ID: PMRREP35847| 193 Pages | 14 Nov 2025 | Format: PDF, Excel, PPT* | Food and Beverages

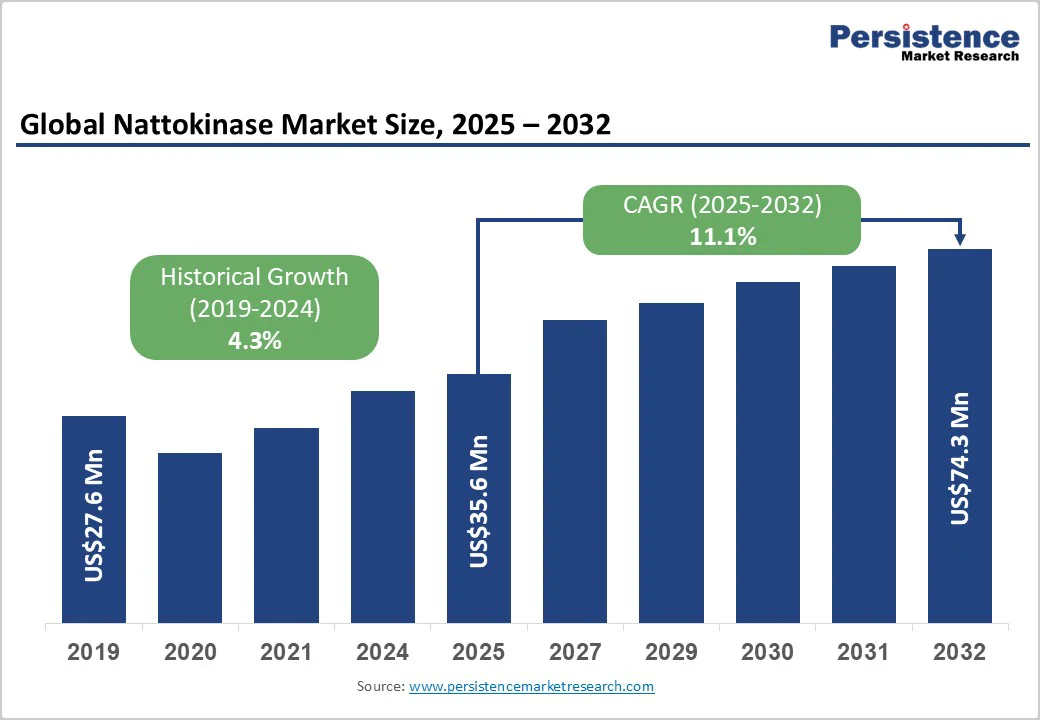

The global nattokinase market size is likely to be valued at US$35.6 Million in 2025 and is expected to reach US$74.3 Million by 2032, growing at a CAGR of 11.1% during the forecast period from 2025 to 2032, driven by rising consumer awareness of cardiovascular health, increasing adoption of natural enzymatic supplements, and the launch of Nattokinase-based products across nutraceuticals and functional foods.

Regulatory clarity and safety assessments have eased technical barriers, but clinical evidence and drug interactions remain challenges. The market's small size makes it sensitive to OEM contracts and regulatory approvals.

| Key Insights | Details |

|---|---|

| Nattokinase Market Size (2025E) | US$35.6 Mn |

| Market Value Forecast (2032F) | US$74.3 Mn |

| Projected Growth (CAGR 2025 to 2032) | 11.1% |

| Historical Market Growth (CAGR 2019 to 2024) | 4.3% |

Cardiovascular disease is the leading cause of global mortality, prompting increased preventive health spending. Consumers are increasingly investing in supplements that support blood flow, lipid management, and blood pressure regulation, driving demand for Nattokinase.

In developed markets, higher preventive supplement penetration directly translates into growth for clinically-backed ingredients. Manufacturers offering evidence-supported nattokinase gain premium positioning and faster uptake in both retail and online channels.

Branded nattokinase extracts such as NSK-SD and NKCP have clinical backing that establishes credibility for cardiovascular support claims. Regulatory recognition, including ingredient registrations in key markets, provides confidence for formulators to launch products. This combination of safety data and efficacy studies allows manufacturers to command higher prices and accelerates adoption in nutraceutical and functional food formulations.

Japan, China, and Taiwan are primary production hubs, offering both clinical-grade extracts and large-scale fermentation. Advances in process control and standardized activity levels reduce variability and cost, making nattokinase accessible for mass-market supplements. This scalability enables private-label brands and mainstream product launches, expanding the ingredient’s addressable market beyond premium niches.

Nattokinase may interact with anticoagulant and antiplatelet medications, limiting use among certain consumer segments. This constrains prescription-level adoption and requires clear labeling in retail formulations. In populations with high anticoagulant use, formulators must adjust addressable market estimates, particularly among the elderly.

Market estimates vary widely due to differences in definitions (ingredient sales vs. finished-product retail) and regional reporting inconsistencies. The small size of the market amplifies the impact of individual deals or regulatory approvals, creating forecast volatility. Investors and manufacturers must consider scenario-based projections to manage uncertainty.

The fibrinolytic properties of nattokinase offer potential in medical nutrition and adjunctive pharmaceutical formulations. Producing GMP-grade extracts with robust clinical data could capture a portion of this higher-value market. Even a small penetration into a multi-billion-dollar medical nutrition sector could add significant incremental revenue.

Asia Pacific (outside Japan), Latin America, and Eastern Europe are experiencing growing supplement adoption. Affordable private-label nattokinase products in these regions can capture incremental demand. Suppliers that provide localized clinical summaries and regional distribution partnerships will accelerate growth.

Branded fermented extracts such as NSK-SD (Japan Bio Science Laboratory) and NKCP (Miyoshi Oil & Fat Co., Japan) hold the largest market share of 56.8% in the global market. These branded ingredients command strong demand due to clinical validation, regulatory recognition, and safety data published in peer-reviewed journals.

According to Japan’s Ministry of Health, such branded formulations achieve premium pricing, often 40% higher compared with generic powders. The trust built around standardized quality and consistent fibrinolytic activity levels has made branded extracts the first choice for nutraceutical brands entering the cardiovascular health category in North America, Europe, and Japan.

High-activity enzyme powders with high fibrinolytic activity (typically expressed in FU per gram) are emerging as the fastest-growing product type. Unlike branded extracts, these powders allow cost-efficient production and are increasingly adopted by private-label supplement manufacturers in China, India, and Southeast Asia.

Large-scale enzyme production using optimized fermentation technologies is helping to reduce costs while maintaining high potency levels. For example, several U.S. nutraceutical brands now source commodity nattokinase powders standardized to 20,000 FU/g for higher-dose capsules targeted at cholesterol and blood circulation health. This segment is projected to expand rapidly with broader retail penetration and the rise of e-commerce supplement lines.

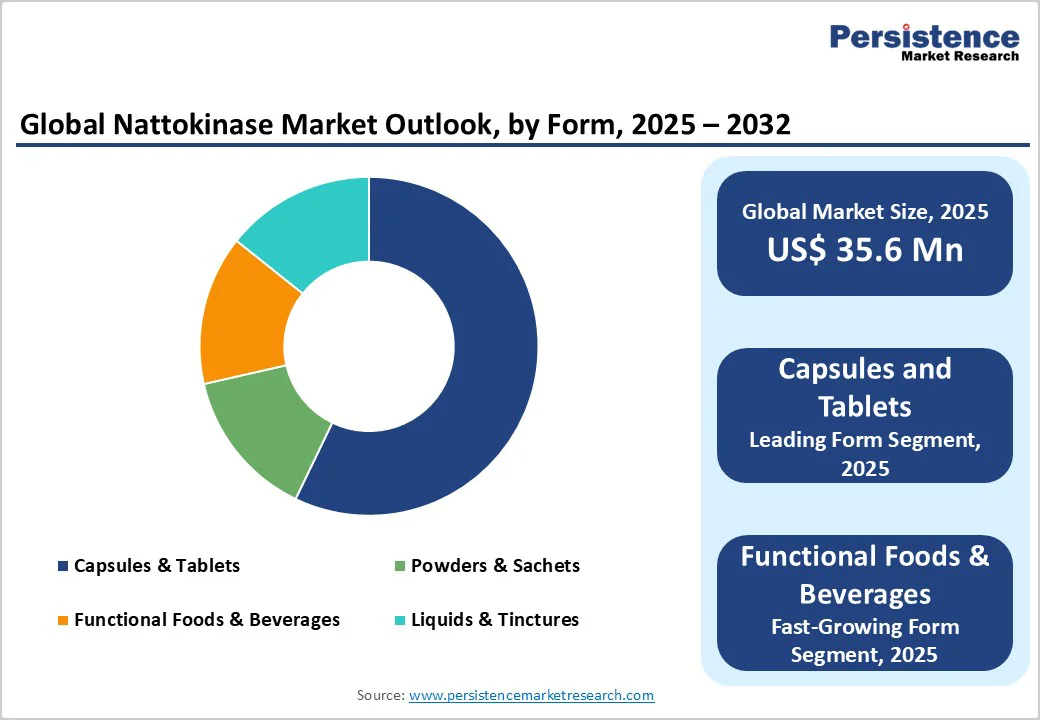

Capsules and tablets remain the dominant form of nattokinase delivery, accounting for 63% of global sales. Their dominance stems from clear dosage definition, regulatory acceptance, and strong consumer familiarity with pill-based formats in dietary supplements. Capsules in particular are preferred due to better ingredient stability and vegetarian-friendly options.

Major nutraceutical companies such as NOW Foods (U.S.) and Doctor’s Best (U.S.) market their leading nattokinase products primarily in capsule form, which has become a trusted choice among cardiovascular health consumers. Retail and pharmacy channels continue to prioritize these formats due to ease of distribution and longer shelf life.

Functional foods and beverages fortified with nattokinase are recording rapid adoption, particularly in Japan and South Korea, where traditional soy-based foods already have strong consumer acceptance. Advances in stability-enhancing technologies and taste-masking are making it possible to incorporate nattokinase into ready-to-drink beverages, protein bars, and yogurts.

For instance, Morinaga Milk Industry (Japan) has introduced heart-health drinks featuring nattokinase extracts, creating mainstream awareness. As health-conscious consumers increasingly look for “food as medicine” solutions, functional products offer an approachable alternative to pills and are likely to witness a strong CAGR over the forecast period.

The nutraceutical and dietary supplement segment represents the largest share of the market, driven by rising cardiovascular disease prevalence and consumer preference for natural preventive solutions. Supplements containing nattokinase are widely marketed for supporting healthy blood pressure, circulation, and clot prevention.

According to the Council for Responsible Nutrition (U.S.), over 70% of U.S. adults consume dietary supplements, with cardiovascular support products among the fastest-growing subcategories. Leading nutraceutical brands in North America, Europe, and Asia, including Swanson Health (U.S.) and Jarrow Formulas (U.S.), have successfully commercialized nattokinase supplements, reinforcing its dominance in this segment.

Although currently smaller in scale, the pharmaceutical and medical nutrition application segment shows high strategic growth potential. Clinical studies in Japan and Europe have demonstrated Nattokinase’s role in reducing blood clot formation, supporting its integration into medical nutrition therapies for cardiovascular patients.

Pharmaceutical-grade formulations require strict GMP compliance and extensive clinical backing but command significantly higher per-unit prices compared to dietary supplements. For example, ongoing research in Europe is exploring nattokinase as an adjunctive therapy in deep vein thrombosis (DVT) management, highlighting its long-term medical relevance. As more clinical trials conclude successfully, this segment is expected to expand rapidly by 2032.

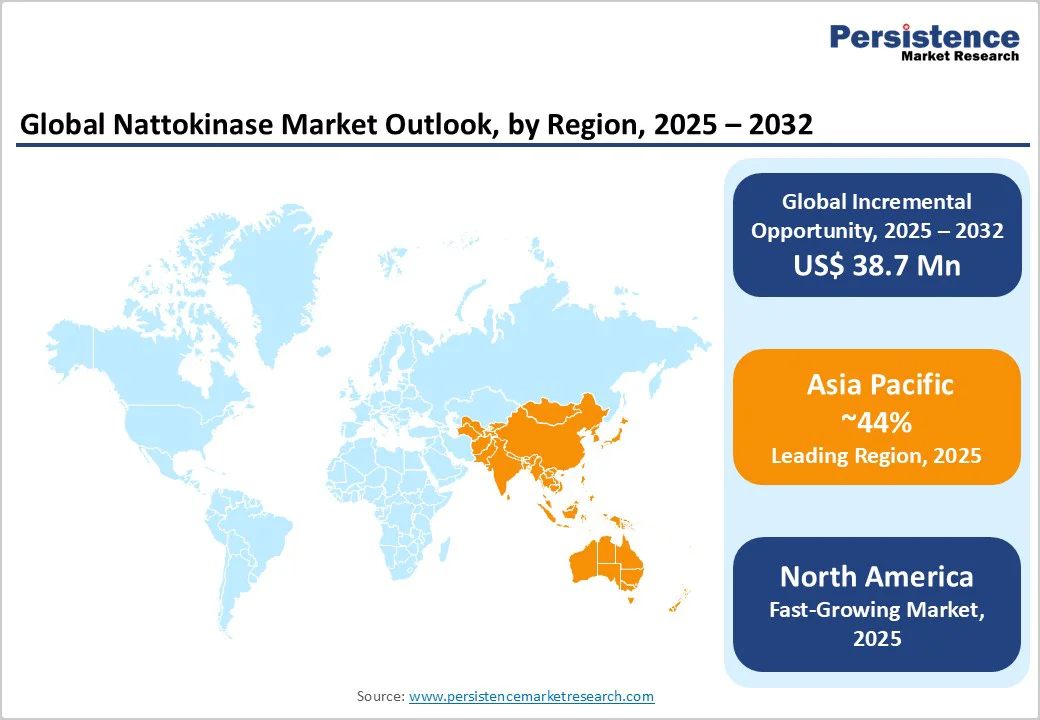

North America is the fastest-growing region. The U.S. market leads due to its aging population (16% over 65 years, U.S. Census Bureau 2024), high supplement penetration, and consumer awareness of cardiovascular risks. E-commerce platforms such as Amazon and direct-to-consumer channels are accelerating adoption, particularly through private-label and subscription models.

Regulatory pathways favor dietary supplements marketed with structure/function claims rather than drug approvals, creating a supportive commercial environment. Japanese and Korean suppliers, including Japan Bio Science Laboratory, continue to dominate imports, while U.S.-based brands rely heavily on white-label partnerships.

The U.S. is the epicenter of demand, supported by an estimated US$60 Billion dietary supplement industry (Council for Responsible Nutrition, 2024). Recent developments include NOW Foods’ 2024 launch of an enhanced nattokinase formula standardized to 20,000 FU, signaling increased consumer demand for higher-potency formats.

Distributor partnerships, such as Glanbia’s 2023 expansion into cardiovascular-support ingredients, highlight the consolidation trend. Future investments are expected in clinical trials conducted at U.S. universities to strengthen scientific positioning and build differentiation for premium-priced nattokinase formulations.

Europe represents a moderate but highly regulated market, with countries such as Germany, the U.K., France, and Spain showing steady supplement adoption. The European Food Safety Authority (EFSA) has maintained strict requirements for novel foods, which favor branded extracts with published clinical data and safety dossiers.

Branded ingredients such as NSK-SD® hold a competitive edge, as EFSA’s regulatory sophistication aligns with clinically validated products. Consumer trust in evidence-backed supplements drives uptake, especially in cardiovascular prevention markets. Distribution relies heavily on pharmacies and health-food chains, where documented science is a key purchasing trigger.

Germany is the largest market in Europe, supported by a strong nutraceutical culture and pharmacy-driven distribution channels. Recent developments include Pharma Nord (Denmark) expanding its German distribution network in 2024 with a new Nattokinase-based cardiovascular health line, leveraging EFSA-compliant formulations.

Partnerships between local nutraceutical companies and Asian suppliers are strengthening supply resilience. Growth is projected to accelerate, creating strong demand for cardiovascular preventive supplements. However, regulatory hurdles, such as high compliance costs for novel food approvals, continue to limit smaller entrants.

Asia Pacific is both a production hub and a growth driver, and dominates with a 44% share, combining legacy innovation in Japan with cost-efficient manufacturing in China and Taiwan. Japan remains the benchmark market for clinical-grade branded Nattokinase, where products are supported by more than 20 years of clinical research.

China has become a powerhouse in large-scale fermentation and B2B exports, driving down raw material costs. India and ASEAN countries are emerging as new demand centers due to rising supplement awareness and increasing cardiovascular disease incidence. Investment trends focus on contract manufacturing, private-label exports, and cross-border e-commerce sales, particularly to the U.S. and Europe.

Japan continues to shape the global narrative, with Miyoshi Oil & Fat Co. expanding its NKCP portfolio in 2024 to include GMP-certified medical nutrition solutions. Domestic consumption remains strong due to a cultural acceptance of fermented soy-based products, but Japan’s role as an exporter of branded ingredients makes it strategically critical.

In contrast, China has streamlined health food registration processes since 2023, encouraging domestic supplement launches featuring nattokinase as a cardiovascular-supporting ingredient. India’s nutraceutical sector is also gaining traction, with Himalaya Wellness exploring nattokinase-based capsules in 2025 as part of its cardiovascular health portfolio.

The nattokinase market is moderately consolidated, with top branded suppliers such as Japan Bio Science Laboratory, Daiwa Pharmaceutical, and NattoPharma accounting for nearly 60% of global revenues. This concentration reflects the dominance of clinically validated, premium extracts in regulated markets.

At the same time, the market remains competitive and moderately fragmented in commodity powders, where numerous regional fermenters in China, India, and Southeast Asia supply private-label and bulk buyers. Competitive dynamics are shaped by two distinct strategies, branded suppliers leveraging clinical differentiation, GMP certifications, and established distribution, versus commodity producers competing on cost efficiency and volume scalability.

The nattokinase market size was US$35.6 Million in 2025.

The nattokinase market is projected to reach US$74.3 Million by 2032.

The key trends are the rising awareness of cardiovascular health and preventive nutrition and increased adoption of functional foods and beverages fortified with Nattokinase.

Branded Fermented Extracts (e.g., NSK-SD, NKCP) dominate revenue due to clinical validation, premium pricing, and safety profiles.

The nattokinase market is expected to grow at a CAGR of 11.1% between 2025 and 2032.

Key players in the nattokinase market include Japan Bio Science Laboratory, Daiwa Pharmaceutical, NattoPharma, and Contek Life Science.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Form

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author