ID: PMRREP32642| 0 Pages | 30 Dec 2025 | Format: PDF, Excel, PPT* | Healthcare

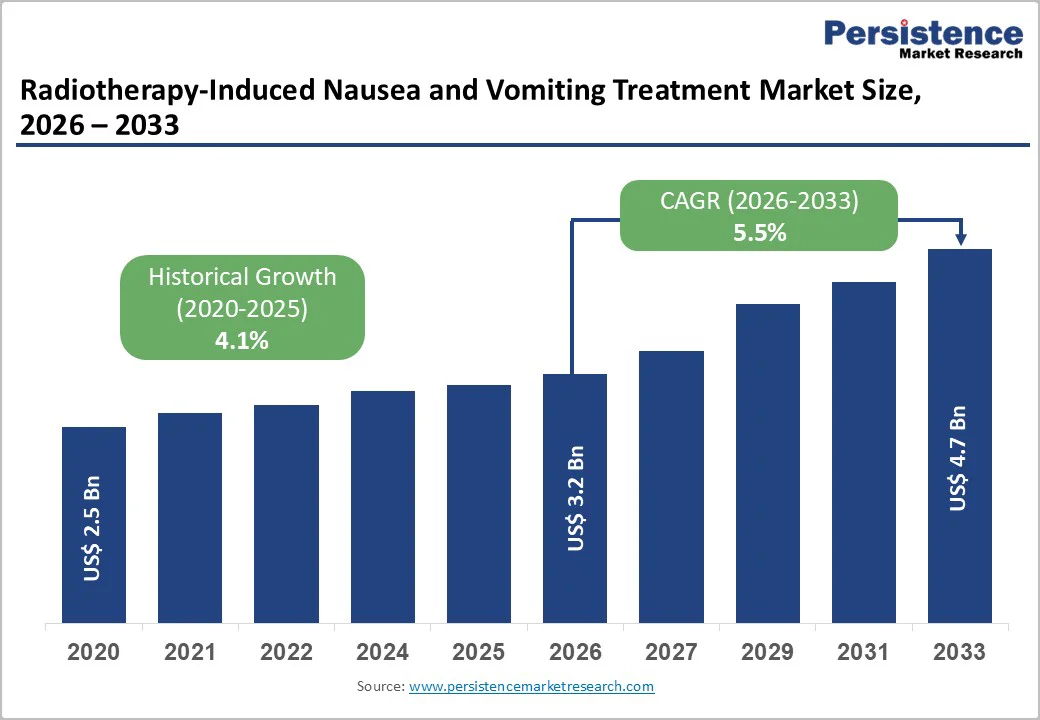

The global Radiotherapy-Induced Nausea and Vomiting Treatment Market is estimated to grow from US$ 3.2 billion in 2026 to US$ 4.7 billion by 2033. The market is projected to record a CAGR of 5.5% during the forecast period from 2026 to 2033.

The Radiotherapy-Induced Nausea and Vomiting Treatment Market is an important segment of supportive oncology, driven by rising global radiotherapy utilization and increasing emphasis on maintaining patient quality of life during cancer treatment. Radiotherapy is recommended for around 50–60% of all cancer patients, and international analyses estimate that 10.0 million patients required radiotherapy in 2022, a figure projected to grow to 16.5 million by 2050, significantly enlarging the population at risk for radiotherapy-induced nausea and vomiting (RINV). Guidelines from bodies such as MASCC/ESMO, ASCO, and national health systems support prophylactic use of Serotonin (5 HT3) receptor antagonists, often combined with corticosteroids and, in higher risk regimens, NK1 receptor antagonists, positioning these drug classes at the center of modern RINV management. Growing awareness of guideline-concordant supportive care, better access to radiotherapy in emerging regions, and investments in advanced antiemetic combinations are expected to sustain market growth over the next decade.

| Global Market Attributes | Key Insights |

|---|---|

| Radiotherapy-Induced Nausea and Vomiting Treatment Market Size (2026E) | US$ 3.2 Bn |

| Market Value Forecast (2033F) | US$ 4.7 Bn |

| Projected Growth (CAGR 2026 to 2033) | 5.5% |

| Historical Market Growth (CAGR 2020 to 2025) | 4.1% |

Market Growth Drivers

Rising Radiotherapy Utilization and Cancer Burden

Rising cancer incidence and expanding radiotherapy utilization are key growth drivers for the Radiotherapy-Induced Nausea and Vomiting Treatment Market. Global estimates indicate that there were about 20.0 million new cancer cases in 2022, of which roughly 10.0 million required radiotherapy at a 50% utilization rate; projections suggest 33.1 million new cases and 16.5 million radiotherapy candidates by 2050. Radiotherapy is central to curative and palliative treatment across tumor types such as breast, head and neck, lung, gastrointestinal, and gynecologic cancers, many of which involve abdominal or craniospinal fields associated with moderate to high emetogenic risk. Without effective prophylaxis, up to 80% of patients may experience nausea and vomiting during cancer therapy, negatively affecting adherence, nutritional status, and quality of life. As more radiotherapy units are commissioned—particularly in underserved regions—the absolute number of patients needing evidence based RINV prophylaxis using 5HT3 receptor antagonists, NK1 receptor antagonists, and corticosteroids will grow steadily, fueling market expansion.

Guideline-Driven Adoption of Preventive Antiemetic Regimens

Strong international guideline support for prophylactic RINV management is another major driver. The MASCC/ESMO and ASCO antiemetic guidelines recommend classifying radiotherapy by emetogenic risk and routinely administering Serotonin (5 HT3) receptor antagonists ± dexamethasone before moderate to high risk regimens, rather than relying on rescue medication alone. Clinical trials have shown that agents such as ondansetron and granisetron provide significantly better protection than metoclopramide or prochlorperazine, with complete vomiting control rates reaching 60–97% in patients receiving upper abdominal or lower thoracic radiotherapy. Health system guidelines from major centers confirm that scheduled 5 HT3-based prophylaxis reduces unplanned admissions and improves treatment tolerance. As cancer programs worldwide align with these recommendations, the share of radiotherapy patients receiving standardized preventive antiemetic regimens continues to rise, directly increasing utilization of key RINV drug classes

Market Restraints

Cost Constraints and Limited NK1 Access in Resource-Limited Settings

Cost constraints and unequal access to advanced antiemetics restrict market growth, especially in low and middle income countries where radiotherapy capacity is expanding most rapidly. While generic 5HT3 receptor antagonists are now widely available, newer long acting 5HT3 formulations and NK1 receptor antagonists can be expensive relative to local healthcare budgets, limiting their routine use despite guideline endorsement. Global radiotherapy access reports from the IAEA and international oncology consortia underscore that many centers in Africa, parts of Asia, and Latin America struggle with basic infrastructure and workforce shortages, leaving limited resources for comprehensive supportive care. In such environments, clinicians may prioritize minimal symptomatic management using low cost agents like metoclopramide or phenothiazines, which suppresses potential demand for higher value NK1-containing regimens.

Under-Recognition of RINV and Practice Variability

Under recognition of RINV and inconsistent implementation of emetogenic risk assessment are additional restraints. Historically, more attention has been given to chemotherapy-induced nausea and vomiting, and some radiotherapy departments still underestimate the prevalence and impact of RINV, especially when low daily doses are used over many fractions. International guidelines categorize radiotherapy regimens into high, moderate, low, and minimal risk, yet adoption of these categories remains variable across countries and even between institutions. Where risk stratification is not systematically applied, prophylactic antiemetics may be under prescribed, with treatment reserved for breakthrough symptoms, leading to suboptimal control and lower per patient drug utilization than guideline models would predict.

Market Opportunities

Digital Symptom Monitoring and Patient-Centric Supportive Care

Another promising opportunity is the integration of RINV treatments with digital symptom monitoring and patient centric care models. Radiotherapy is typically delivered over several weeks, creating multiple opportunities to adjust prophylaxis based on daily symptom tracking. Digital tools—mobile applications, web portals, and electronic diaries—can capture real time nausea and vomiting scores, medication adherence, and rescue requirements, enabling clinicians to tailor regimens in line with ASCO and MASCC principles of individualized supportive care. Hospitals and cancer networks are increasingly adopting such platforms to reduce emergency visits and treatment interruptions, particularly as value based reimbursement models gain momentum. Companies that pair 5 HT3 and NK1 therapies with digital adherence services, educational content, and remote coaching can differentiate their offerings, improve real world efficacy, and strengthen partnerships with leading oncology centers.

Treatment Type Analysis

By treatment type, Preventive treatment is the dominant segment in the Radiotherapy-Induced Nausea and Vomiting Treatment Market. Randomized clinical trials and meta analyses comparing prophylactic versus rescue antiemetic strategies show that pre treatment with Serotonin (5HT3) receptor antagonists, with or without dexamethasone, yields significantly better control of vomiting and nausea, particularly in upper abdominal or craniospinal irradiation. Complete control rates of vomiting exceeding 60–90% have been reported in prophylaxis arms, compared with much lower rates when patients receive antiemetics only after symptoms appear. Consequently, guidelines from MASCC/ESMO, ASCO, and national health services strongly recommend preventive antiemetic regimens for moderate and high emetic risk radiotherapy, making prophylaxis standard practice in many centers. As awareness grows in emerging markets and more protocols formalize prophylaxis, this segment is expected to retain its clear lead over rescue treatment.

Drug Type Analysis

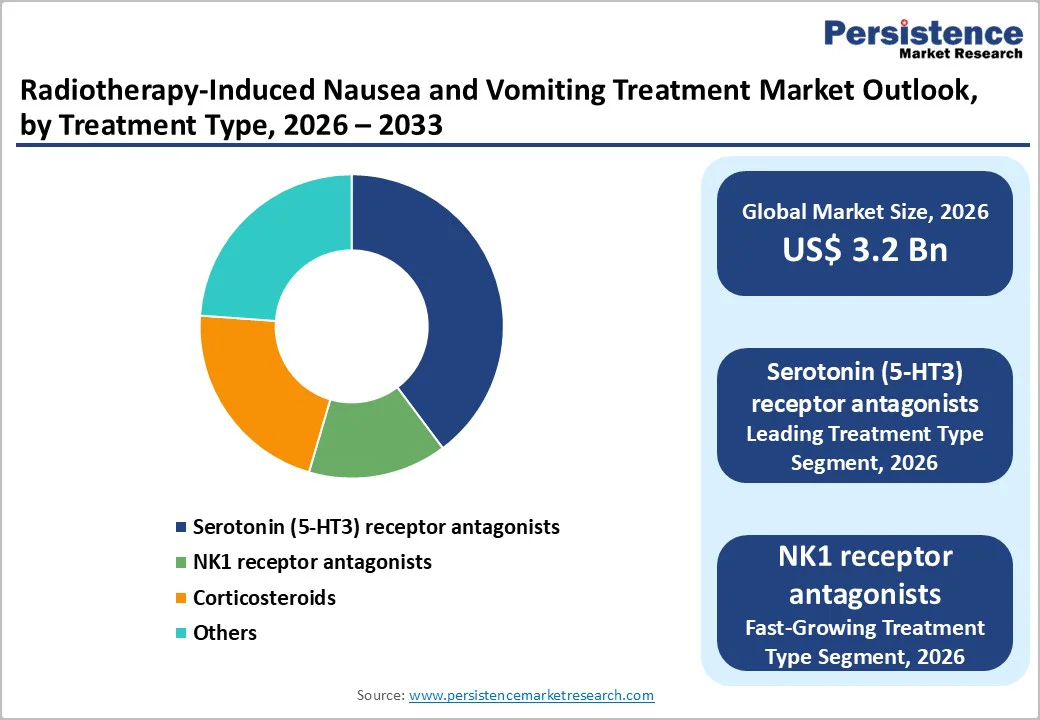

Within drug type, Serotonin (5 HT3) receptor antagonists represent the leading segment, accounting for an estimated 35% share of the global market in 2025. Agents such as ondansetron, granisetron, tropisetron, and palonosetron block serotonin-mediated signaling from the gastrointestinal tract to the central nervous system, a key pathway in radiation- and chemotherapy-induced emesis. Clinical trials in RINV demonstrate that these agents are significantly more effective than metoclopramide or phenothiazines, with some studies reporting up to 97% complete control of vomiting during fractionated abdominal radiotherapy. International guidelines uniformly recommend 5 HT3 receptor antagonists as first line prophylaxis for moderate and high-risk radiotherapy regimens, often in combination with dexamethasone, ensuring entrenched use across hospital and outpatient settings. Their availability in both oral and injectable forms, widespread generic competition, and strong clinician familiarity reinforce their dominant position, while NK1 receptor antagonists are anticipated to be the fastest growing subsegment as triplet regimens gain traction.

Distribution Channel Analysis

By distribution channel, Hospital pharmacies constitute the leading segment and are expected to hold the largest share, likely around 45–50% in 2025. Radiotherapy is heavily concentrated in hospital-based or affiliated cancer centers, where treatment teams develop standardized order sets that include prophylactic 5HT3, NK1, and corticosteroid regimens for specific radiotherapy protocols. Hospital pharmacies manage formulary decisions, ensure cold chain and stock management for injectable products, and coordinate with oncology, radiation, and pharmacy committees regarding guideline implementation and cost effectiveness evaluations. Inpatients receiving intensive chemoradiotherapy, total body irradiation, or craniospinal fields depend almost entirely on hospital pharmacies for both preventive and rescue antiemetics. Retail pharmacies and online pharmacies are gaining importance for maintenance oral therapies during outpatient radiotherapy courses and for refills, but the initial prescription, regimen design, and high risk cases remain dominated by hospital channels, securing their leadership position over the forecast period.

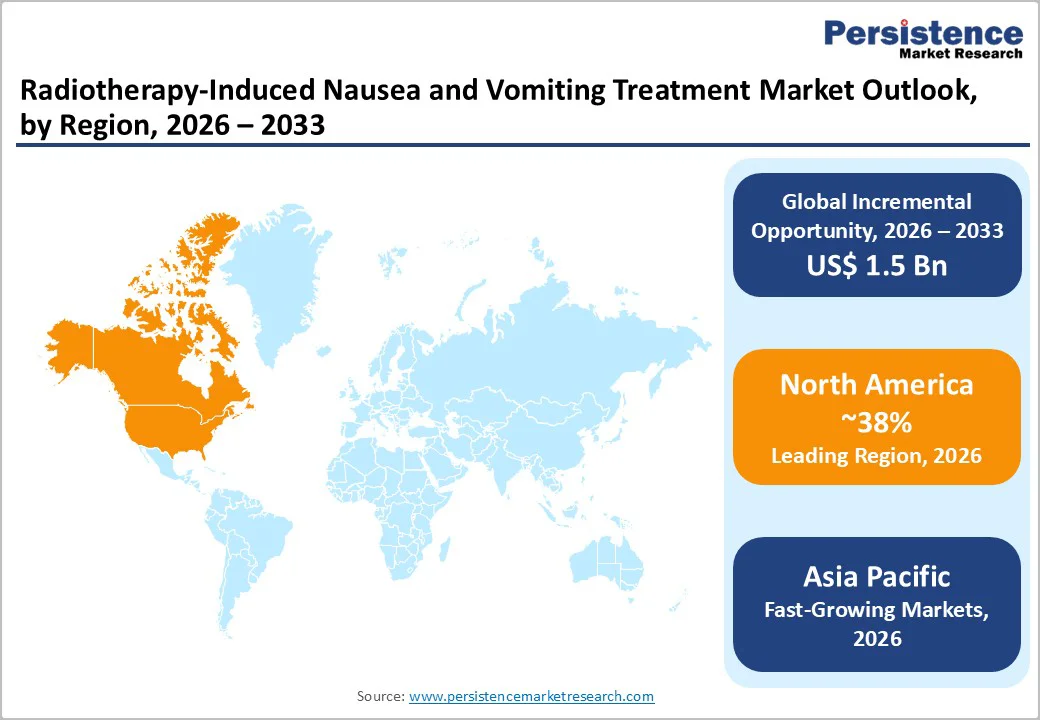

North America Radiotherapy-Induced Nausea and Vomiting Treatment Market Trends and Insights

North America is the leading regional market, accounting for an estimated 36% share in 2025, supported by high cancer incidence, extensive radiotherapy infrastructure, and strong implementation of evidence based antiemetic guidelines. The American Cancer Society reports approximately 2.0 million new cancer cases and more than 600,000 cancer deaths annually in the United States, with radiotherapy indicated in about 50–60% of treatment courses. Comprehensive cancer centers and community networks commonly use standardized order sets based on ASCO and MASCC/ESMO antiemetic recommendations, deploying Serotonin (5HT3) receptor antagonists with dexamethasone and, in high risk or concurrent chemoradiotherapy settings, NK1 receptor antagonists.

Regulatory oversight from the U.S. Food and Drug Administration (FDA) and Health Canada supports continuous innovation in antiemetic products, including extended-release and fixed dose combinations. Companies such as Pfizer Inc., GlaxoSmithKline plc, Merck & Co., Inc., Helsinn Group, Heron Therapeutics Inc., and Unimed Pharmaceuticals (AbbVie) maintain strong portfolios of 5 HT3 and NK1 agents that are widely adopted across hospital and outpatient settings. Hospitals increasingly integrate digital nausea assessment tools and patient reported outcome measures into radiotherapy workflows, aligning with value based care initiatives and further embedding prophylactic antiemetics into standard practice. These dynamics collectively reinforce North America’s leadership in both market size and adoption of advanced RINV regimens.

Asia Pacific Radiotherapy-Induced Nausea and Vomiting Treatment Market Trends and Insights

Asia Pacific is projected to be the fastest growing region in the Radiotherapy-Induced Nausea and Vomiting Treatment Market, driven by rapid cancer incidence growth, expanding radiotherapy availability, and improving access to antiemetic therapies. Global radiotherapy white papers emphasize that many countries in Asia historically had severe equipment shortages, with some reporting fewer than 1 machine per million people, compared with much higher densities in North America and Western Europe. Recent analyses reveal a strong upward trend in radiotherapy utilization across China, Japan, India, and ASEAN states as governments invest heavily in linear accelerators, workforce training, and national cancer control programs. As more abdominal and pelvic radiotherapy courses are delivered, the number of patients requiring effective RINV prophylaxis increases sharply.

Regional and national guidelines in countries such as Japan and Australia align closely with MASCC/ESMO and ASCO recommendations, encouraging the use of 5HT3 receptor antagonists and dexamethasone, with selective adoption of NK1 receptor antagonists for high risk regimens. Local manufacturers including Dr. Reddy’s Laboratories Ltd., Cipla Ltd., Teva Pharmaceutical Industries Ltd., Qilu Pharma, and Taiji Group supply cost effective generics, improving availability in both public and private sectors. Growth in e pharmacies and digital health platforms in major markets like China and India further enhances access to oral antiemetics during outpatient radiotherapy. Collectively, these factors position Asia Pacific as the fastest growing regional market between 2025 and 2032, with significant headroom for increased guideline-concordant RINV management.

Market Structure Analysis

The Radiotherapy-Induced Nausea and Vomiting Treatment Market is moderately fragmented, with competition between multinational innovators and strong regional generic manufacturers. Strategic priorities center on formulation innovation (extended release, fixed dose combinations), geographic expansion, hospital contracting, and partnerships with cancer centers to embed products into standardized radiotherapy antiemetic protocols.

Key Market Developments

The global market is projected to be valued at US$ 3.2 Bn in 2026, supported by growing radiotherapy volumes, higher cancer incidence, and wider adoption of guideline-recommended prophylactic antiemetic regimens in oncology centers worldwide.

Key drivers include rising global radiotherapy demand, strong MASCC/ESMO and ASCO guideline support for preventive use of Serotonin (5‑HT3) receptor antagonists with corticosteroids, and increasing focus on reducing treatment-related toxicity to preserve quality of life.

The global market is expected to grow at a CAGR of 5.5% between 2026 and 2033, outpacing historical growth as radiotherapy access improves in emerging economies and advanced antiemetic combinations gain wider clinical acceptance.

North America currently leads the market, driven by high cancer prevalence, extensive radiotherapy infrastructure, strong reimbursement systems, and comprehensive implementation of guideline-based RINV prophylaxis in major cancer centers.

Key players include Pfizer Inc., GlaxoSmithKline plc, Merck & Co., Inc., Sanofi S.A., Novartis AG, Teva Pharmaceutical Industries Ltd., Dr. Reddy’s Laboratories Ltd., Cipla Ltd., Mylan (Viatris), Qilu Pharma, Taiji Group, Helsinn Group, Heron Therapeutics Inc., Kyowa Kirin Co., Ltd., Unimed Pharmaceuticals (AbbVie), F. Hoffmann-La Roche Ltd., Eisai Co., Ltd., and Aurobindo Pharma Ltd.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis Units | Value: US$ Mn/Bn, Volume: As Applicable |

| Geographical Coverage | North America, Europe, East Asia, South Asia and Oceania, Latin America, Middle East and Africa |

| Segmental Coverage | Treatment Type, Drug Type, Distribution Channel |

| Competitive Analysis | Pfizer Inc., GlaxoSmithKline plc, Merck & Co., Inc., Sanofi S.A., Novartis AG, Teva Pharmaceutical Industries Ltd., Dr. Reddy’s Laboratories Ltd., Cipla Ltd., Mylan (Viatris), Qilu Pharma, Taiji Group, Helsinn Group, Heron Therapeutics Inc., Kyowa Kirin Co., Ltd., Unimed Pharmaceuticals (AbbVie), F. Hoffmann-La Roche Ltd., Eisai Co., Ltd., Aurobindo Pharma Ltd. |

| Report Highlights | Market Forecast and Trends, Competitive Intelligence & Share Analysis, Growth Factors and Challenges, Strategic Growth Initiatives, Pricing Analysis, Future Opportunities and Revenue Pockets, Market Analysis Tools |

Treatment Type

Drug Type

Distribution Channel

Regions

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author