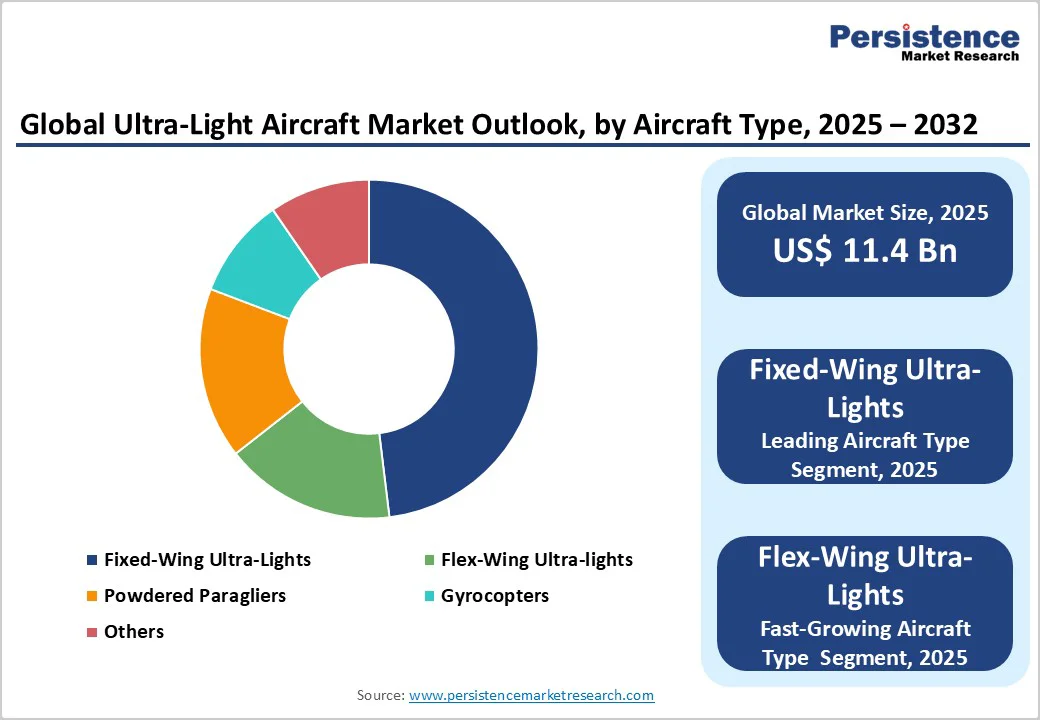

Fixed-Wing Ultra-lights lead the market, holding 50% of the share in 2025, driven by superior stability, reliability, and ease of control. Their widespread use in flight schools and training programs strengthens dominance. Growing demand for pilot education, coupled with accessible pricing and versatile performance, continues to support the fixed-wing segment’s leadership in the ultralight aircraft market.

Flex-Wing Ultra-lights is the fastest-growing segment, driven by their portability, ease of assembly, and strong adoption in recreational and sports aviation. Their quick setup and compact design make them ideal for enthusiasts seeking convenient flying experiences. The thrill and freedom they offer, combined with lower costs, significantly boost their global market appeal.

Recreation dominates the market, contributing nearly 60% of revenue in 2025. Its popularity stems from widespread use in sports, flying, and personal leisure. Affordable prices, ease of operation, and minimal maintenance make ultralight aircraft highly preferred by hobbyists and enthusiasts seeking accessible, enjoyable, and adventure-driven aviation experiences.

The commercial segment is the fastest-growing, propelled by expanding tourism, aerial photography, and charter services. Its growth is supported by versatile aircraft designs offering low operational costs and flexibility. Businesses increasingly adopt ultralight models for sightseeing, patrolling, and short-distance transport, enhancing the segment’s global market expansion.

Civil leads the market, with approximately 75% share in 2025. Accessibility through aviation clubs and flight schools enhances adoption. Growing interest in leisure flying, adventure tourism, and affordable pilot training further strengthens the civil sector’s leading position in the global market.

Military & Government is the fastest-growing segment, driven by rising demand for surveillance, reconnaissance, and pilot training applications. Lightweight and agile aircraft enable cost-effective operations, rapid deployment, and versatility in diverse terrains. Growing defense modernization and border monitoring initiatives further accelerate demand for these efficient, manoeuvrable aerial platforms.

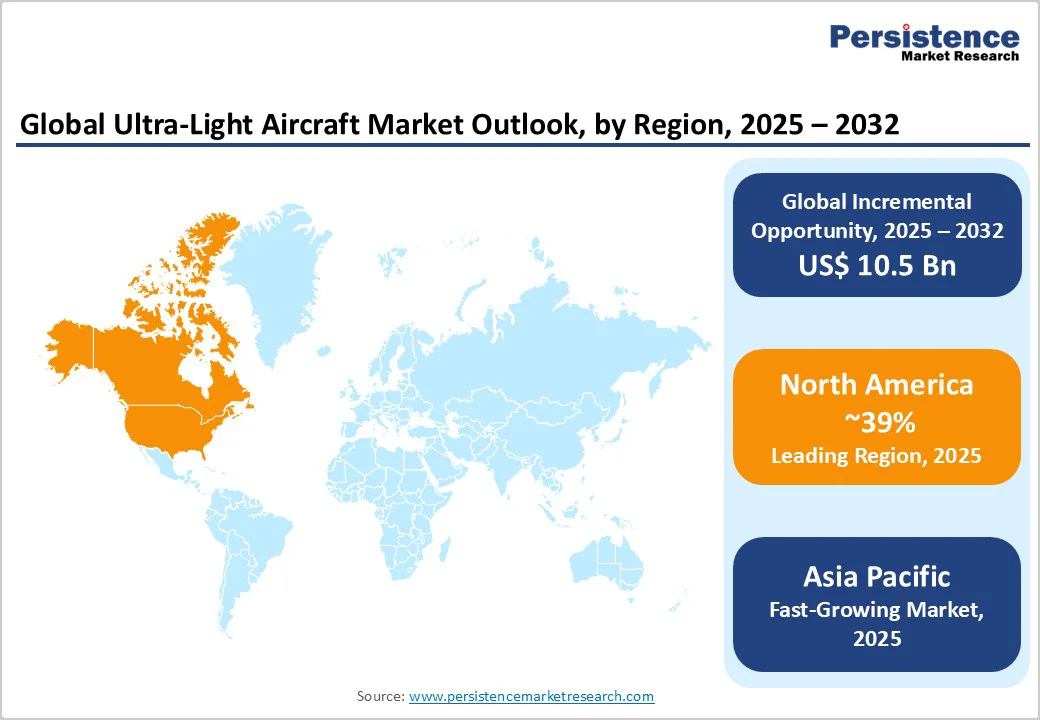

North America account for nearly 39% share in 2025, supported by a strong general aviation culture, technological advancement, and increasing interest in recreational and personal flying. The United States leads the region, with a well-established network of flight training schools, aero clubs, and manufacturers. Key players such as Cub Crafters, Inc. and American Legend Aircraft Company dominate the market through innovative designs, performance efficiency, and safety enhancements.

The region’s focus on electric propulsion systems and advanced composite materials is driving the development of lightweight, eco-friendly aircraft with improved range and lower operating costs. The popularity of sport flying, adventure tourism, and pilot training programs has significantly boosted demand for ultralight models. Government initiatives and relaxed aviation regulations under the FAA’s light-sport aircraft category further support market expansion. Increasing investments in R&D, digital avionics, and hybrid-electric prototypes are shaping the future of the sector.

Europe holds a 27% share in 2025, driven by strong aviation heritage, technological innovation, and supportive regulatory frameworks. Countries such as Germany, France, Italy, and the United Kingdom remain key hubs for light aircraft manufacturing and recreational aviation. Established players such as Flight Design GmbH and Costruzioni Aeronautiche TECNAM S.r.l. Lead the market through continuous R&D investments, advanced composite materials, and aerodynamic design improvements.

The growing adoption of electric and hybrid propulsion systems is a major trend, aligning with Europe’s environmental goals to reduce aviation carbon emissions. Ultra-light aircraft are increasingly used for pilot training, sport flying, and aerial surveillance, supported by the region’s extensive network of small airports and flying clubs. European Union initiatives promoting green mobility and innovation in aerospace technology are encouraging the development of next-generation lightweight aircraft. The region also sees rising demand for customized and high-performance models among private owners and training institutions.

Asia Pacific is the fastest-growing, commands 20% share in 2025, driven by increasing interest in recreational flying, pilot training, and aerial tourism. Countries such as China, Australia, India, and Japan are expanding aviation infrastructure and easing regulatory norms to promote general aviation. The region benefits from a growing number of aviation enthusiasts and from investments in affordable, lightweight aircraft for personal and recreational use.

Manufacturers such as Jabiru Aircraft Pty. Ltd. are leveraging localized production, cost-effective materials, and region-specific designs to cater to diverse climatic and operational needs. The push for electric and hybrid propulsion technologies is gaining momentum as governments encourage sustainable aviation solutions to reduce emissions. The market is also supported by an expanding pilot training ecosystem, where ultra-light aircraft serve as cost-efficient trainers. Increasing participation in aero sports and airshows further boosts regional awareness and adoption.

The global Ultra-light Aircraft Market is highly competitive, featuring a diverse mix of aviation specialists and emerging innovators. In developed regions such as North America and Europe, established players like Cub Crafters, Inc. and Flight Design GmbH dominate the market through strong research and development capabilities, advanced manufacturing, and extensive distribution networks. These companies focus on enhancing flight efficiency, safety, and design versatility to cater to recreational, training, and surveillance applications.

In the Asia Pacific region, Jabiru Aircraft Pty. Ltd. is gaining traction with localized production and cost-effective solutions tailored to regional aviation needs. A growing emphasis on electric propulsion and hybrid aircraft technologies is reshaping market dynamics, driven by sustainability goals and fuel efficiency requirements. Strategic partnerships, acquisitions, and technology collaborations are fostering product innovation, particularly in lightweight composite materials and digital flight systems.

The global ultra-light aircraft market is projected to reach US$11.4 Billion in 2025.

The rising prevalence of recreational flying and demand for affordable aviation are key drivers.

The market is poised to witness a CAGR of 9.8% from 2025 to 2032.

Advancements in electric propulsion and composite materials are a key opportunity.

P&M Aviation, Costruzioni Aeronautiche TECNAM S.r.l., Cub Crafters, Inc., Flight Design GmbH, and Quicksilver Aircraft are key players.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Engine Type

By Aircraft Type

By Application

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author