ID: PMRREP31977| 189 Pages | 14 Nov 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

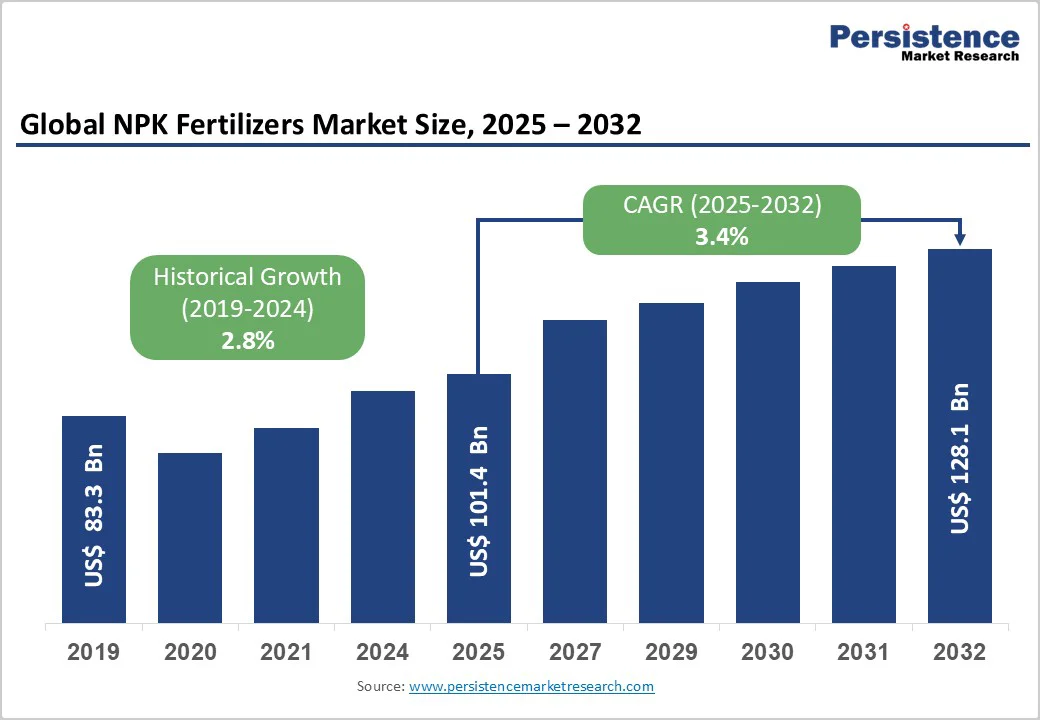

The global npk fertilizers market size is likely to value at US$ 101.4 billion in 2025 and is projected to reach US$ 128.1 billion, growing at a CAGR of 3.4% between 2025 and 2032.

The growth reflects sustained demand driven by accelerating global population growth, intensification of agricultural practices, and increasing adoption of precision farming technologies. The market represents approximately 55% to 75% of the global fertilizers market, underscoring the critical role of nitrogen, phosphorus, and potassium-based formulations in modern agriculture.

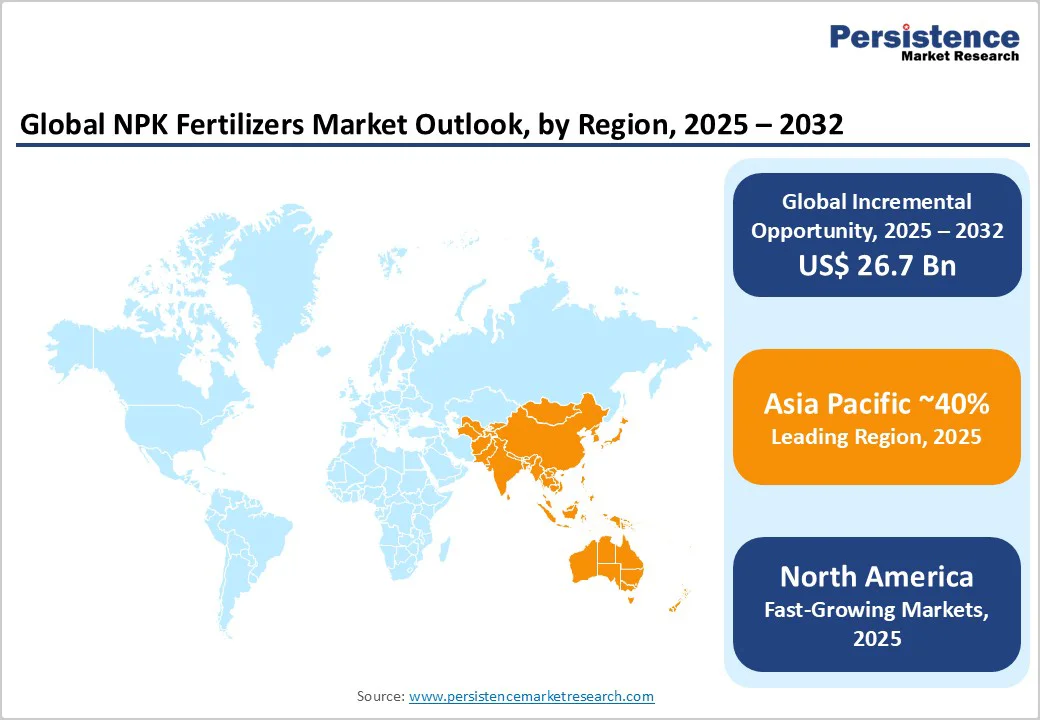

With incremental market opportunities exceeding US$ 26.7 billion over the forecast period, the NPK fertilizers sector presents substantial expansion potential for manufacturers, distributors, and agricultural stakeholders worldwide.

| Key Insights | Details |

|---|---|

| NPK Fertilizers Market Size (2025E) | US$101.4 Bn |

| Market Value Forecast (2032F) | US$128.1 Bn |

| Projected Growth (CAGR 2025 to 2032) | 3.4% |

| Historical Market Growth (CAGR 2019 to 2024) | 2.8% |

Modern agricultural systems increasingly employ intensive farming methodologies and monoculture approaches that deplete soil nutrient reserves, necessitating regular NPK fertilizer applications. Beyond staple crops of wheat, rice, and maize, farmers are diversifying into high-value horticultural products, including fruits, vegetables, and specialty crops that require specialized nutrient formulations.

These diversification strategies, particularly pronounced in developing economies, require tailored NPK ratios to optimize yield and quality parameters. Applications in fruits and vegetables represent the fastest-growing segment with accelerated CAGR rates, driven by consumer demand for premium-quality produce and rising disposable incomes in emerging markets.

Sugar crops and fiber applications demonstrate particularly strong growth trajectories at 4.4% and 4.2% CAGRs, respectively, with manufacturers investing in specialized formulations to meet crop-specific nutrient requirements and achieve quality enhancement objectives.

The United Nations projects the global population to reach 9.7 billion by 2050, creating unprecedented pressure on agricultural systems to enhance crop yields sustainably. This demographic expansion directly drives NPK fertilizer demand, as these formulations provide essential macronutrients-nitrogen for protein formation and leafy growth, phosphorus for energy storage and root development, and potassium for disease resistance and stress tolerance.

In 2022, the USDA reported that nitrogen-based fertilizers accounted for over 50% of U.S. fertilizer usage, with similar patterns evident across major agricultural regions.

The food security imperative incentivizes farmers to adopt NPK fertilizers that deliver balanced nutrient profiles, ensuring optimal crop productivity on existing arable land rather than expanding cultivation into ecologically sensitive areas.

Market research indicates that intensification of agriculture in regions like India, China, and Southeast Asia directly correlates with NPK consumption growth, with India alone demonstrating an 8-10% year-on-year increase in NPK imports driven by government direct benefit transfer subsidies and the PM PRANAM initiative promoting balanced nutrition strategies

Increasingly stringent environmental legislation addressing nutrient runoff, soil acidification, and greenhouse gas emissions represents a structural constraint on traditional synthetic NPK fertilizer growth.

The European Union's Fertilizing Products Regulation (FPR), implemented in July 2022, substantially modified fertilizer certification and labeling requirements, requiring manufacturers to demonstrate compliance with REACH registration protocols and contaminant standards.

Water pollution from eutrophication-causing phosphorus and nitrogen runoff, combined with groundwater nitrate contamination risks, has prompted regulatory restrictions on application rates and seasons.

These regulatory frameworks accelerate market transition toward organic and bio-based alternatives, reducing the addressable market for conventional synthetic NPK products while creating counterbalancing opportunities in alternative formulation segments.

The Carbon Border Adjustment Mechanism (CBAM) regulations similarly impose environmental compliance costs that disadvantage conventional fertilizer production methodologies, particularly affecting manufacturers lacking advanced efficiency technologies.

Geographic Expansion in Emerging Markets and Precision Agriculture Services

Emerging economies across South Asia, Southeast Asia, and Sub-Saharan Africa demonstrate nascent adoption of balanced NPK fertilization practices, creating substantial greenfield expansion opportunities.

India’s NPK fertilizer market holds a dominant share within the South Asia and Pacific region, with continued penetration potential in lower-income agricultural demographics. New distribution channel development through digital platforms, agricultural cooperatives, and direct-to-farmer models creates service differentiation and margin expansion opportunities.

Asia-Pacific’s NPK fertilizer market is poised for steady long-term growth, with India, Vietnam, and Indonesia collectively representing a major portion of regional consumption. North America, with a highly consolidated market structure, offers opportunities through advanced formulation positioning and sustainability certification premiums.

Companies integrating agronomic advisory services, soil testing capabilities, and precision application technologies with NPK product offerings create value-added service bundles that enhance customer retention and enable premium pricing potential.

Powder formulations hold a dominant position in the global NPK fertilizers market, accounting for over 60% of total revenue. Their leadership is driven by easy availability, large-scale production, established distribution channels, and strong farmer familiarity.

Powder NPK fertilizers offer superior storage stability, easy handling, and cost-effectiveness while being compatible with conventional spreader equipment-minimizing additional investment needs for farmers. This long-standing dominance reflects decades of standardized agricultural practices and continued investments in production and supply chain optimization, ensuring stable market value despite emerging alternatives.

In contrast, liquid NPK fertilizers represent the fastest-growing segment, fueled by rising adoption in precision agriculture, drip irrigation, and foliar feeding applications. Water-soluble formulations enable higher nutrient uptake efficiency, reduced application rates, and adaptability to advanced irrigation systems.

The growing focus on irrigation modernization-particularly across the Middle East, North Africa, and water-scarce Asian regions-accelerates demand. With projected growth exceeding 5.5% CAGR, manufacturers offering concentrated, stable, and micronutrient-enriched liquid NPK solutions are gaining a premium foothold in this rapidly evolving, high-efficiency fertilizer segment.

Synthetic NPK fertilizers dominate the global market, accounting for over 70% of total revenue, owing to well-established production infrastructure, standardized nutrient formulations, and proven agronomic efficiency. These fertilizers provide precisely balanced NPK ratios, ensuring consistent nutrient availability tailored to crop and soil needs.

Their long shelf life, pathogen-free nature, and predictable performance across varied agroclimatic conditions strengthen their adoption. Major producers such as Yara International, The Mosaic Company, EuroChem Group, and Coromandel International collectively hold around 30-35% of the global share. The segment continues expanding in developing regions where affordability, accessibility, and ease of use favor synthetic products among smallholder farmers.

In contrast, organic NPK fertilizers are emerging as the fastest-growing segment, recording 7-8% CAGR in sustainable agriculture markets. Derived from animal waste, plant residues, and microbial sources, these formulations enhance soil health, minimize chemical residues, and support organic certification.

Backed by government sustainability incentives and consumer demand for organic produce, adoption is strongest in Europe and North America (15-25% market penetration). Continuous innovations in biofortified and controlled-release organic formulations further enhance their competitiveness.

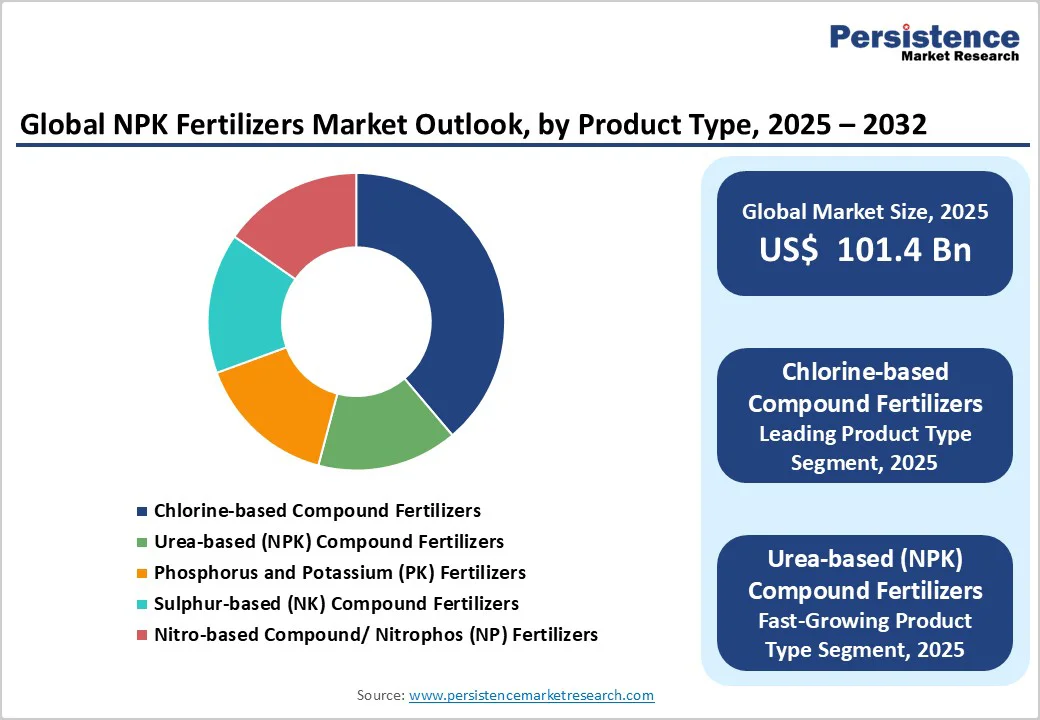

Chlorine-Based Fertilizers Dominate the NPK Market, While Urea-Based Formulations Emerge as the Fastest-Growing Segment

Chlorine-based compound fertilizers lead the NPK product-type segment, accounting for over 30% of global revenue share. Their balanced nutrient composition effectively meets combined nitrogen and potassium crop requirements, enhancing photosynthesis and disease resistance for improved yields.

With well-established manufacturing infrastructure and reliable supply chains, these fertilizers maintain steady demand across both developed and emerging markets, particularly in potassium-deficient regions of Eastern Europe and Asia. Supported by a stable CAGR of around 1.5% (2022 - 2032), chlorine-based formulations remain a cornerstone of global crop nutrition strategies.

Conversely, urea-based NPK compound fertilizers represent the fastest-growing product category, registering a projected CAGR above 4.5% through 2032. Their rise is fueled by superior nitrogen-use efficiency, reduced greenhouse gas emissions, and strong alignment with sustainability and precision agriculture practices.

These formulations combine urea’s nitrogen efficiency with phosphate and potassium components, making them ideal for high-value crops. Ongoing advancements in controlled-release urea and nitrification inhibitor technologies further strengthen this segment’s competitive position, enabling enhanced productivity with lower environmental impact.

Asia Pacific holds over 40% of global NPK fertilizer consumption, solidifying its position as the leading regional growth hub. The region’s market, valued at US$ 9.2 billion in 2024, is expected to grow at a 1.9% CAGR through 2035, driven by India, Vietnam, and Indonesia, which collectively account for nearly 68% of consumption. China’s NPK market is projected to reach US$ 34.4 billion and India’s US$ 25.3 billion by 2032.

China remains the largest regional exporter with a 50% export share, while both China and India lead in import volumes. Competitive advantages stem from low-cost manufacturing, abundant mineral reserves, and efficient logistics networks.

Coromandel International’s 30-lakh-ton Kakinada complex exemplifies regional production strength, with ongoing expansion in granulation and acid plants. Emerging trends include greenfield capacity projects, precision agriculture integration, and growing use of nano-fertilizers, water-soluble, and micronutrient-enriched NPK formulations.

North America maintains a substantial regional market share, driven by established baking and food processing industries, advanced biotechnology infrastructure, and stringent regulatory frameworks supporting enzyme adoption.

The United States represents the dominant market within the region, supported by significant ethanol production capacity and robust pharmaceutical research sectors, creating a huge demand for NPK fertilizers across multiple applications. The region holds approximately 39% of the global food enzymes market, reflecting mature industry development and high enzyme adoption rates across commercial food manufacturing.

Production facilities for major enzyme manufacturers, including Novozymes and DuPont operations, support regional supply security and rapid customer support capabilities. Government incentives promoting renewable energy and bio-based industries support bioethanol production growth, incrementally increasing demand for NPK fertilizers' demand fuel ethanol applications.

Regulatory frameworks, while more streamlined than European systems, maintain rigorous safety and efficacy standards supported by FDA oversight and established enzyme registration protocols. North American manufacturers prioritize innovation in specialized enzyme variants, thermostable formulations, and clean-label solutions meeting premium market segments.

Investment trends reflect strong R&D spending by multinational corporations seeking novel applications and enhanced enzyme performance characteristics.

The global NPK fertilizers market demonstrates moderate consolidation characteristics, with leading manufacturers holding 30-35% collective market share concentrated among Borealis AG, Yara International ASA, ICL Group Ltd., EuroChem Group, and IFFCO.

This fragmented structure contrasts with fertilizer industry segments showing higher consolidation, reflecting persistent geographic scale advantages, regional manufacturing cost variations, and tariff/trade policy impacts, fragmenting global market integration. Mid-tier manufacturers (CF Industries, Mosaic Company, Nutrien, Coromandel International) command 15-20% regional market share through differentiated positioning and geographic focus strategies.

Regional manufacturers and blending operations proliferate in developing markets, capitalizing on transportation cost advantages and localized farmer relationship networks. This market structure enables differentiation opportunities through innovation, sustainability positioning, and service bundling rather than purely scale-based competition.

The NPK Fertilizers market is estimated to be valued at US$ 101.4 Bn in 2025.

The key demand driver for the NPK fertilizers market is the rising global need for enhanced crop productivity and soil nutrient management to meet the growing food demand driven by population expansion and shrinking arable land.

In 2025, the Asia Pacific region will dominate the market with an exceeding 40% revenue share in the global NPK Fertilizers market.

Among forms, the Powder NPK Fertilizers have the highest preference, capturing beyond 60% of the market revenue share in 2025, surpassing other forms.

Yara International, ICL Group, EuroChem, PhosAgro, and Coromandel International are recognized as leading global players, commanding significant market share through technological innovation, strategic expansions, and strong global supply capabilities.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Mn, Volume: Tons |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Form

By Nature

By Product Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author