ID: PMRREP24907| 199 Pages | 17 Nov 2025 | Format: PDF, Excel, PPT* | Healthcare

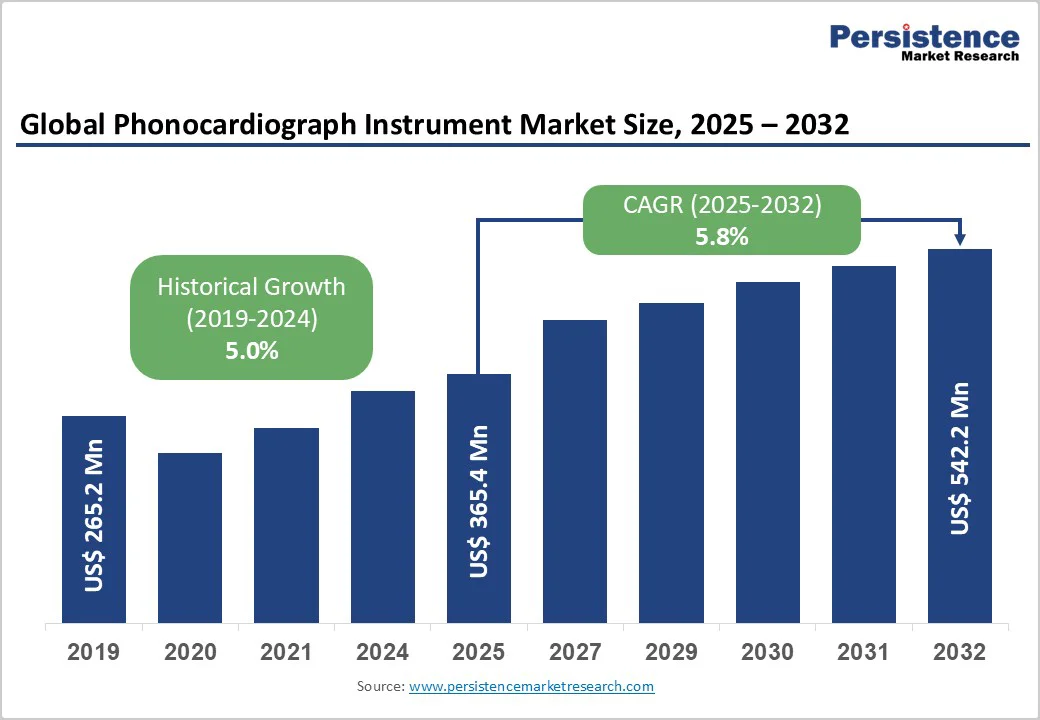

The global phonocardiograph instrument market size is likely to be valued at US$365.4 Million in 2025, expected to US$542.2 Million by 2032, growing at a CAGR of 5.8% during the forecast period from 2025 to 2032, driven by the rising prevalence of cardiovascular diseases, advancements in non-invasive diagnostic technologies, and increasing demand for portable cardiac monitoring devices.

Phonocardiograph Instruments are critical for detecting heart murmurs and rhythm abnormalities, boosting their adoption in hospitals, clinics, and home care settings, particularly in regions with aging populations and expanding healthcare infrastructure. Innovations in digital and electronic phonocardiographs, offering enhanced accuracy and telemedicine integration, further fuel market growth. The growing acceptance of phonocardiograph instruments as cost-effective tools for early cardiac diagnosis is a key growth driver.

| Key Insights | Details |

|---|---|

|

Phonocardiograph Instrument Market Size (2025E) |

US$365.4 Mn |

|

Market Value Forecast (2032F) |

US$542.2 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

5.8% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.0% |

The increasing prevalence of cardiovascular diseases (CVD) and demand for non-invasive diagnostic tools are primary drivers of the phonocardiograph instrument market. driven by the rising prevalence of cardiovascular diseases (CVDs) and the increasing need for non-invasive diagnostic solutions. Cardiovascular conditions, including heart murmurs, valve disorders, arrhythmias, and congenital heart defects, are among the leading causes of morbidity and mortality worldwide. Aging populations, lifestyle-related risk factors such as obesity, sedentary behaviour, and unhealthy diets, as well as increasing awareness of heart health, are contributing to a growing patient base requiring early detection and continuous monitoring.

Phonocardiograph instruments offer a reliable, non-invasive method for assessing cardiac health by analyzing heart sounds with high precision. Unlike invasive procedures, these instruments provide rapid, risk-free evaluation, making them suitable for use in hospitals, clinics, and home care settings. The availability of digital and AI-enhanced phonocardiographs further improves diagnostic accuracy, enabling early detection of subtle abnormalities that might be missed during traditional auscultation.

High costs of advanced phonocardiograph instruments and limited awareness in emerging markets pose significant restraints. Advanced phonocardiograph devices, particularly digital and AI-integrated models, require substantial investment, making them less accessible to smaller hospitals, clinics, and homecare providers with limited budgets. High initial purchase costs, coupled with ongoing maintenance and training expenses, often discourage healthcare providers from investing in these technologies, especially in regions where healthcare funding is constrained.

Limited awareness among both healthcare professionals and patients further hampers adoption. Many clinicians rely on traditional auscultation methods and may lack training in advanced phonocardiography, reducing demand for sophisticated instruments. Patients, particularly in rural or underserved areas, are often unaware of the benefits of early cardiac monitoring and preventive diagnostics, limiting uptake. Inconsistent infrastructure, including unreliable electricity, poor internet connectivity, and limited access to telemedicine platforms, restricts the effective use of digital and wearable devices.

Advancements in wearable phonocardiograph instruments and AI integration offer significant growth opportunities. driven by wearable devices and AI integration, transforming cardiac diagnostics and patient monitoring. Wearable phonocardiographs enable continuous, non-invasive monitoring of heart sounds, allowing early detection of abnormalities such as murmurs, arrhythmias, and valve disorders outside traditional clinical settings. These portable devices provide convenience for patients, especially in homecare and remote monitoring scenarios, while facilitating real-time data collection for clinicians.

AI integration enhances the diagnostic capabilities of phonocardiographs by enabling automated heart sound analysis, anomaly detection, and predictive insights. Machine learning algorithms can identify subtle acoustic patterns that may be missed by conventional auscultation, improving diagnostic accuracy and supporting timely clinical intervention. Combined with cloud-based platforms, AI-powered devices allow data sharing and telemedicine consultations, expanding accessibility to high-quality cardiac care.

Digital Phonocardiographs dominate the market, expected to hold 40% of the share in 2025, driven by their high precision, data accuracy, and seamless integration with digital health platforms. These devices enable real-time analysis, remote monitoring, and AI-assisted diagnostics, making them essential in modern cardiac care. Growing telemedicine adoption further reinforces their leadership in the market.

Electronic Phonocardiographs are the fastest-growing segment, driven by their portability, digital integration, and compatibility with telemedicine platforms. These devices enable real-time heart sound recording, storage, and remote analysis, enhancing accessibility for both clinicians and patients. The growing adoption of AI-based diagnostics and wireless connectivity further accelerates demand for advanced, user-friendly electronic phonocardiograph systems.

Cardiac Diagnosis leads with a 50% share, fueled by the growing need for early detection of heart conditions such as valve disorders and arrhythmias. Electronic stethoscopes provide accurate, non-invasive heart sound analysis, supporting timely clinical decisions. Rising cardiovascular disease prevalence and demand for advanced diagnostic tools further strengthen this segment’s dominant position.

Monitoring Heart Murmurs is the fastest-growing, driven by its critical role in pediatric and geriatric care. Digital stethoscopes enable early detection of congenital and age-related cardiac abnormalities through precise heart sound analysis. Growing awareness of preventive cardiology and advancements in AI-assisted diagnostics further enhance accuracy and accessibility, supporting wider adoption across healthcare settings.

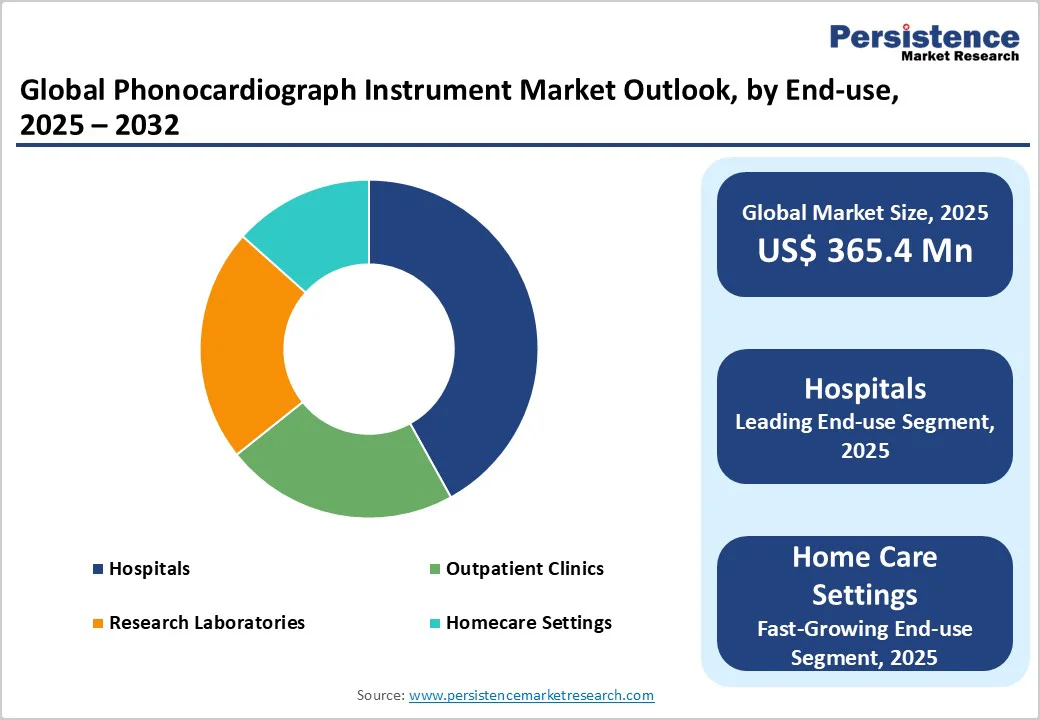

Hospitals hold nearly 45% share, driven by their extensive use of electronic stethoscopes for high-volume cardiac diagnostics and patient monitoring. Equipped with advanced infrastructure and skilled professionals, hospitals rely on these devices for accurate heart sound analysis, early disease detection, and clinical decision support, ensuring reliable, large-scale cardiovascular assessments within integrated healthcare systems.

Homecare Settings are the fastest-growing, propelled by the rising trend of remote cardiac monitoring and patient-centric healthcare. Increasing use of portable and wearable digital stethoscopes enables continuous, non-invasive heart assessment outside hospitals. Advancements in telemedicine, AI integration, and smartphone connectivity further support early diagnosis and chronic disease management, enhancing accessibility and convenience for patients

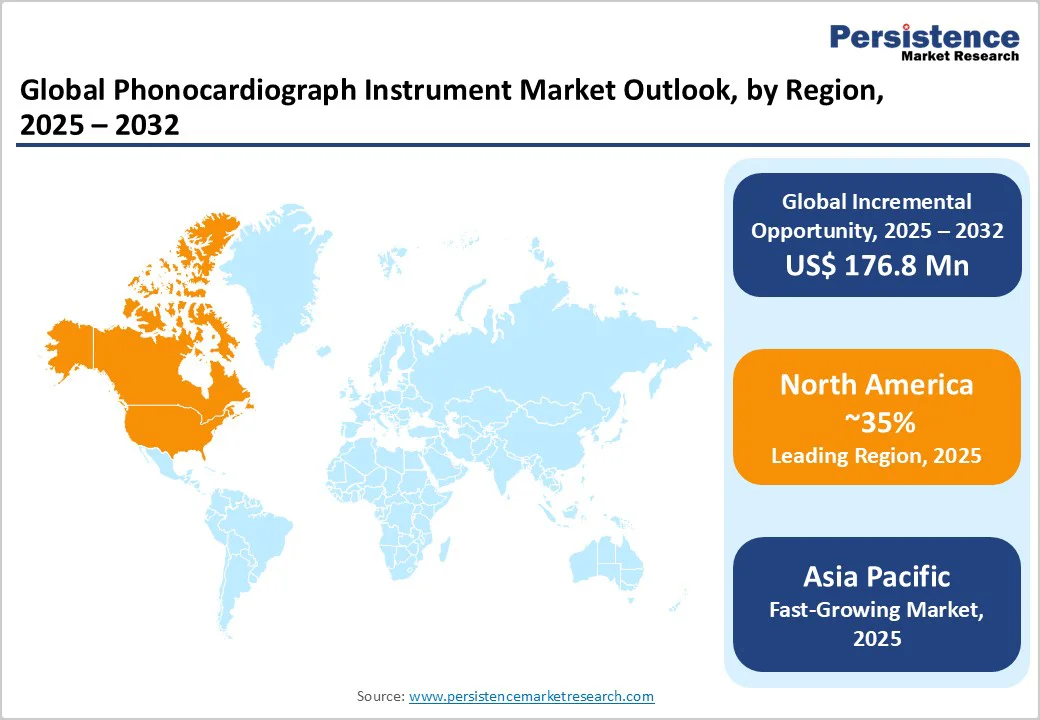

North America accounts for 35% in 2025, driven primarily by the United States’ significant investments in cardiology and digital health innovation. The region’s high prevalence of cardiovascular diseases (CVDs), coupled with strong healthcare infrastructure and reimbursement support, fuels the adoption of advanced diagnostic tools. The U.S. is witnessing growing integration of AI-enabled electronic stethoscopes in hospitals, clinics, and remote monitoring systems to enhance early detection and accuracy in cardiac assessment. Increasing research funding and collaborations between medical device manufacturers and academic institutions further stimulate technological advancements.

The U.K. is geographically part of Europe; its market trends closely mirror those in North America. The National Health Service (NHS) is actively promoting telemedicine and digital diagnostics to strengthen preventive cardiology care. Adoption of AI-integrated phonocardiograph systems in primary care settings is rising, enabling faster, non-invasive cardiac screening.

Europe holds about 30% market share, led by Germany and France. The region’s growth is supported by substantial EU health technology funding, aimed at enhancing diagnostic innovation, digital health integration, and early disease detection. Governments and healthcare institutions across Europe are prioritizing cardiovascular prevention programs, creating strong demand for advanced, non-invasive cardiac monitoring tools like phonocardiographs.

Germany, with its well-established healthcare infrastructure and strong R&D capabilities, remains a frontrunner in adopting AI-driven and digital diagnostic technologies. Meanwhile, France continues to expand its cardiovascular screening initiatives and invest in telemedicine, fostering the use of portable and connected phonocardiograph systems. The European Union’s focus on interoperability, electronic health records, and patient data security further promotes the integration of phonocardiographs into digital healthcare ecosystems.

The Asia Pacific region commands around a 25% share and is the fastest-growing, driven by demographic shifts and the development of healthcare infrastructure. China’s rapidly aging population is leading to a higher prevalence of cardiovascular diseases, fueling demand for advanced yet affordable diagnostic tools such as phonocardiographs. The country’s focus on strengthening preventive healthcare and integrating digital health solutions further accelerates market growth.

In India, the expansion of cardiology infrastructure, increased government investments in healthcare modernisation, and growing awareness of heart disease detection are creating a strong demand for cost-effective and portable diagnostic instruments. The rise of telemedicine and AI-powered diagnostic platforms also supports wider adoption, especially in rural and underserved areas. Regional manufacturers are actively developing locally produced, low-cost phonocardiograph systems to enhance accessibility and reduce dependency on imports.

The global phonocardiograph instrument market is highly competitive, driven by rapid technological advancements and a growing emphasis on digital and wearable innovations. Key players are increasingly integrating artificial intelligence (AI), machine learning, and cloud-based data analytics to improve the accuracy and efficiency of heart sound analysis. Wearable phonocardiograph devices are gaining traction as they enable continuous cardiac monitoring and early detection of abnormalities outside clinical settings.

Strategic collaborations among medical device manufacturers, research institutions, and healthcare providers are becoming a key growth strategy to enhance diagnostic precision and expand market reach. Companies are also focusing on developing user-friendly, portable instruments compatible with smartphones and telemedicine platforms to support remote patient monitoring.

The global phonocardiograph instrument market is projected to reach US$365.4 Million in 2025, driven by rising cardiovascular disease cases.

The growing incidence of heart conditions worldwide, especially among aging populations, fuels demand for accurate and early cardiac diagnostics.

The market is poised to witness a CAGR of 5.8% from 2025 to 2032, supported by digital and wearable innovations.

Wearable digital stethoscopes for home care monitoring offer significant growth opportunities in telemedicine.

3M Littmann, Thinklabs, HD Medical Group, eKuore, and Minttihealth lead through innovative digital stethoscopes.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Mn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Instrument Type

By Application

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author