ID: PMRREP33596| 200 Pages | 30 Dec 2025 | Format: PDF, Excel, PPT* | Semiconductor Electronics

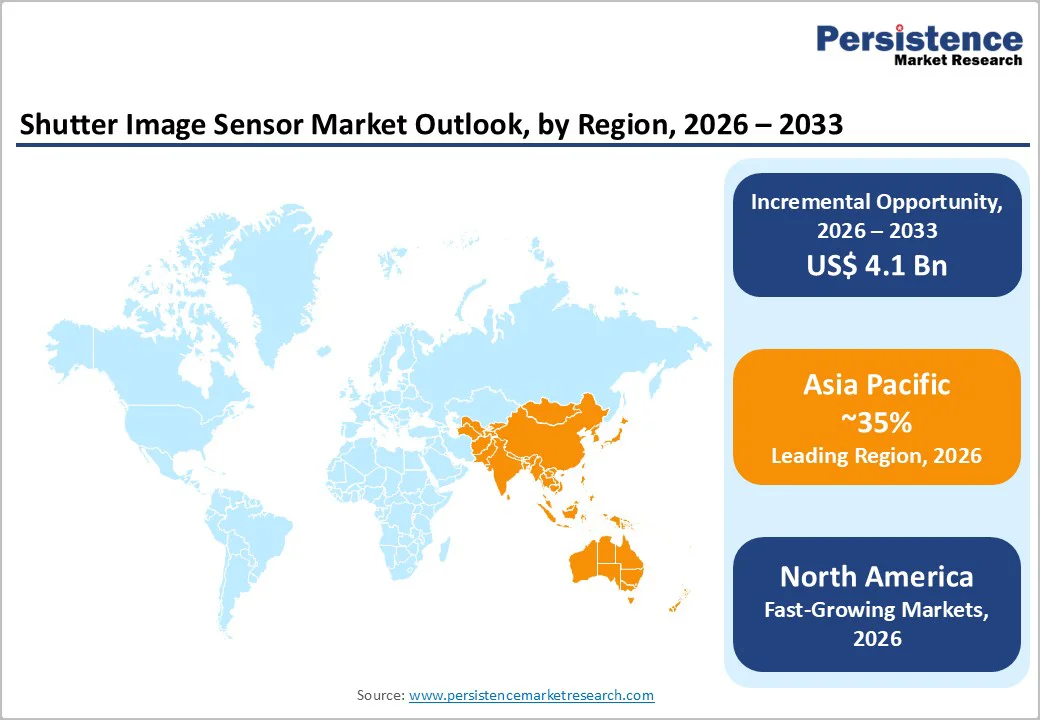

The global shutter image sensor market size is valued at US$ 3.4 billion in 2026 and is projected to reach US$ 7.5 billion by 2033, growing at a CAGR of 12.1% between 2026 and 2033.

The market is driven by widespread smartphone adoption incorporating multi-camera systems, escalating autonomous vehicle development requiring advanced computer vision capabilities, and regulatory mandates for advanced driver assistance systems (ADAS) across major automotive markets.

| Key Insights | Details |

|---|---|

| Shutter Image Sensor Market Size (2026E) | US$ 3.4 Bn |

| Market Value Forecast (2033F) | US$ 7.5 Bn |

| Projected Growth (CAGR 2026 to 2033) | 12.1% |

| Historical Market Growth (CAGR 2020 to 2024) | 11.6% |

The increasing need for high-quality images is the main driver propelling the growth of the shutter image sensor market. Consumers increasingly expect high-quality images and videos from their devices, including smartphones, digital cameras, and other imaging devices. This demand is fueled by the desire for visually appealing content and immersive experiences. The popularity of social media platforms, blogging, and content creation has led to a surge in demand for imaging devices that can capture high-resolution photos and videos. This trend is especially prominent among younger demographics.

Ongoing advancements in image sensor technologies, including higher megapixel counts, improved low-light performance, and enhanced image processing capabilities, contribute to delivering high-quality imaging experiences. Beyond consumer electronics, there is a growing demand for high-quality imaging in professional and industrial applications. This includes applications in medical imaging, surveillance, automotive safety systems, and industrial automation, where image sensors play a crucial role.

Global smartphone production reached approximately 1.2-1.4 billion units annually in 2024 - 2025, with 95%+ incorporating advanced multi-camera systems requiring specialized image sensors. Mobile device camera complexity expansion, with flagship smartphones integrating 4-6 camera modules addressing telephoto, ultra-wide, macro, and depth-sensing functionalities, drives proportionate sensor demand. Consumer camera demand, with smartphone photography increasingly replacing dedicated digital cameras and driving 8-12% annual growth in imaging capability expectations, establishes foundational market drivers.

Computational photography advancement, with AI-powered image processing enabling real-time optimization of exposure, focus, and white balance through software algorithms, necessitates high-performance image sensors. Video recording evolution, with 4K video recording becoming standard specification on 95%+ of mid-range and premium smartphones and 8K recording advancing in flagship segments, requires advanced sensor architectures. SAP SuccessFactors analytics and Oracle Fusion HCM Analytics integrate generative AI enabling conversational interfaces, natural language processing for sentiment analysis from employee surveys, and autonomous anomaly detection identifying organizational dysfunction indicators. These technological advancements enable HR teams to transition from reactive problem-solving to proactive workforce strategy optimization. Johnson & Johnson's AI skills-inference framework, integrating passive assessments and taxonomies, improved learning alignment and hiring accuracy measurably.

Implementing advanced manufacturing processes to produce high-quality shutter image sensors can be expensive. This includes using precision machinery and specialized facilities, leading to higher production costs. High-quality materials, especially those that enhance sensor performance, can contribute to increased production costs.

Advanced materials and technologies often come with a premium price. High initial costs can be challenging to offset, especially low production volumes. Achieving economies of scale becomes crucial to making the technology more cost-effective, but it may take time to reach this stage.

The demand for higher resolution and smaller form factors requires manufacturers to increase pixel density while maintaining image quality. Achieving this balance can be challenging due to limitations in pixel size and sensor dimensions. Achieving optimal performance in low-light conditions is an ongoing challenge.

Improving sensitivity without compromising image quality is crucial, especially in surveillance and automotive imaging applications. Image sensors in battery-operated devices, like smartphones and IoT devices, must balance high performance with low power consumption. Developing energy-efficient sensors without sacrificing image quality is a continuous challenge.

Augmented reality device adoption, with AR glasses, AR contact lenses, and AR headsets projected to reach 100-150 million installed units by 2033, establishes substantial imaging sensor demand. Mixed reality ecosystem expansion, with metaverse platforms and immersive computing environments requiring advanced depth sensing and environmental mapping, drive specialized sensor requirements.

Eye-tracking technology advancement, with consumer-grade eye-tracking sensors achieving price points enabling mass-market integration and growing 40-60% annually, establish dedicated sensor segment. Spatial computing architecture adoption, with AR systems requiring simultaneous capture of depth, motion, and environmental mapping through multi-sensor arrays, drive sensor integration expansion. Consumer acceptance trajectory, with AR device adoption in gaming, enterprise training, and consumer applications growing 35-50% annually, establish proportionate sensor demand.

Industrial automation adoption acceleration, with manufacturing facilities incorporating 5-15 vision-enabled robots per facility and automated inspection systems expanding 15-25% annually, establish substantial imaging sensor demand. Logistics and warehouse automation, with fulfillment centers deploying autonomous navigation systems and robotic arm integration incorporating vision systems growing 30-50% annually, drive sensor procurement.

Quality control automation, with computer vision-based inspection systems replacing manual quality assurance and achieving defect detection rates of 99.5%+ versus 85-90% manual detection, establish economic justification. Collaborative robot proliferation, with cobots incorporating safety vision systems enabling human-robot collaboration in shared workspaces, drive sensor requirements.

The CMOS image sensor segment commands 47.3% market share within technology classification, reflecting superior power efficiency and integration advantages. Semiconductor manufacturing compatibility, with CMOS technology leveraging standard semiconductor fabrication processes enabling cost-effective mass production, establishes broad market accessibility. Smartphones use CMOS image sensors to capture high-quality photos and videos. They support features such as autofocus, image stabilization, and low-light performance. Both compact digital cameras and professional DSLRs often utilize CMOS image sensors for their imaging capabilities.

Nonetheless, the CCD image sensor segment of the shutter image sensor market is expanding at the quickest rate. CCD sensors are often used in astronomical imaging because they capture faint light over long exposure times. They are employed in telescopes and observatories for capturing high-resolution images of celestial objects.

The 3D image sensor market segment is the largest for shutter image sensors. The automotive industry's increasing integration of advanced driver assistance systems (ADAS) and in-cabin sensing technologies fuels the demand for 3D image sensors. These sensors contribute to applications such as gesture-based controls, driver monitoring, and collision avoidance systems.

Nevertheless, the market segment exhibiting the most rapid growth is the 2D image sensor. The need for 2D image sensors is driven by automation and machine vision in industrial settings for process monitoring, quality control, and inspection. These sensors are necessary to take precise pictures of products and components during production.

The array type segment is categorized into linear image sensor, area image sensor, and others. Linear image sensor occupies the highest market share. Linear image sensors are widely used in barcode scanners and object detection systems. The ability to capture a continuous line of data makes linear sensors efficient for applications requiring rapid barcode reading and precise object detection in industrial and retail settings.

In contrast, the area image sensor market segment is expanding quickly. The healthcare industry uses Area image sensors in digital radiography, CT scanners, X-ray machines, and other medical imaging equipment. The high-quality medical images captured for diagnosis and therapy planning are made possible by these sensors.

The consumer electronics segment holds 38.4% market share, driven by the scale of the smartphone and mobile device market. Global smartphone production exceeds 1.2-1.4 billion units annually, with over 95% incorporating advanced imaging systems. Rapid multi-camera adoption, expanding from single to 4-6 camera setups, increases sensor demand per device. Growth in AI-driven computational photography sustains demand for high-performance sensors, while tablets, laptops, and wearables increasingly integrate cameras for video communication, AR, and health applications.

The automotive segment is the fastest growing, projected to expand at 18% CAGR through 2033. Growth is driven by ADAS regulatory mandates, autonomous vehicle development, and stricter safety standards. Modern vehicles integrate 8-12 camera modules for surround-view, driver monitoring, and occupant detection, with EV platforms and 5G-enabled V2X connectivity accelerating sensor penetration.

The increasing demand for high-quality medical images for diagnostic purposes requires advanced image sensors capable of delivering superior resolution, sensitivity, and dynamic range. In North America, this trend towards minimally invasive surgical procedures, such as endoscopy, laparoscopy, and catheter-based interventions, has been accelerating the demand for compact and high-resolution image sensors over the recent past.

Image sensors play a crucial role in real-time imaging applications, such as fluoroscopy and interventional radiology, where the ability to capture high-speed and high-quality images is essential for procedural guidance. In medical research and diagnostics, adopting digital pathology and high-resolution microscopy requires advanced image sensors for capturing and analyzing detailed cellular and tissue-level images.

Europe represents approximately 22% of the global shutter image sensor market share, valued at approximately US$ 880 million in 2026. Germany, France, UK, and Spain collectively represent 72% of the European market value, reflecting established automotive manufacturing presence and advanced technology adoption.

Automotive manufacturing excellence tradition, with German luxury brands including BMW, Mercedes-Benz, and Audi prioritizing advanced imaging systems for premium vehicle platforms. GDPR and privacy regulation emphasis, with European regulatory bodies establishing stringent privacy protections for facial recognition and biometric imaging driving technology standards. Autonomous vehicle pilot programs, with European cities including Amsterdam, Hamburg, and Paris, are conducting large-scale AV deployment trials requiring advanced imaging systems.

Asia Pacific has consistently demonstrated high rates of smartphone adoption. This widespread use of smartphones contributes to a substantial demand for advanced camera technologies, where high-quality image sensors play a crucial role. As consumers in the Asia Pacific region become more tech-savvy, there is a heightened demand for smartphones with advanced camera capabilities. This includes high resolution, low-light performance, and advanced image processing. The growing middle-income group in several Asian countries has increased disposable income. This has led to higher demand for premium smartphones with sophisticated imaging capabilities, driving the need for advanced image sensors.

Sony has a strong business strategy for the shutter image sensor market based on innovation, customer focus, and global expansion. The company is the market leader, committed to continuous product innovation and invests heavily in R&D to create cutting-edge shutter image sensors that meet the evolving needs of the industry. The company focuses on developing high-performance, reliable, cost-effective sensors that cater to various applications. Sony is strictly committed to quality and reliability in their products and services. They adhere to international standards, undergo rigorous testing and certification procedures, and implement stringent quality control measures. This focus on quality has earned them a reputation for providing dependable and long-lasting imaging and sensing solutions.

The Shutter Image Sensor market is estimated to be valued at US$ 3.4 Bn in 2026.

The key demand driver for the Shutter Image Sensor market is the growing need for high-precision, distortion-free imaging in machine vision, industrial automation, and advanced automotive applications.

In 2026, the Asia Pacific region will dominate the market with an exceeding 35% revenue share in the global Shutter Image Sensor market.

Among the end-users, consumer electronics holds the highest preference, capturing beyond 32.3% of the market revenue share in 2026, surpassing other application type.

The key players in Shutter Image Sensor are Sony, Samsung, OmniVision, ON Semiconductor and Canon.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Bn, Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Technology

By Processing Type

By Spectrum

By Array Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author