ID: PMRREP35713| 198 Pages | 10 Oct 2025 | Format: PDF, Excel, PPT* | Industrial Automation

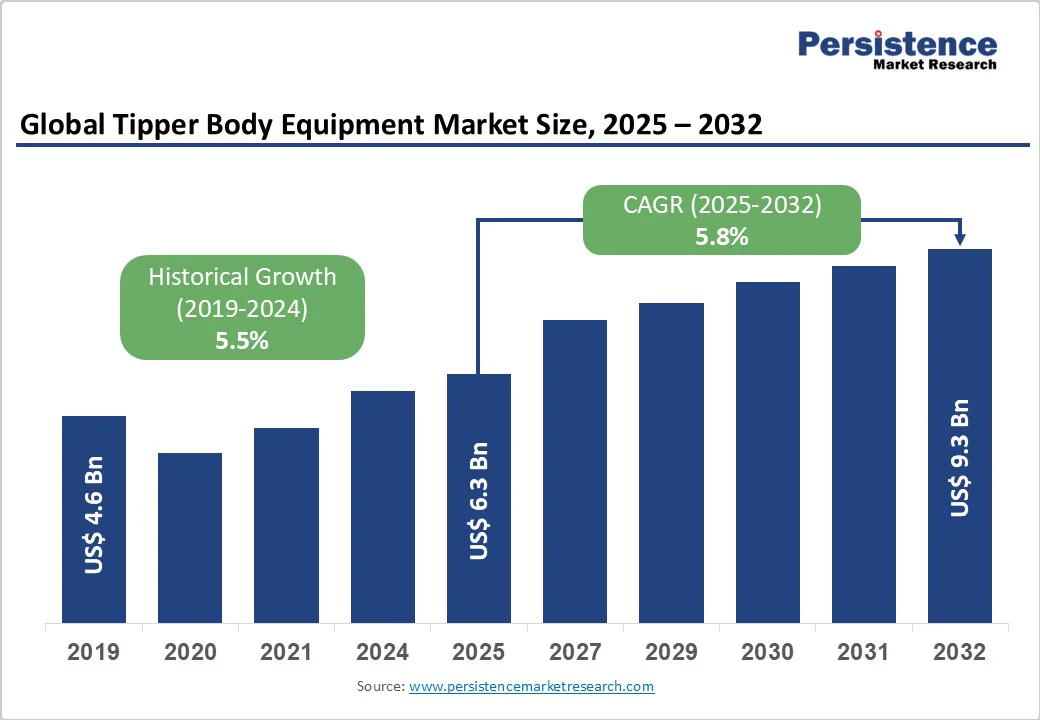

The global tipper body equipment market size is likely to be valued at US$6.3 billion in 2025 and is projected to reach US$9.3 billion by 2032, growing at a CAGR of 5.8% between 2025 and 2032.

Accelerating global infrastructure development initiatives and expanding construction activities across emerging economies drive the market growth.

Besides, the emphasis on mechanized material handling solutions in mining operations and the rising adoption of advanced hydraulic tipping systems further propel market expansion.

| Key Insights | Details |

|---|---|

| Tipper Body Equipment Market Size (2025E) | US$6.3 Bn |

| Market Value Forecast (2032F) | US$9.3 Bn |

| Projected Growth CAGR(2025-2032) | 5.8% |

| Historical Market Growth (2019-2024) | 5.5% |

Unprecedented Global Infrastructure Development Surge

The tipper body equipment market is experiencing robust growth, driven by large-scale infrastructure initiatives worldwide. China’s infrastructure spending rose by 10% in 2023, supporting heightened demand for construction machinery, while India’s Union Budget 2024-25 earmarked US$133.86 billion for infrastructure projects, an 11.1% increase. These investments encompass highway expansions, urban development, smart city initiatives, and industrial hub construction, generating sustained demand for specialized tipper body equipment.

International programs, such as the Belt and Road Initiative, are driving demand for heavy machinery across Southeast Asia and Africa. In 2023, over half of China’s construction equipment exports were directed to Southeast Asian markets. This surge underscores the crucial role of tipper body equipment in supporting large-scale projects, ensuring efficient material handling, and facilitating timely project execution within the expanding global construction landscape.

Rising Mechanization in Mining and Resource Extraction

The global mining sector’s push toward mechanization is a key driver of growth for the tipper body equipment market. Resource-rich countries are investing heavily in high-capacity machinery to meet the rising demand for minerals and metals. For instance, Indonesia’s mining operations required 30% more equipment in 2023 to support increased mineral exports, while Australia continues to invest in automated transport solutions for its mining operations.

This trend is reinforced by the growing demand for metals and minerals in industries such as electronics, automotive, and renewable energy. Mining companies are increasingly prioritizing advanced tipper body equipment to optimize payload capacities, reduce operational downtime, and enhance safety standards on challenging terrains. Consequently, the mechanization of mining operations is creating sustained demand and significant growth opportunities for tipper body equipment manufacturers worldwide.

High Initial Investment and Maintenance Cost Barriers

The adoption of tipper body equipment is often hindered by high upfront capital requirements, posing significant challenges for small and medium-sized enterprises, especially in emerging markets. Advanced hydraulic systems, precision-engineered components, and specialized steel fabrication drive substantial initial investment, creating entry barriers for cost-sensitive operators.

Beyond procurement, ongoing maintenance costs for hydraulic mechanisms, structural reinforcements, and replacement parts over the equipment lifecycle further increase financial pressure. In developing economies, where financing options are limited, these cost factors can restrict market penetration and slow adoption rates. Consequently, the high investment and operational expenses act as a considerable restraint on market growth, particularly in price-sensitive regions seeking cost-effective construction and mining solutions.

Supply Chain Disruptions and Raw Material Price Volatility

Tipper body equipment manufacturers face persistent challenges from global supply chain disruptions and fluctuating raw material prices. Components such as high-tensile steel, hydraulic systems, and specialized engine parts often experience shortages or price volatility, which can impact production schedules and delivery timelines.

These manufacturing delays can directly affect construction and mining operations that rely on timely equipment availability, disrupting project execution and operational planning. Supply chain uncertainties not only limit manufacturers’ production efficiency but also increase costs for end-users, creating market unpredictability. As a result, raw material price volatility and supply chain constraints serve as key restraints, potentially curbing growth opportunities across regional tipper body equipment markets.

Accelerating Adoption of Electric and Autonomous Technologies

The tipper body equipment market is poised for growth through the integration of electric and autonomous technologies, particularly in developed regions emphasizing sustainability and operational efficiency. Stricter emission regulations are driving the adoption of electric tipper trucks, with Europe and North America at the forefront due to government incentives and compliance requirements.

Autonomous dumping systems equipped with AI-powered predictive maintenance and IoT integration enhance operational safety and reduce labor costs. Manufacturers investing in energy-efficient hydraulic systems, digital transformation, and smart fleet management solutions are well-positioned to benefit from this technological shift.

As infrastructure projects increasingly prioritize sustainable transport systems, the transition to electric and autonomous tipper equipment presents significant opportunities to optimize performance, reduce environmental impact, and cater to evolving regulatory landscapes.

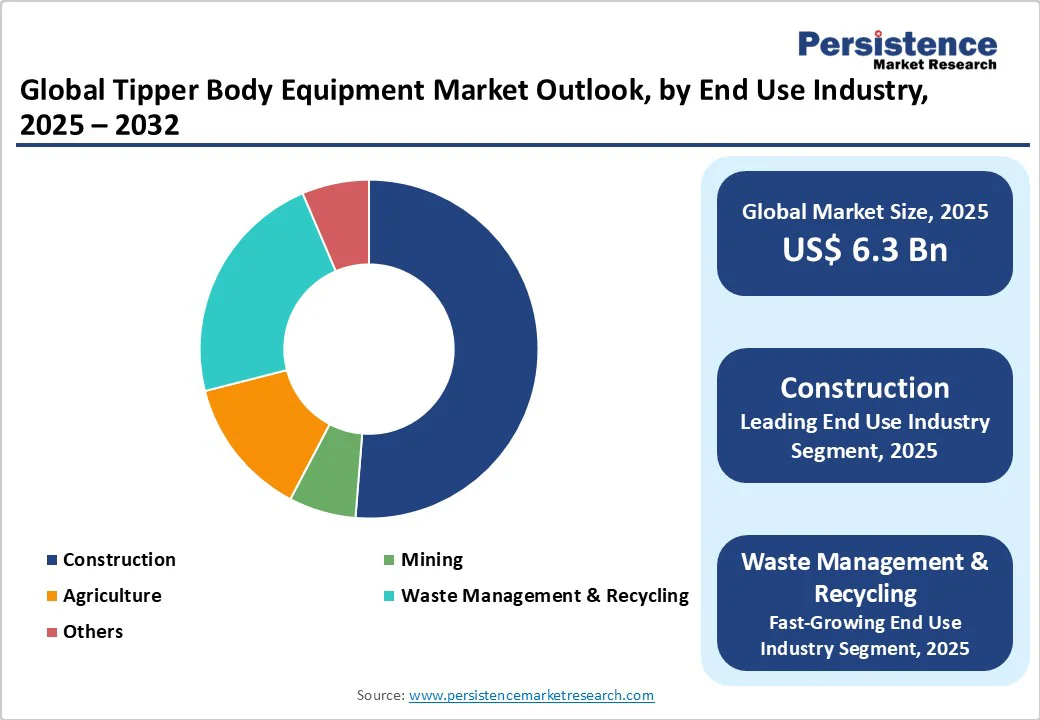

Explosive Growth in Waste Management and Recycling Sectors

The Waste Management and Recycling sector offers substantial growth opportunities for tipper body equipment, driven by urbanization and stricter environmental regulations. Municipalities across the Asia Pacific and Latin America are modernizing waste collection fleets, creating strong demand for specialized tipper trucks.

Adoption of circular economy principles and government-led sustainability initiatives further accelerates procurement for efficient waste transportation and processing. Smart city programs in emerging economies focus on advanced waste management infrastructure, while developed regions emphasize automated and electric waste collection systems.

This growing focus on environmental sustainability and technological integration across markets positions the tipper body equipment segment to capitalize on increasing demand, enabling manufacturers to diversify offerings across different levels of technological sophistication within the broader Construction and Mining Equipment Market.

Rear tippers lead the tipper body equipment market with a 56% share in 2025, reflecting their adaptability and broad applicability across construction, mining, and industrial sectors. Their operational efficiency in controlled unloading makes them particularly suited for construction sites that require precise material placement and mining operations demanding reliable bulk transport.

Rear tippers also offer superior load distribution, enhanced stability during tipping operations, and compatibility with multiple chassis configurations from prominent OEMs. Supported by well-established manufacturing ecosystems, extensive service networks, and proven performance under challenging conditions, rear tippers maintain their dominant market position. Their versatility and reliability continue to make them a preferred choice for contractors seeking efficient, durable, and high-performing tipper body solutions in diverse operating environments.

The above 30-ton capacity segment is expected to hold the largest revenue share of 46% in 2025, driven by the growing need for high-capacity material transport in large-scale infrastructure and mining projects. The construction sector is increasingly favoring mechanized solutions that can efficiently handle substantial material volumes for highways, dams, and other major projects.

Heavy-duty tipper bodies in this capacity range deliver superior payload efficiency, reduced transportation cycles, and enhanced operational productivity, enabling contractors to manage extensive earthmoving tasks effectively. Key infrastructure initiatives in the Asia Pacific, such as China’s high-speed rail expansion and India’s highway development programs, further bolster demand for high-capacity equipment. These factors reinforce this segment’s leadership and underline its critical role in supporting large-scale construction and mining operations.

Construction continues to dominate as the leading end-use industry with a 50% share in 2025, highlighting the sector’s reliance on efficient material transportation solutions. Global construction activity, including residential, commercial, and infrastructure modernization projects, sustains continuous demand for tipper body equipment.

The sector relies on these vehicles to transport essential materials such as sand, gravel, concrete, and construction debris across diverse project sites. Initiatives such as the Smart Cities Mission programs and other government-led urban development projects further strengthen demand.

Well-established supply chains, standardized equipment specifications, and strong manufacturer-contractor relationships reinforce construction’s leadership, cementing its position as the primary driver of the tipper body equipment market within the broader construction and infrastructure ecosystem.

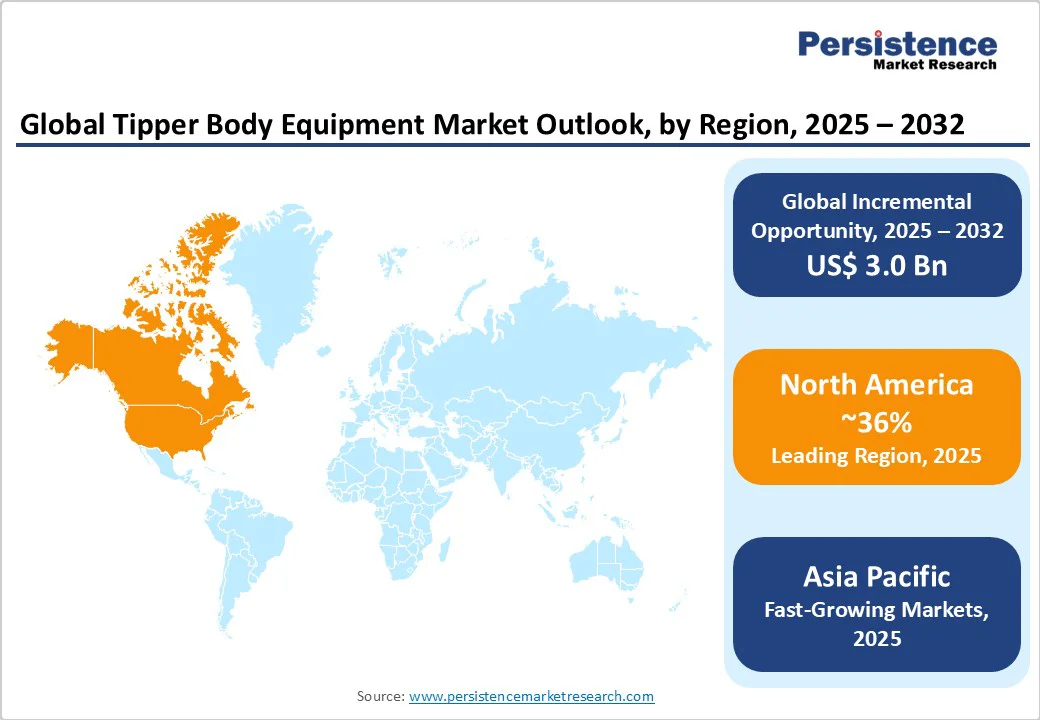

North America demonstrates strong market performance driven by the United States' leadership in advanced construction and mining sectors, with the region estimated to reach over US$14.70 billion by 2032. The market benefits from well-established construction infrastructure, ongoing mining activity, and a significant presence of leading manufacturers, including Caterpillar Inc. and advanced technology integration. United States infrastructure modernization programs and highway maintenance projects create sustained demand for specialized tipper body equipment.

The integration of advanced hydraulic systems and lightweight materials leads to improved fuel economy and enhanced vehicle performance across North American fleets. Regulatory policies governing load management and safety standards impact market trends, while technological innovations, including automated tipping features and IoT integration, enhance operational efficiency. The presence of key manufacturers and well-established distribution networks supports market growth, with increasing focus on electric and hybrid tipper trucks under environmental sustainability initiatives.

European markets prioritize sustainability and regulatory harmonization, with Germany, the United Kingdom, France, and Spain leading the regional performance through the adoption of advanced technology and stringent environmental standards. Schmitz Cargobull AG and Meiller Group represent key European manufacturers focusing on lightweight aluminum construction and energy-efficient hydraulic systems. The region prioritizes electric tipper trucks and automated systems in line with European Union emission reduction policies.

European markets demonstrate strong demand for customized tipper body solutions tailored to specific applications, including the transportation of construction materials and waste management operations. The emphasis on circular economy principles drives the adoption of specialized equipment for recycling and waste processing applications.

Regional manufacturers invest heavily in research and development for advanced materials, automated systems, and digital connectivity solutions, positioning Europe as a hub for technology innovation within the global Compact Electric Construction Equipment Market.

Asia Pacific represents the fastest-growing regional market, with China accounting for 45% revenue share and the region projected to reach over US$19.61 billion by 2032. Extensive government investments in infrastructure development, rapid urbanization, and booming construction activities across China and India drive regional market expansion. Asia Pacific benefits from substantial manufacturing capabilities and cost-competitive production systems.

China's 14th Five-Year Plan aims to enhance transport infrastructure, creating sustained demand for construction equipment, including tipper body systems. India's infrastructure investment programs, including highway network development and urban modernization projects, generate substantial demand for equipment.

Regional markets are emphasizing high-capacity tipper bodies, which are suitable for large-scale infrastructure projects, with an increasing adoption of advanced hydraulic systems and telematics solutions. The presence of major OEMs, including BEML, Tata Motors Limited, and Ashok Leyland Limited, supports regional market development through comprehensive product portfolios and service networks.

The tipper body equipment market demonstrates a moderately fragmented competitive structure with several key players maintaining significant market positions through diverse strategies. Leading companies focus on product innovation, geographic expansion, and strategic partnerships with OEMs to strengthen market presence. Market concentration varies by region, with European and North American markets showing higher consolidation levels compared to fragmented Asian markets.

Companies employ differentiation strategies through advanced hydraulic technology, lightweight materials, and digital integration capabilities. The competitive landscape emphasizes research and development investments for automated systems, electric powertrains, and predictive maintenance solutions. Emerging business models include equipment-as-a-service offerings and integrated fleet management platforms, while market leaders pursue vertical integration and supply chain optimization strategies.

The global tipper body equipment market was valued at US$ 6.3 billion in 2025 and is projected to reach US$ 9.3 billion by 2032, growing at a CAGR of 5.8% during the forecast period, driven by increasing infrastructure development and construction activities worldwide.

Key demand drivers include unprecedented global infrastructure development surge with government investments exceeding US$ 133.86 billion in India alone, rising mechanization in mining operations requiring 30% more high-capacity machinery, and increasing adoption of advanced hydraulic tipping systems across construction sectors.

Rear Tippers dominate the market with 56% share in 2025, owing to their versatility in construction and mining applications, superior load distribution characteristics, and compatibility with diverse chassis configurations from major OEMs worldwide.

Asia Pacific represents the fastest-growing regional market, projected to reach over US$ 19.61 billion by 2032, driven by China's infrastructure spending growth of 10% and India's massive highway development programs creating sustained equipment demand.

Major opportunities include accelerating adoption of electric and autonomous technologies in developed markets, explosive growth in Waste Management & Recycling segment with 7.8% CAGR, and increasing demand for specialized equipment in emerging smart city development projects globally.

Key market players include Hyva Global B.V. with 20-25% market share, Meiller Kipper holding 16-20% share, Schmitz Cargobull AG with 12-16% share, along with major OEMs including Caterpillar Inc., Tata Motors Limited, Volvo Construction Equipment, and BEML serving diverse global markets.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis Units | Value: US$ Mn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Tipping Type

By Capacity

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author