ID: PMRREP23257| 199 Pages | 6 Jan 2026 | Format: PDF, Excel, PPT* | IT and Telecommunication

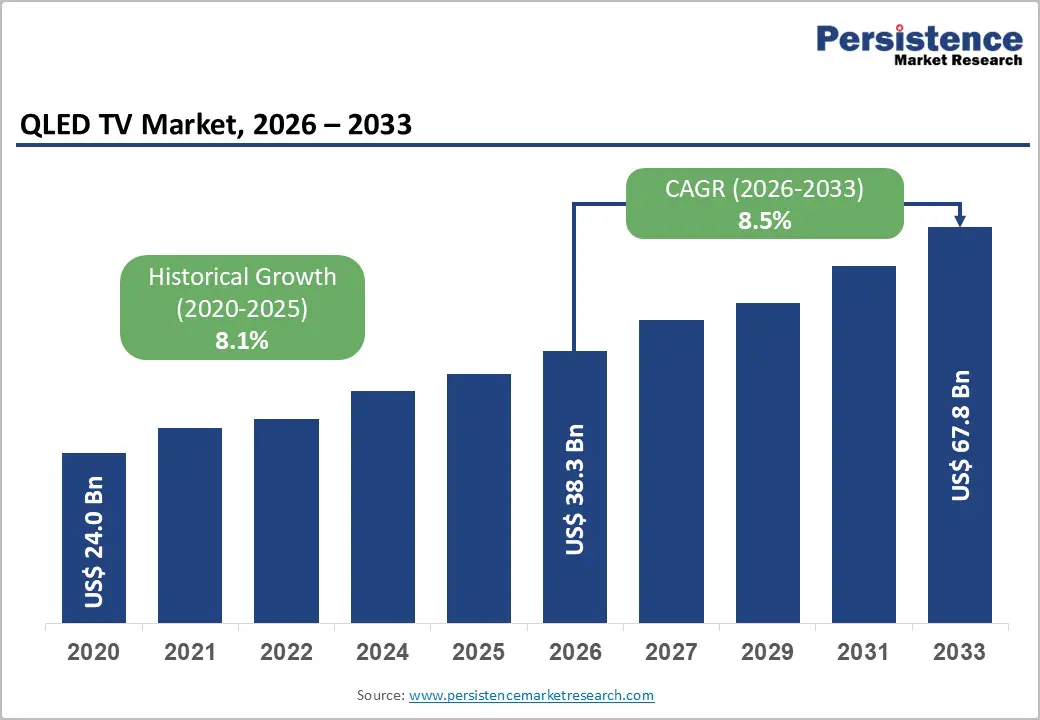

The global QLED TV market size is likely to be valued at US$ 18.2 billion in 2026, and is projected to reach US$ 34.4 billion by 2033, growing at a CAGR of 8.5% during the forecast period of 2026 - 2033.

This steady market expansion is driven by rising demand for premium large-screen televisions, continuous advancements in quantum dot display technology, and strong replacement cycles in mature economies. The increased penetration of 4K and 8K ultra-high-definition (UHD) content, combined with declining panel costs and aggressive brand investments, continues to support sustained volume growth. Asia Pacific remains the primary manufacturing hub, while North America and Europe dominate value-based consumption.

| Key Insights | Details |

|---|---|

|

QLED TV Market Size (2026E) |

US$ Bn |

|

Market Value Forecast (2033F) |

US$ 75.1 Bn |

|

Projected Growth (CAGR 2026 to 2033) |

8% |

|

Historical Market Growth (CAGR 2020 to 2025) |

1.6% |

The QLED TV market is growing as full HD televisions are replaced with 4K as the default resolution standard and as the market gradually premiumizes toward 8K formats. Retail sales data across major consumer electronics markets indicate that 4K models now represent well over two-thirds of televisions sold in the mid-to-premium price bands, supported by expanding ultra-high definition streaming libraries, native 4K gaming consoles, and upgraded broadcast transmission standards. This shift is reinforced by regulatory-led spectrum reallocation and next-generation broadcasting rollouts, which are accelerating UHD signal availability. QLED technology’s high luminance performance and color stability make it particularly suited for large-screen viewing and high-ambient-light environments.

The scale of manufacturing and process optimization have materially improved QLED affordability, strengthening mass-market adoption. The expansion of high-generation LCD fabs and automation in backlight assembly and quantum-dot film applications has driven cost reductions since 2020, particularly in the 50–65-inch segment. These efficiencies have allowed brands to price QLED TVs competitively against conventional LCD and entry-level OLED models, widening penetration among upper-middle-income households. Coupled with growing integration of AI-based upscaling, gaming-grade refresh rates, and smart-ecosystem compatibility, QLED TVs increasingly align with consumer demand for high-performance, future-proof home entertainment platforms.

QLED TV manufacturers face sustained margin pressure from rapid substitution by OLED and advanced mini-LED displays in the premium price band, where purchasing decisions are driven by contrast performance, industrial design, and perceived technological leadership. Industry shipment and retail revenue trends indicate that OLED-based models now account for roughly one-third of global premium television revenues, reducing the addressable high-margin space for QLED offerings. At the same time, Mini-LED backlighting has narrowed performance differentials within LCD-based displays, intensifying intra-category competition and limiting the ability of QLED brands to command pricing premiums, particularly in the 65-inch and above segment.

The supply chain volatility for critical QLED components adds further cost pressure. Production depends on quantum dot enhancement films, display driver integrated circuits (ICs), and high-efficiency backlight units, which are essential for achieving the brightness, color volume, and lifespan advantages of QLED TVs. In 2024–2025, extended lead times for display driver ICs, caused by semiconductor capacity being allocated to automotive and AI applications, delayed panel assembly for major QLED models. Coupled with shortages of quantum dot films and shipping delays from East Asia, these factors increased the overall bill of materials, disrupted production schedules, and constrained manufacturers' ability to respond promptly to growing UHD TV demand, particularly in the mid- to large-screen segments.

The QLED TV market has rich growth potential through advanced smart ecosystem integration and next-generation display experiences. With rising consumer preference for immersive technologies, AI-enabled picture optimization, voice interaction, and smart connectivity are emerging as significant differentiators, allowing QLED TVs to serve as central hubs in modern digital homes. Enhanced connectivity and machine learning-based content calibration can drive higher user engagement and unlock value-added services, while 5G and high-speed broadband rollout continue to support seamless 4K/8K streaming adoption. Manufacturers that embed intuitive smart features and ecosystem compatibility in their QLED portfolios can expand addressable demand across both premium and mid-tier segments, while justifying higher average selling prices.

In addition, commercial and specialized applications beyond traditional living rooms present strong revenue opportunities. QLED TVs are increasingly adopted in retail signage, corporate collaboration spaces, hospitality media systems, and education technology deployments, owing to superior brightness, durability, and wide-view performance in diverse lighting conditions. Commercial-grade models with remote management capabilities, extended warranties, and enhanced security are gaining traction as businesses digitize their engagement and presentation environments. This trend is supported by steady growth in commercial display procurement and the ongoing digital transformation of enterprise and institutional buyers seeking reliable, high-impact visual solutions.

The 4K QLED TV segment is expected to be the market leader, accounting for an estimated 60% of QLED shipments in 2026, driven by broad content availability, mainstream pricing, and integration with smart home and gaming ecosystems. Competitive 4K models from major brands now commonly include AI-based upscaling, HDR10+/Dolby Vision support, and low-latency gaming features, expanding appeal across households and gaming segments. Flagship 4K QLED launches emphasized smart connectivity and personalized AI viewing profiles, helping sustain volume leadership and reinforce value within the mainstream consumer base. The proliferation of 4K content on streaming platforms and the upgrade to broadcast standards continue to solidify this segment’s dominance.

8K QLED TVs are anticipated to be the fastest-growing sub-segment in 2026, with a projected CAGR of 13% through 2033, reflecting premium adoption and technological differentiation. While absolute penetration remains moderate today, premium 8K models introduced in 2025 have showcased advanced upscaling engines and broader size availability, helping close the gap to early adopters. Seeking the opportunity, Samsung expanded its Neo QLED 8K lineup and increased its focus on AI-driven picture enhancement, illustrating how original equipment manufacturers (OEMs) are positioning 8K as a flagship experience for high-end cinema and gaming use cases. As panel prices continue to decline, demand for higher-resolution panels is expected to rise among affluent households and commercial installations.

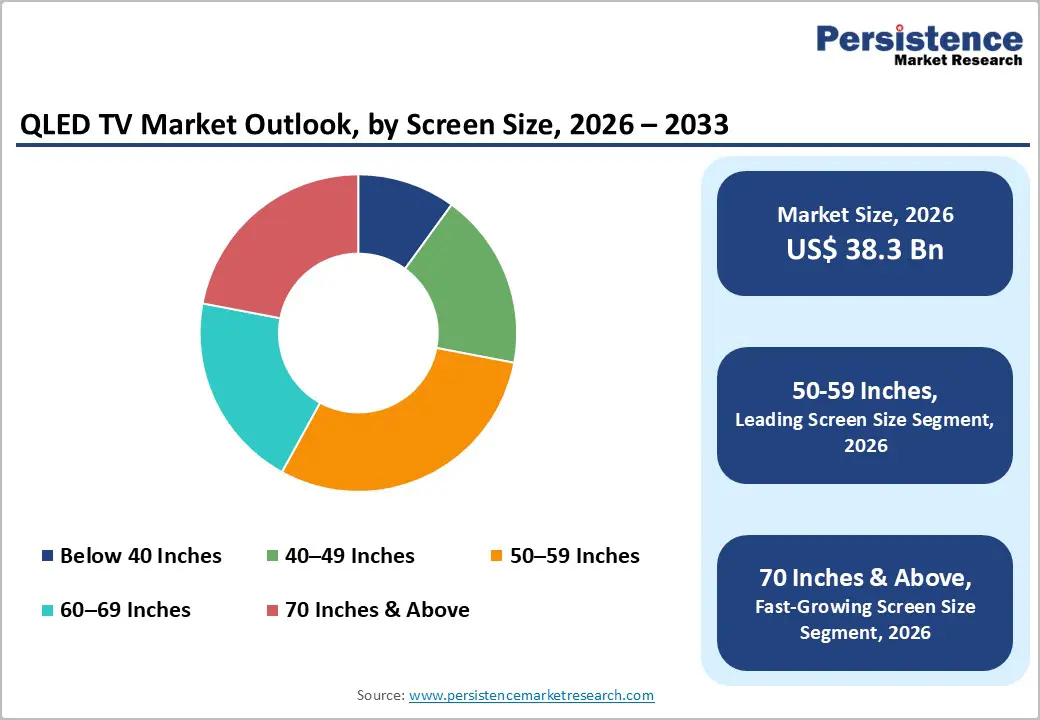

The 50–59 inches category is poised to lead in 2026, capturing about 30% of the QLED TV market revenue share in 2026, due to its balanced combination of screen real estate and affordability for typical living spaces. This segment’s popularity is reinforced by strong retail presence in urban markets and frequent promotional activity from major TV brands. The innovations, such as bezel-less designs, enhanced local dimming zones, and integrated AI motion handling, have made models in this size range increasingly attractive to both family viewers and gamers seeking quality performance without premium pricing. These enhancements are helping sustain leadership by marrying price-value with advanced features.

The 70 inches & above segment is set to be the fastest-growing, with an estimated CAGR of 12% from 2026 to 2033, driven by declining panel costs and an uptick in demand for a cinema-style home viewing experience. Large-format QLED TVs benefit from superior brightness and color volume, making them especially popular in well-lit living rooms and home theater setups. Through past years, several brands expanded their super-big TV lineups up to 100–115 inches, incorporating advanced AI picture optimization and adaptive sound systems to elevate immersive viewing. This growth reflects not only rising consumer preference for larger screens but also the role of premium content and gaming ecosystems that maximize screen impact.

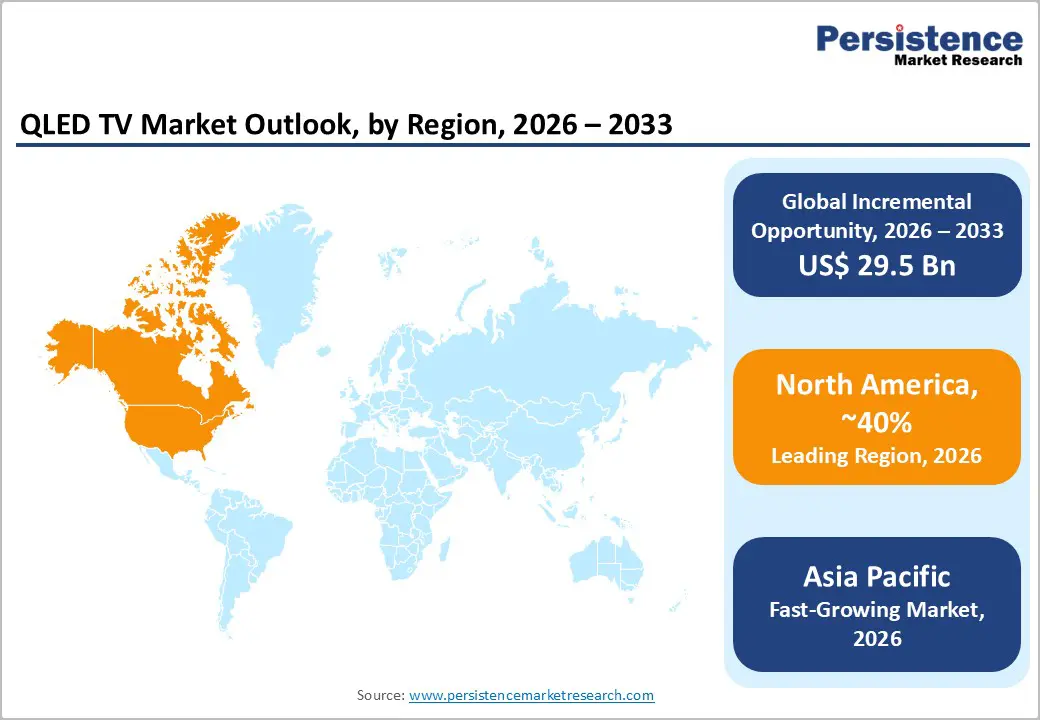

North America is expected to account for approximately 40% of the QLED TV market share in 2026, with the United States leading regional demand, supported by widespread smart TV penetration, high broadband connectivity, and a strong home entertainment culture. Multi-TV households continue to fuel replacement cycles, while consumers increasingly seek immersive viewing experiences and advanced gaming-ready panels. Lifestyle trends favoring home theaters, combined with growing interest in connected smart home ecosystems, reinforce demand for high-resolution QLED models.

Consumer preferences indicate that over 50% of households now prefer screen sizes above 55 inches, reflecting demand for cinematic viewing and high-performance displays. Streaming services and on-demand content account for the majority of viewing hours, encouraging upgrades to 4K and larger-format QLED TVs. The robust e-commerce channels and seasonal promotional events, such as holiday sales, amplify unit volumes and retail penetration. Continuous adoption of smart home integration, AI-powered picture optimization, and voice-controlled features positions North America for steady growth in premium QLED adoption, driven by evolving consumer lifestyles and technology trends.

Europe represents a mature and stable market for QLED TVs, with key the markets being Germany, the U.K., France, and Spain. European consumers place a premium on energy efficiency, smart connectivity, and multisource content access, driven in part by regional energy labeling standards and eco-design requirements that guide product development and procurement practices. Most of the buyers prioritize displays with strong energy performance and multi-language user interfaces, particularly in Western European countries where broadband penetration is high and digital lifestyles are deeply embedded.

In addition to residential uptake, institutional and commercial purchases, including digital signage in public spaces and corporate rooms, contribute meaningfully to regional volumes. Replacement cycles for premium TVs in Europe tend to favor performance upgrades that balance picture quality with energy savings. Government-led digital transition programs and cultural consumption patterns around sports and entertainment further support the adoption of high-resolution QLED models across European households. Competitive pricing strategies are also critical, especially in Southern European markets where price sensitivity remains high.

Asia Pacific is expected to be the fastest-growing regional market for QLED TVs in 2026, with a 2026-2033 CAGR of approximately 9.5%, driven by rapid urbanization, rising household incomes, and strong adoption of large-format smart displays. The increasing popularity of streaming platforms, gaming content, and digital media is boosting demand for high-resolution QLED panels across urban and semi-urban centers. Larger-screen TVs (60 inches and above) are experiencing higher adoption, reflecting consumer preference for immersive, premium viewing experiences that align with QLED technology’s advanced color, brightness, and HDR performance.

In key markets including India, China, and ASEAN nations, the transition to advanced QLED models continues to gain momentum. In India, the Digital India Initiative has expanded broadband access and digital services, directly increasing demand for smart, internet-enabled QLED TVs. This growth is further supported by rising middle-class incomes, more affordable large-screen options, and evolving content consumption habits. Government policies in China promote high-tech display manufacturing and innovation in quantum dot and AI-assisted technologies. The OEMs in the region are introducing AI-enhanced QLED models with adaptive picture optimization and energy-efficient panels, catering to diverse lighting conditions. These factors position Asia Pacific as the fastest-growing and most innovation-driven QLED TV market, with sustained adoption and technological development expected through 2026 and beyond.

The global QLED TV market structure is moderately consolidated, with Samsung, LG, TCL, Hisense, and Sony leading the way. These companies capitalize on strong brand recognition, extensive retail and online networks, and advanced R&D capabilities to stay ahead in 4K and 8K resolution, quantum dot technology, AI-powered upscaling, and smart TV features. By offering premium experiences, such as adaptive picture optimization, gaming-certified panels, and voice-controlled interfaces, they continue to attract high-end consumers and differentiate themselves in a highly competitive market.

The regional and niche players such as Skyworth, Changhong, and Panasonic carve out their space by focusing on specific segments, including mid-range, large-screen, and commercial QLED displays. While high manufacturing costs, complex supply chains, and technology integration create hurdles for new entrants, trends such as connected home ecosystems, streaming service growth, and AI-enhanced display features are opening opportunities for innovative smaller players. The market is expected to consolidate further as leading brands acquire regional players, expand their global footprint, and invest in next-generation technologies, strengthening their position across both consumer and professional applications.

The global QLED TV market is projected to reach US$ 18.2 billion in 2026.

Mainstream adoption of 4K and 8K display standards, falling panel costs due to large-scale manufacturing, and growing consumer preference for smart, AI-enhanced home entertainment systems are driving the market.

The market is poised to witness a CAGR of 8.5% from 2026 to 2033.

Expanding adoption of high-end TVs in commercial and institutional applications across developing economies and growing integration with AI-driven smart TV platforms for immersive, personalized viewing experiences are opening novel opportunities.

Samsung Electronics, LG Electronics, TCL, Sony, Hisense, Skyworth, Panasonic, and Changhong are some of the key market players.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 - 2025 |

|

Forecast Period |

2026 - 2033 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Screen Size

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author