ID: PMRREP8119| 190 Pages | 14 Nov 2025 | Format: PDF, Excel, PPT* | Industrial Automation

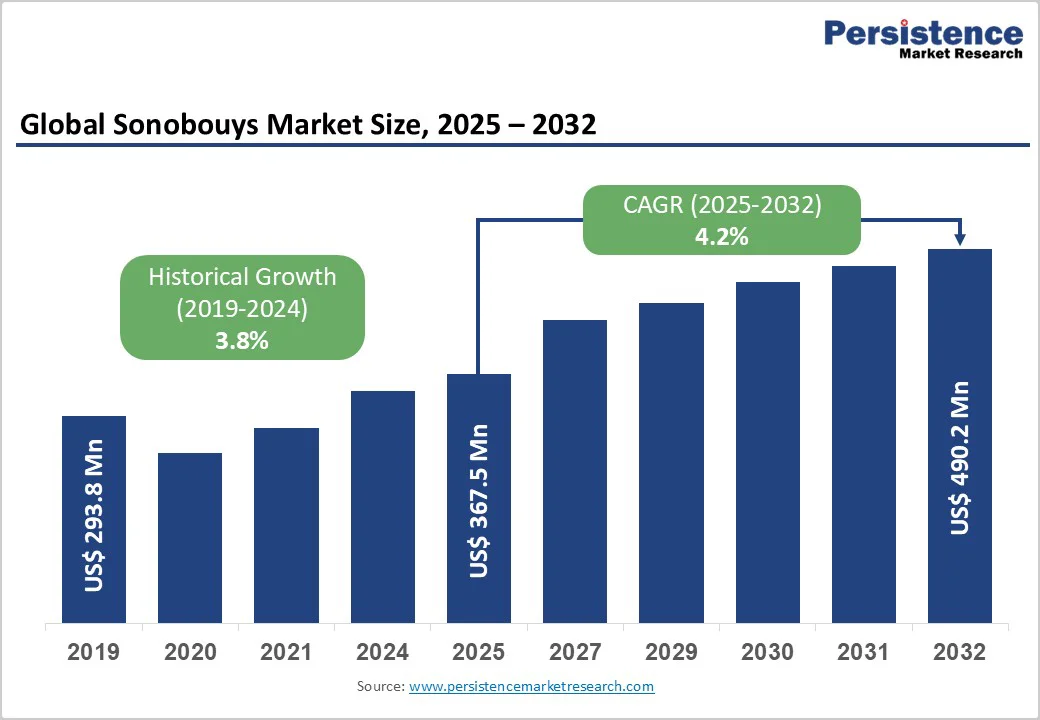

The global sonobuoys market size is likely to value at US$ 367.5 million in 2025 and is projected to reach US$ 490.2 million, growing at a CAGR of 4.2% between 2025 and 2032. The sonobuoys market is experiencing steady growth driven by escalating geopolitical tensions and increased defense spending across maritime nations. Rising submarine activities in strategic waters, particularly in the Indo-Pacific region and Arctic waters, coupled with growing emphasis on underwater domain awareness capabilities, are propelling market expansion through enhanced anti-submarine warfare investments.

| Key Insights | Details |

|---|---|

| Sonobuoys Market Size (2025E) | US$ 367.5 million |

| Market Value Forecast (2032F) | US$ 490.2 million |

| Projected Growth CAGR(2025-2032) | 4.2% |

| Historical Market Growth (2019-2024) | 3.8% |

Global naval forces are witnessing unprecedented levels of submarine proliferation and stealth technology advancement, necessitating sophisticated anti-submarine warfare capabilities. China’s expanding submarine fleet and advanced underwater platforms have prompted allied nations to invest heavily in sonobuoy technologies for enhanced underwater surveillance.

The U.S. Navy allocated over US$ 2.7 trillion in defense spending in 2024, with significant portions directed toward anti-submarine warfare systems. Strategic initiatives such as the India-U.S. sonobuoy co-production agreement valued at US$ 52.8 million demonstrate increased bilateral cooperation to counter underwater threats. Modern sonobuoys featuring GPS synchronization and artificial intelligence-driven analytics are providing navies with superior detection ranges and classification accuracy, reinforcing their critical role in maritime defense strategies.

Revolutionary developments in digital signal processing and multi-sensor integration are transforming sonobuoy capabilities beyond traditional acoustic detection methods. Next-generation systems like the AN/SSQ-125A and Thales SonoFlash incorporate both active and passive sensing modes, significantly extending operational range and detection accuracy.

Ultra Maritime’s advanced sonobuoys with DICASS and DIFAR technologies offer enhanced battery life exceeding 24 hours of operational duration while providing precise submarine classification. The integration of quantum sensor technology and electromagnetic detection capabilities is enabling sonobuoys to detect even the quietest nuclear submarines at ranges previously considered impossible. These technological breakthroughs are attracting substantial investment from defense agencies seeking to maintain technological superiority in underwater warfare.

Sonobuoy manufacturing involves complex sensor technologies, specialized electronics, and precision engineering components sourced from limited global suppliers. Recent supply chain disruptions and geopolitical tensions have extended production lead times and increased manufacturing costs by approximately 15-20%. The specialized nature of sonobuoy components requires substantial R&D investment, with companies like ERAPSCO and Sparton Corporation investing millions in advanced manufacturing facilities. Additionally, stringent defense procurement regulations and export control restrictions limit market expansion opportunities, particularly for international collaborations and cross-border technology transfers.

Sonobuoys are inherently expendable systems with operational lifespans typically ranging from 1-24 hours before requiring replacement, creating continuous procurement demands. Harsh marine environments, extreme weather conditions, and corrosive saltwater exposure pose significant challenges to system reliability and performance consistency. The need for frequent replacement and the inability to recover deployed systems result in substantial ongoing operational costs for naval forces. Environmental regulations regarding ocean pollution and marine ecosystem protection are increasingly restricting sonobuoy deployment in sensitive marine areas, potentially limiting operational flexibility.

The proliferation of unmanned underwater vehicles (UUVs) and autonomous maritime platforms presents significant opportunities for sonobuoy integration and deployment. General Atomics’ MQ-9B SeaGuardian has successfully demonstrated autonomous sonobuoy deployment capabilities, enabling persistent underwater surveillance over vast oceanic areas. The integration of sonobuoys with artificial intelligence and machine learning algorithms is enabling real-time pattern recognition and automated threat classification, reducing operator workload and improving response times.

Future developments in swarm robotics and networked sensor systems could revolutionize underwater domain awareness by deploying coordinated sonobuoy networks capable of covering entire ocean basins. This technological convergence offers substantial market expansion opportunities as navies seek cost-effective solutions for wide-area maritime surveillance.

Beyond military applications, sonobuoys are finding increasing utilization in environmental monitoring, oceanographic research, and commercial maritime activities. Climate change research initiatives and marine ecosystem monitoring programs are driving demand for long-endurance sonobuoys capable of collecting oceanographic data.

The marine buoys market, valued at US$ 945.5 million in 2025, demonstrates growing commercial interest in ocean monitoring technologies. Offshore oil and gas exploration activities require sophisticated underwater detection systems for pipeline monitoring and environmental compliance. NOAA and similar organizations worldwide are deploying thousands of smart sonobuoys for real-time weather forecasting and tsunami early warning systems, representing substantial market diversification opportunities beyond traditional defense applications.

The passive sonobuoys segment dominates the market with approximately 65% market share, driven by their stealth characteristics and extended operational capabilities. Passive systems like the AN/SSQ-53G DIFAR utilize Directional Frequency Analysis and Recording technology to detect submarine acoustic signatures without revealing their own position, making them preferred for covert surveillance operations. These systems can operate continuously for up to 8 hours at depths reaching 305 meters, providing sustained underwater monitoring capabilities.

The U.S. Navy maintains inventory exceeding 100,000 passive sonobuoy units for deployment across 70+ aircraft platforms, demonstrating their operational significance. Recent technological enhancements including GPS integration and enhanced battery technology, have nearly doubled operational lifespan while improving acoustic sensitivity, reinforcing passive sonobuoys’ market leadership position.

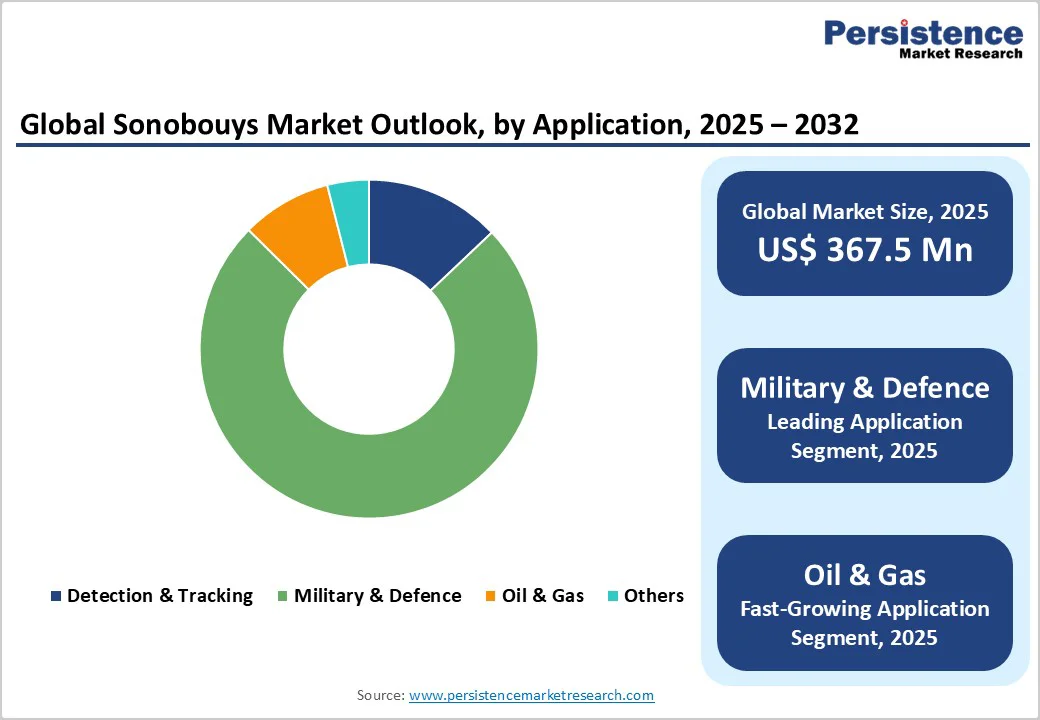

The military & defence application segment commands the largest market share at approximately 75%, reflecting sonobuoys’ critical role in national security and naval operations. Anti-submarine warfare operations represent the primary driver, with nations investing heavily in underwater threat detection capabilities amid growing submarine proliferation. NATO standardization requirements and interoperability mandates ensure consistent sonobuoy specifications across allied naval forces, creating substantial procurement volumes.

The Indian Navy’s recent US$ 52.8 million sonobuoy acquisition program and Turkey’s indigenous AselBUOY 100P development demonstrate expanding military applications. Commercial applications in oil and gas exploration, environmental monitoring, and oceanographic research are experiencing rapid growth, with the marine buoys market providing complementary opportunities for sonobuoy deployment in civilian maritime surveillance and data collection activities.

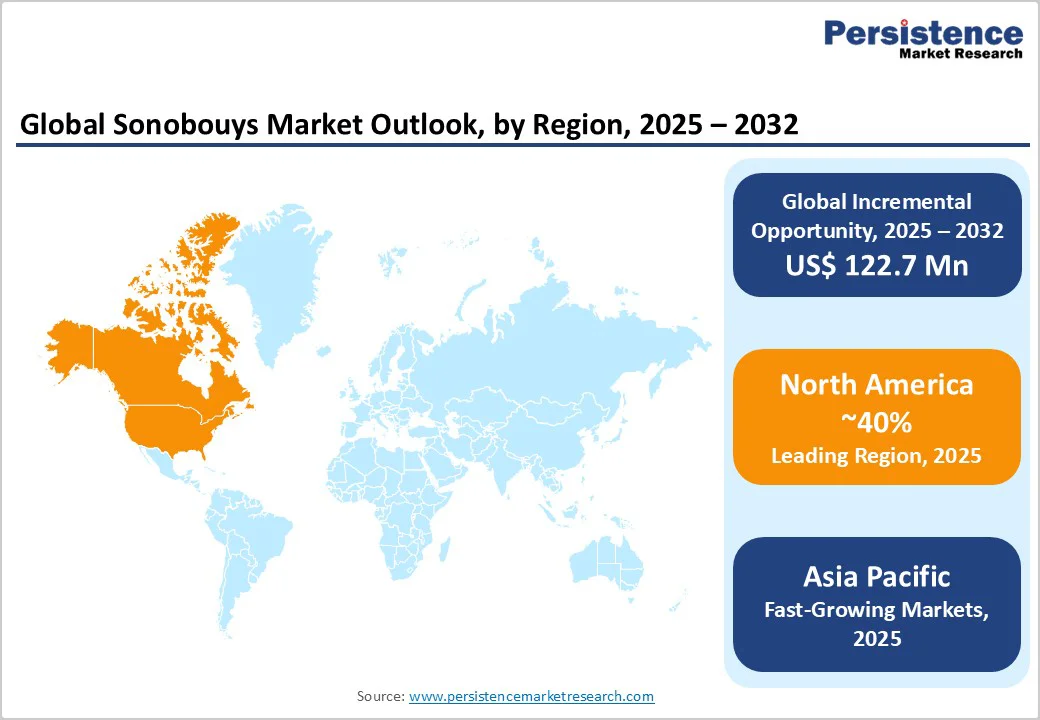

North America maintains market leadership with approximately 40% global market share, primarily driven by the United States’ extensive naval modernization programs and advanced anti-submarine warfare capabilities. The U.S. Navy operates the world’s largest sonobuoy procurement program with annual requirements exceeding 500,000 units deployed across P-8A Poseidon maritime patrol aircraft and MH-60R helicopter platforms. Recent contracts awarded to ERAPSCO, Lockheed Martin, and Sparton Corporation totaling over US$ 5.1 billion demonstrate sustained government investment in sonobuoy technologies.

Canada’s Arctic sovereignty initiatives and Hudson Bay underwater surveillance programs are driving increased sonobuoy deployment for northern maritime domain awareness. The Royal Canadian Navy’s integration with U.S. Navy sonobuoy systems ensures interoperability during joint operations while supporting Arctic infrastructure protection mission.

European markets are experiencing robust growth driven by NATO modernization requirements and increasing maritime security concerns in the Baltic Sea and North Atlantic. France’s Direction Générale de l’Armement has contracted Thales Group for several hundred SonoFlash sonobuoys, representing the first indigenous European active/passive sonobuoy system. The United Kingdom’s Royal Navy maintains significant sonobuoy capabilities through Ultra Maritime partnerships, with £31 million contracts supporting Merlin helicopter anti-submarine warfare operations.

Germany’s maritime patrol expansion and Norway’s Arctic surveillance requirements are creating additional procurement opportunities. Spain and Italy are modernizing their naval aviation capabilities with enhanced sonobuoy systems to support Mediterranean maritime security operations against evolving underwater threats.

Asia Pacific represents the fastest-growing regional market with projected CAGR exceeding 6%, driven by China’s submarine expansion and regional maritime tensions. India’s strategic partnership with Ultra Maritime for sonobuoy co-production will establish domestic manufacturing capabilities at Bharat Dynamics Limited facilities in Visakhapatnam by 2027. Japan’s Maritime Self-Defense Force operates extensive P-3C Orion and P-1 maritime patrol aircraft fleets requiring continuous sonobuoy replenishment for anti-submarine warfare missions.

Australia’s Royal Australian Air Force P-8A Poseidon operations and South Korea’s maritime patrol capabilities are driving sustained sonobuoy procurement. ASEAN nations are increasingly investing in underwater domain awareness capabilities to monitor strategic shipping lanes and detect unauthorized submarine activities in territorial waters.

The global sonobuoys market exhibits a consolidated structure with a limited number of qualified manufacturers due to stringent defense requirements and advanced technology barriers. ERAPSCO, a joint venture between Ultra Electronics and Sparton Corporation, historically dominated U.S. Navy procurement before dissolving in September 2023, creating competitive opportunities for individual companies. Market leaders focus on research and development investments averaging 4-6% of revenue to maintain technological superiority in signal processing algorithms and sensor miniaturization.

Strategic partnerships between Original Equipment Manufacturers (OEMs) and government agencies ensure long-term supply agreements spanning 5-10 years. Companies are pursuing vertical integration strategies to control critical component supply chains and reduce dependency on specialized suppliers, while emerging players like Aselsan are developing indigenous capabilities to serve regional markets with customized solutions.

The global sonobuoys market is projected to reach US$ 490.2 million by 2032, growing at a CAGR of 4.2% from 2025 to 2032.

Key growth drivers include escalating maritime security threats, naval modernization programs, technological advancements in active/passive sonar systems, and increasing submarine proliferation globally.

Passive sonobuoys dominate the market with approximately 65% market share, preferred for their stealth characteristics and extended operational capabilities in anti-submarine warfare operations.

North America leads the market with approximately 40% global market share, primarily driven by extensive U.S. Navy procurement programs and advanced maritime patrol aircraft capabilities.

Integration with autonomous and unmanned systems presents the most significant opportunity, with UUV deployment and AI-enhanced processing enabling persistent wide-area underwater surveillance capabilities.

Major players include ERAPSCO, Thales Group, Ultra Electronics Group, Sparton Corporation, General Dynamics Corporation, Lockheed Martin Corporation, Radixon Group, Aselsan, and Sealandaire Technologies Inc.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 – 2024 |

| Forecast Period | 2025 – 2032 |

| Market Analysis Units | Value: US$ Mn/Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author