ID: PMRREP36014| 211 Pages | 13 Jan 2026 | Format: PDF, Excel, PPT* | Packaging

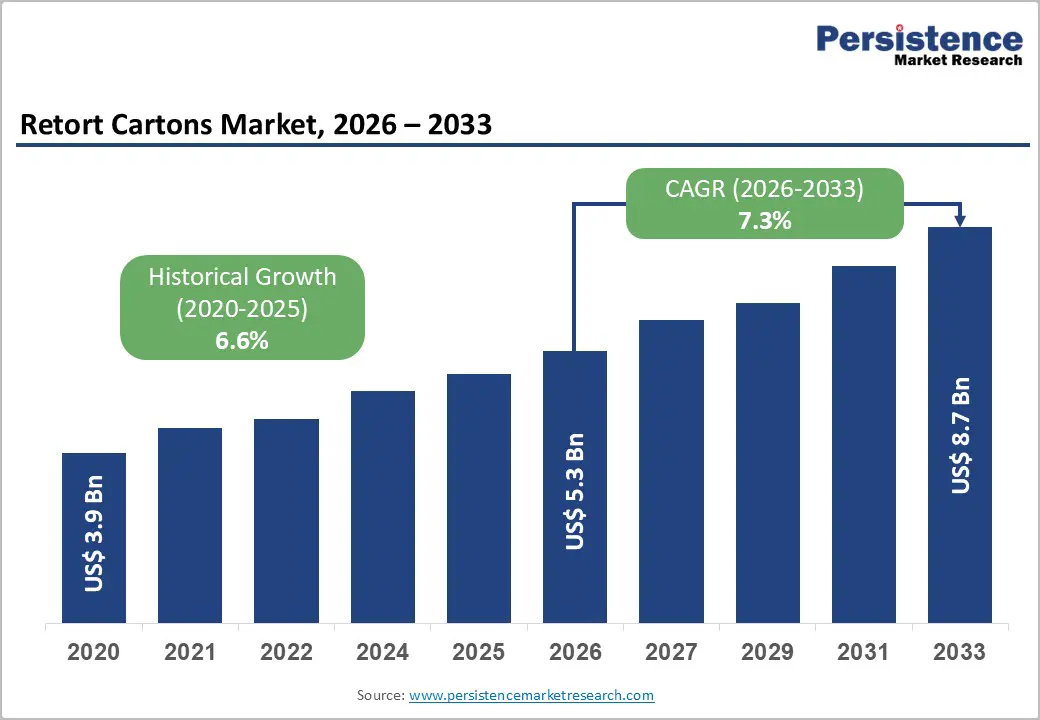

The global retort cartons market size is likely to be valued at US$5.3 billion in 2026 and is expected to reach US$8.7 billion by 2033, growing at a CAGR of 7.3% between 2026 and 2033, driven by increasing adoption of shelf-stable packaging solutions by food and beverage manufacturers seeking to balance convenience, product safety, and operational efficiency. Retort cartons are increasingly replacing metal cans and glass containers due to their lightweight design, improved shelf appeal, and suitability for high-temperature sterilization.

Continued investments in retort-compatible filling systems and advanced materials that preserve product quality are driving wider adoption, with the Asia Pacific emerging as the fastest-growing market due to expanding food processing capacity and strong demand for ready-to-eat and shelf-stable foods.

| Key Insights | Details |

|---|---|

| Retort Cartons Market Size (2026E) | US$5.3 Bn |

| Market Value Forecast (2033F) | US$8.7 Bn |

| Projected Growth (CAGR 2026 to 2033) | 7.3% |

| Historical Market Growth (CAGR 2020 to 2025) | 6.6% |

Demand for ready-to-eat meals and shelf-stable packaged foods continues to rise as urban lifestyles, longer working hours, and smaller household sizes reshape consumption patterns. Single-serve and portion-controlled formats are gaining preference, particularly in ready meals, baby food, soups, and pet food categories. The expansion of single-serve and multi-serve retort cartons in the 100-500 ml range increases per-unit value and supports premium pricing strategies. Foodservice-to-retail conversion, particularly for soups, sauces, and baby food, further increases volume throughput and justifies capital investment in retort filling lines. These shifts materially improve scale economics for manufacturers.

Ongoing improvements in barrier materials and filling technology are strengthening the technical viability of retort cartons across a broader range of food applications. Multilayer structures combining paperboard with polyester, aluminum foil, and polypropylene sealing layers deliver enhanced oxygen and moisture resistance while withstanding thermal sterilization cycles. At the same time, modern retort filling systems incorporating in-line sterilization and advanced sealing technologies reduce product loss and shorten validation timelines. These advancements lower the effective capital cost per SKU and enable faster commercialization of new products. As a result, brand owners can transition higher-margin canned and glass-packaged products into cartons, improving operational efficiency and return on investment.

Clear regulatory frameworks governing thermal processing and food packaging materials support broader adoption of retort cartons. Regulatory authorities recognize retort cartons as suitable containers for thermally processed foods when validated under approved sterilization parameters. This regulatory clarity reduces approval risk and accelerates time-to-market for new products. Manufacturers benefit from standardized validation protocols that streamline compliance across multiple geographies. As technical and regulatory risks decline, beverage and processed-food producers increasingly view retort cartons as a viable alternative to traditional packaging formats, supporting sustained market growth in both developed and emerging economies.

The implementation of retort carton packaging requires specialized filling equipment, sterilization systems, and validation capabilities. For small and mid-sized producers, the upfront capital investment and technical complexity can present significant barriers. Payback periods tend to lengthen when SKU volumes are limited, reducing investment attractiveness. Capital expenditure for retort-capable production lines typically ranges from mid-six-figure to low-seven-figure USD levels, depending on automation and capacity. This cost structure slows adoption among regional manufacturers and constrains short-term capacity expansion in price-sensitive markets.

Multilayer laminates required for retort performance complicate recycling due to the combination of paperboard, polymers, and aluminum. Recycling infrastructure capable of efficiently separating these materials remains inconsistent across regions. As environmental regulations tighten, manufacturers may face increased compliance costs through extended producer responsibility programs and packaging taxes. Investments in recyclable or mono-material alternatives could raise production costs in the near term, potentially slowing adoption among cost-focused brands.

Partial substitution of metal cans with retort cartons in pet food and prepared meal categories represents a substantial near-term opportunity. If only 10-15% of canned products transition to carton formats in mature markets by 2030, incremental demand could reach several hundred million USD in market value, depending on pack size mix. Retort cartons offer advantages in lightweighting, reduced logistics costs, and improved shelf differentiation. These benefits enable margin enhancement while supporting lower transportation emissions, making the format attractive to both retailers and consumers.

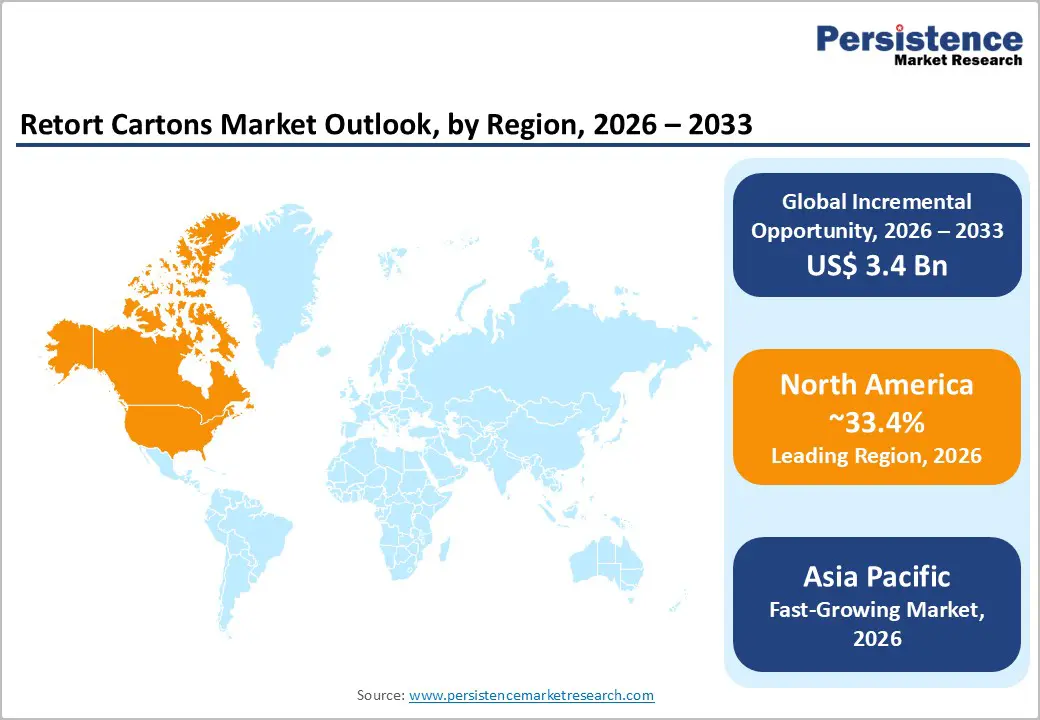

Asia Pacific is the fastest-growing regional market, driven by rapid urbanization, rising disposable incomes, and growing consumption of shelf-stable convenience foods. Competitive manufacturing costs and expanding filling capacity attract both global brands and regional co-packers. Strategic investments in production capacity, line modernization, and local material sourcing across China, India, and ASEAN countries can capture a disproportionate share of incremental global growth. Localized production shortens supply chains and enables faster product customization, strengthening competitive positioning.

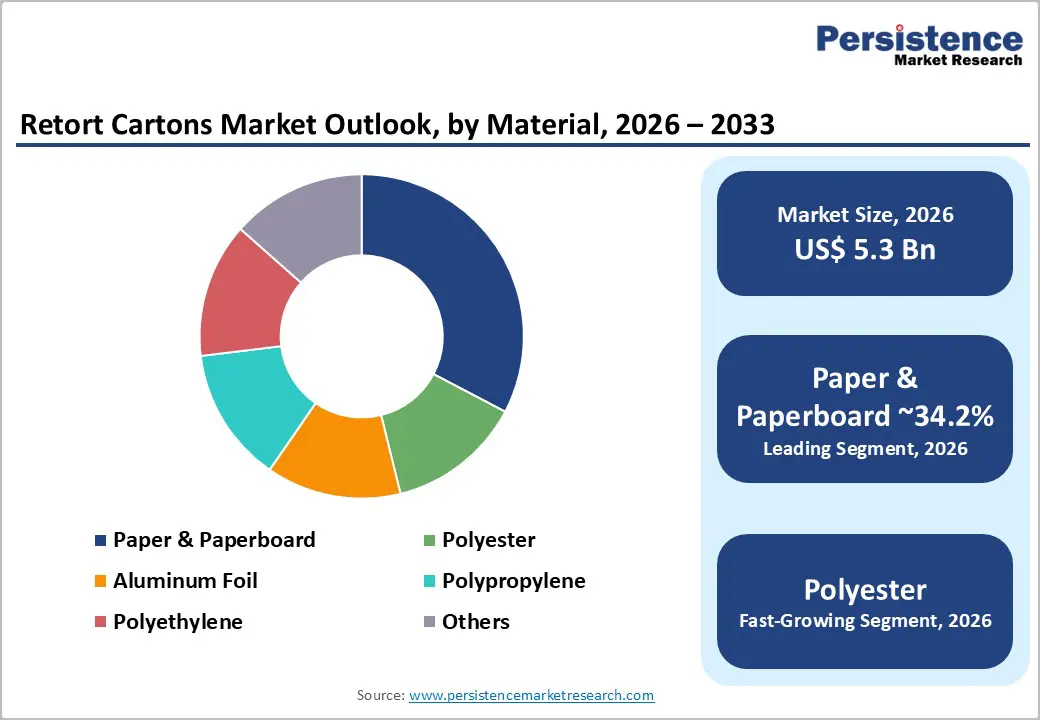

The paper and paperboard segment is expected to hold 34.2% market share in 2026, due to their strong structural integrity, excellent printability, and ability to incorporate advanced barrier coatings required for retort processing. These materials are widely used in beverage packaging and selected ready-to-eat food applications, where shelf visibility, brand communication, and sustainability perception directly influence purchasing decisions. Common examples include shelf-stable soups, dairy-based beverages, nutritional drinks, and baby food products packaged in brick-style cartons. Paperboard-based cartons offer substantial weight advantages over metal cans and glass containers, reducing transportation costs while enabling premium branding, matte finishes, and high-definition graphics that support product differentiation at retail.

Polyester laminates are emerging as the fastest-growing material segment, playing a critical role in multilayer retort carton structures. Polyester improves puncture resistance, dimensional stability, and thermal performance, making it suitable for high-temperature sterilization cycles required for shelf-stable foods. Its use enables thinner aluminum foil layers and hybrid laminate constructions without compromising barrier performance. These structures are increasingly adopted in retort cartons for ready meals, sauces, and pet food, where mechanical strength and seal integrity are essential. By reducing total material thickness while maintaining performance, polyester laminates support cost efficiency and align with material-reduction and lightweighting strategies pursued by packaging manufacturers.

Food applications are estimated to represent the largest share of 36.5% in 2026, due to high conversion potential from traditional metal cans, glass jars, and flexible pouches. Retort cartons are increasingly used for soups, sauces, baby food, broths, and complete meal components, where packaging aesthetics, portion flexibility, and ease of handling create strong consumer appeal. Examples include shelf-stable vegetable soups, puréed infant foods, curry bases, and ready-to-heat meal components. Brand owners favor retort cartons for their ability to deliver extended shelf life while supporting modern, premium packaging formats that enhance shelf presence and facilitate efficient logistics.

Ready-to-eat meals are likely to be the fastest-growing end-use segment as advancements in retort processing improve heat penetration control and product integrity in complex formulations. Enhanced processing techniques help preserve texture, flavor, and nutritional value in meals containing proteins, grains, and sauces. Retail expansion of convenience meal sections, particularly in urban supermarkets and e-commerce channels, is accelerating adoption. Product launches in categories such as single-serve rice meals, pasta dishes, ethnic cuisines, and protein-based meals are driving higher revenue contribution from this segment compared with traditional liquid and semi-liquid packaging applications.

North America represents the largest regional market, accounting for approximately 33.4% of the market share in 2026, driven by strong consumption of premium shelf-stable foods, ready meals, and pet food products. The U.S. leads the region due to its advanced food processing infrastructure, high penetration of co-packers, and early adoption of alternative packaging formats. Canada contributes through sustainable packaging initiatives and premium private-label food offerings, while Mexico supports niche growth through cost-competitive manufacturing and proximity-based exports to the U.S. market. Growth in the region is primarily driven by conversion from metal cans to lightweight cartons, retail premiumization, and logistics optimization across long-distance distribution networks. Major food brands such as Campbell Soup Company, Hormel Foods, and Nestlé USA have expanded shelf-stable meal and broth portfolios, encouraging packaging suppliers to scale retort carton compatibility. In the pet food segment, companies such as Mars Petcare and General Mills (Blue Buffalo) continue to shift toward portion-controlled, shelf-stable wet formats that favor carton-based solutions.

Clear regulatory frameworks under the U.S. Food and Drug Administration (FDA) and Health Canada support faster product validation and commercialization compared with emerging markets. Investments in retort filling lines, aseptic-retort hybrid technologies, and small-format cartons are strengthening regional supply resilience. Packaging producers such as Tetra Pak and SIG have expanded technical service capabilities and pilot facilities in the U.S., reinforcing North America’s position as the global innovation and commercialization hub for retort cartons.

Europe represents a mature but strategically important market, characterized by high consumption of processed and convenience foods, strong sustainability mandates, and advanced packaging regulations. Germany, the U.K., France, and Spain lead regional adoption, supported by well-established food manufacturing ecosystems and a strong private-label retail culture. Retort cartons are increasingly used for soups, sauces, baby food, and plant-based meals, where shelf life, portion flexibility, and premium shelf presentation are critical. Regulatory harmonization across the European Union enables cross-border product launches and standardized packaging compliance, reducing commercialization risks for brand owners. Policies such as the EU Packaging and Packaging Waste Regulation (PPWR) and extended producer responsibility (EPR) schemes directly influence material selection, accelerating the shift toward paperboard-heavy and recyclable laminate structures. Retailers such as Tesco, Carrefour, and Aldi have expanded shelf-stable ready meal and soup offerings, encouraging suppliers to adopt carton formats with improved recyclability credentials.

Investment activity in Europe focuses on recyclable barrier technologies, aluminum-reduction strategies, and lower-carbon paperboard substrates. Packaging companies, including Stora Enso, Elopak, and SIG, have announced upgrades to paper-based barrier coatings and renewable material sourcing across European operations. These developments support Europe’s dual objective of maintaining food security while meeting aggressive climate and circular economy targets, positioning the region as a global benchmark for sustainability-driven retort carton innovation.

Asia Pacific is the fastest-growing regional market for retort cartons, supported by rapid urbanization, rising disposable incomes, and modernization of retail and food distribution systems. China, Japan, India, and key ASEAN economies drive demand across ready-to-eat meals, soups, snacks, and pet food. Changing lifestyles, longer working hours, and increased demand for convenient, shelf-stable foods are accelerating the adoption of retort packaging formats that offer portability and extended shelf life. Local manufacturing expansion and export-oriented production play a central role in regional growth. Multinational brands such as Nestlé, Unilever, and Ajinomoto continue to expand shelf-stable meal and culinary product lines tailored to regional tastes. In China and Japan, retort cartons are increasingly used for premium soups, broths, and functional beverages, while in India and Southeast Asia, adoption is rising in curries, gravies, and single-serve meal bases. Packaging suppliers including Tetra Pak and SIG have expanded production capacity and technical centers in China and Southeast Asia to support regional demand.

Foreign direct investment and government support for food processing infrastructure accelerate capacity growth across the region. Despite regulatory complexity and country-specific compliance requirements, standardized thermal validation protocols and alignment with international food safety standards enable both regional and global market access. These factors position Asia Pacific as the primary volume growth engine for the global retort cartons market over the forecast period.

The global retort cartons market is moderately concentrated, led by integrated system providers supplying cartons, barrier materials, and filling equipment. A long tail of regional converters and co-packers supports localized production and niche applications. Market leadership is defined by technical validation capability and end-to-end solution offerings.

Key strategies include technical differentiation through validated retort systems, cost optimization via localized production, and sustainability-driven material innovation. Integrated solutions that reduce time-to-market and secure long-term supply agreements remain a competitive advantage.

The retort cartons market is valued at US$5.3 billion in 2026.

By 2033, the retort cartons market is expected to reach US$8.7 billion.

Key trends include rising demand for shelf-stable convenience foods, increased replacement of metal cans with paper-based cartons, innovation in barrier laminates compatible with high-temperature sterilization, growth of small-format and single-serve packs, and expanding retort filling capacity in Asia Pacific and North America.

The food end-use segment is the leading category, accounting for 36.5% market share, driven by strong uptake in soups, sauces, baby food, and shelf-stable ready meals.

The market is projected to grow at a CAGR of 7.3% between 2026 and 2033.

Major players include Tetra Pak, SIG Combibloc, Elopak, Amcor, and Greatview Aseptic.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Material

By Application

By Capacity

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author