ID: PMRREP35925| 199 Pages | 1 Dec 2025 | Format: PDF, Excel, PPT* | Energy & Utilities

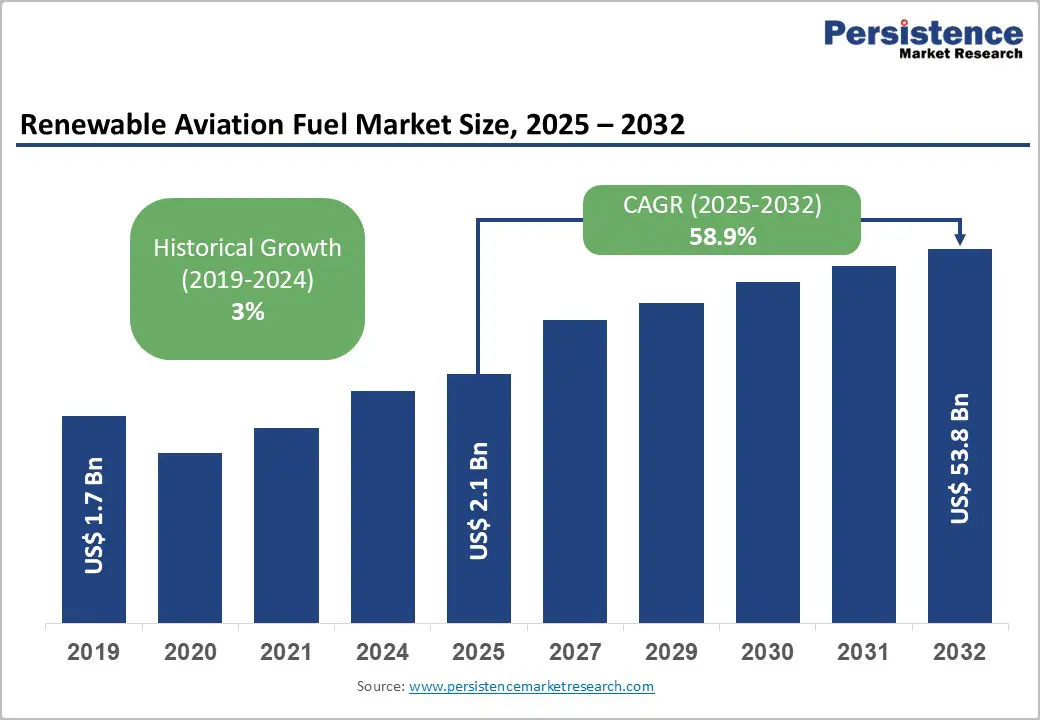

The global renewable aviation fuel market size is likely to be valued at US$2.1 Billion in 2025, and is estimated to reach US$53.8 Billion by 2032, growing at a CAGR of 58.9% during the forecast period 2025 - 2032, driven by national emissions mandates, aggressive decarbonization targets, and surging airline demand for sustainable solutions.

This growth is driven by blending quotas, expanding SAF infrastructure, and new feedstock options. Airlines are increasingly adopting SAF to reduce carbon risks, motivated by regulatory penalties and voluntary offset programs. The shift toward renewable aviation fuels reflects rising policy pressure, technological progress, and new market entrants.

| Key Insights | Details |

|---|---|

| Renewable Aviation Fuel Market Size (2025E) | US$2.1 Bn |

| Market Value Forecast (2032F) | US$53.8 Bn |

| Projected Growth (CAGR 2025 to 2032) | 58.9% |

| Historical Market Growth (CAGR 2019 to 2024) | 3% |

Policy incentives from governments and supranational bodies are catalyzing investment in renewable aviation fuels. For example, the U.S. Inflation Reduction Act provides a SAF tax credit of US$1.25/gallon plus additional credits for lifecycle GHG reduction, which can cause a marked acceleration of SAF production projects.

Similarly, the European Union (EU)’s ReFuelEU Aviation mandate requires fuel suppliers to blend increasing amounts of SAF, starting at 2% in 2025 and scaling to 70% by 2050. At the global level, the CORSIA program of the International Civil Aviation Organization (ICAO) is imposing global emissions monitoring and supporting international adoption.

These measures are lowering entry barriers, spurring multibillion-dollar investments in new bio-refineries, and encouraging partnerships between airlines, refiners, and feedstock suppliers. They are also driving rapid market scale-up by guaranteeing long-term demand and facilitating financial close for large-scale projects.

The SAF market confronts significant near-term risks from constrained feedstock supply and complex logistics. Used cooking oil (UCO) and tallow represent the leading feedstock, but geographic unevenness and regulatory hurdles, such as the EU’s RED II anti-fraud frameworks, have created uncertainty for sourcing and certification.

Biofuel producers face volatile pricing, while alternative feedstock sources such as lignocellulosic biomass face slow commercial maturity and high conversion costs. Transport infrastructure limitations, especially cold chain and bulk storage for low-volume feedstock, raise CAPEX and OPEX burdens.

Supply chain risks are further amplified by the limited availability of dedicated bio-refining facilities, often resulting in bottlenecks and sub-scale production runs. These systemic barriers require strategic feedstock diversification and robust traceability frameworks.

The rapid maturation of power-to-liquids (PtL) technology offers a transformative growth opportunity. PtL enables the production of e-kerosene from captured CO2 and renewable electricity, addressing both feedstock scarcity and carbon emissions. This technology is making notable headway in the renewable aviation fuel market, catalyzed by falling renewable energy costs and expanding hydrogen availability.

The EU is providing heavy funding for PtL innovation through the Horizon Europe initiative, with the first commercial e-fuel plants in Germany and Norway slated to come online by 2026. Airlines aiming for net-zero status are partnering with fuel innovators, providing offtake agreements and joint development capital. PtL’s scalability, grid interconnection, and carbon reduction profile position it as the next major driver of SAF adoption and investment prioritization.

Biofuels dominate the renewable aviation fuel market landscape in 2025, capturing approximately 78% of the revenue share. This leadership position reflects the segment's commercial maturity, regulatory certainty, and operational compatibility with existing aviation infrastructure.

Biofuel-derived SAF is produced through well-established conversion pathways, most prominently HEFA-SPK, which converts renewable feedstock into drop-in jet fuel meeting ASTM D7566 specifications. Airlines operating biofuel SAF blends report seamless integration with existing turbine engines without mechanical modifications, reducing transition risks and operational complexity.

Major carriers, including American Airlines, Lufthansa, and Singapore Airlines, have secured multiyear offtake contracts for biofuel SAF, signaling confidence in feedstock availability and supply chain stability. Regulatory frameworks across the U.S., the EU, and Asia Pacific mandate biofuel blending thresholds, guaranteeing sustained demand through 2030.

Synthetic fuels, particularly PtL and e-kerosene, represent the fastest-expanding fuel category through 2032. This segment is accelerating rapidly as renewable energy costs decline and regulatory support intensifies. PtL technology converts renewable electricity and captured CO2 into synthetic kerosene through advanced chemical processes, such as Fischer-Tropsch synthesis, circumventing traditional feedstock constraints.

The EU is investing heavily in PtL infrastructure, with Germany's INERATEC commissioning Europe's largest commercial e-fuel plant, ERA ONE, in 2025, capable of producing 130,000 tons annually. Airlines and corporate aircraft operators are bidding aggressively for e-fuel offtake contracts, viewing PtL as a long-term decarbonization pathway without agricultural land-use constraints.

UCO and waste animal fats dominate, representing 85% of the renewable aviation fuel market revenue share in 2025. The growth of this segment is rooted in the abundant supply from the food industry, established collection and logistics infrastructure, and attractive sustainability metrics.

The EU's ReFuelEU Aviation mandate and advanced biofuel classification provide strong regulatory incentives, with sustainability certification frameworks, such as RSPO and ISCC, ensuring traceability and environmental credibility.

Energy majors such as Neste and World Energy have established long-term contracts with municipal waste treatment facilities, food processing companies, and restaurants, securing feedstock predictability. As a result, UCO-based SAF production is forecast to grow rapidly, driven by expanded collection networks, regulatory compliance investments, and airline demand.

Renewable electricity and green hydrogen are emerging as the fastest-growing feedstocks, owing to PtL technology adoption and accelerating renewable energy deployment. This segment is transitioning from pilot projects to commercial-scale manufacturing, with an anticipated CAGR of 54% through 2032.

PtL feedstock economics are improving dramatically due to a decline in solar PV costs in favorable geographies and increasing price competitiveness in wind power. Green hydrogen, produced via water electrolysis powered by renewables, is the intermediate energy carrier for PtL synthesis.

Current hydrogen production costs are declining, as electrolyzer manufacturing scales and renewable electricity contracts mature. The aviation sector's net-zero commitments are accelerating PtL feedstock development, with the ICAO's CORSIA program and voluntary corporate pledges creating demand certainty.

HEFA-SPK technology commands 68% of the SAF market revenue share in 2025, attributable to its commercial maturity and long operational history, existing refinery compatibility, modest capital requirements, and ASTM D7566 approval for up to 50% jet fuel blending. The HEFA process involves hydrogenation of fatty acid esters and triglycerides to produce saturated hydrocarbons, followed by isomerization and distillation to meet jet fuel specifications.

HEFA technology is deployed widely across commercial-scale facilities worldwide, generating massive volumes of SAF globally. Capital intensity for HEFA plants is also significantly lower than alternative conversion pathways, making it an attractive investment option for SAF market players. Airlines favor HEFA-SPK due to regulatory certainty and minimal engine modification requirements, further promoting this segment.

FT-SPK represents the fastest-growing segment through 2032. FT-SPK converts synthesis gas (syngas), a mixture of carbon monoxide and hydrogen derived from biomass, waste, captured CO2, or coal, into synthetic paraffinic kerosene via the Fischer-Tropsch catalytic process. FT-SPK's competitive advantages include feedstock flexibility, process scalability, and superior lifecycle carbon reduction when powered by sustainable feedstock.

FT-SPK's modular design also enables deployment in waste-abundant regions, decoupling SAF production from geographically concentrated feedstock sources. Technology maturation is progressing rapidly, with the technical versatility and scalability of FT-SPK serving as a cornerstone of long-term, high-volume SAF production.

North America is driven by strong regulatory incentives such as the Inflation Reduction Act's tax credits, extensive aviation infrastructure, and robust capital markets, attracting significant venture and equity investment. The U.S. dominates regional capacity, with major production hubs in the Gulf Coast, California, and the Midwest, supported by significant investments from key producers such as World Energy, Gevo, and Neste targeting substantial capacity expansion.

Leading airlines have committed to large SAF purchases, backed by streamlined U.S. regulatory approvals and government initiatives aimed at scaling production. Canada and Mexico are emerging players, leveraging biomass and agricultural feedstock to support SAF development.

The regional market growth is characterized by policy stability, increasing airline demand for sustainable fuels, ongoing technological innovations in PtL and Fischer-Tropsch processes, and secure feedstock supply from agricultural and waste streams. The regulatory framework includes the U.S. Environmental Protection Agency (EPA)’s Renewable Fuel Standard and state-level incentives, complemented by ICAO’s emissions monitoring programs.

The market is moderately consolidated among established firms, with new entrants advancing innovative pathways such as alcohol-to-jet and carbon capture fuels, while investments from major energy companies increase, underscoring strong sector confidence and growth potential.

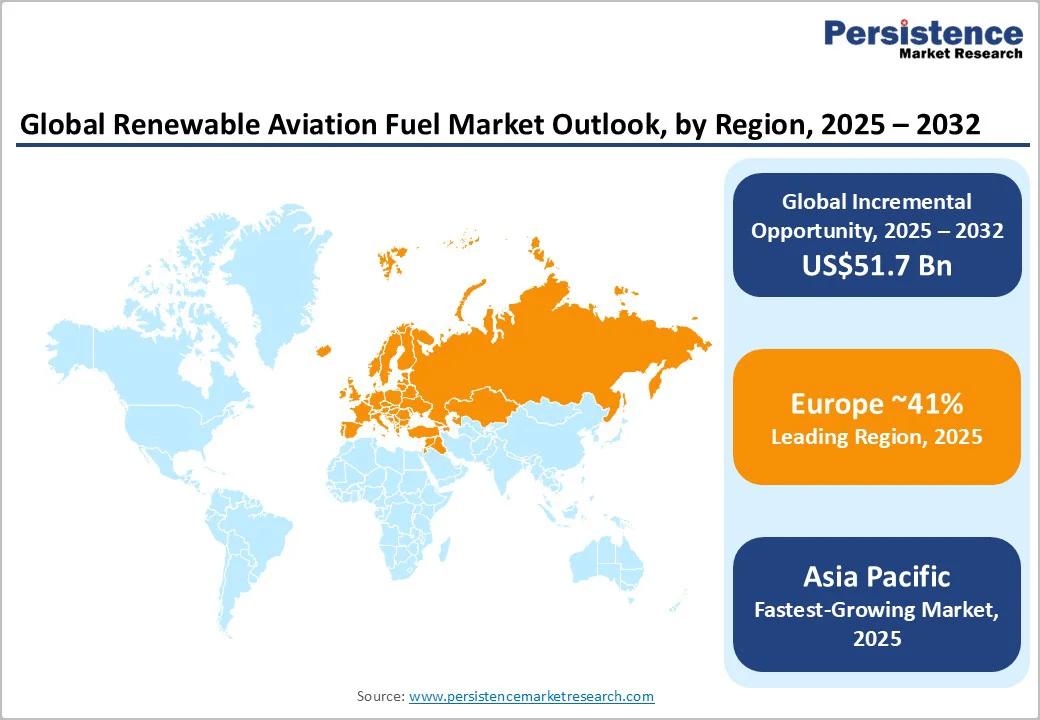

Europe leads the renewable aviation fuel market in 2025, holding 41% of revenue and acting as the main hub for innovation and policy leadership driven by ambitious climate commitments and a comprehensive regulatory framework, including ReFuelEU Aviation and Fit for 55. Germany is the regional production leader with strong support for PtL technology, advanced renewable electricity infrastructure, and active SAF procurement by carriers such as Lufthansa.

The Netherlands is a key SAF producer, leveraging Rotterdam’s logistics and established supply chains, while the U.K., France, Spain, Italy, and Scandinavian countries are rapidly expanding production capacities and technology adoption.

Europe’s regulatory environment is the most rigorous globally, emphasizing lifecycle emissions assessments, anti-fraud measures, and sustainability traceability, with additional support from EU funding programs such as Horizon Europe.

The region’s competitive market is more fragmented than North America’s, featuring multiple regional producers and strategic airline-producer alliances that consolidate demand. Strong government and institutional investments underscore Europe’s leading role in driving demand growth and infrastructure development for sustainable aviation fuels.

Asia Pacific represents the fastest-growing regional market for renewable aviation fuel, driven by rapidly expanding aviation demand, abundant feedstock resources, emerging policy support, and manufacturing cost advantages. China is establishing regional dominance through state-backed investments in SAF conversion capacity, agricultural waste utilization, and airport blending programs, while major carriers implement supply contracts.

Japan leads in technology innovation and efficiency, with carriers pioneering SAF adoption and technology conglomerates advancing advanced conversion methods, though domestic feedstock supply requires regional imports. India is an emerging frontier with rapidly expanding aviation demand and agricultural feedstock potential, supported by government biofuel initiatives and strategic partnerships with global producers.

Southeast Asian countries position themselves as feedstock hubs with significant used cooking oil and palm oil resources, while carriers commit to SAF adoption despite slower infrastructure development due to capital constraints.

South Korea and Australasia are developing niche roles focused on technology innovation and renewable energy-driven e-fuel production. The regulatory environment remains heterogeneous across the region, lacking unified frameworks comparable to Europe, though policy convergence is gaining momentum.

The global renewable aviation fuel market structure is moderately consolidated with several key players dominating, such as Neste Oyj, World Energy, LanzaTech, Gevo, and SkyNRG.

These companies leverage their technological expertise, long-term feedstock agreements, and airline partnerships to maintain competitive advantages. While mature technologies such as HEFA-SPK drive most current production, emerging processes such as Fischer-Tropsch and Power-to-Liquids are gaining traction, encouraging technological diversification and innovation.

The industry is witnessing strategic partnerships between airlines and producers, aligning long-term supply and demand to reduce investment risks.

Although barriers such as high capital costs and feedstock supply constraints exist, regulatory support and demand for sustainable fuels are fostering market growth. The competitive landscape is expected to evolve with consolidation among mid-tier firms, regional specialization, and technology-driven disruptions, creating a dynamic yet progressively mature market environment.

The global renewable aviation fuel market is projected to reach US$2.1 Billion in 2025.

National emissions mandates, aggressive corporate decarbonization targets, and surging airline demand for sustainable solutions are driving the aviation fuel market.

The aviation fuel market is poised to witness a CAGR of 58.9% from 2025 to 2032.

The implementation of blending quotas, escalating investment in sustainable aviation fuel infrastructure, and emerging feedstock alternatives are key market opportunities.

Neste Oyj, World Energy LLC, and LanzaTech Global are some of the key players in the aviation fuel market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Fuel Type

By Feedstock

By Technology

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author