ID: PMRREP25243| 198 Pages | 29 Oct 2025 | Format: PDF, Excel, PPT* | Industrial Automation

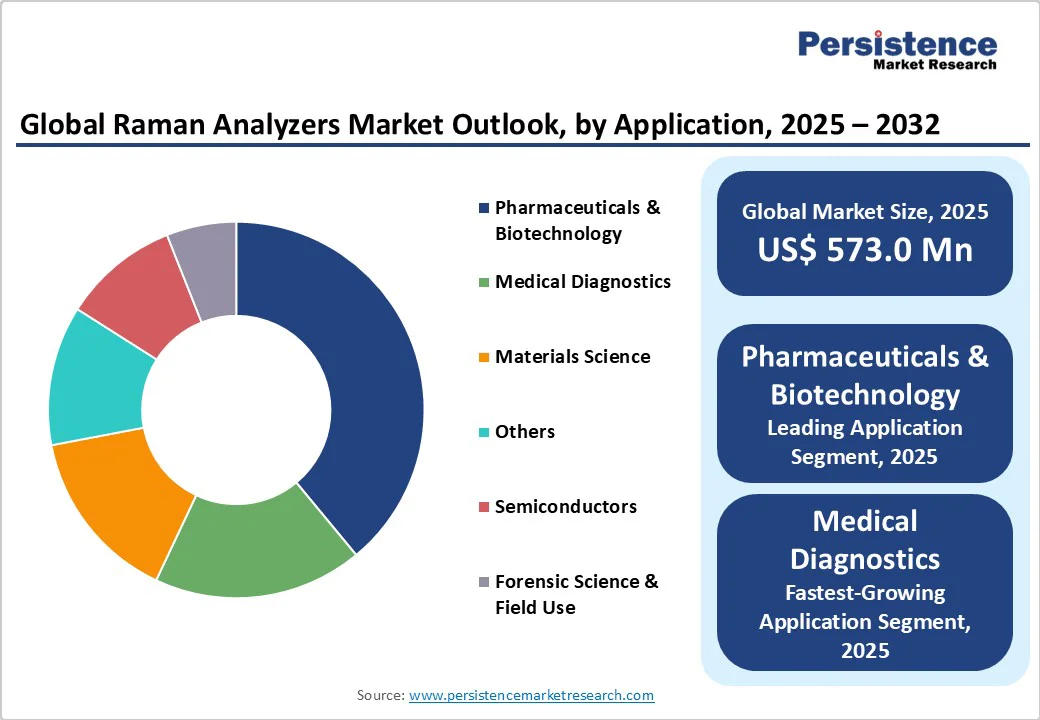

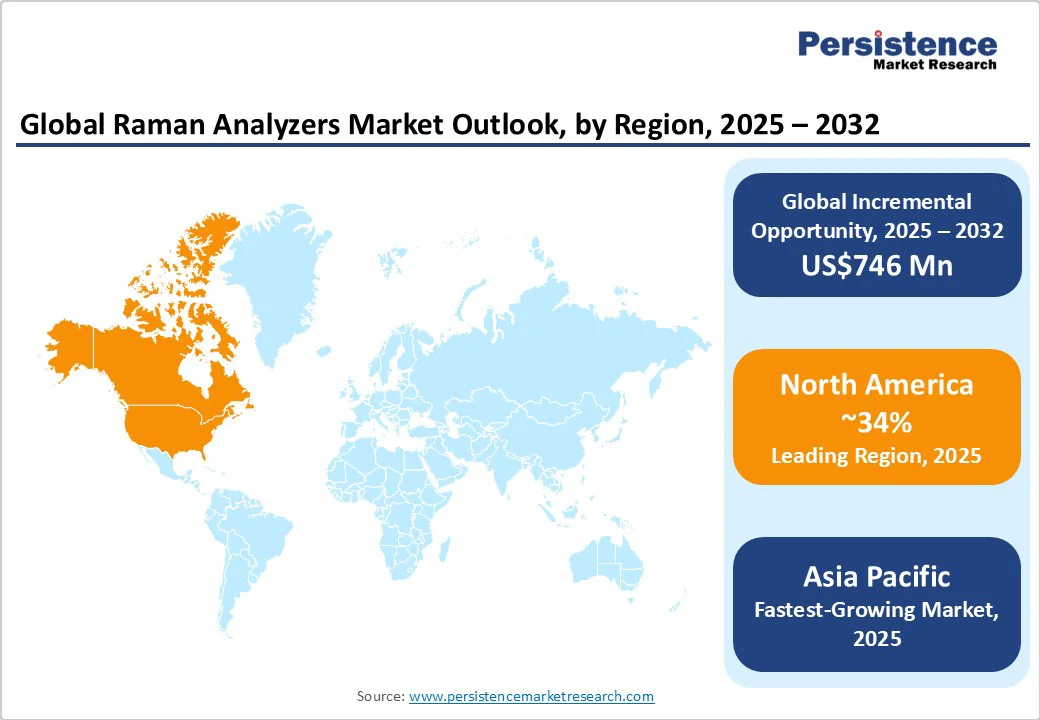

The global Raman analyzers market size is likely to be valued at US$573.0 Million in 2025, and is estimated to reach US$1,319.0 Million by 2032, growing at a CAGR of 7.4% during the forecast period 2025−2032, driven by growing demand for non-destructive, label-free analytical solutions across pharmaceuticals, biotechnology, and advanced materials research. Market growth is driven by the adoption of advanced portable and benchtop Raman devices and the integration of AI and ML for real-time process analytics, particularly in pharmaceutical authentication and life sciences. North America holds a 34% share, while Asia Pacific is the fastest-growing region, supported by manufacturing strengths and rising R&D investments.

| Key Insights | Details |

|---|---|

|

Raman Analyzers Market Size (2025E) |

US$573.0 Mn |

|

Market Value Forecast (2032F) |

US$1,319.0 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

7.4% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.8% |

Advanced integration of machine learning and AI into Raman spectroscopy workflows represents the most transformative niche driver currently shaping the market environment. AI-enhanced Raman analyzers enable high-throughput analysis, automate peak identification, and resolve complex spectra with over 95% accuracy in pharmaceutical polymorph recognition.

According to the American Chemical Society, the U.S. Food and Drug Administration (FDA)’s Process Analytical Technology (PAT) mandates have catalyzed a 37% increase in industry deployment of Raman/AI platforms from 2019 to 2024. These systems improve operational efficiency, minimize human error, and support near real-time decision-making on pharmaceutical production floors, significantly lowering regulatory non-compliance risk. In biomedical applications, AI-driven Raman systems are being deployed for cancer diagnostics, providing sensitivity rates exceeding 85% in differentiating diseased versus healthy tissues, as per NIH reports. Such precision analytics are being adopted for in-line monitoring across high-growth verticals.

Despite rapid technological advancements, product adoption remains visibly limited because of the high upfront investment and operational complexities associated with Raman analyzers. The average acquisition cost for high-performance Raman systems exceeds US$80,000 per unit, according to OECD estimates, restricting access for academic labs and small & medium businesses (SMBs), especially in developing economies.

Lifecycle expense further includes calibration, maintenance, and periodic upgrades, factors that significantly increase the total ownership costs. Operationalization also demands skilled personnel, which is an ongoing challenge, given the global shortage of spectroscopy specialists. This complexity further hampers market penetration and scalability, especially in resource-strapped environments.

The convergence of nanotechnology and Raman analytics is creating highly lucrative opportunities within high-growth sectors like semiconductors and advanced materials. Raman analyzers offer label-free, real-time molecular characterization of carbon nanostructures, graphene, and novel composite materials, a capability increasingly valued by electronics manufacturers and research institutions.

Advanced features such as spatial chemical mapping and strain/stress monitoring, only possible with high-resolution Raman analyzers, are enabling material scientists to optimize yield, reduce defect rates, and accelerate product development cycles. The addressable market for nano-enabled Raman analytics promises high potential over the next decade. Regulatory initiatives, such as the European Union (EU)'s Horizon Europe grants, and private sector investments are projected to drive volume growth, particularly in Asia Pacific and Europe.

Benchtop analyzers currently dominate with an estimated 2025 market share of 46%, attributable to their high sensitivity, resolution, and widespread adoption in pharmaceutical R&D and materials research labs. These units provide robust analytical performance for complex chemical and biological samples, offering superior data quality for industrial QC and academic settings.

Portable and handheld Raman analyzers are witnessing the fastest growth, posting a notable 2025–2032 CAGR on the strength of their application in pharmaceuticals authentication, food safety, and security screening. The proliferation of these devices is closely tied to ongoing miniaturization and software-driven advancements, enabling field analysts and production staff to conduct rapid, on-site validation. Technological progress in detector sensitivity and user-friendly interfaces is facilitating cross-sectoral expansion, promising disruptive change in industry practices as their adoption rates rise.

Surface-Enhanced Raman Scattering (SERS) techniques are the leading sampling technique, expected to capture approximately 33% of the Raman analyzers market revenue share in 2025. The prominence of this technique is primarily due to its critical role in life sciences, especially for single-molecule detection, cancer research, and antimicrobial surveillance. SERS delivers up to 106-fold signal enhancement, granting unprecedented sensitivity for early disease detection and biomarker identification.

Confocal Raman microscopy is projected as the fastest-growing sampling technique, with a sizeable CAGR of about 18% through 2032, underpinned by its spatial mapping capability for composite materials and cellular studies. These developments are being supported by advancements in micron-scale imaging hardware and algorithmic data analysis, which allow researchers to unlock complex molecular patterns and map chemical heterogeneity with precision, driving vertical market expansion in pharmaceuticals, semiconductors, and nanotechnology.

The pharmaceuticals & biotechnology segment is slated to remain the commanding applications, representing approximately 39% of the market in 2025, due to pervasive investment in drug development, API characterization, and manufacturing quality assurance. Raman spectroscopy is now standard for verifying raw materials and detecting counterfeit drugs, responding to increased regulatory scrutiny and the demand for efficient PAT workflows.

The medical diagnostics segment is set to record the fastest growth with a staggering CAGR hovering around 20% through 2032, driven by adoption in early cancer screening, pathogen detection, and real-time tissue analysis during surgery. Biotech labs and healthcare providers are increasingly leveraging Raman’s label-free, non-invasive molecular detection to enhance diagnostic speed and accuracy, supported by ongoing R&D investment in SERS and hyperspectral imaging modalities.

North America is expected to hold its leadership position, representing a projected 34% of the Raman analyzers market share in 2025. The U.S. is central to this growth, supported by intensive pharmaceutical and biotechnological R&D, and regulatory frameworks that encourage Raman-based PAT. The region’s dominant position is reinforced by NIH, FDA, and private sector investments, notably the US$530 Billion directed toward pharmaceutical innovation in 2024.

University research institutions and defense agencies are major users, driving a highly consolidated competitive landscape dominated by global leaders such as Thermo Fisher Scientific, Bruker, and Renishaw. Accelerated market expansion is imminent as AI-based automation and cloud-linked analytical platforms become more prevalent. The regulatory environment and market entry barriers remain favorable for innovation, with next-generation drug authentication and real-time monitoring attracting substantial venture funding and strategic partnerships.

Europe is anticipated to be the second-largest regional market for Raman analyzers with an estimated 33% share in 2025. Germany leads in both instrument deployment and process applications, complemented by growing adoption in the U.K. and France within research, healthcare, and food safety domains.

The harmonization of regulatory standards, such as REACH and EU Horizon funding, serves as a catalyst for advanced technology uptake and sustainability-driven quality control. EU grants and sectoral association programs are actively stimulating upgrades in Raman instrumentation and analytical workflows across manufacturing, environmental safety, and chemical analysis. The exceptional growth rate of the regional market for 2025–2032 will be shaped by further collaboration among large enterprises, SMEs, and academic innovators, particularly in integrated quantum and hyperspectral platforms.

Asia Pacific is predicted to register the highest growth rate, with an outstanding forecast CAGR of 18% through 2032 and a projected 28% market share in 2025. Market expansion is fueled by China’s and Japan’s investments in manufacturing, research infrastructure, and next-generation analytical systems, while India and ASEAN economies are accelerating Raman analyzer adoption for commercial QC, healthcare, and academic research. Government policy measures and state-led initiatives, such as Made in China 2025 and Digital India, continue to boost R&D spending and improve access to advanced instruments.

The regional regulatory landscape is also evolving to align with global compliance, safety standards, and interoperability, driving end-users toward more robust solutions. Investments in manufacturing localization, R&D partnerships, and technology transfer agreements are fostering innovation and enabling Asia Pacific to be the key engine of Raman analyzers market growth through 2032.

The global Raman analyzers market exhibits a semi-consolidated structure, with the five largest companies controlling approximately 46% of total revenue in 2025. The main multinational players, Thermo Fisher Scientific, Renishaw, and Bruker, command sectoral leadership in high-end, research-intensive, and regulatory-driven verticals.

Mid-sized and specialized developers such as B&W Tek, Kaiser Optical, and Smiths Detection are advancing technical innovation within portable analyzers, real-time monitoring, and process analytic technology segments. High market concentration in pharmaceuticals and life sciences is contrasted with increasing fragmentation in emerging sectors like environmental safety, security, and food analysis, where diverse requirements and tailored solutions are needed.

The global Raman analyzers market was valued at US$ 585.5 Mn in 2021.

Sales of Raman analyzers are set to exhibit 4.8% CAGR and reach US$ 970.8 Mn by 2032.

The U.S., China, India, Japan, and U.K. account for most demand for Raman analyzers, currently holding 54% market share.

The U.S. accounts for around 92.3% share of the North American market.

Agilent, Bruker, and Thermo Fisher Scientific are the top three manufacturers of Raman products.

China held a share of 53.7% in the East Asia Raman analyzers market in 2021.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Mn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Instrument Type

By Sampling Technique

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author