ID: PMRREP34924| 199 Pages | 3 Feb 2026 | Format: PDF, Excel, PPT* | Healthcare

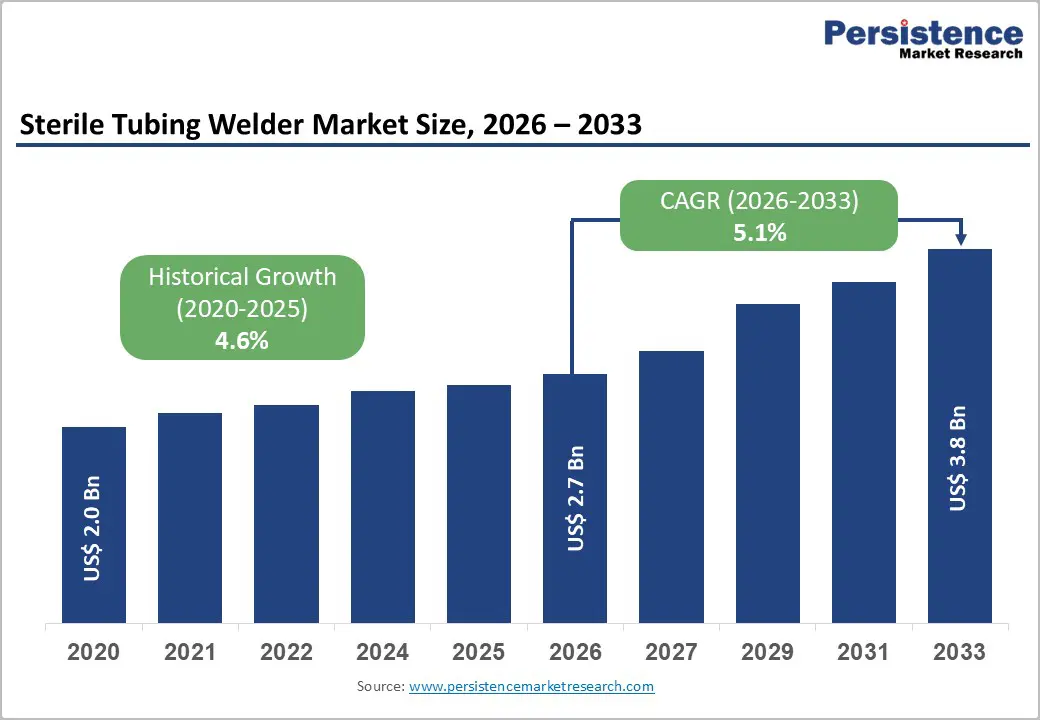

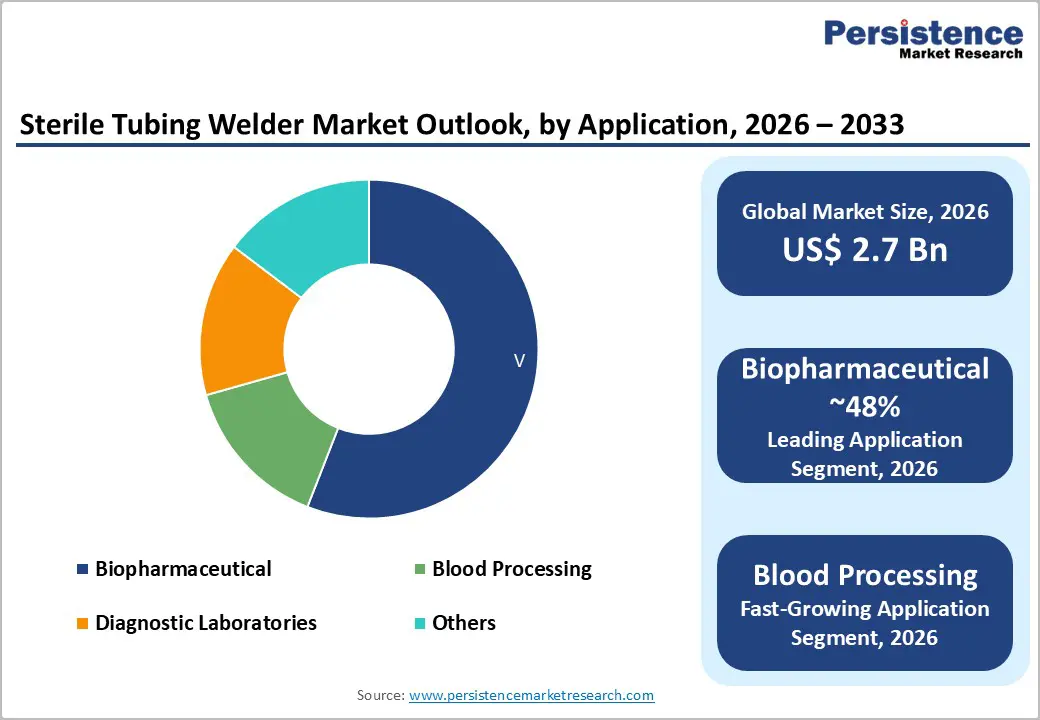

The global sterile tubing welder market size is expected to be valued at US$ 2.7 billion in 2026 and projected to reach US$ 3.8 billion by 2033, growing at a CAGR of 5.1% between 2026 and 2033. The global sterile tubing welder market is anticipated to showcase decent growth in the forecast period amid increasing demand for sterile and contamination-free environments in the pharmaceutical and medical sectors.

Manufacturers are set to focus on enhancing product safety and efficacy, as well as innovations in welding technology. Latest trends indicate a shift toward automation and smart technologies, enabling precise welding processes and minimizing human error. The rise in biopharmaceutical production and growing emphasis on personalized medicine are further fueling the need for efficient sterile connection systems.

Sustainability is also gaining traction, with companies seeking eco-friendly materials and processes. The market is poised for expansion as it adapts to the changing industry requirements and technological developments.

| Key Insights | Details |

|---|---|

| Sterile Tubing Welder Market Size (2026E) | US$ 2.7 Bn |

| Market Value Forecast (2033F) | US$ 3.8 Bn |

| Projected Growth (CAGR 2026 to 2033) | 5.1% |

| Historical Market Growth (CAGR 2020 to 2024) | 4.6% |

The rise in biopharmaceutical production is a key driver of growth for the sterile tube welder industry. This high production rate is fueled by ongoing investments and innovative offerings by leading companies. According to a report by the U.S. Department of Health and Human Services, the biopharmaceutical market is projected to reach US$500B by 2025, growing at an annual rate of 6.9%.

Companies such as Watson-Marlow Fluid Technology Group, based in the U.K., recently launched their BioPure single-use sterile tubing welders to meet rising demand. These welders enhance efficiency and minimize contamination risks in biopharmaceutical manufacturing.

A few studies report global biopharmaceutical research and development investment of US$276 Bn across 4,191 companies in 2021, including both publicly traded and privately owned companies. This underscores the need for unique sterile connection technologies, further bolstering market growth.

Stringent regulatory requirements regarding product safety and sterility are propelling sales of sterile tube welders for pharmaceutical tubes. The U.S. Food and Drug Administration (FDA) has emphasized the need for rigorous quality control in the manufacturing of medical devices and pharmaceuticals.

In 2021, the FDA reported a 15% increase in inspections for compliance with sterility standards. To keep up with evolving norms, several healthcare companies and institutions are focusing on launching new products that meet stringent safety standards. For example, in 2022, Wuhan BMS Medicaltech. Co., Ltd., based in China, developed the STW6810-RFID Sterile Tube Welder. This model is used to connect two closed internally sterile components, such as blood collection containers and transfer sets, by making a sterile weld in the tubing. It is FDA-approved and designed to ensure high sterility.

The urgent need to comply with strict safety standards is expected to build consumer trust and boost the market over the next ten years.

One significant factor impeding growth in the sterile tubing welder market is the high initial investment costs associated with advanced welding technologies. Various manufacturers face financial constraints when considering the adoption of automated and sophisticated welding systems.

The capital required to purchase, install, and maintain these systems can be substantial, particularly for small-scale companies. This financial barrier may deter potential entrants and limit the expansion of existing players, ultimately slowing down market growth. As a result, companies are likely to adopt less efficient manual processes, which can compromise sterility and operational efficiency.

An important challenge facing the sterile tube welding industry is the complexity of regulatory compliance. Manufacturers must adhere to stringent regulations set by health authorities, such as the FDA, which can vary by region.

Understanding stringent regulations requires substantial time and resources, often resulting in delays in product development and market entry. Additionally, the need for continuous updates to meet evolving standards can strain operational capabilities. This regulatory burden may discourage investments in new technologies and innovations, hindering market growth, as companies prioritize compliance over expansion.

The integration of Industry 4.0 technologies presents a promising opportunity for manufacturers of sterile tubing welders. As companies seek efficiency and automation, tools like IoT, artificial intelligence, and big data analytics become increasingly relevant. For example, the GE Wave Sterile Tubing Welder provides complete automation and aseptic operation, capable of fusing tubing with outer diameters ranging from 1/4 to 7/8 inches. It is designed for single-use applications and comes with a warranty, ensuring quality and compliance.

Several reports suggest that adopting digital technologies could increase operational efficiency by up to 40%. This trend toward smart manufacturing not only improves productivity but also ensures compliance with stringent safety standards. It further helps in positioning leading companies for future success in the market.

The automatic sterile tubing welder industry has significant growth potential in emerging areas, where healthcare infrastructure is rapidly developing. According to the World Bank, healthcare spending in the Asia-Pacific region is projected to reach US$1 trillion by 2025, creating rising demand for advanced medical technologies.

Companies like Parker Hannifin are capitalizing on this opportunity with the launch of the Parker Tubing Welder. It is primarily designed for use in a range of healthcare settings. Recent industry news highlights investments in healthcare facilities in countries such as India and Brazil. It further underscores the need for reliable, sterile welding solutions to support the expansion of biopharmaceutical production and medical device manufacturing.

In the sterile tubing welder market, the automatic segment is expected to dominate, given its superior efficiency and productivity compared with manual welders. Automatic welders streamline the welding process, reducing reliance on human labor and minimizing the risk of human error. This results in faster production, consistent quality, and higher throughput, making them ideal for biopharmaceutical manufacturing, blood processing, and diagnostic laboratories. Hospitals and manufacturing facilities increasingly seek solutions that can maintain sterility while reducing operational costs, driving the adoption of automatic welders.

In addition, these machines often include real-time monitoring and advanced control systems, allowing precise welding for sensitive medical devices such as IV lines, catheters, and blood bags. The shift toward automation also aligns with broader industry trends emphasizing technological innovation and operational efficiency, enabling companies to optimize processes, improve safety, and meet stringent regulatory standards. As demand for sterile connections rises, the automatic segment is poised for sustained growth globally.

Hospitals are projected to remain the largest end-user segment in the sterile tubing welder market, given their high patient volumes and strict infection-control requirements. With the increasing prevalence of blood disorders, chronic diseases, and complex treatments, hospitals require sterile fluid transfer systems to ensure patient safety. Sterile tubing welders are critical in maintaining the sterility of IV lines, catheters, and other medical devices, minimizing the risk of hospital-acquired infections. The growing focus on infection prevention has led companies to develop specialized products and modules tailored for clinical use. For example, in November 2024, MedSource Labs and Ghost Medical introduced training modules for clinicians, distribution partners, and first responders. These modules provide guidance on both blood and non-blood protocols, improving procedural accuracy, patient safety, and overall care quality. Hospitals’ ongoing investments in staff training and advanced equipment continue to support the demand for sterile tubing welders across clinical environments.

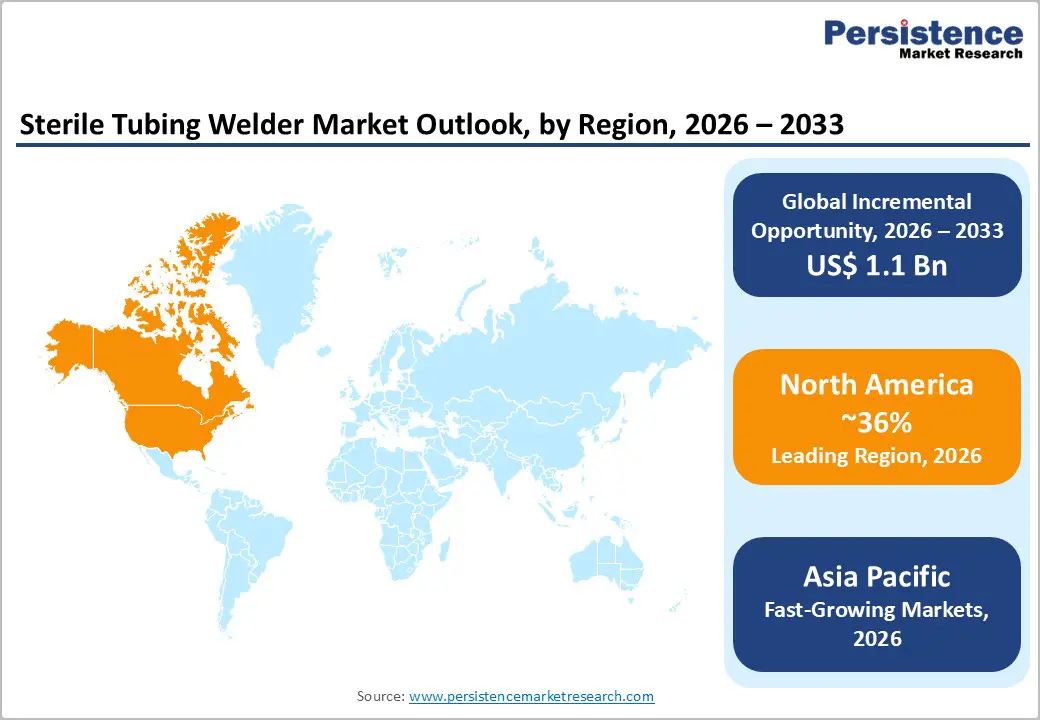

In 2026, North America is expected to lead the global sterile tubing welder market, capturing approximately 36% of total value share. This dominance is fueled by the increasing prevalence of chronic diseases, rapid technological advancements, and heightened demand for sterile processing environments to minimize contamination risks during medical procedures and biopharmaceutical production. The large patient population with chronic conditions creates persistent demand for blood processing, diagnostics, and therapeutic manufacturing equipment, reinforcing the need for reliable sterile tubing solutions. Recent data from National Center for Chronic Disease Prevention and Health Promotion shows about 76.4% of U.S. adults more than 194 million people reported having at least one chronic condition in 2023, underscoring the significant healthcare burden driving equipment utilization.

Moreover, substantial investments in biopharmaceutical R&D, particularly in the U.S., support ongoing market expansion. For instance, the U.S. biopharmaceutical industry was one of the most research-intensive globally, spending tens of billions on R&D, which enhances infrastructure and demand for advanced sterile technologies in manufacturing and clinical applications

The Asia Pacific sterile tubing welder market is growing rapidly as the region expands its healthcare and pharmaceutical infrastructure. In 2026, the Asia-Pacific region is estimated to account for approximately 29% of the global sterile tubing welder market, supported by increased biopharmaceutical production and investments in healthcare technologies. China leads the region in market share, followed by Japan and India; rising production capacity in South Korea and Southeast Asia also contributes to growth. Strong government initiatives and funding toward healthcare modernization and digitalization have accelerated the adoption of advanced sterile processing systems. Rising healthcare expenditure and increasing demand for contamination-free fluid transfer in clinical and manufacturing applications are key drivers. With the continued expansion of pharmaceutical manufacturing facilities and an enhanced focus on quality and sterility in medical processes, the Asia-Pacific region is projected to remain the fastest-growing market.

The sterile tubing welder market is highly competitive, driven by technological innovation and strategic initiatives from key players. Sartorius Stedim Biotech S.A. notably launched the Sartorius BioConnect® sterile tubing welder in 2022, designed to improve efficiency, reliability, and precision in biopharmaceutical manufacturing. This product incorporates advanced automation features and real-time monitoring, catering to the growing need for accurate sterile connections. As the market continues to expand, companies are increasingly prioritizing innovations in automation, connectivity, and single-use systems to maintain competitive edges. These strategies also support compliance with stringent regulatory standards. Overall, the landscape reflects a strong focus on product differentiation, technological advancements, and strategic planning to capture market share in a rapidly evolving industry.

The global sterile tubing welder market is projected to be valued at US$ 2.7 Bn in 2026.

Raising biopharmaceutical production, blood processing demand, single-use system adoption, automation in labs, and stringent sterility regulations drive growth.

The global sterile tubing welder market is expected to witness a CAGR of 5.1% between 2026 and 2033.

Sartorius AG, GE Healthcare, and Genesis BPS are a few leading players.

North America is the leading region in the global sterile tubing welder market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn and Volume (if Available) |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Mode

By Application

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author