ID: PMRREP35930| 197 Pages | 2 Dec 2025 | Format: PDF, Excel, PPT* | Industrial Automation

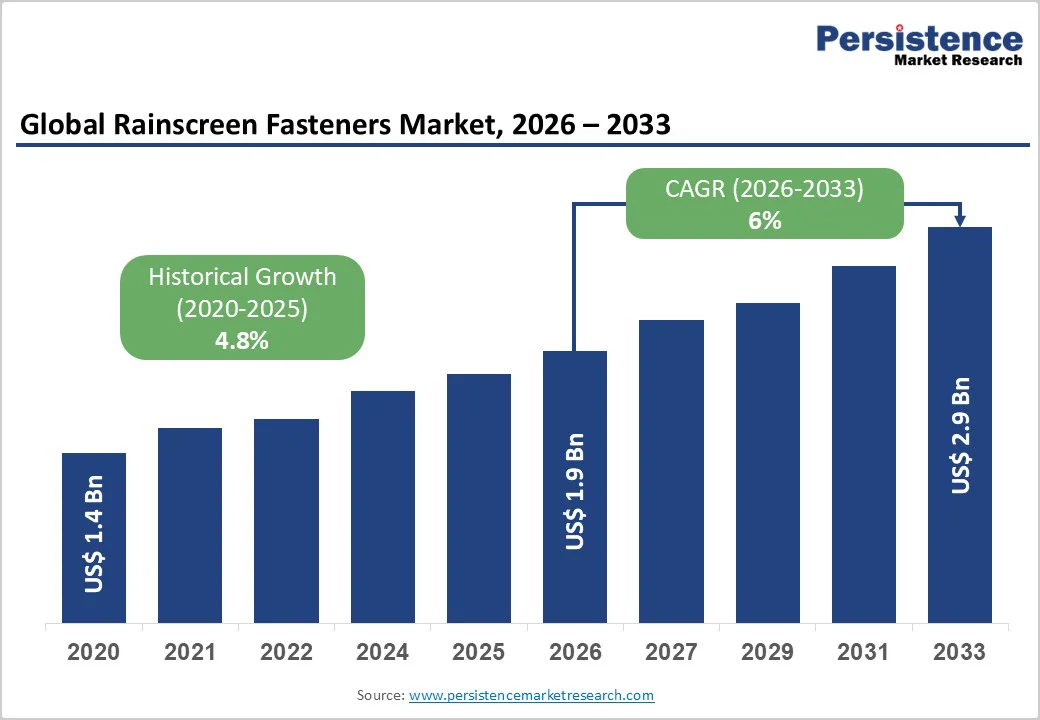

The global rainscreen fasteners market size is likely to be valued at US$1.9 billion in 2026 and is expected to reach US$2.9 billion by 2033, growing at a CAGR of 6% during the forecast period from 2026 to 2033, driven by the rising façade modernization, stricter energy-efficiency requirements, and an increase in non-residential renovation spending.

Improved moisture-management technologies boost demand, rising construction activity in the Asia Pacific, stricter building-envelope standards, and insurer focus on resilient exterior cladding.

| Key Insights | Details |

|---|---|

| Rainscreen Fasteners Market Size (2026E) | US$1.9 Bn |

| Market Value Forecast (2033F) | US$2.9 Bn |

| Projected Growth (CAGR 2026 to 2033) | 6% |

| Historical Market Growth (CAGR 2020 to 2025) | 4.8% |

Governments across North America, Europe, and parts of Asia continue to implement stricter building-energy codes requiring enhanced façade ventilation and moisture-control systems. Programs such as the U.S. DOE’s “Building Energy Codes Program,” EU Energy Performance of Buildings Directive revisions, and Canada’s National Energy Code updates have increased the use of rainscreen assemblies.

These mandates lift demand for precision-engineered fasteners that provide structural reliability and long-term weather resistance. As more jurisdictions adopt zero-carbon building frameworks and require improved thermal performance, the use of rainscreen systems is accelerating, directly driving fastener consumption across commercial, industrial, and institutional construction.

A vast proportion of Western commercial and public buildings are over 25-40 years old and require façade renewal to meet modern moisture-protection standards. According to government infrastructure assessments published in the U.S., Canada, and Western Europe, deferred maintenance has led to accelerated deterioration of exterior walls, increasing the need for rainscreen retrofits.

These projects rely heavily on stainless steel and coated fasteners engineered for high corrosion resistance. Market activity is heightened by publicly funded renovation programs, municipal energy-efficiency incentives, and post-weather-event resilience upgrades. The shift toward long-term asset protection strengthens demand for premium-grade fasteners.

Increasing urbanization rates in China, India, Indonesia, and Vietnam are driving new commercial build-outs, including offices, transportation hubs, retail developments, and medical facilities. Government-led smart-city initiatives, infrastructure upgrades, and foreign direct investment projects are accelerating the adoption of ventilated façade solutions, particularly in climate-sensitive regions exposed to monsoon conditions.

Builders in these markets increasingly prefer reliable fastener solutions that prevent façade failures, condensation, and structural decay. As multinational architecture practices adopt global façade guidelines, demand for compliant fastening components continues to scale.

Rainscreen systems require precise alignment, advanced fastening tools, and trained installers familiar with ventilation cavities and thermal-bridge prevention. Many contractors report longer installation timelines and higher labor costs when compared to traditional cladding attachment systems.

In regions where certified installers are limited, projects experience delays and cost overruns, creating hesitancy among mid-scale builders. This structural cost barrier can reduce adoption rates, particularly in budget-sensitive projects and developing markets.

Stainless steel, aluminum, and specialty-coated fasteners depend on metals that are subject to frequent price fluctuations due to changes in energy costs, mining output variability, and trade regulations. Rapid increases in raw-material prices affect the cost structure of fastener manufacturers, pushing up retail pricing. This volatility can slow procurement among small contractors and influence purchasing cycles, creating short-term uncertainty.

Stricter fire-safety standards in the U.S., EU, and Middle East are increasing interest in A2 and A1 fire-rated rainscreen systems, creating an opportunity for specialized fastener materials such as stainless steel grades with higher heat resistance and non-combustible coatings.

As insurers and certification bodies tighten façade-safety requirements, suppliers offering compliant fastener solutions stand to capture share in both new construction and major retrofits. Market potential is expanding in high-density urban areas where fire-performance mandates are intensifying.

Offsite construction facilities require standardized, high-precision rainscreen fasteners to streamline assembly. The rise of modular buildings in North America, Europe, Singapore, and Australia is strengthening demand for fasteners compatible with automated fastening equipment and quality-controlled manufacturing lines.

As modular adoption increases in multi-family housing, education facilities, and temporary structures, manufacturers supplying bulk fastener packs and assembly-ready systems can unlock new revenue streams.

Governments promoting low-carbon construction materials, recycled metals, and long-service-life components create opportunities for eco-engineered fasteners. Manufacturers investing in recyclability, low-VOC coatings, and extended-durability certifications can position themselves favorably for public-sector projects. Sustainable procurement rules in major economies are accelerating vendor qualification for environmentally responsible fastener options.

Mechanical visible-fixing systems, including screws and self-drillers with exposed heads or washers, are expected to account for the largest share, 34.5%, in 2026. Their dominance stems from broad compatibility with metal and composite façade panels and from lower unit costs relative to concealed systems.

This segment remains especially prominent in light-commercial construction and refurbishment work, where installation speed and affordability guide specification decisions.

The widespread availability of standardized product lines, structural test certifications, and compliance with regional substrate approvals (concrete, steel, timber) further reinforces leadership. Typical applications include mid-rise office façades, metal-panel retrofits, and bracketed assemblies where visible fastener lines are acceptable.

Concealed fastening systems, such as hidden clips, interlocking brackets, and engineered mechanical locking modules, are likely to be the fastest-growing product category. Growth is driven by higher aesthetic expectations in premium commercial development and by regulatory trends encouraging the design of thermally efficient façades.

Architects increasingly specify seamless, uninterrupted façade surfaces, while high-value projects demonstrate a greater willingness to invest in validated concealed systems. Adoption is strongest in new high-rise construction and iconic architectural projects where non-visible fastening is a design prerequisite. Suppliers offering certified concealed clip systems earn higher average selling prices (ASPs) and benefit from stronger specification control.

Anchor bolts and mechanical anchors used to secure brackets to concrete or masonry substrates represent the largest substructure product group, accounting for 33.9% of market share in 2026. Their prominence reflects the widespread use of concrete and masonry as primary structural materials in both renovation and new builds.

These fasteners typically carry the most stringent testing requirements, structural pull-out resistance, seismic qualification, and fire-related performance metrics. As substructure anchoring is an early critical-path activity in façade installation, contractors prioritize high-reliability products with proven engineering documentation. Brands offering tested anchor portfolios and project-specific engineering assistance hold an outsized influence in this category.

Lightweight aluminum subframe elements are likely to grow fastest due to higher demand for lightweight, thermally efficient façade assemblies. These systems reduce overall structural load and accelerate on-site installation, making them particularly attractive for tall buildings and regions with seismic sensitivity.

Pre-fabricated rail-and-bracket kits are becoming more common in dense urban construction, where installation efficiency directly affects project cost. Suppliers emphasizing modularity, corrosion resistance, and installation training are gaining market share in this fast-scaling segment.

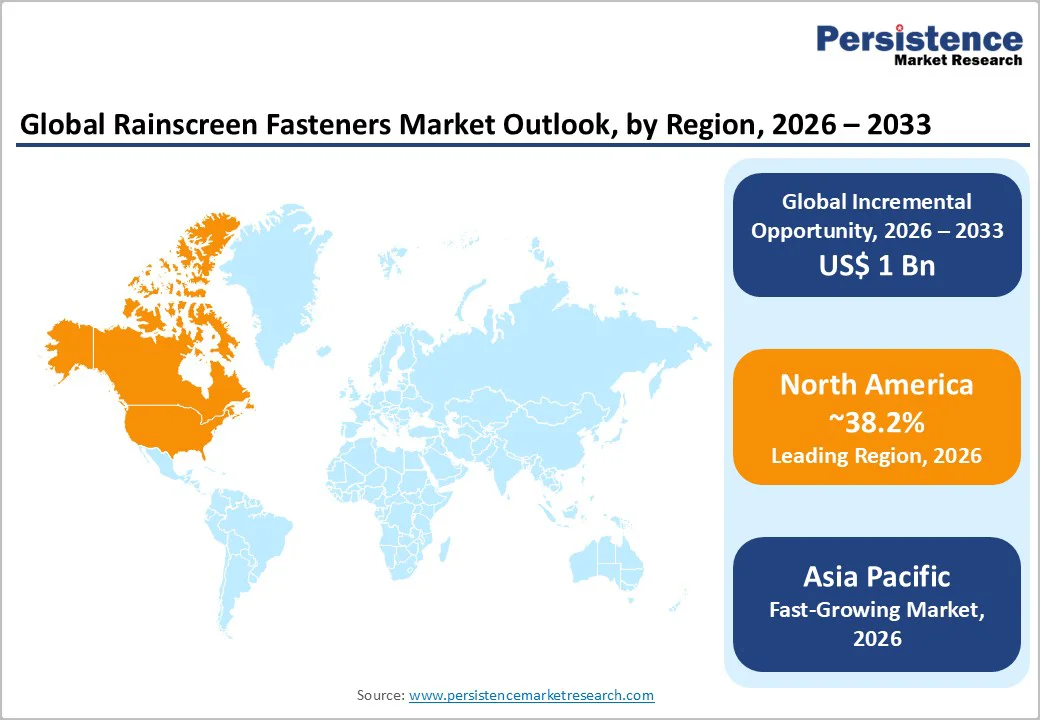

North America is projected to hold around 38.2% of the global market share by 2026, led by the U.S. Growth is driven by increased adoption of rainscreen façades in commercial and institutional buildings, urban renovation programs, and state mandates for improved envelope performance. The region shows mature specification behavior, prioritizing code compliance, structural documentation, fire-safety testing, and product approvals.

Regulatory influence primarily comes from state and municipal levels. Energy codes, fire-safety requirements, and façade inspection rules guide specification choices. Post-incident remediation has heightened scrutiny of cladding attachments, boosting demand for certified fastening systems.

States with strict energy standards, such as Massachusetts, New York, and California, see stronger uptake of thermally optimized substructures and engineered fastener assemblies.

Investment focuses on expanded distribution hubs, localized fabrication, and advanced testing facilities. Suppliers target corrosion-resistant products for coastal areas and pre-engineered bracket kits to simplify installation. Opportunities exist in municipal remediation, energy-efficient retrofits, and engineered fastener-substructure system bundles for institutional projects.

Recent developments include new stainless-grade fasteners, rapid-install bracket and rail kits, and strategic distribution partnerships to cut lead times. Bundling engineering assessments with product packages helps suppliers secure specification-driven commercial contracts.

Europe is anticipated to remain the largest regional market in 2026, accounting for approximately 31.9% of global rainscreen fastener revenue.

Strict building-performance standards, high renovation activity, and architectural preference for premium façade materials such as terracotta, fiber cement, and high-pressure laminates support growth. Germany, the U.K., France, and Spain are the core markets, each with established regulatory frameworks and extensive building stocks requiring energy-efficiency upgrades.

National energy-transition policies shape Germany’s market, driving demand for tested anchors, certified substructure systems, and thermally optimized fasteners. In the U.K., heightened fire-safety regulations following public inquiries have boosted demand for certified façade systems and rigorously tested fastening solutions.

Key growth drivers include tightening fire-performance regulations, retrofitting mid-20th-century buildings, and demand for complex façade geometries requiring engineered fastening. EU-wide energy directives standardize performance benchmarks, while national fire codes require independent testing, limiting the use of untested fasteners.

Investments focus on expanding testing laboratories, enhancing fabrication, and integrating with façade-system manufacturers. M&A activity reflects the consolidation of fastener, adhesive, and substructure capabilities to create turnkey envelope solutions.

Recent developments include concealed clip systems for premium claddings, expanded Central European fabrication, enhanced testing programs, and corrosion-resistant alloys and high-strength subframes designed for coastal and high-wind areas.

Asia Pacific is projected to be the fastest-growing region by 2026, driven by rapid urbanization, large-scale construction, and sustained commercial real estate investments. China and India are the primary volume contributors, while Southeast Asia shows increasing demand from commercial developments, hospitality projects, and high-rise residential buildings.

China leads the region with its extensive pipeline of urban districts, industrial facilities, and public buildings, supported by ongoing renovation initiatives and municipal façade standards that boost demand for engineered fastening systems. Japan’s market remains stable and specification-driven, shaped by seismic requirements, fire codes, and architectural precision.

ASEAN markets, particularly Indonesia, Vietnam, and the Philippines, benefit from tourism-driven construction and foreign direct investment in commercial real estate.

Key growth drivers across the region include corrosion-resistant fastening systems for tropical and coastal climates, energy-efficient façade assemblies, and government-backed urban regeneration programs. Regulatory frameworks are evolving, with China and India updating building codes to enhance façade safety and thermal performance, accelerating the adoption of certified engineered solutions over commodity products.

Investments in APAC focus on new assembly plants, technical service centers, expanded distribution networks, regional installer training programs, and local testing laboratories to shorten approval timelines. Recent developments include expanded distribution footprints in India and Southeast Asia, region-specific fastener lines with extended corrosion warranties, and localized aluminum subframe manufacturing to reduce lead times and strengthen supply-chain resilience.

The global rainscreen fasteners market is moderately concentrated, with leading engineering firms dominating engineered anchors, concealed-clip systems, and certified substructure components, while visible fixings and commodity screws remain fragmented among local suppliers. High concentration exists in categories requiring structural testing, fire-safety certification, and documented engineering support.

Market leaders gain an advantage through integrated system solutions, extensive approvals, localized distribution, and technical support. Key differentiators include testing documentation, digital design tools, corrosion-resistant materials, installer training, prefabricated kits, and full-system warranties, all influencing specification decisions and reinforcing competitive positioning.

The global rainscreen fasteners market size is estimated to reach US$1.9 Billion in 2026.

By 2033, the rainscreen fasteners market is projected to reach US$2.9 Billion.

Key trends include growing adoption of ventilated façade systems in energy-efficient construction and a shift toward corrosion-resistant metal alloys and engineered composite fasteners.

The metal fasteners segment is anticipated to lead the market in 2026, holding around 55.58% share, due to durability, structural performance, and compliance with global façade standards.

The rainscreen fasteners market is expected to grow at a CAGR of 6% from 2026 to 2033.

Major companies include SFS Group, Hilti Corporation, TruFast, ETANCO, and Illinois Tool Works (ITW).

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Façades Product

By Substructure Product

By Cladding Material

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author