ID: PMRREP19180| 200 Pages | 26 Dec 2025 | Format: PDF, Excel, PPT* | Food and Beverages

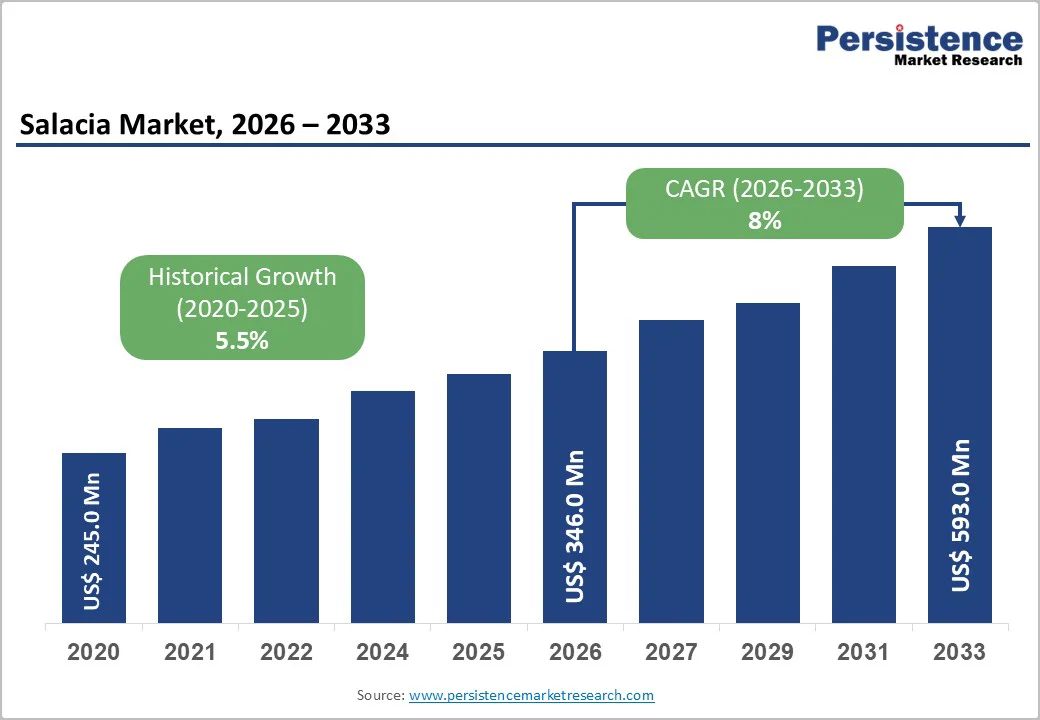

The global salacia market size is likely to be valued at US$ 346.0 million in 2026, and is projected to reach US$ 593.0 million by 2033, growing at a CAGR of 8.0% during the forecast period 2026−2033. This trajectory aligns with the strengthening demand for plant-based interventions that support blood sugar control and metabolic balance, as more patients and practitioners look beyond conventional pharmaceuticals toward evidence-backed botanicals. Several structural drivers underpin this outlook, including rising global diabetes prevalence, heightened consumer awareness of natural health supplements, and expanded pharmaceutical interest in salacia-derived compounds for metabolic health.

The combination of traditional use in Ayurvedic and other systems of medicine with emerging clinical and mechanistic data is shifting salacia from a niche herb to a more credible therapeutic option in mainstream healthcare and wellness. Stakeholders that prioritize quality control, regulatory compliance, and education for healthcare professionals will be best positioned to build trust, justify premium pricing, and secure long-term partnerships across nutraceutical, functional food, and drug-development channels.

| Key Insights | Details |

|---|---|

| Salacia Market Size (2026E) | US$ 346.0 Mn |

| Market Value Forecast (2033F) | US$ 593.0 Mn |

| Projected Growth (CAGR 2026 to 2033) | 8% |

| Historical Market Growth (CAGR 2020 to 2025) | 5.5% |

The escalating incidence of diabetes is a catalyst for the salacia market growth. Rising global cases of the disease are driving sustained demand for natural, plant-based solutions that support blood sugar regulation and long-term metabolic health. According to the International Diabetes Federation (IDF), around 590 million people globally are living with diabetes, and this number is projected to reach around 853 million by 2050. In this context, salacia extracts are increasingly recognized as credible options in diabetes management because of their ability to modulate carbohydrate digestion and reduce post-meal glucose fluctuations. Growing clinical interest and practitioner awareness are reinforcing confidence in these botanicals as part of integrated care approaches, where they are often used alongside conventional therapies rather than as standalone alternatives.

Mounting concerns about the side effects and long-term safety of certain synthetic drugs are prompting patients and healthcare providers to explore botanical and nutraceutical interventions as complementary options. In line with this shift, Salacia has gained traction across both developed and emerging markets through prescription-adjacent use, over-the-counter supplements, and functional health products. Pharmaceutical and nutraceutical companies are increasingly incorporating salacia into formulations targeting metabolic health, supporting broader commercial adoption and ongoing product innovation. This combined momentum of medical interest and consumer preference is strengthening salacia position as a strategic ingredient within the wider diabetes management ecosystem.

Salacia species, particularly Salacia reticulata and Salacia oblonga, face significant sourcing challenges because they are native to relatively narrow tropical forest zones in South Asia and Southeast Asia. This limited geographic range concentrates supply risk in a small number of ecosystems that are already under pressure from habitat loss and competing land uses. Rising commercial demand has led to over-harvesting in several key areas, prompting conservation groups to identify certain salacia species as being at risk. These sustainability concerns are increasingly shaping how regulators, buyers, and certification bodies evaluate and approve Salacia-based products for international markets.

Limited cultivation infrastructure for salacia significantly constrains producers’ ability to stabilize and scale supply. Reliance on wild collection drives recurring price volatility and exposes manufacturers to frequent and unpredictable supply chain disruptions. As input costs rise, margins for producers and formulators are compressed, making Salacia-based products less affordable for more price-sensitive consumer segments. Increasing requirements for traceable, sustainable harvesting, together with the long growth cycle of Salacia plants before they reach harvestable maturity, further slow capacity expansion and discourage new entrants that lack the capital and time horizon needed for long-term cultivation investments.

Expansion into weight management and obesity treatment represents a significant growth avenue for the salacia market. The global rise in obesity and related metabolic disorders is driving strong demand for safe, effective, natural interventions that complement diet and lifestyle changes. Salacia’s mechanism of action, particularly its ability to influence carbohydrate processing and key metabolic pathways, positions it well for inclusion in weight management formulations aimed at both general consumers and clinically managed patients. As health systems and consumers increasingly prioritize long-term, sustainable approaches over short-term fixes, interest in botanicals that support metabolic resilience continues to intensify.

Pharmaceutical and nutraceutical companies are increasingly exploring salacia as part of combination strategies designed to enhance the effectiveness of existing weight management therapies while improving tolerability. This approach aligns with the growing adoption of multi-modal obesity treatment models that integrate behavioral change, pharmacotherapy, and evidence-based natural supplements. Within this framework, salacia-enriched products can function as adjuncts that expand therapeutic options for overweight and obese individuals. As brands seek to differentiate their weight management portfolios and respond to rising consumer preferences for plant-based solutions, salacia is emerging as a strategic ingredient that supports new product development, line extensions, and premium positioning in the global marketplace.

Root extract is slated to be the leading segment with an approximate 62% of the salacia market revenue share in 2026, due to its superior concentration of bioactive compounds, particularly salacinol and kotalanol, which exhibit the strongest alpha-glucosidase inhibitory activity. Root extracts show 3-4 times greater potency than other plant parts, making them the preferred option for pharmaceutical uses that demand standardized therapeutic doses. The established extraction protocols, extensive clinical validation, and regulatory acceptance for root-based formulations reinforce this segment's market leadership. Manufacturing efficiency has improved through optimized extraction technologies, partially offsetting higher raw material costs associated with root harvesting sustainability concerns.

Steam extract is likely to be the fastest-growing segment during the 2026-2033 forecast period. Stem extract adoption is being driven by both sustainability initiatives and cost optimization priorities. Stem harvesting allows for non-destructive collection methods that preserve plant viability, helping to address conservation concerns while lowering raw material costs compared to root-based sourcing. Thus, manufacturers serving mass-market dietary supplement segments are increasingly using stem extracts to protect profit margins while aligning with rising consumer expectations for sustainably sourced ingredients.

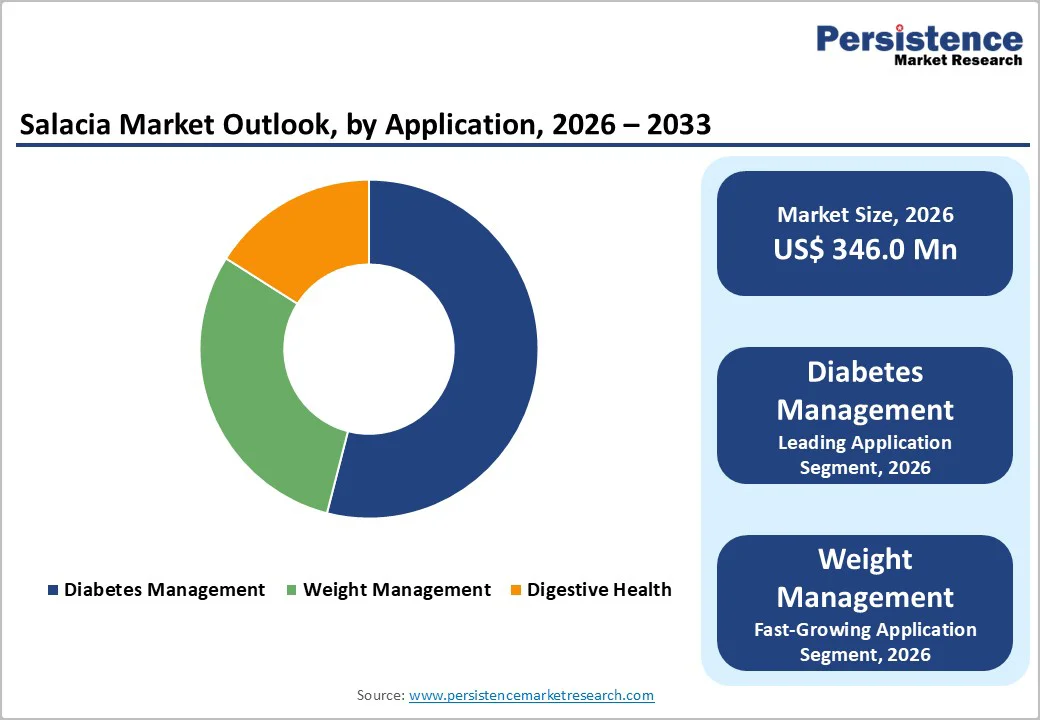

Diabetes management is predicted to dominate with an estimated 54% of market share in 2026. The segment benefits from rising diabetes diagnosis rates, a rapidly expanding pre-diabetic population, and broader insurance coverage for complementary diabetes management products in developed markets. Salacia’s demonstrated ability to improve glycemic control and reduce postprandial glucose excursions positions it as an evidence-based adjunct within integrated treatment regimens. Pharmaceutical companies are developing prescription-grade Salacia formulations for Type 2 diabetes patients, particularly in markets such as Japan, where botanical medicines have strong regulatory recognition and broad medical acceptance. Institutional healthcare system adoption in India, driven by the integration of traditional medicine within national health services through the Ministry of AYUSH, represents emerging growth opportunity.

Weight management is anticipated to be the fastest-growing segment from 2026 to 2033, fueled by rising obesity rates and consumer preference for natural weight loss solutions over synthetic pharmaceuticals. As per the World Health Organization (WHO), 1 in 8 people in the world were obese in 2022. Salacia’s mechanism of inhibiting carbohydrate breakdown while modulating fat metabolism appeals to consumers who are seeking holistic improvements in body composition. Its integration into functional foods, meal replacement products, and sports nutrition formulations extends market reach beyond traditional supplement users. The convergence of metabolic health concerns such as diabetes, obesity, and cardiovascular disease creates synergistic opportunities for products that address multiple health objectives at once, supporting premium pricing and encouraging repeat purchases.

Dietary supplements are anticipated capture around 68% of the Salacia market revenues in 2026, supported by extensive retail coverage across specialty health stores, online platforms, and pharmacy channels. This segment benefits from relatively lower regulatory barriers than pharmaceutical applications, which allows faster product introductions and greater flexibility in formulation development and innovation. The growing availability of combination products that pair Salacia with complementary ingredients such as chromium, berberine, and cinnamon strengthens their value proposition and improves on-shelf differentiation. Direct-to-consumer brands using e-commerce have widened access, especially among younger, prevention-focused consumers. Overall, the segment’s growth trajectory closely tracks the broader expansion of the global dietary supplements industry.

The pharmaceutical industry is expected to be the fastest-growing during the 2026-2033 forecast period, driven by increasing investment in botanical drug development and regulatory pathways facilitating natural product approvals. Pharmaceutical manufacturers increasingly recognize Salacia’s potential both as a standalone therapeutic and as a combination agent that can enhance the effectiveness of existing diabetes medications while helping to lower dosage requirements and mitigate side effects. Ongoing clinical development efforts are exploring Salacia-based interventions for broader metabolic conditions, including metabolic syndrome, non-alcoholic fatty liver disease, and cardiovascular complications, creating a multi-indication pipeline.

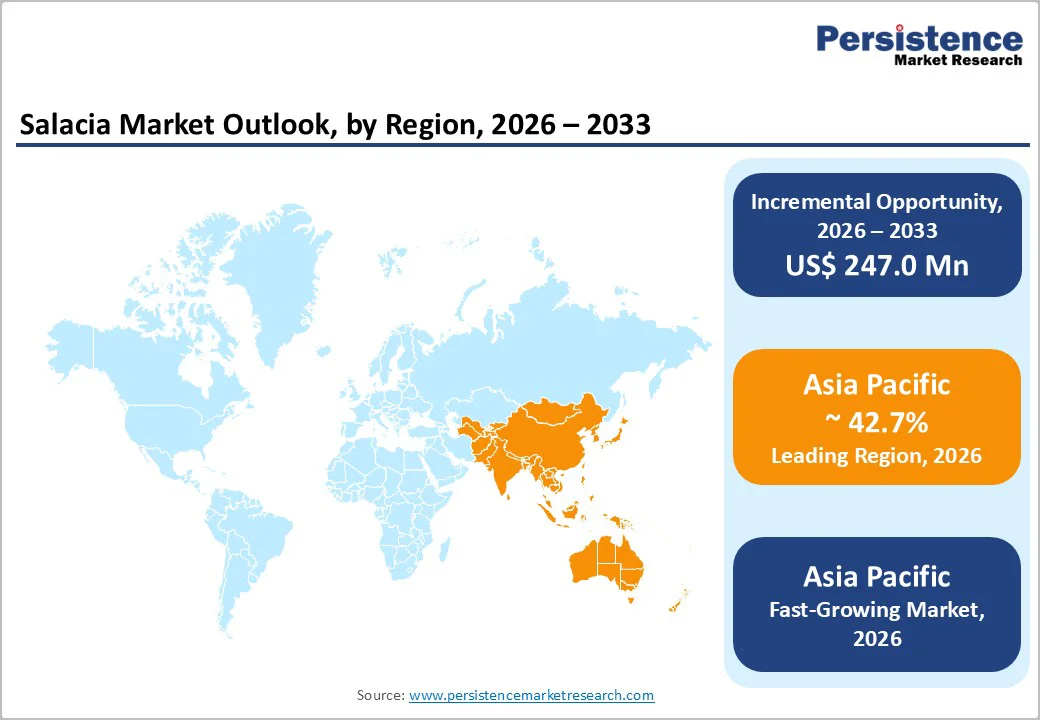

Asia Pacific is likely to be both the leading and fastest-growing regional market for salacia in 2026, accounting for approximately 42.7% of the market share, supported by a combination of indigenous plant availability, long-established traditional medicine systems, and a rapidly expanding middle class that places increasing emphasis on health and wellness. China, Japan, and India account for most of the regional demand, with China emerging as a key growth engine due to its large patient base and strong policy support for traditional medicine. Japan represents the most mature and clinically sophisticated market, where Salacia-based products are integrated into regulated functional food categories and benefit from clear health-claim frameworks and reimbursement pathways. India leverages its traditional medicine ecosystem and cultural familiarity with Salacia to drive uptake across both formal healthcare channels and informal retail markets, supported by extensive local supply chains.

Policy support for traditional and botanical medicine, combined with strong manufacturing fundamentals, is accelerating the commercialization of Salacia-based products. Proximity to raw material sources, established extraction capabilities, and competitive production costs enable local manufacturers to offer attractive pricing while maintaining consistent quality standards. A young demographic profile and rising digital engagement create favorable conditions for long-term market expansion, as e-commerce and social platforms are increasingly used to educate consumers and distribute Salacia-enriched products. Investment into regional nutraceutical and functional food businesses is reinforcing innovation pipelines and scaling production capacity, while governments promote medical tourism and integrated care models that incorporate traditional therapies.

Europe is a core market for salacia extracts and products, supported by sophisticated consumer preferences and a well-established regulatory framework. The market is fueled by strong demand in Germany, the United Kingdom, France, and Spain, where consumers actively favor organically certified, sustainably sourced botanical ingredients, reinforcing the growth of premium product segments. Regulatory instruments such as the European Union (EU)’s Traditional Herbal Medicinal Products Directive provide a structured route to market for salacia-based products, although stringent documentation and traditional-use requirements increase complexity and raise barriers for new entrants. In Germany, frameworks such as Commission E and recognition from national drug authorities further strengthen medical and practitioner acceptance of herbal and botanical formulations.

Growing concern about diabetes and other metabolic disorders across Europe, combined with healthcare systems emphasis on prevention and lifestyle modification, is creating favorable conditions for Salacia adoption in both self-care and professionally supervised treatment settings. National preventive health programs, such as France’s long-standing initiatives promoting a balanced diet and regular physical activity, reinforce the role of natural and plant-based solutions in everyday health management. Competitive dynamics in the region include both multinational pharmaceutical companies exploring botanical drug development and specialized European herbal medicine manufacturers with well-established distribution networks. A high degree of collaboration between botanical suppliers and academic institutions supports ongoing clinical research.

North America is forecasted to secure a sizeable portion of the salacia market share in 2026, with the U.S. spearheading regional demand, supported by high diabetes prevalence, strong consumer familiarity with dietary supplements, and broad engagement with preventive health solutions. The market also benefits from advanced research and clinical infrastructure, with universities and medical centers actively generating evidence on Salacia’s therapeutic potential, which supports product integration and strengthens the basis for regulatory acceptance. An aging population, rising healthcare costs, and growing interest in self-directed chronic disease management further reinforce demand for natural, evidence-informed options that complement conventional therapies.

Regulatory clarity and product innovation are key enablers of market development, especially where Salacia is recognized as safe for use in functional foods, beverages, and dietary supplements, allowing companies to move beyond niche formulations into mainstream consumer offerings. Awareness among healthcare professionals is improving through continuing education and scientific publications, which is gradually increasing their comfort with recommending salacia-containing products, particularly for metabolic health support. The competitive landscape is defined by partnerships between established nutraceutical brands and botanical extract specialists, helping to secure raw material supply and maintain consistent quality standards.

The global salacia market structure is moderately fragmented, dominated by leading players such as Sabinsa Corporation, Nutra Green Biotechnology, Arjuna Natural Pvt. Ltd., and Nutriscience Innovations LLC. These players collectively capture around 38-42% of the market share. Competitive positioning in the Salacia market is increasingly shaped by differentiation in technology, integration, and evidence generation. Companies that invest in advanced extraction platforms, robust quality systems, and strong regulatory capabilities are better able to deliver standardized, high-purity ingredients that meet the expectations of pharmaceutical, nutraceutical, and functional food customers. At the same time, sustained clinical research investment around metabolic health outcomes enhances scientific credibility and supports premium pricing and long-term brand equity.

Leading players are pursuing vertical integration by securing cultivation capacity or long-term sourcing agreements to stabilize supply and control quality from farm to finished extract. Mid-sized firms tend to compete through specialization, focusing on particular applications (such as diabetes or weight management), specific extract types, or priority regional markets where they have established distribution relationships. Although fragmentation is gradually increasing as larger groups acquire niche specialists and regional producers, the market remains relatively fragmented, particularly in the dietary supplements space, where moderate entry barriers and country-specific rules still support the viability of local and regional brands.

The global salacia market is projected to reach US$ 346.0 million in 2026.

Surging diabetes and metabolic disorder prevalence, coupled with growing consumer preference for natural, plant-based therapeutic solutions, is driving the market.

The market is poised to witness a CAGR of 8% from 2026 to 2033.

Key market opportunities include the expanding use of salacia in weight management and functional foods, alongside growing demand in emerging markets with strong traditional medicine adoption.

Sabinsa Corporation, Nutra Green Biotechnology, Arjuna Natural Pvt. Ltd., and Nutriscience Innovations LLC are some of the key players in this market.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 - 2025 |

|

Forecast Period |

2026 - 2033 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Extract Type

By Application

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author