ID: PMRREP32801| 200 Pages | 6 Jan 2026 | Format: PDF, Excel, PPT* | IT and Telecommunication

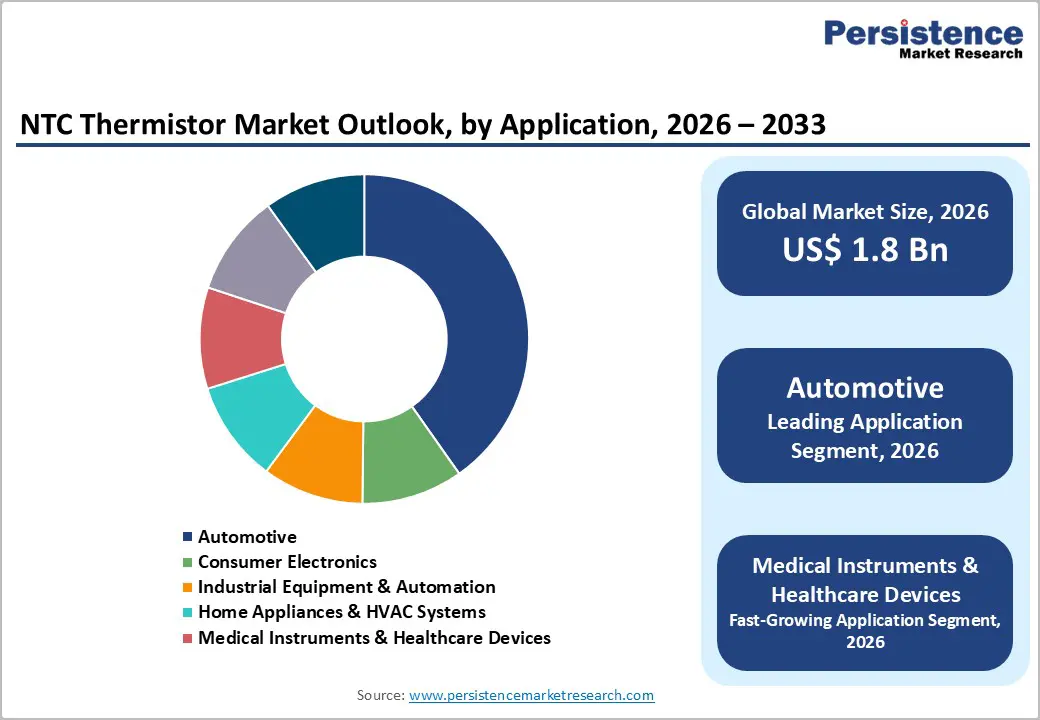

The global NTC Thermistor market is expected to be valued at US$ 1.8 billion in 2026 and projected to reach US$ 2.7 billion by 2033, growing at a CAGR of 5.7% between 2026 and 2033.

Market growth is fundamentally driven by three primary catalysts. The escalating demand for electric vehicles (EVs) necessitates sophisticated battery thermal management systems where NTC thermistors serve as critical temperature monitoring components. Simultaneously, stringent global emission regulations and fuel efficiency standards compel automotive manufacturers to implement advanced engine control systems reliant on precise temperature sensing. Finally, the proliferation of connected devices and Internet of Things (IoT) technologies across consumer electronics, HVAC systems, and industrial automation creates sustained demand for compact, reliable temperature sensors with superior sensitivity—characteristics that NTC thermistors inherently provide.

| Global Market Attributes | Key Insights |

|---|---|

| NTC Thermistor Market Size (2026E) | US$ 1.8 billion |

| Market Value Forecast (2033F) | US$ 2.7 billion |

| Projected Growth CAGR (2026-2033) | 5.7% |

| Historical Market Growth (2020-2025) | 5.2% |

Electrification of Automotive Industry and EV Battery Management

The rapid expansion of the electric vehicle (EV) market represents the most significant growth driver for the NTC thermistor sector. Lithium-ion battery packs in modern EVs operate optimally within narrow temperature ranges (approximately 20°C to 45°C), requiring continuous temperature monitoring to prevent thermal runaway and optimize charging/discharging efficiency. Each EV battery pack typically incorporates multiple NTC thermistor sensors, estimated at 8-15 units per vehicle, to monitor temperature across different cell modules and battery management system components.

The global electric vehicle market experienced a 35-40% growth rate in 2024, with projections indicating over 40 million EVs on roads globally by 2030. This trajectory translates directly into exponential demand for NTC thermistors, with battery thermal management representing a market opportunity valued in the multi-hundred million dollar range. Leading automotive manufacturers and Tier-1 suppliers are increasingly specifying high-precision NTC thermistors with tolerance levels down to ±0.5% and operating ranges up to 175°C for inverter and DC-DC converter applications.

Stringent Emission Regulations and HVAC System Enhancement

Global regulatory frameworks, including EU Euro 6 standards, US EPA regulations, and China’s National Standard 6 (GB6), mandate stringent emission control and fuel efficiency targets that force automotive manufacturers to optimize engine combustion and thermal management. NTC thermistors play essential roles in exhaust gas temperature (EGT) sensing, transmission fluid temperature monitoring, and engine coolant temperature measurement, all critical parameters for achieving compliance.

Simultaneously, the enhancement of HVAC systems in modern vehicles and buildings, driven by consumer demand for climate comfort and energy efficiency, necessitates precise temperature control. NTC thermistors with response times as fast as 0.5-1.0 seconds enable thermostat circuits and climate control modules to react rapidly to temperature fluctuations. Data from the HVAC industry indicates that global heating and cooling system installations grow at approximately 6-7% annually, particularly in developing economies experiencing rapid urbanization and increased disposable income.

Supply Chain Vulnerabilities and Raw Material Cost Fluctuations

The NTC thermistor manufacturing process depends heavily on specialized ceramic materials containing transition metal oxides, rare earth elements, and proprietary sintering techniques conducted at temperatures exceeding 1000-1400°C. Geopolitical tensions, particularly sourcing constraints for critical materials from limited geographic regions, have created supply chain vulnerabilities. The semiconductor and passive components sector experienced significant supply disruptions during 2021-2023, with NTC thermistor lead times extending from standard 4-6 weeks to 12-16 weeks.

Additionally, fluctuations in energy costs directly impact manufacturing expenses, as sintering processes consume substantial electricity. Raw material price volatility, particularly for ceramic precursors and precious metals used in contact layers, has compressed profit margins for manufacturers, with cost increases estimated at 20% during 2023-2024 periods. These cost pressures are gradually being passed to end-users, potentially dampening adoption in price-sensitive consumer electronics segments.

Competition from Alternative Temperature Sensing Technologies

The temperature sensor market faces increasing competition from alternative technologies including Resistance Temperature Detectors (RTDs), thermocouples, semiconductor-based silicon temperature sensors, and infrared thermal sensors. Modern RTDs offer superior accuracy (±0.5% of measured value) across extended temperature ranges (-200°C to 800°C), appealing to applications requiring extreme temperature measurement. Silicon-based sensors with integrated signal conditioning and digital output interfaces reduce system-level design complexity.

While NTC thermistors maintain advantages in cost-effectiveness, sensitivity, and miniaturization within moderate temperature ranges (-55°C to 200°C), emerging applications increasingly favor integrated solutions offering both sensing and signal processing. Manufacturers must continuously invest in product differentiation and integrated solutions to maintain competitive positioning against technologically advanced alternatives.

EV Powertrain Electrification and Oil-Cooling System Adoption

The automotive industry’s transition toward advanced powertrains is creating unprecedented opportunities for specialized NTC thermistor applications. Traditional air-cooling systems for electric powertrains are increasingly being supplemented or replaced by oil-cooling systems that provide superior thermal management density for high-power inverters and motors operating at elevated temperatures. TDK Corporation, a leading component manufacturer, introduced the B58101A0851A000 immersion-type NTC thermistor specifically designed for oil-cooled EV drivetrain systems in March 2025, capable of operating at temperatures up to 175°C with sealed construction for fluid immersion.

This product category represents a nascent market segment projected to grow at 15% CAGR through 2033, as vehicle manufacturers optimize thermal efficiency in next-generation EV platforms. The adoption of oil-cooling technology is anticipated to become standard in premium and performance EV segments by 2028-2030, creating demand for specialized high-temperature NTC thermistor variants that command pricing premiums of 30-50% over standard products.

Healthcare Digitalization and Precision Medical Device Applications

The global healthcare sector is experiencing accelerated digitalization with expanding adoption of remote patient monitoring devices, wearable health trackers, and point-of-care diagnostic equipment. NTC thermistors with exceptional accuracy and miniaturization capabilities are integral to these applications—from temporal artery thermometers with ±0.1°C precision to implantable biocompatible temperature sensors for surgical monitoring. The global digital health market is projected to expand from $200 billion in 2024 to over $500 billion by 2030, creating substantial demand for precise temperature measurement components.

Medical-grade NTC thermistors must satisfy stringent regulatory requirements including ISO 13485 certification, FDA approval, and biocompatibility standards (ISO 10993). Manufacturers are developing specialized NTC thermistor variants with glass encapsulation, enhanced stability, and custom resistance-temperature curves optimized for specific medical applications. The medical device segment for NTC thermistors is experiencing growth rates of 10% annually, with particular acceleration in emerging markets where telemedicine adoption is expanding rapidly.

SMD/SMT type thermistors represent the dominant product segment, accounting for approximately 48% of the global NTC thermistor market in 2025, driven by widespread adoption of surface-mount technology across automotive electronics, consumer devices, and industrial control systems. Demand is supported by ongoing miniaturization trends and the shift toward fully automated assembly lines, where compact, reflow-compatible components are essential. These thermistors are commonly produced in standardized case sizes such as 0402 and 0603, using multilayer ceramic structures and nickel barrier terminations to ensure reliability under thermal cycling. Their integration into battery management systems, electronic control units, and compact power modules reinforces their leadership, particularly in space-constrained, high-density electronic architectures.

Automotive applications represent the largest demand segment, capturing approximately 42% of the total NTC thermistor market in 2025. Temperature sensing is critical across modern vehicle systems, including battery management systems, engine control units, climate control modules, and transmission monitoring. A single vehicle typically incorporates 15–25 NTC thermistors, with higher counts observed in electric vehicles due to advanced thermal management requirements. Growth in this segment is accelerated by global EV adoption rates exceeding 15% annually in developed markets and 25–30% in major manufacturing hubs such as China. Stringent emission regulations and increasing vehicle electrification continue to drive demand for reliable, automotive-grade NTC thermistors.

OEM supply channels dominate the NTC thermistor market, accounting for approximately 75% of total sales volume in 2025, reflecting the importance of direct integration into automotive, electronics, and industrial equipment manufacturing. OEM customers typically engage in long-term supply agreements that involve custom product specifications, high-volume commitments, and strict quality requirements, including IATF 16949 and ISO 9001 certifications. This channel provides manufacturers with predictable demand and higher value realization due to application-specific design and qualification efforts. OEM dominance is further reinforced by increasing component integration in EV platforms and complex electronic systems, where reliability, traceability, and lifecycle support are critical procurement criteria.

North America represents the most mature developed market for NTC thermistors, supported by a well-established automotive manufacturing base, stringent regulatory oversight, and early adoption of electric vehicle technologies. The United States remains the primary demand center, underpinned by extensive automotive clusters across Michigan, Ohio, and Tennessee and an installed vehicle base exceeding 280 million registered vehicles. Policy support through the Inflation Reduction Act and EPA-led emission regulations has driven over US$100 billion in cumulative investments into EV assembly and battery manufacturing facilities.

Leading OEMs such as Tesla, General Motors, and Ford are expanding dedicated EV production lines, significantly increasing demand for high-precision NTC thermistors in battery management and thermal control systems. North America also benefits from a strong innovation ecosystem, with companies such as Littelfuse, Vishay, and Honeywell supporting advanced product development. The regional market is projected to grow at 5.4% CAGR through 2033, with automotive applications contributing 65–70% of incremental demand.

Europe constitutes the second-largest regional market, driven by aggressive decarbonization policies and some of the world’s strictest automotive emission standards. The European Union’s Euro 6 regulations and the planned ICE phase-out by 2035 are accelerating the transition toward electric mobility, creating sustained demand for EV-specific NTC thermistor solutions. Germany remains the regional epicenter, supported by automotive leaders including BMW, Volkswagen, Mercedes-Benz, and Audi, which actively collaborate with component suppliers on advanced thermal management technologies.

Major suppliers such as TDK Electronics and Murata’s European operations benefit from close proximity to OEM customers. France and the UK are emerging growth markets, with France targeting 2.5 million EVs annually by 2030, supported by expanding battery manufacturing capacity. Harmonized compliance frameworks, including CE marking and REACH, standardize technical requirements across the region. Europe’s NTC thermistor market is expected to grow at 5.1% CAGR through 2033, with incremental demand from medical devices and industrial automation.

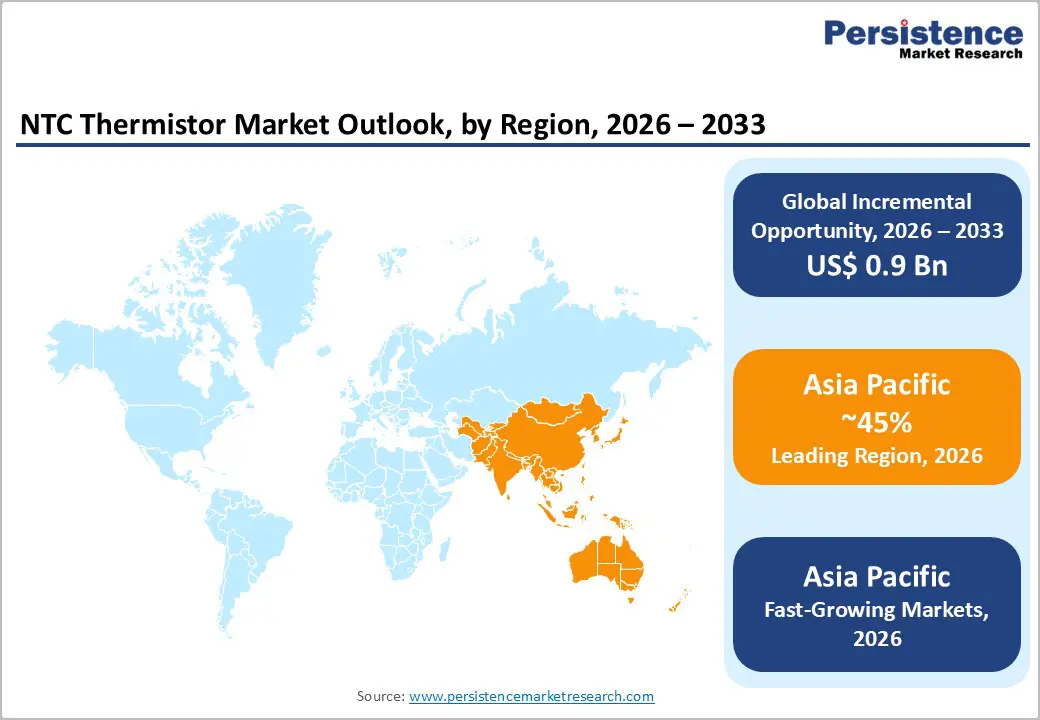

Asia Pacific represents the largest and fastest-growing regional market, serving as the global hub for NTC thermistor manufacturing, consumption, and export. China dominates regional output, producing over 4.5 billion NTC thermistor units annually as of 2024, accounting for nearly 70% of global production capacity. This manufacturing scale is reinforced by China’s EV leadership, with over 10 million electric vehicles produced in 2024, driving exceptional demand for automotive-grade thermistors.

Japan maintains technological leadership through companies such as Murata Manufacturing, TDK Corporation, Panasonic, and Ohizumi, which focus on advanced materials, miniaturization, and integrated sensor solutions. India is emerging as a strategic growth market, supported by expanding automotive and electronics manufacturing and government initiatives such as Make in India. The region’s diversified industrial base further supports broad application demand. Asia Pacific is projected to expand at 6.8% CAGR through 2033, the highest globally.

The global NTC thermistor market is moderately consolidated while a fragmented second tier serves niche and regional demand. Market structure is shaped by scale-driven competition at the top and application-specific specialization among smaller suppliers. Leading players pursue vertical integration strategies, building in-house capabilities for ceramic material formulation, sintering, precision machining, and encapsulation to ensure cost control, quality consistency, and supply security. Business strategies increasingly emphasize automotive-grade compliance, high-volume SMD production, and application-tailored designs for EV thermal management, industrial automation, and medical devices.

Consolidation through targeted acquisitions remains a key growth lever, enabling portfolio expansion and access to specialized technologies. Product differentiation is driven by innovations such as immersion-type thermistors for oil-cooled EV systems, high-temperature variants rated up to 200 °C, and compact designs optimized for automated assembly. High capital requirements, stringent certification standards, and precision manufacturing needs create substantial barriers to entry, reinforcing the current competitive structure.

March 2025: TDK Corporation introduced the B58101A0851A000 immersion-type NTC thermistor for oil-cooled EV powertrain systems, featuring a fully sealed design, operating temperatures up to 175°C, and fast thermal response to enhance battery management and inverter protection in high-performance electric vehicles.

August 2024: Murata Manufacturing commenced mass production of 0603M-size copper electrode NTC thermistors for automotive applications, offering improved solderability, higher thermal stability, and compatibility with high-density PCB assemblies used in next-generation vehicle electronic control modules.

June 2024: Vishay Intertechnology acquired Ametherm, Inc. to expand its temperature sensing and inrush current limiter portfolio, strengthening its position in automotive and industrial thermal management while adding localized manufacturing capacity in North America to support regional OEM demand.

The global NTC Thermistor Market is projected to reach US$ 1.8 billion in 2026, up from US$ 1.3 billion in 2020.

Growth is driven by EV battery thermal management demand, stringent emission regulations, and rising adoption in consumer electronics, industrial automation, HVAC, and healthcare.

Asia Pacific leads the market with around 45% global volume share, supported by large-scale EV production, strong electronics manufacturing, and established supplier ecosystems.

Major opportunities include EV oil-cooled powertrain systems growing at 15% CAGR and medical-grade thermistors expanding at 8.2% CAGR.

Leading competitors include Murata Manufacturing, TDK Electronics, Vishay Intertechnology, Panasonic Corporation, Littelfuse, Honeywell International, Ohizumi Manufacturing Company Limited, Mitsubishi Materials Corporation, Taica Corporation, and Semitec Corporation.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis Units | Value: US$ Mn/Bn, Volume: Units as Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author