ID: PMRREP29887| 220 Pages | 6 Jan 2026 | Format: PDF, Excel, PPT* | Semiconductor Electronics

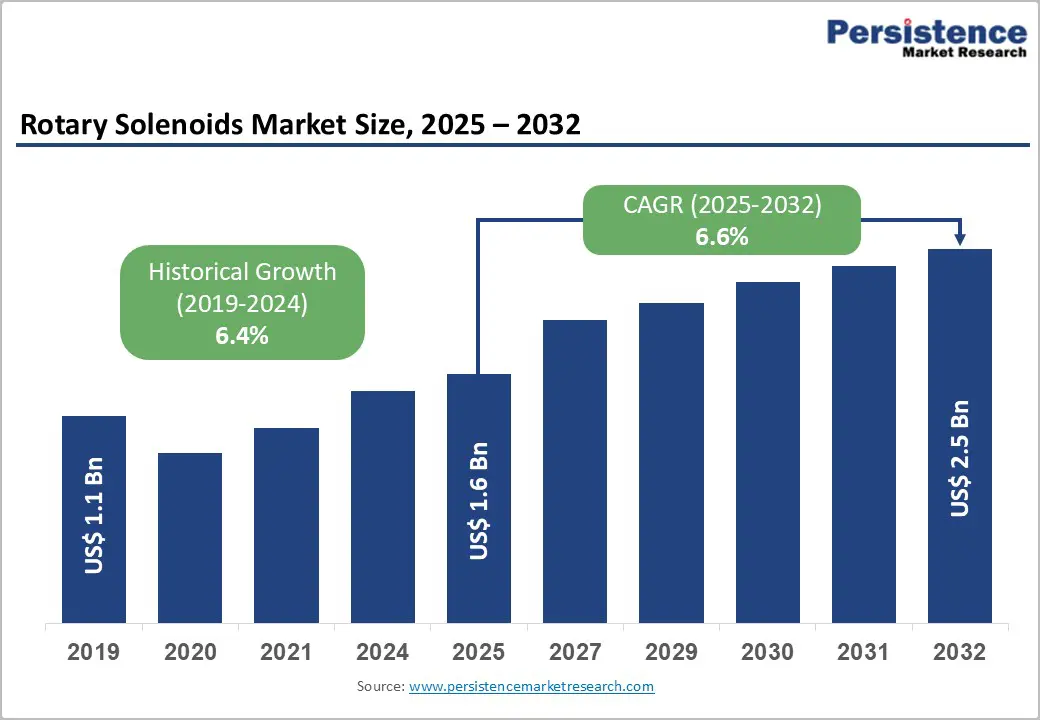

The global rotary solenoids market size is likely to be valued at US$1.6 billion in 2025 and is expected to reach US$2.5 billion by 2032, growing at a CAGR of 6.6% during the forecast period from 2025 to 2032, driven by increasing industrial automation, rising adoption of robotics, and expanding demand for precise electromechanical actuation across automotive, packaging, electronics, aerospace, and medical device sectors.

High adoption of DC and servo rotary solenoids in automotive systems, collaborative robots, and industrial machinery is fueling market expansion. Miniaturization trends and Industry 4.0 initiatives are encouraging the integration of IoT-enabled, compact, and energy-efficient rotary solenoids in smart factories.

| Key Insights | Details |

|---|---|

| Rotary Solenoids Market Size (2025E) | US$1.6 Bn |

| Market Value Forecast (2032F) | US$2.5 Bn |

| Projected Growth CAGR (2025 - 2032) | 6.6% |

| Historical Market Growth (2019 - 2024) | 6.4% |

The industrial automation revolution is transforming the rotary solenoid market, fueled by the growing adoption of smart factory technologies such as IIoT, edge computing, and AI-driven predictive maintenance. Manufacturers are increasingly using real-time sensors and digital twins to enhance production efficiency, minimize downtime, and enable data-driven decision-making, which is driving demand for compact, reliable, and high-speed actuators such as rotary solenoids. Rising investments across industries such as automotive, electronics, and packaging are accelerating the shift from manual and pneumatic systems to electric rotary solenoids. Their low maintenance requirements, energy efficiency, and seamless integration make them ideal for high-volume automated operations.

The expansion of collaborative robots, autonomous mobile robots, and intelligent motion control systems is further boosting the need for precise actuation. These advanced applications demand fast, accurate, and repeatable torque, areas where rotary solenoids excel, particularly as factories adopt modular, reconfigurable layouts and hyper-automation strategies. The robotics surge is driving demand for high-precision, rapid-response rotary solenoids that deliver torque, speed, and repeatability for modern automated production. Miniaturized solenoid designs are enabling broader use in space-limited robotic joints and medical automation, while integration with smart controllers allows adaptive, real-time motion control.

The rotary solenoids market faces significant restraints due to high cost barriers and supply chain complexity. Raw material prices, especially for copper, steel, and rare-earth magnets, are highly volatile, pushing up production costs. Advanced rotary solenoids, including miniaturized, servo, and high-torque variants, require precision machining, specialized windings, and tight tolerances, resulting in higher capital expenditure and longer development cycles. These cost pressures limit adoption in price-sensitive applications such as mass-market consumer electronics and small-scale manufacturing.

Market growth is being restrained by supply chain challenges. The reliance on semiconductors, electronic drivers, and specialized components has made manufacturers vulnerable to extended lead times and volatile procurement costs, especially in the wake of recent IC shortages. Geopolitical tensions, trade restrictions, and regional supply imbalances continue to disrupt sourcing and logistics, particularly across international manufacturing networks. Companies also face challenges in production planning, inventory management, and rapid capacity scaling. Smaller and regional players are disproportionately affected, as limited supplier options and weaker bargaining power make it harder to absorb cost fluctuations, slowing overall market expansion.

Rotary solenoids are increasingly used in automotive assembly, consumer electronics manufacturing, packaging lines, and industrial equipment due to their compact size, fast response, and cost-effective integration. Growing investments in EV production, electronics exports, and advanced manufacturing hubs are strengthening demand. The rotary solenoids market is shifting toward miniaturization and compact actuator design, especially in the Asia Pacific. As electronics, medical devices, and robotics become smaller and more functionally dense, manufacturers increasingly prefer compact rotary solenoids that deliver precise motion in limited spaces.

Large-scale manufacturing capacity and government-backed automation incentives that favor high-volume deployment of rotary solenoids. India is emerging as a high-growth market, supported by rising foreign direct investment, expanding adoption of robotics, and the modernization of the manufacturing, packaging, and medical electronics sectors. Rising labor costs, growing middle-class consumption, and a shift toward efficient, high-speed production systems are encouraging manufacturers to adopt advanced rotary solenoids. Local manufacturing expansion and supply chain localization are shaping market dynamics. Many OEMs are setting up production facilities and sourcing components locally in APAC to reduce costs, shorten lead times, and mitigate geopolitical risks.

DC rotary solenoids lead the rotary solenoids market, capturing around 46% of total revenue in 2025, driven by their low-cost manufacturing, ease of integration, and broad utility across the automotive and industrial automation sectors. Their ability to switch rapidly, deliver reliable performance, and adapt to different voltages allows them to scale efficiently in high-volume environments such as manufacturing lines and robotics deployments. For example, DC rotary solenoids are widely used in automotive door locking systems and transmission control mechanisms, where cost efficiency and reliability are critical. They are also commonly deployed in industrial valve actuation and conveyor sorting systems, supporting continuous, high-cycle operations in automated factories.

Servo rotary solenoids represent the fastest-growing product type, driven by increasing demand in robotics, aerospace, and medical devices. As factories and medical labs push toward more precise and compact motion control, the premium pricing of servo solenoids is being justified by their superior accuracy, dynamic response, and seamless compatibility with advanced control architectures. For example, servo rotary solenoids are increasingly used in collaborative robot joints and end-effectors to enable precise and repeatable movements. They also play a key role in medical imaging systems and minimally invasive surgical instruments, where high positioning accuracy and controlled motion are essential.

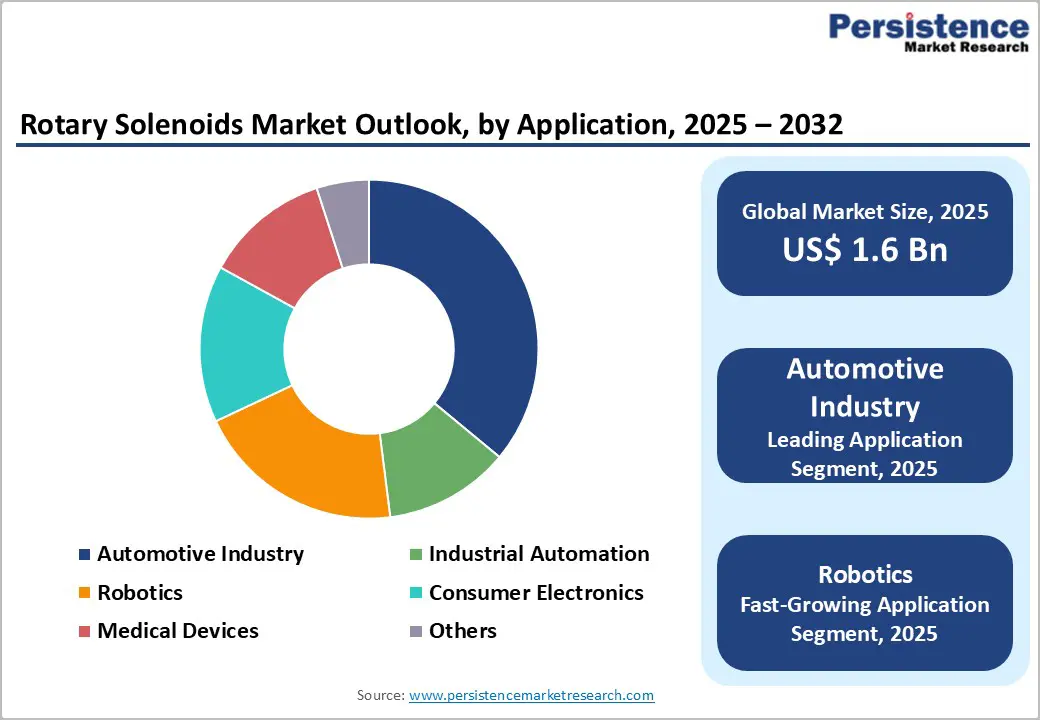

The automotive industry leads the market, accounting for over 29% of revenue share in 2025, driven by extensive use in EV components, locking mechanisms, and climate control systems, and by strong OEM orders for ADAS and hybrid platforms. Rotary solenoids are commonly used in electronic steering column locks and automatic transmission selector systems to ensure fast and reliable actuation. In electric vehicles, they are also deployed in battery cooling valves and thermal management systems, supporting energy efficiency and system safety. Rising vehicle electrification and software-defined architectures are increasing the use of rotary solenoids in electronic door latches, active grille shutters, and brake-by-wire systems.

Robotics is the fastest-growing application segment, driven by the miniaturization of rotary solenoids, which enable agile, precise, and flexible movements in collaborative robots, medical robots, and consumer robotics. They are widely used in collaborative robot end-effectors and pick-and-place arms to achieve accurate positioning and repeatable motion. Consumer electronics and medical devices are also expanding, with rotary solenoids integrated into smartphone camera autofocus modules, haptic feedback units, infusion pumps, and minimally invasive surgical tools, highlighting their importance in high-precision and safety-critical applications.

Aerospace is the leading end-user segment, accounting for 15% of revenue, driven by high-integrity actuator demand in avionics, cabin management, and space exploration. Rotary solenoids are used in aircraft fuel valve actuation, landing-gear locking systems, and satellite antenna positioning mechanisms, where precision and reliability are critical. Servo and explosion-proof variants are commonly specified by Boeing, Airbus, and major space system integrators to meet stringent aviation and space certification standards. Telecommunications and manufacturing also represent significant end-user segments, with applications in network switching equipment, fiber-optic assembly, industrial robotics, and automated production lines, reflecting a steady demand from digital infrastructure expansion and smart manufacturing investments.

Packaging is the fastest-growing end-user segment, driven by rising automation in high-speed filling, capping, labeling, and sealing operations, as well as increasing demand for hygienic, efficient, and flexible packaging solutions across the food, beverage, and pharmaceutical industries. For example, automated bottling and packaging lines used by FMCG manufacturers rely on pneumatic and DC rotary solenoids for rapid, reliable actuation. The shift toward smart packaging equipment is also increasing the adoption of compact, energy-efficient rotary solenoids with high cycle life. Stringent hygiene regulations and the need for frequent line changeovers are accelerating demand for precise, low-maintenance solenoid-driven actuators.

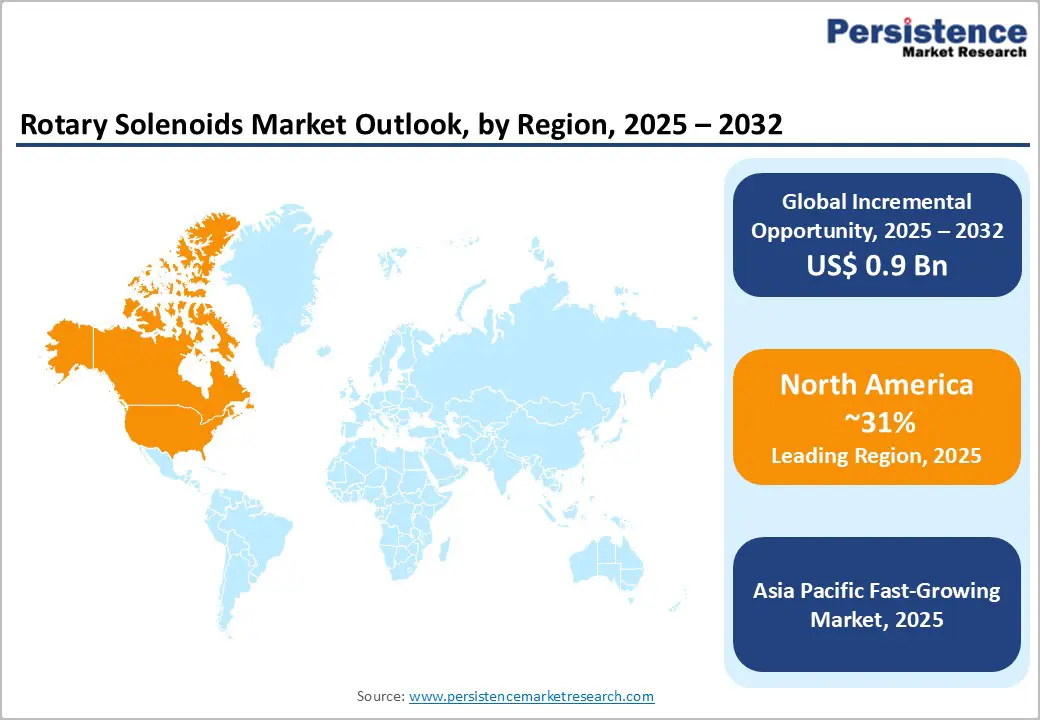

North America is emerging as the leading region in the rotary solenoids market, driven by its mature industrial base and strong investments in automation. The U.S. leads in smart factory deployments and robotics adoption, sustaining high demand for precise electromechanical actuators. Rotary solenoids are increasingly embedded in collaborative robots and autonomous mobile robots deployed by manufacturers such as Rockwell Automation customers and Tesla’s automated vehicle production lines. Advanced motion-control systems used in warehouse automation platforms from companies like Amazon Robotics are driving consistent demand for fast, reliable rotary solenoid solutions aligned with Industry 4.0 strategies.

North American manufacturers are also prioritizing compact, energy-efficient, and IoT-enabled rotary solenoids with integrated sensors for remote monitoring and predictive maintenance. Companies such as Kendrion and Johnson Electric are expanding their regional portfolios to support smart actuation and digitally connected systems. Reshoring initiatives and domestic manufacturing investments, supported by the U.S. industrial policy, are reducing supply-chain dependence on overseas components. This trend is evident in aerospace and medical device manufacturing hubs, where localized sourcing and high-performance actuator requirements reinforce North America’s role as a center for advanced solenoid innovation.

Europe remains a significant market for rotary solenoids, due to its mature industrial automation and precision engineering base, especially in countries such as Germany, France, Italy, and the U.K. There is a growing demand for compact, high-precision rotary actuators as European manufacturers modernize machinery and facilities to comply with sustainability and energy-efficiency mandates. Growing modernization of machinery across automotive, packaging, and industrial equipment sectors is driving demand for compact, high-precision rotary actuators.

Regulatory pressure, such as the EU’s Ecodesign Directive, is pushing designers to adopt energy-efficient solenoid technologies with lower standby consumption. Nearshoring and reshoring trends are gaining traction in Europe, which is helping reduce dependence on long overseas supply chains and improving lead times for critical components such as solenoids. Companies such as Kendrion and Magnet-Schultz are actively integrating sensors, connectivity, and smart control features into rotary solenoids, enabling predictive maintenance and seamless integration into Industry 4.0.

Asia Pacific is the fastest-growing region in the rotary solenoids market, driven by rapid industrialization and automation in major economies such as China and India. The region also shows strong growth in monostable rotary solenoids, especially in consumer electronics and medical device segments, driven by miniaturization and rising automation. Smart factory incentives are driving heavy demand for solenoids in robotics, automotive, and electronics production. For example, China’s electronics manufacturing hubs in Shenzhen and Suzhou extensively use compact rotary solenoids in smartphone assembly and testing equipment.

The region is experiencing strong growth in robotics and the deployment of compact actuators. As robot adoption surges across logistics, healthcare, and collaborative manufacturing, compact rotary actuators, including solenoids, are increasingly used in space-constrained joints and precise motion systems. South Korea’s logistics automation players and India’s expanding adoption of robotics in automotive and packaging plants are driving demand for space-efficient rotary solenoids in robot joints and end-effectors. Japanese automation leaders such as FANUC and Yaskawa support production lines with high-precision solenoids for quality-critical operations.

The global rotary solenoids exhibit a moderately fragmented structure, driven by growing demand across automotive, industrial automation, robotics, and consumer electronics sectors, as well as increasing adoption of smart factory and Industry 4.0 technologies. With key leaders including Johnson Electric, Kendrion, Magnet Schultz, Takano, and Shindengen Electric Manufacturing, the market remains competitive and innovation-driven.

These players compete through technological advancements, such as energy-efficient, miniaturized, and IoT-enabled rotary solenoids, product differentiation, and strategic expansions in manufacturing and R&D. Regional and niche companies gain traction by offering customized and cost-effective solutions, particularly in emerging markets across Asia Pacific and Latin America. Collaborations with OEMs, robotics integrators, and industrial automation providers further strengthen market presence.

The rotary solenoid market is valued at US$1.6 billion in 2025 and expected to reach US$2.5 billion by 2032, reflecting robust growth.

The primary demand drivers for the rotary solenoids market include rapid automation adoption, robotics integration, automotive electrification, and investments in smart factory initiatives.

DC rotary solenoids lead the product type segment with 46% revenue share, driven by low-cost production, easy integration, and widespread use in automotive and industrial automation.

North America dominates, capturing over 31% of the market share in 2025, driven by robust industrial automation in the U.S., OEM/ODM adoption of AI and advanced control systems, automotive and electronics manufacturing in Canada and Mexico, and supportive UL, ASTM, and FDA regulatory standards.

The digitization of industrial automation, combined with IoT integration and the expansion of the medical device segment, represents key growth opportunities.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author