ID: PMRREP35625| 187 Pages | 17 Sep 2025 | Format: PDF, Excel, PPT* | Healthcare

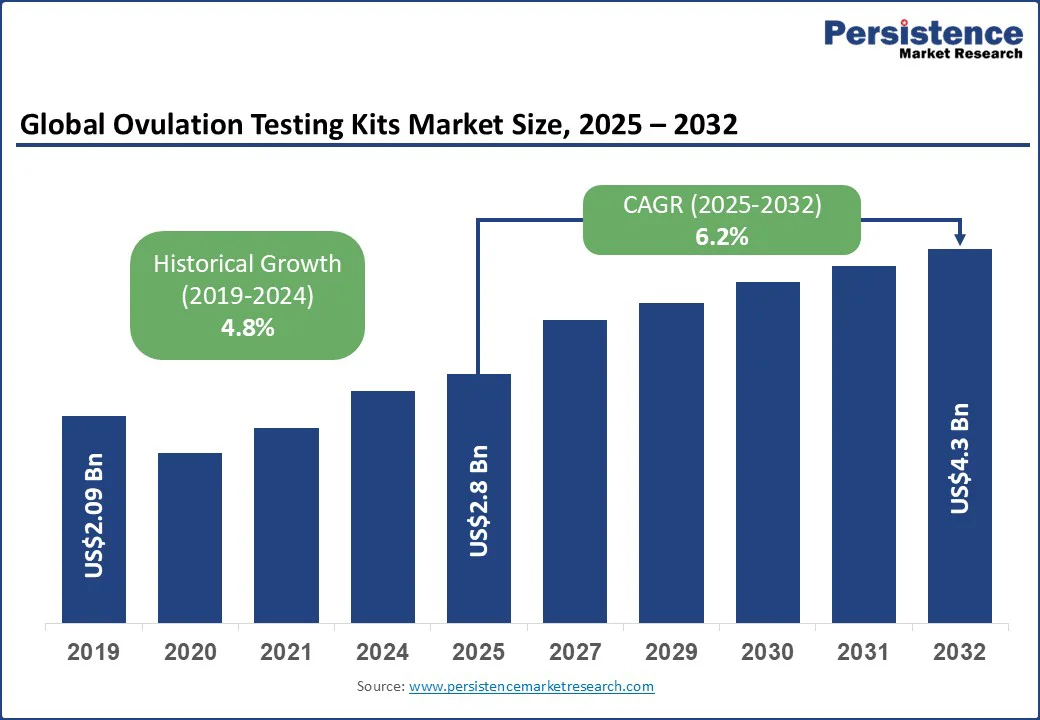

The global ovulation testing kits market size is projected to rise from US$ 2.8 Bn in 2025 to US$ 4.3 Bn by 2032. It is anticipated to witness a CAGR of 6.2% during the forecast period from 2025 to 2032, driven by the growing awareness of fertility solutions, increasing rates of infertility linked to lifestyle and medical factors, and the preference for convenient, accurate, and affordable self-testing kits.

Key Industry Highlights

| Global Market Attribute | Key Insights |

|---|---|

| Ovulation Testing Kits Market Size (2025E) | US$ 2.8 Bn |

| Market Value Forecast (2032F) | US$ 4.3 Bn |

| Projected Growth (CAGR 2025 to 2032) | 6.2% |

| Historical Market Growth (CAGR 2019 to 2024) | 4.8% |

The adoption of multi-hormone ovulation test kits that measure both luteinizing hormone (LH) and estrogen is reshaping accuracy standards in fertility tracking, giving women more reliable results than traditional LH-only kits. The surge in AI-powered digital ovulation kits, often Bluetooth-enabled and connected to mobile apps, allows users to receive automatic interpretations, daily fertility insights, and long-term cycle tracking.

Many of these devices are offered through subscription-based fertility bundles, which combine test kits with virtual coaching or app access, creating recurring revenue streams while embedding fertility tracking into everyday health routines.

Market growth is also being fueled by greater accessibility and regional customization. In the U.S., pharmacies such as CVS are expanding fertility wellness aisles, while e-commerce platforms such as Amazon have added dedicated fertility categories, boosting visibility and sales. In Asia Pacific, demand is being met with low-cost ovulation test strips and PCOS-specific ovulation kits designed to cater to affordability and local health challenges.

Manufacturers are increasingly investing in broader distribution networks, ensuring availability in Tier-2 and Tier-3 cities and even rural markets, which is widening consumer reach and supporting faster adoption of reproductive health solutions worldwide.

One of the major challenges in the ovulation testing kits market is the issue of ambiguous or faint test lines, which often leads to misinterpretation of results. Women with conditions such as PCOS or irregular hormone surges are particularly affected, as their fluctuating LH levels may produce unclear outcomes.

This lack of clarity reduces user confidence and discourages consistent use, especially among first-time buyers who rely heavily on visual cues. As a result, concerns about accuracy and usability limit the wider adoption of traditional line-based kits in comparison to digital alternatives.

Another growing restraint is linked to privacy risks in app-connected ovulation kits. Many smartphone-based fertility trackers and AI-integrated kits collect sensitive reproductive data, including hormone readings, cycle patterns, and contraceptive details.

Reports of data-sharing with third parties and advertising platforms have raised alarm among consumers who worry about how their personal health information is being used. Some users have even noted that apps restrict access unless they agree to broad data consent terms, creating distrust. Ongoing concerns over digital privacy may slow the adoption of connected ovulation kits, despite their technological benefits.

An emerging opportunity in the ovulation testing kits market is the development of saliva-based ferning kits that are both reusable and eco-friendly. Unlike disposable strip-based tests, these kits detect estrogen changes by analyzing ferning patterns in saliva through a small microscope.

They not only reduce waste but also allow for long-term use, making them highly attractive to sustainability-conscious consumers. When paired with smartphone apps that can store and interpret results, these solutions provide a convenient and environmentally responsible alternative for women seeking reliable fertility tracking.

Another strong growth driver is the rise of AI-powered fertility platforms that integrate ovulation testing with digital health ecosystems. These platforms combine Bluetooth-enabled kits, multi-hormone detection, and predictive algorithms to deliver personalized fertility insights, especially useful for women with irregular cycles or PCOS.

Subscription-based models are also gaining traction, offering users continuous access to test kits, app features, and even virtual fertility coaching. This creates a holistic service that meets the demand for convenience, accuracy, and tailored reproductive health support.

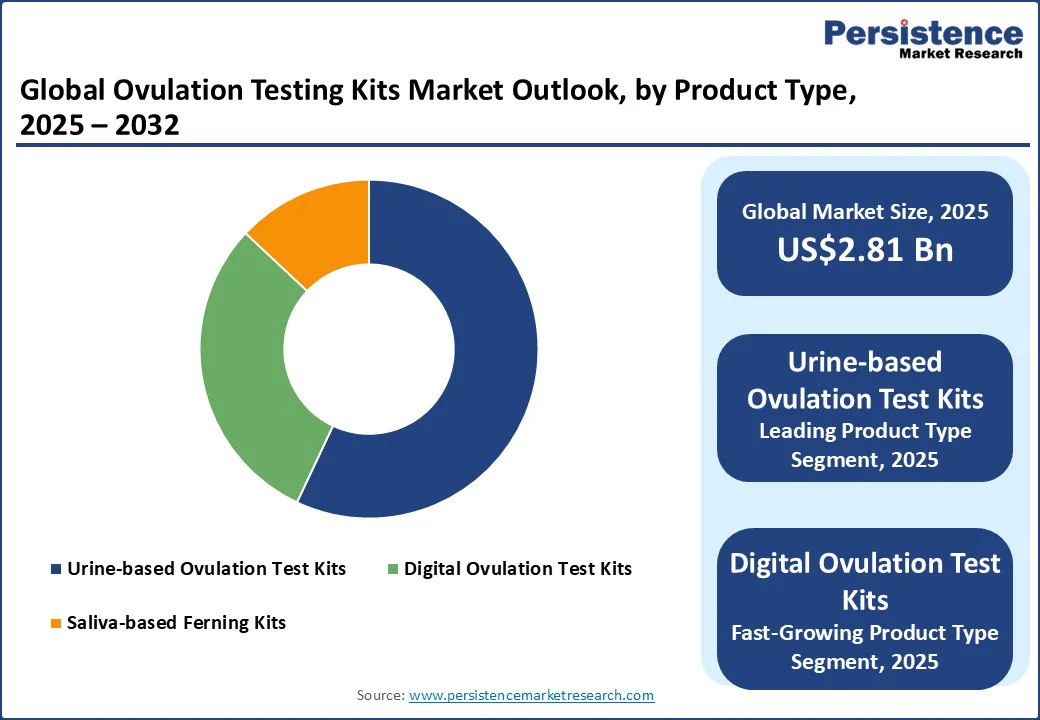

The urine-based ovulation test kits segment currently holds the largest share of the market, accounting for nearly 57% of global sales. Their dominance comes from being affordable, easy to use, and widely available across pharmacies, supermarkets, and online platforms.

These kits rely on detecting the luteinizing hormone (LH) surge, which makes them familiar and trusted by millions of women worldwide. Clearblue’s standard LH urine strips remain among the most purchased fertility aids globally, owing to their simplicity and reliability.

Digital ovulation test kits represent the fastest-growing product segment. Unlike traditional line-based tests, digital kits display results in clear symbols or words, reducing the risk of misinterpretation. Many models also monitor multiple hormones, such as LH and estrogen, and connect to mobile apps for cycle tracking.

This makes them particularly attractive to tech-savvy women and those managing complex fertility challenges such as PCOS. For instance, the Clearblue Advanced Digital Ovulation Test not only provides accurate readings but also links with digital tools, enhancing convenience and accuracy.

Within test formats, strip-based ovulation tests are the most widely used and are anticipated to dominate the market in 2025 with a market share of 46%. Their appeal lies in being low-cost, compact, and disposable, which makes them highly accessible to first-time users and women in emerging markets.

They are especially popular for bulk purchases, where women use multiple strips across a cycle to increase accuracy. Easy@Home and Premom test strips are often paired with mobile apps for result interpretation, offering a budget-friendly yet effective solution.

At the same time, digital ovulation tests are the fastest-growing format and are expected to expand at the highest CAGR over the next decade. Their main advantage is eliminating confusion; results are displayed as clear indicators such as “Peak Fertility” or smiley faces, leaving no room for guessing.

Many digital devices also sync with fertility apps, offering women insights and long-term cycle patterns. This clarity and added functionality explain why more users are shifting from simple strips to digital kits, especially in developed regions where convenience and accuracy are highly valued.

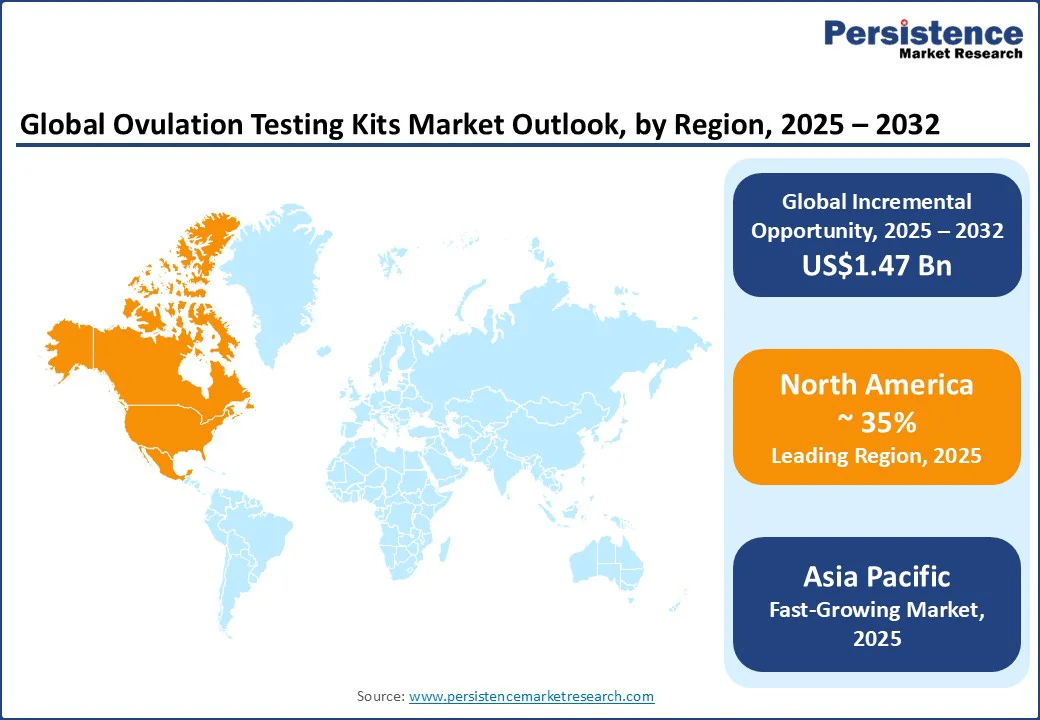

North America is the largest regional market for ovulation testing kits, holding over 35% of the market share. The region’s growth is fueled by rising infertility cases, lifestyle-related reproductive health issues, and the trend of delayed motherhood among women in their 30s and 40s.

In particular, digital ovulation testing kits are growing rapidly in the U.S. as women increasingly favor user-friendly, app-connected solutions that track multiple fertility indicators beyond the traditional LH surge. For example, Clearblue’s AI-driven digital kits, introduced in 2023, have improved accuracy and gained strong traction among consumers seeking advanced solutions for family planning.

In Canada, market expansion is supported by strong healthcare awareness campaigns and the growing role of fertility clinics, which recommend at-home ovulation kits for women preparing for assisted reproductive technologies (ART) such as IVF.

Telehealth platforms in Canada are also bundling fertility consultations with home delivery of ovulation testing kits, improving accessibility for women in remote areas. Both countries benefit from well-established e-commerce channels such as Amazon, which has become a key sales driver for bulk purchases of urine-based strip kits, such as Easy@Home, which dominate entry-level consumer preferences.

Asia Pacific is the fastest-growing regional market, projected to expand at a CAGR of nearly 8% through 2032. The region’s rapid expansion is attributed to rising infertility rates, lifestyle shifts such as late marriages, and increasing awareness of reproductive health through digital campaigns and government initiatives.

Urine-based kits dominate sales due to their affordability, but digital ovulation testing kits are the fastest-growing sub-segment, particularly in urban centers where women are highly tech-savvy and more open to digital health monitoring.

China is the largest contributor within Asia Pacific, with government policies that promote maternal health and the easing of childbirth restrictions (such as the one-child policy), encouraging women to actively track fertility. Local manufacturers are also producing low-cost alternatives, making ovulation kits accessible in both urban and semi-urban regions.

India represents another high-potential market. Rising awareness campaigns by pharmaceutical companies and NGOs are driving adoption, particularly in Tier II and Tier III cities. The launch of Mankind Pharma’s Ova News Ovulation Detection Kit has made ovulation tracking more affordable, ensuring broader adoption among middle-income households.

In Japan, where the average maternal age continues to rise, fertility clinics often recommend digital kits integrated with smartphone apps, catering to women who want precise and reliable data. South Korea’s government-backed initiatives to tackle declining birth rates are encouraging young couples to consider fertility tracking, creating new demand for advanced ovulation monitoring solutions.

Europe remains a key market due to strong consumer awareness, supportive public health campaigns, and the rising average age of first-time mothers, which are major factors supporting adoption. France is projected to record the fastest growth in the region, supported by government-backed awareness initiatives on fertility health and campaigns promoting early pregnancy planning.

Pharmacies and online retailers in France report growing demand for digital midstream kits, which offer convenience and reliability. Meanwhile, the U.K. is at the forefront of innovation, with startups such as Hertility Health integrating fertility testing into broader women’s health services. In 2023, Hertility partnered with insurers to expand access to at-home hormone and fertility kits, making them more affordable and widely available.

In Germany, a growing number of fertility clinics and gynecologists are recommending women to combine ovulation kits with digital fertility tracking apps, supporting a hybrid approach that blends traditional testing with digital monitoring. This shift toward precision-based, tech-enabled solutions reflects the broader European consumer preference for reliability and integration with digital health ecosystems.

The global ovulation testing kits market is moderately consolidated, with a few multinational players such as Clearblue (Swiss Precision Diagnostics), Proov, Easy@Home (Premom), and Ava Science holding significant market share.

These companies dominate through strong brand recognition, wide product portfolios, and multi-channel distribution strategies that include pharmacies, supermarkets, and e-commerce platforms. Their focus is largely on product innovation, such as digital kits with app integration, multi-hormone detection, and AI-based cycle tracking, which cater to tech-savvy users seeking higher accuracy and convenience.

Regional and emerging players are rapidly gaining ground, particularly in Asia-Pacific and Europe, by offering cost-effective urine-based kits and expanding through online channels. Companies such as Mankind Pharma (India) and iProvèn (Netherlands) are leveraging affordability and accessibility to penetrate underserved markets.

Partnerships with fertility clinics, pharmacies, and telehealth platforms are also becoming a competitive strategy, enabling brands to position themselves not just as test providers but as part of broader fertility management ecosystems.

The ovulation testing kits market is projected to be valued at US$2.81 Bn in 2025.

By 2032, the ovulation testing kits market is projected to reach US$4.28 Bn.

Key trends include the growing adoption of digital ovulation test kits with app connectivity, rising demand for multi-hormone detection kits, and the expansion of e-commerce distribution channels that make products more accessible globally.

The urine-based ovulation test kits segment is the largest, holding nearly 57% of the global market share, due to affordability, ease of use, and broad availability.

The ovulation testing kits market is expected to grow at a CAGR of 6.2% from 2025 to 2032, driven by increasing fertility awareness and demand for at-home diagnostic tools.

The leading players include Swiss Precision Diagnostics GmbH (Clearblue), Proov, Easy@Home (Premom), Church & Dwight Co., Inc. (First Response), and Wondfo Biotech Co., Ltd.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Test Format

By Sample Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author