ID: PMRREP30147| 195 Pages | 10 Jan 2026 | Format: PDF, Excel, PPT* | Industrial Automation

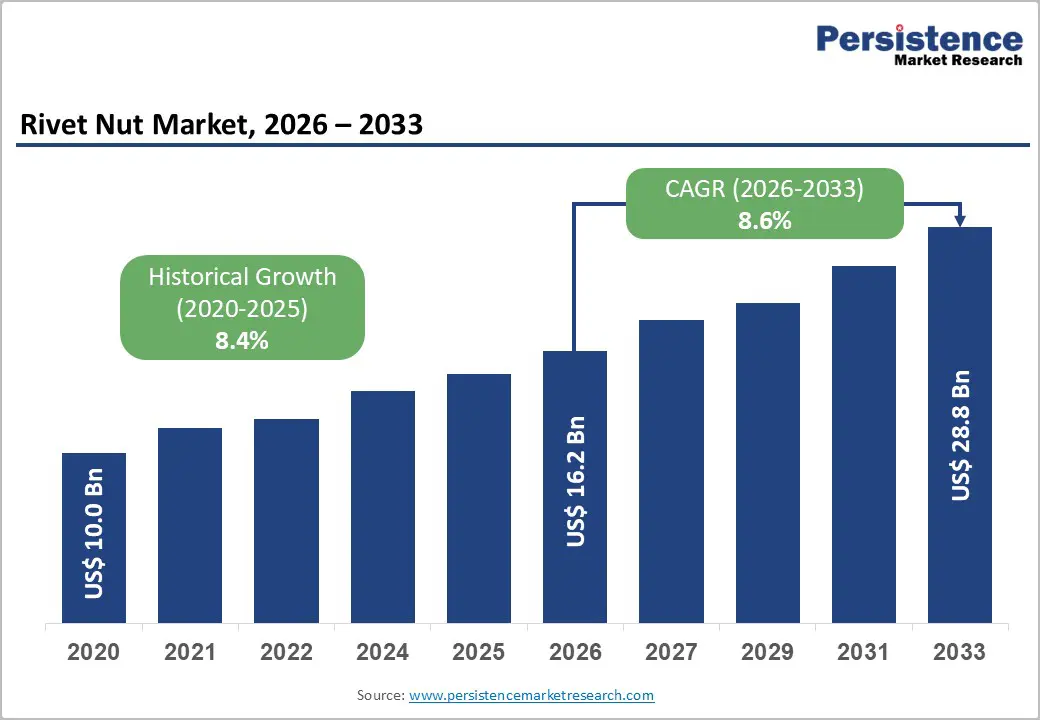

The global rivet nut market size is likely to be valued at US$16.2 billion in 2026 and is expected to reach US$28.8 billion by 2033, growing at a CAGR of 8.6% during the forecast period from 2026 to 2033, driven by the expansion of manufacturing activities in emerging economies, particularly across Asia Pacific, where industrialization and infrastructure development are progressing rapidly.

Technological advancements in rivet nut designs and automated installation tools are improving productivity, precision, and assembly-line efficiency, encouraging wider industrial usage. The gradual recovery and modernization of the construction, railways, and industrial equipment sectors are strengthening demand. Despite challenges such as raw material price volatility and competition from alternative fastening methods, the market outlook remains positive, supported by continuous innovation and diversified end-use applications.

| Key Insights | Details |

|---|---|

| Rivet Nut Market Size (2026E) | US$16.2 Bn |

| Market Value Forecast (2033F) | US$28.8 Bn |

| Projected Growth (CAGR 2026 to 2033) | 8.6% |

| Historical Market Growth (CAGR 2020 to 2025) | 8.4% |

Automotive manufacturers are increasingly integrating rivet nuts into their assembly lines for body-in-white structures, interior components, chassis assemblies, and specialized modules such as battery enclosures in electric vehicles (EVs). Rivet nuts offer critical advantages for mass production, including strong threaded joints in thin or lightweight materials, ease of installation from a single side, and compatibility with automated assembly systems. With the automotive industry emphasizing efficiency and reduced assembly time, rivet nuts help streamline manufacturing processes, minimize rework, and maintain consistent quality. North America and Europe see sustained demand due to advanced automotive production facilities, increasing EV output, and modernized assembly lines.

Light weighting trends in the automotive sector amplify demand for rivet nuts as manufacturers focus on reducing vehicle weight to improve fuel efficiency, lower emissions, and enhance performance, especially in electric and hybrid vehicles. Traditional welding and bolting methods are often unsuitable for lightweight metals such as aluminum alloys, high-strength steels, and composite materials due to challenges in thread formation and material deformation. Rivet nuts provide a reliable, strong, and reusable fastening solution without compromising the integrity of thin sheets or hybrid material assemblies. This has led to their widespread use in battery housings, structural panels, and modular components where precision and durability are critical.

In many applications, especially in automotive, electronics, and construction, these alternatives offer comparable mechanical strength, easier availability, or lower upfront costs, which can limit rivet nut adoption. Self-tapping screws are often preferred in low-volume or repair applications as they do not require pre-installed threaded inserts, reducing assembly steps. Advanced adhesives and bonding solutions provide uniform stress distribution and vibration resistance, making them attractive in aerospace and industrial machinery applications. In cost-sensitive segments of emerging markets, traditional bolting or welding methods remain dominant, as rivet nuts may require specialized tools and operator training.

The presence of alternative fastening solutions slows the pace of expansion in the rivet nut market, particularly in regions or industries where cost efficiency and simplicity are prioritized over installation speed and design flexibility. Automotive and industrial OEMs often evaluate trade-offs between installation time, material compatibility, and long-term durability, occasionally opting for conventional fasteners when rivet nuts are not strictly necessary. Emerging technologies such as laser welding, clinching, and advanced snap-fit mechanisms are gaining traction, especially in lightweight vehicle assemblies and modular industrial components. Rivet nut manufacturers are investing in R&D to improve performance through closed-end designs, lightweight aluminum variants for EVs, and automated high-speed installation tools.

Manufacturers are increasingly adopting corrosion-resistant and recyclable metals, such as aluminum and stainless steel, which reduce environmental impact while maintaining mechanical strength. The use of lightweight, eco-friendly materials aligns with sustainability goals and government regulations targeting reduced carbon emissions and improved energy efficiency. In EVs, for example, lightweight rivet nuts contribute to lower overall vehicle mass, enhancing battery efficiency and range. The aerospace sector favors high-performance, corrosion-resistant materials that meet strict safety and durability standards.

High-performance materials present additional opportunities for rivet nut growth by enabling applications in extreme environments and specialized industries. Nickel alloys, Monel, and high-strength stainless steels allow rivet nuts to withstand high temperatures, vibration, and chemical exposure, expanding their use in energy, marine, and aerospace sectors. These materials also support light-weighting initiatives while maintaining structural integrity, a critical factor for EVs and next-generation vehicles. Combining sustainable and high-performance materials allows manufacturers to target premium segments with value-added products that justify higher pricing. Ongoing R&D in coatings, composite compatibility, and hybrid metal designs enhances rivet nut versatility.

Open-end rivet nuts are expected to lead the rivet nut market, accounting for approximately 60% of total revenue in 2026, due to their versatility, cost-effectiveness, and ease of installation in general-purpose applications. These rivet nuts are widely used in the automotive and industrial sectors, where fasteners must be installed quickly and reliably on thin sheets or dissimilar materials. For example, in the automotive assembly of sedans and SUVs, open-end rivet nuts are commonly used to attach interior panels, chassis brackets, and door components, offering strong threaded joints without the need for rear-side access. Their compatibility with manual, pneumatic, and automated installation tools makes them particularly suitable for high-volume production lines, reducing labor time and minimizing installation errors.

Closed-end rivet nuts are likely to represent the fastest-growing segment in 2026. These rivet nuts are increasingly adopted in moisture-prone and outdoor environments, such as marine construction, electrical enclosures, and EV battery housings. For example, in EV battery pack assembly, closed-end rivet nuts provide secure, waterproof fastening points that protect sensitive components from corrosion, vibration, and environmental exposure. Their sealed design ensures long-term reliability, which is crucial for safety-critical applications. Regulatory requirements for waterproof assemblies in construction and industrial machinery have increased adoption. Closed-end variants are compatible with automation systems, allowing manufacturers to scale production efficiently while maintaining precision.

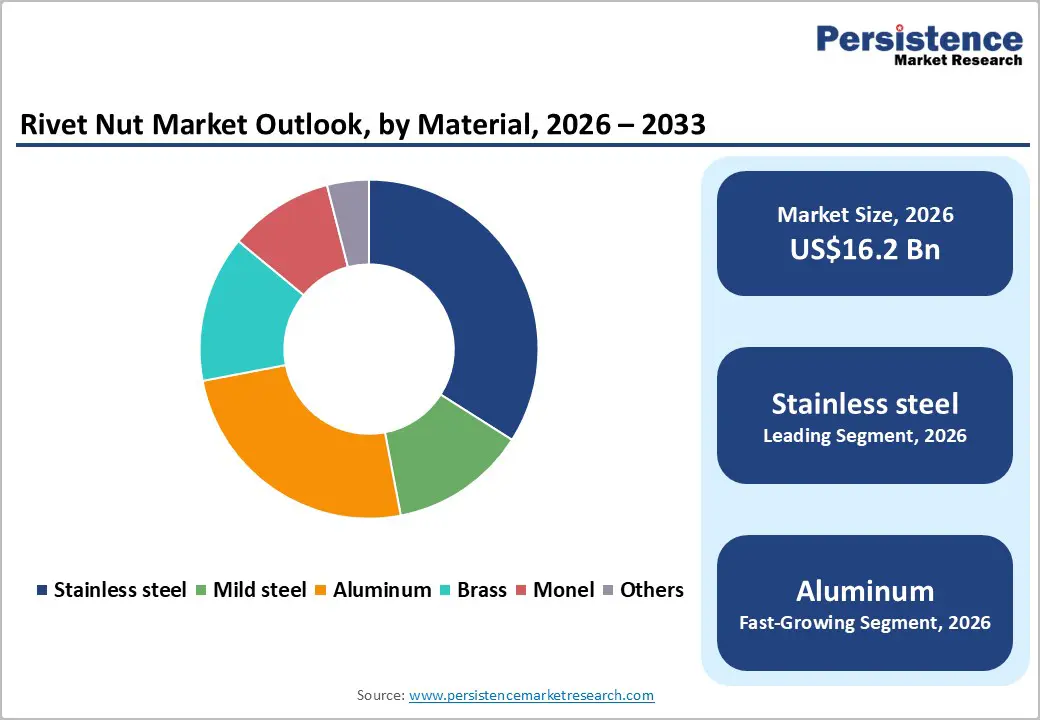

Stainless steel is projected to lead the market, capturing around 50% of the market share in 2026, owing to its exceptional corrosion resistance, mechanical strength, and suitability for demanding applications in the automotive, industrial machinery, and construction sectors. For example, in commercial vehicle manufacturing, stainless steel rivet nuts are widely used to fasten exterior body panels, protective guards, and structural brackets where exposure to road salts, moisture, and vibration is high. Their durability ensures long-term performance in harsh operating conditions, helping OEMs reduce maintenance and warranty costs. Stainless steel rivet nuts provide high torque capacity and resistance to fatigue, making them ideal for securing load-bearing components in heavy-duty trucks, trailers, and off-highway equipment.

Aluminum is likely to be the fastest-growing material in 2026, driven by light-weighting trends in automotive, aerospace, and industrial machinery applications. Aluminum rivet nuts are increasingly used in EVs to reduce overall vehicle weight, improve battery efficiency, and meet fuel-economy and emissions regulations. For example, in EV body panels and battery enclosures, aluminum rivet nuts provide strong threaded connections while reducing mass, enhancing vehicle performance and energy efficiency. Their corrosion resistance, ease of installation, and compatibility with automated assembly systems make them suitable for high-volume production. Lightweight aluminum rivet nuts also support the shift toward hybrid and composite materials, enabling manufacturers to optimize designs without compromising structural integrity.

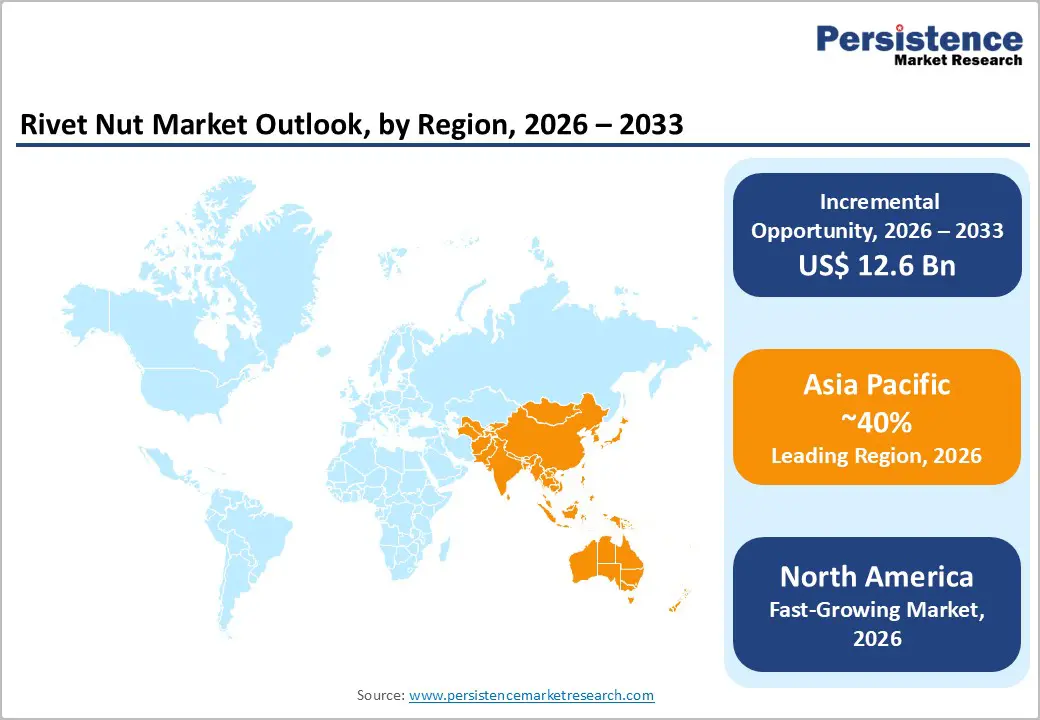

North America is likely to be the fastest-growing region in the rivet nut market, driven by robust demand from key end-use industries such as automotive, aerospace, and industrial machinery. Increasing production of EVs and stringent fuel-efficiency regulations are prompting OEMs to adopt lightweight and high-performance fastening solutions, increasing the use of rivet nuts made from aluminum and stainless steel. Rivet nuts are particularly suitable for blind fastening applications where access to the backside of assemblies is limited, such as in EV battery enclosures and chassis components. The shift toward automation, with manufacturers integrating rivet nut installation into high?speed assembly lines to enhance production efficiency and reduce labor costs.

In the aerospace sector, rivet nut suppliers are aligning product offerings with stringent industry standards for safety, durability, and corrosion resistance. For example, Stanley Engineered Fastening has been supplying specialized rivet nut solutions to major aerospace manufacturers, addressing requirements for high-strength and lightweight fasteners used in aircraft interiors and structural assemblies. The industrial machinery segment is witnessing increased adoption of rivet nuts in equipment frames, enclosures, and maintenance applications due to their versatility and ease of installation. The trend toward localized supply chains strengthened by on-shoring initiatives and resilience planning has encouraged major automotive and aerospace OEMs to partner with regional fastener manufacturers, reducing lead times and logistics costs.

Europe is expected to be a key market for rivet nuts in 2026, driven by strong demand from the automotive, industrial, and construction sectors, which are increasingly adopting lightweight and durable fastening solutions. OEMs across Germany, France, and the U.K. are integrating rivet nuts into electric and hybrid vehicle assemblies to help meet strict EU emissions and fuel-efficiency standards, particularly for battery enclosures, body panels, and structural components. Rivet nuts are increasingly preferred for blind fastening applications where access to both sides of the assembly is limited, enhancing assembly efficiency and reducing production costs. In industrial machinery, especially in metal fabrication and modular equipment, rivet nuts are valued for reliable thread formation in thin materials and composite joints, driving their adoption in applications requiring durability and high mechanical strength.

Major European fastening technology companies are expanding their rivet nut portfolios to cater to diverse industrial needs. For example, Bossard Group, a Swiss multinational fastener technology provider, strengthened its presence in Europe’s rivet nut market by acquiring Dejond Fastening NV, a Belgian manufacturer of blind rivet nuts, to offer high-quality fastening solutions and logistics support across regional automotive and industrial customers. Rising infrastructure spending and construction activity in Eastern Europe are driving demand for rivet nuts in structural applications.

The Asia Pacific region is expected to be the leading region, accounting for 40% in 2026, driven by countries such as China, India, Japan, and South Korea, which are increasingly adopting advanced fastening solutions across the automotive, aerospace, and industrial sectors. Rapid industrialization and urbanization in these economies are driving demand for rivet nuts, which are essential in assembling lightweight vehicle structures, battery housings, and industrial machinery, where blind fastening capability improves manufacturing efficiency. In the automotive segment, manufacturers are turning to rivet nuts to support the shift toward EVs and lighter body designs, responding to regulatory pressures for reduced emissions and improved fuel efficiency.

Asia Pacific’s market growth is also shaped by increasing investments in manufacturing capabilities and product innovation by local players operating in the region. Leading companies are enhancing their portfolios to meet diverse industry needs, such as developing rivet nuts from lightweight and high-performance materials to accommodate the demands of EV production and advanced industrial applications. For example, Huck Fasteners has expanded its presence in the Asia Pacific by offering engineered fastening solutions tailored to automotive and heavy equipment manufacturers, helping streamline assembly processes and improve joint reliability in high-volume production environments.

The global rivet nut market exhibits a moderately fragmented structure, driven by the presence of both established multinational corporations and numerous regional and specialized manufacturers competing across diverse end-use industries. Market participants vary in scale from large global players with extensive portfolios and distribution networks to smaller firms focusing on niche applications and price-competitive standard products. Innovation and product differentiation are key competitive levers, as manufacturers invest in R&D to develop high-performance rivet nuts that meet demanding industry requirements for strength, corrosion resistance, and compatibility with automated assembly systems.

With key leaders including Stanley Black & Decker through its Stanley Engineered Fastening division, Bollhoff Group, SFS Group AG, Sherex Fastening Solutions, and AVK Industrial Products, the competitive landscape is shaped by strategic R&D investments, geographic expansion, and value-added service offerings. These players compete through continuous product innovation, broader product portfolios tailored to specific industries such as automotive and aerospace, and partnerships with OEMs and Tier-1 suppliers to secure long-term supply contracts.

The global rivet nut market is projected to reach US$16.2 billion in 2026.

Increasing demand for lightweight, high-strength, and easy-to-install fastening solutions across automotive, aerospace, and industrial applications.

The rivet nut market is expected to grow at a CAGR of 8.6% from 2026 to 2033.

The adoption of lightweight and high-performance materials, growth in EVs and aerospace applications, increasing industrial automation, and expansion in emerging markets with rising infrastructure and manufacturing activities.

Acument Global Technologies Inc., Arconic Inc., Bulten AB, and STANLEY Engineered Fastening are the leading players.

| Report Attribute | Details |

|---|---|

| Historical Data | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Material

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author