ID: PMRREP6098| 191 Pages | 10 Sep 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

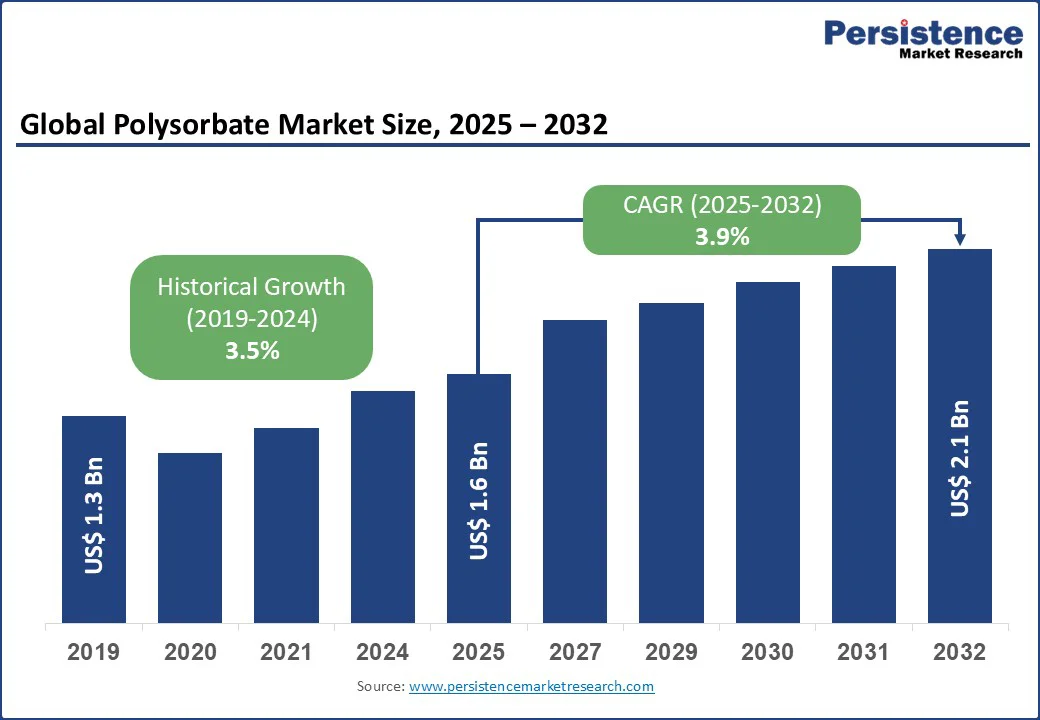

The global polysorbate market size is likely to be valued at US$1.6 Bn in 2025 and is expected to reach US$2.1 Bn by 2032, growing at a CAGR of 3.9% during the forecast period from 2025 to 2032.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Polysorbate Market Size (2025E) |

US$1.6 Bn |

|

Market Value Forecast (2032F) |

US$2.1 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

3.9% |

|

Historical Market Growth (CAGR 2019 to 2024) |

3.5% |

Increasing demand across the food, pharmaceutical, and cosmetic industries drives the need for polysorbates. Polysorbates serve as emulsifiers, solubilizers, and stabilizers, improving product texture, consistency, and shelf life. Expansion in processed food production, rising pharmaceutical formulations, and growing personal care consumption are key contributors.

The rising demand for processed foods and pharmaceutical formulations is a key driver. Polysorbates, as versatile emulsifiers and stabilizers, play a critical role in improving the texture, shelf-life, and overall quality of processed food products such as baked goods, dairy items, sauces, and dressings. With the increasing preference for ready-to-eat and convenience foods driven by busy lifestyles, manufacturers are increasingly incorporating polysorbates to maintain product consistency and prevent separation, ensuring consumer satisfaction. For instance, in ice cream production, polysorbates help prevent the formation of ice crystals, enhancing smoothness and extending shelf life, which is essential for both retail and foodservice channels.

In the pharmaceutical sector, polysorbates are widely used as solubilizing agents and emulsifiers in formulations, including vaccines, injectables, and oral medications. The surge in vaccine production, particularly during global health emergencies, has further accentuated the demand for polysorbates due to their ability to stabilize active ingredients and improve bioavailability. Companies such as Croda and BASF have increasingly focused on supplying high-purity polysorbates for these applications, underscoring their critical role in supporting the processed food and pharmaceutical industries.

Regulatory challenges pose a significant restraint. Governments and regulatory bodies across regions, including the U.S. FDA and the European Food Safety Authority (EFSA), enforce strict guidelines on the use of food additives and pharmaceutical excipients. Manufacturers must comply with stringent quality, safety, and labeling standards, which can increase production costs and delay product launches. Non-compliance may result in recalls, fines, or restricted market access, creating operational challenges for polysorbate producers and end-users alike.

Additionally, the polysorbate market is highly sensitive to raw material price volatility, particularly due to its dependence on sorbitol and fatty acids derived from vegetable oils. Fluctuating prices of these raw materials, driven by agricultural yield variations and global supply-demand imbalances, can impact production costs and profit margins, posing a challenge for consistent market growth.

The growing demand for cosmetics and personal care products presents a significant opportunity for the polysorbate market. Polysorbates are widely used as emulsifiers, solubilizers, and stabilizers in skincare, haircare, and makeup formulations, enhancing texture, consistency, and product performance. With increasing consumer awareness about personal grooming and rising disposable incomes, manufacturers are leveraging polysorbates to develop high-quality, stable, and visually appealing cosmetic products that meet evolving consumer expectations.

Emerging markets in the Asia Pacific, Latin America, and the Middle East are witnessing rapid urbanization and a surge in beauty and personal care consumption. These regions offer lucrative growth prospects for polysorbate manufacturers, driven by expanding retail channels, rising e-commerce penetration, and the preference for international cosmetic brands. The combination of product innovation and increasing accessibility is expected to fuel demand for polysorbates in these markets over the forecast period.

Liquid polysorbates dominate the polysorbate market, holding around 50% share due to their ease of use, versatility, and compatibility with various applications across food, pharmaceutical, and cosmetic industries. A majority of food and beverage manufacturers rely on liquid polysorbates for emulsification, as they improve product consistency, stability, and texture. Their ready-to-use form makes them ideal for large-scale production, ensuring uniform quality and reliable performance across diverse applications.

Powder polysorbates are emerging as the fastest-growing form. Their adoption is increasing in pharmaceutical and cosmetic applications due to benefits such as precise dosing, longer shelf life, and easier storage. An increasing number of manufacturers are incorporating powder forms to produce stable, high-quality formulations across multiple industries.

Polysorbate 80 dominates, holding around 35% share due to its extensive use in food, pharmaceuticals, and cosmetics for emulsification and solubilization. Its effectiveness in stabilizing formulations makes it the preferred choice in injectable drugs, enhancing drug stability and ensuring consistent performance. The widespread adoption of Polysorbate 80 across multiple industries underlines its critical role in maintaining product quality and reliability.

Polysorbate 20, meanwhile, is emerging as the fastest-growing type. Its mild properties and suitability for skincare and haircare formulations are driving increased adoption in cosmetic applications. Manufacturers are increasingly incorporating Polysorbate 20 to develop stable, gentle, and high-quality personal care products across a growing number of markets.

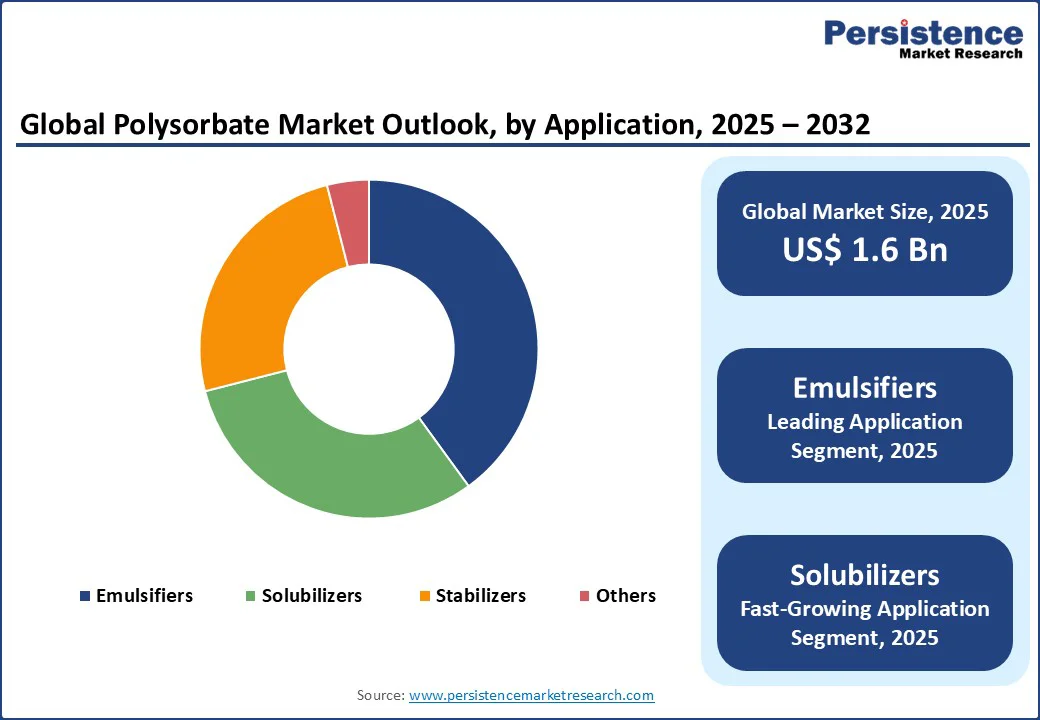

Emulsifiers dominate with a 40% share, driven by strong demand in the food and beverage industry. Polysorbates are widely used to create stable emulsions in products such as ice cream, sauces, and margarine, enhancing texture, consistency, and shelf life. In 2024, a majority of processed food manufacturers incorporated polysorbates as emulsifiers, improving product stability and consumer satisfaction.

Solubilizers, on the other hand, are emerging as the fastest-growing application of polysorbates. Their increasing adoption in pharmaceutical formulations, particularly for poorly soluble drugs, is driving market growth. A growing number of drug manufacturers are incorporating polysorbates as solubilizers to improve drug bioavailability and formulation stability across diverse pharmaceutical applications.

The food and beverages segment dominates, holding around 35% share, driven by the growth of the processed food industry. Polysorbates are widely used for emulsification and stabilization, enhancing product consistency, texture, and shelf life in items such as baked goods, dairy products, sauces, and dressings. In 2024, a majority of food manufacturers incorporated polysorbates to improve overall product quality and ensure reliable performance across large-scale production.

The pharmaceutical segment is emerging as the fastest-growing application of polysorbates. Increasing demand for injectable and oral drug formulations, supported by regulatory approvals and the need for high-purity ingredients, is driving adoption. Manufacturers are leveraging polysorbates to enhance drug stability, solubility, and bioavailability in diverse pharmaceutical applications.

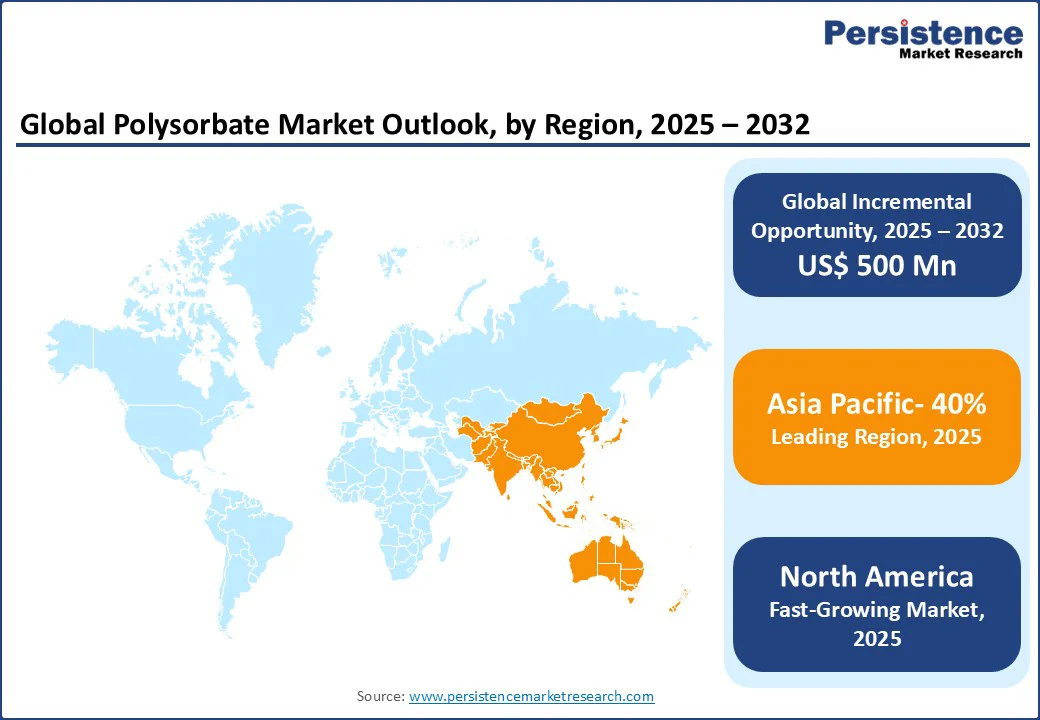

North America is emerging as the fastest-growing market for polysorbates, driven by increasing demand across food, pharmaceutical, and cosmetic industries. The region’s well-established processed food sector extensively uses polysorbates for emulsification, stabilization, and shelf-life enhancement in products such as baked goods, dairy, and sauces.

In pharmaceuticals, the growing production of injectable drugs and oral formulations requiring high-purity polysorbates supports regional growth, alongside stringent regulatory standards ensuring product safety and efficacy. Additionally, rising consumer awareness of personal care and cosmetic products is fueling adoption in skincare and haircare applications. The combination of advanced manufacturing infrastructure, strong R&D capabilities, and expanding end-use industries positions North America as a key growth hub for polysorbates in the coming years.

Europe holds a notable share in 2025 - driven by strong demand across food, pharmaceutical, and cosmetic industries. The region’s well-established processed food sector extensively uses polysorbates for emulsification, stabilization, and improving product consistency in items such as baked goods, sauces, and dairy products.

In the pharmaceutical industry, the adoption of high-purity polysorbates for injectable and oral formulations supports regional market strength, with regulatory compliance ensuring safety and efficacy. Additionally, Europe’s mature personal care and cosmetic market fuels the use of polysorbates in skincare and haircare products, promoting product stability and performance. Robust manufacturing infrastructure and growing R&D initiatives further reinforce Europe’s position as a key contributor.

Asia Pacific dominates the polysorbate market, holding around 40% share in 2025, driven by rapid growth in the food, pharmaceutical, and cosmetic industries. The region’s expanding processed food sector heavily relies on polysorbates for emulsification, stabilization, and enhancing product texture and shelf life in items such as baked goods, sauces, and dairy products. In pharmaceuticals, rising production of injectable and oral drug formulations, coupled with increasing regulatory approvals, is boosting demand for high-purity polysorbates.

Additionally, the growing personal care and cosmetic market, fueled by rising consumer awareness and disposable incomes, drives the adoption of polysorbates in skincare and haircare products. Strong manufacturing capabilities and increasing industrial investments further consolidate Asia Pacific’s leading position globally.

The global polysorbate market is highly competitive, characterized by the presence of numerous established and emerging manufacturers focusing on product innovation, quality enhancement, and regional expansion. Companies are investing in research and development to introduce high-purity polysorbates for pharmaceutical, food, and cosmetic applications.

Strategic initiatives such as capacity expansion, partnerships, and supply chain optimization are being adopted to strengthen market presence. The emphasis on sustainability, regulatory compliance, and advanced formulations further intensifies competition, driving innovation and growth across the industry.

The polysorbate market is projected to reach US$1.6 bn in 2025, driven by demand in food, pharmaceuticals, and cosmetics.

Rising processed food demand, pharmaceutical formulations, and cosmetic applications fuel market growth.

The polysorbate market will grow from US$1.6 bn in 2025 to US$2.1 bn by 2032, with a CAGR of 3.9%.

Growth in cosmetics and emerging market expansion drive opportunities in sustainable applications.

Leading players include Mitsubishi Chemical Corporation, Kao Corporation, AkzoNobel, Croda International, and Evonik Industries.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Form Type

By Product

By Application

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author