ID: PMRREP22225| 197 Pages | 13 Aug 2025 | Format: PDF, Excel, PPT* | Food and Beverages

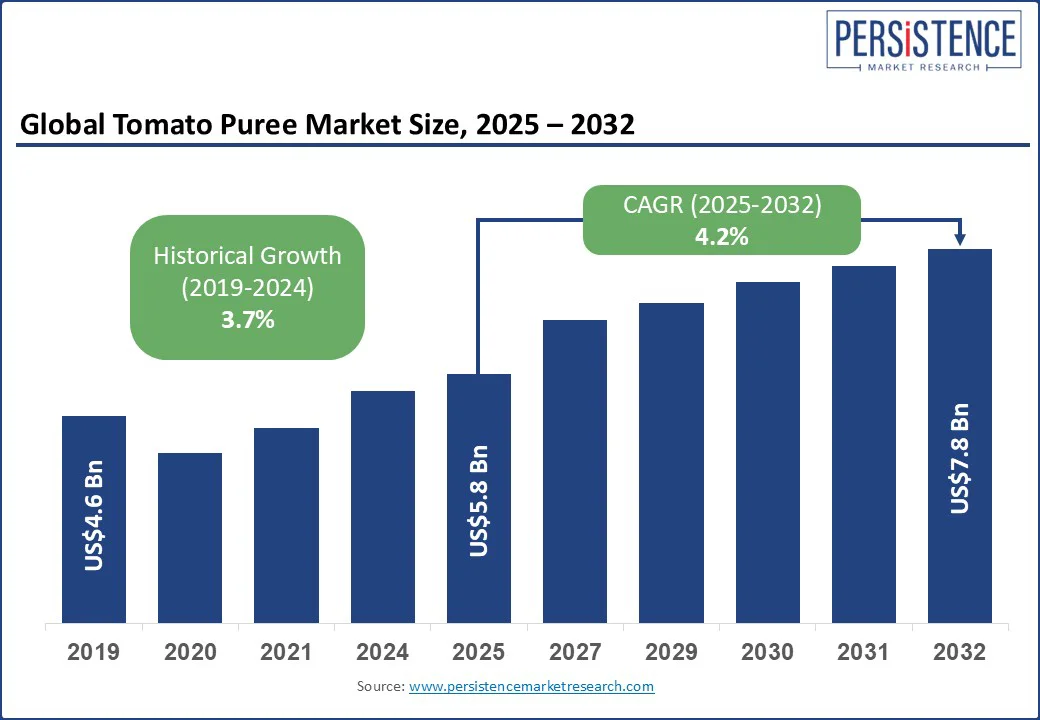

The global tomato puree market size is likely to be valued at US$5.8 Bn in 2025 and is expected to reach US$7.8 Bn, growing at a CAGR of 4.2% during the forecast period from 2025 to 2032.

Tomato puree has emerged as a high-utility commodity in the global processed food market, supported by its role as a foundational ingredient across sauces, ready meals, and foodservice applications.

With its ability to deliver consistent flavor, color, and viscosity, the ingredient is central to product formulation and cost optimization across supply chains. The market is witnessing steady growth as manufacturers tap into evolving consumption trends. These include clean-label formulations, portion-controlled packaging, and rising demand from meal kits, as well as Quick full Service Restaurant (QSR) segments.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Tomato Puree Market Size (2025E) |

US$5.8 Bn |

|

Market Value Forecast (2032F) |

US$7.8 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

4.2% |

|

Historical Market Growth (CAGR 2019 to 2024) |

3.7% |

The use of tomato puree as a base for popular sauces such as marinara, pizza sauce, and curry gravies is pushing its demand across retail and foodservice segments. Brands, including Veeba and Del Monte, have launched multi-purpose tomato-based cooking sauces that include 60 to 70% tomato puree, targeting time-strapped urban consumers. This trend is fueling bulk purchases of puree by contract manufacturers and central kitchens.

In the U.S., tomato puree consumption is being lifted by a surge in home-cooked Italian and Mediterranean meals. Most of these meals use tomato puree as their primary ingredient, contributing to increased procurement by sauce manufacturers. Hunt’s and Rao’s, for example, have expanded puree-based production to meet this demand, while introducing variants such as fire-roasted and garlic-infused options to cater to evolving tastes.

The acidic nature of tomato puree is becoming a point of concern for a surging segment of health-conscious consumers. It is affecting sales among those prone to acid reflux or Gastroesophageal Reflux Disease (GERD). According to a 2023 survey by the American Gastroenterological Association, nearly 27% of adults in the U.S. reported avoiding acidic foods such as tomato-based products due to frequent digestive discomfort. This shift is subtly impacting the tomato puree category, specifically in mature markets where dietary adjustments are common.

A few retailers have also observed a slowdown in repeat purchases among aging consumers. It is attributed to customer feedback citing digestive issues and a preference for milder alternatives, such as white sauces or cream-based bases that are perceived as gentler on the stomach.

The issue is further affecting product formulation strategies. Brands are beginning to deliver low-acid tomato products using specific tomato varieties with reduced citric content. Though still a niche product, the segment will likely witness expansion through specialty stores in the next ten years.

The adoption of High-Pressure Processing (HPP) and High Temperature with Shear (HTS) technologies is creating new avenues for tomato puree market growth. These are enabling brands to deliver clean-label products with better texture and nutritional retention. HPP has allowed cold-pressed tomato puree products to enter premium retail segments. HTS, on the other hand, is gaining traction in industrial production due to its ability to preserve consistency in bulk applications.

The technology blends high heat with intense shear force, reducing viscosity variation and improving shelf life. This has made it convenient for foodservice buyers to use the puree directly in automated dispensers and pre-cooked meals without further blending or thickening. In Asia Pacific, where tomato-based gravies are important to local cuisines, these technologies are being used to cater to evolving consumer expectations for healthy food.

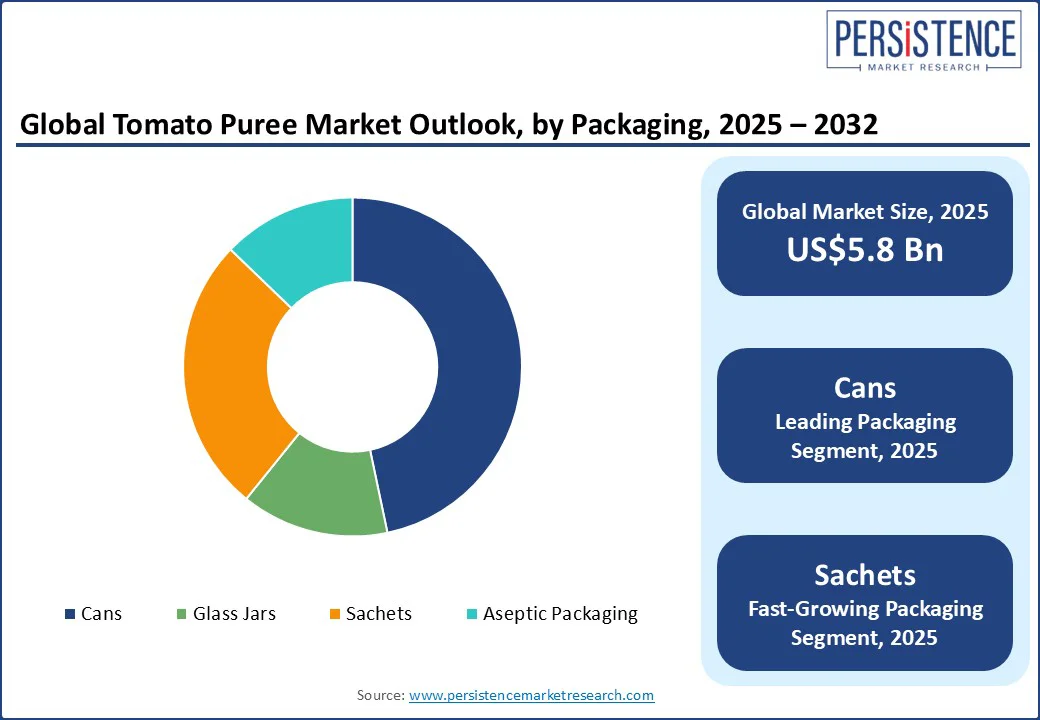

In terms of packaging, the market is segregated into cans, glass jars, sachets, and aseptic packaging. Among these, cans are predicted to hold around 46.7% of the share in 2025 with their ability to preserve product integrity under high-heat sterilization, making them ideal for long shelf life and global distribution. Metal cans help reduce retort processing, which kills bacteria while retaining color and flavor. Cans also offer better protection against light and oxygen exposure, two key factors that degrade the lycopene content in tomato products.

Sachets are gaining momentum due to their affordability, portability, and precise portioning, specifically in price-sensitive and convenience-driven markets. In India, for example, sachet-format tomato puree has become a preferred choice among small households and roadside food vendors. Brands are also using sachets to encourage first-time trials and expand into untapped rural markets. The e-commerce boom is further supporting sachet formats due to low shipping weight and breakage risk.

By application, the market is divided into pizza and pasta, soups and sauces, dressings and marinades, personal care, and baby food. Out of these, the pizza and pasta segment is anticipated to account for nearly 36.2% of the tomato puree market share in 2025, due to its reliance on a smooth, concentrated tomato base that improves flavor, consistency, and color.

Tomato puree provides a richer mouthfeel than fresh or chopped tomatoes, making it the preferred choice for sauces that should cling to dough or pasta. The pizza industry, especially in fast-casual and frozen segments, has standardized tomato puree as the go-to base for red sauces.

Soups and sauces are expected to see steady growth as they mainly rely on tomato puree’s ability to deliver concentrated tomato flavor with minimal cooking. It provides a quick way to build body and color, specifically in tomato bisque and minestrone. For preparing sauces in institutional and foodservice settings, tomato puree offers a shelf-stable solution that performs consistently across batches, thereby augmenting demand.

In Southeast Asia, where sauces such as sambal, curry base, and sweet-and-sour are staples, brands are integrating tomato puree to add acidity and depth without over-reliance on chilies or sugar.

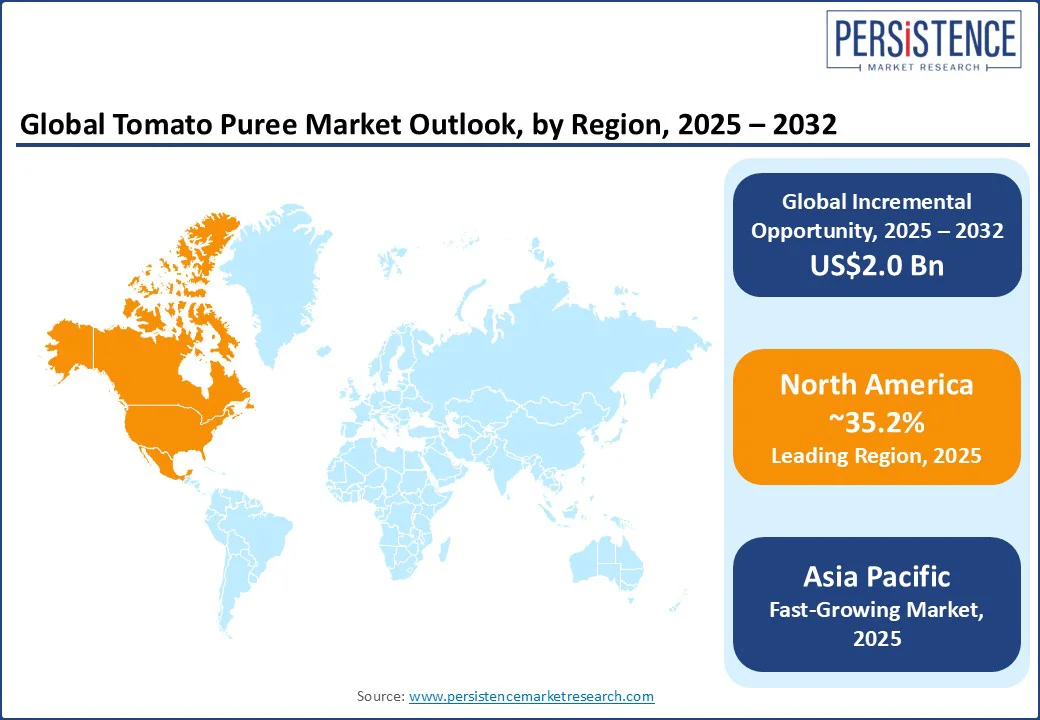

North America is predicted to account for around 35.2% of the share in 2025, owing to changing consumer habits and the rise of scratch cooking. According to the U.S. Department of Agriculture (USDA), food-at-home prices increased by 1.2% in 2024. This trend has led to a spike in the use of basic pantry staples such as tomato puree.

Private-label products are gaining momentum across prominent retail chains such as Costco, Kroger, and Target. These chains are capturing market share by delivering tomato puree in bulk and family-sized packs at competitive prices.

Cross-border trade with Mexico is further influencing the U.S. tomato puree market. In 2023, the country imported over 340,000 metric tons of processed tomato products from Mexico, according to the U.S. Department of Commerce. Mexico-based processors are supplying low-cost puree alternatives that appeal to foodservice operators and institutional buyers in the southern states. This import reliance is affecting pricing dynamics and compelling local manufacturers to improve production efficiency to remain competitive.

Europe’s market is shifting toward traceability, origin labeling, and sustainability. Italy-based producers, especially in the Emilia-Romagna and Campania regions, are dominating in this field. Several domestic tomato processors are now integrating QR codes linking to farm-level sourcing details. This traceability feature has boosted consumer trust, specifically in Sweden and Germany. In these markets, food origin transparency is a key purchase driver.

Spain and Portugal are emerging as high-volume producers due to favorable climate conditions and EU subsidies. Retailers in the U.K. and France are pushing eco-friendly packaging as a differentiator in the tomato puree segment. In addition, regional taste preferences are fueling the market. In Eastern Europe, consumers prefer spiced or herb-infused tomato purees used in stews and meat dishes. To cater to this demand, domestic producers have started exporting value-added variants.

Asia Pacific is witnessing steady growth augmented by rising demand from urban households and the booming ready-to-cook segment. India has seen a notable surge in consumption due to increased adoption of processed alternatives among middle-income families and fluctuations in tomato prices. Brands, including Kissan and Mother’s Recipe, have hence extended their tomato puree portfolios into low-cost sachets. In China, the focus is shifting toward export-oriented production.

Xinjiang, a key tomato-growing region, processed more than 6 million tons of tomatoes in 2023, with a major portion converted into paste and puree for international markets. Japan and South Korea present a different dynamic, where premium and health-centric formulations are gaining popularity. Several producers are also bundling tomato puree into meal kits and home-cooking boxes to cater to the rising popularity of Western-style meals.

The global tomato puree market houses several multinational food processing giants as well as regional and private-label brands. Leading players are competing with their established supply chains, global distribution networks, and well-known product portfolios. They have invested in automation and aseptic processing technologies to ensure long shelf life and product consistency.

At the regional level, local manufacturers are utilizing the freshness and origin appeal of locally sourced tomatoes to gain a competitive advantage. Private-label brands from large retailers are also providing good-quality products at low price points.

The tomato puree market is projected to reach US$5.8 Bn in 2025.

Rising demand for convenience food and the emergence of low-acid tomato puree variants are the key market drivers.

The tomato puree market is poised to witness a CAGR of 4.2% from 2025 to 2032.

Expansion into rural markets with low-cost sachets and the launch of HPP-based premium puree products are the key market opportunities.

Del Monte Foods, Cargill Incorporated, and Olam International are among the key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Nature

By Packaging

By Application

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author