ID: PMRREP33962| 188 Pages | 28 Jan 2026 | Format: PDF, Excel, PPT* | Healthcare

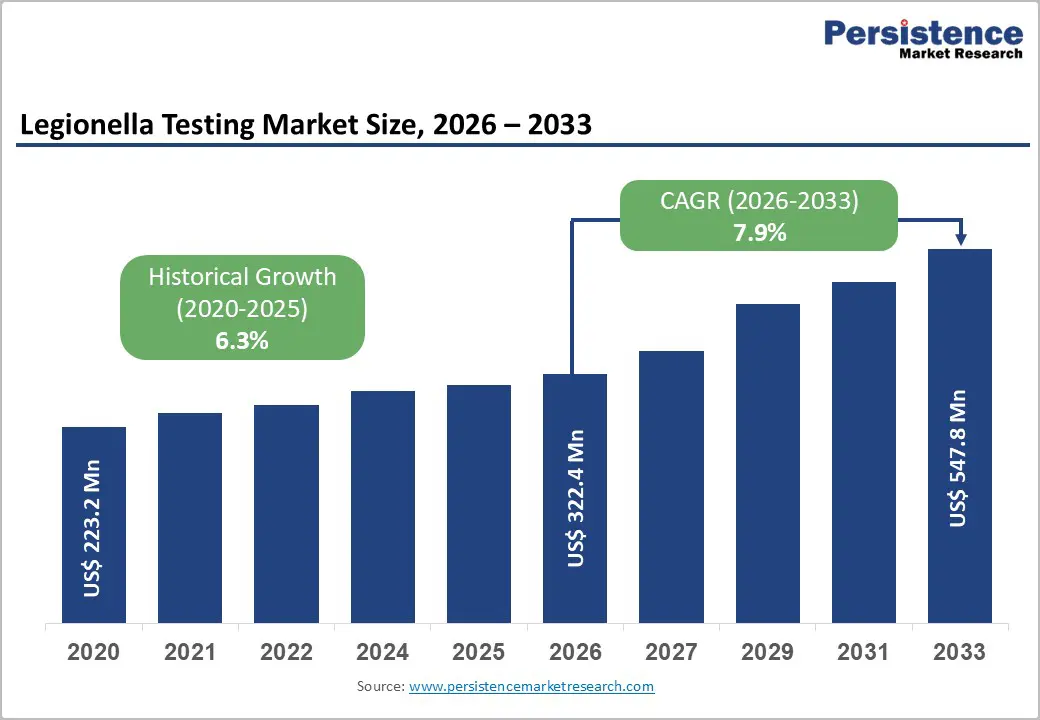

The global legionella testing market is expected to be valued at US$ 322.4 million in 2026 and projected to reach US$ 547.8 million by 2033, growing at a CAGR of 7.9% between 2026 and 2033.

The market’s expansion is fundamentally driven by the rising incidence of Legionnaires’ disease globally and increasingly stringent government regulations mandating water safety management. In the United States alone, the Centers for Disease Control and Prevention (CDC) reports that cases of Legionnaires’ disease have increased by nearly 900% since 2000, underscoring the need for robust testing frameworks. Furthermore, rapid urbanization and the proliferation of complex water systems in healthcare facilities, hotels, and industrial cooling towers have heightened the risk of Legionella colonization. The adoption of advanced molecular diagnostic technologies, such as Polymerase Chain Reaction (PCR), is accelerating due to their ability to provide rapid and accurate results compared to traditional culture methods, thereby supporting timely clinical interventions and environmental safety compliance.

| Key Insights | Details |

|---|---|

| Legionella Testing Market Size (2026E) | US$ 322.4 million |

| Market Value Forecast (2033F) | US$ 547.8 million |

| Projected Growth CAGR (2026 - 2033) | 7.9% |

| Historical Market Growth (2020-2025) | 6.3% |

The escalating prevalence of Legionnaires’ disease serves as a primary catalyst for market growth. The CDC estimates that between 8,000 and 18,000 people are hospitalized with Legionnaires’ disease annually in the U.S., though many infections remain undiagnosed. This respiratory infection is particularly dangerous for the elderly and immunocompromised individuals, a demographic segment that is expanding globally. Concurrently, aging water infrastructure in developed nations provides an ideal breeding ground for Legionella bacteria. Biofilm formation in corroded pipes and stagnant water systems in older buildings amplifies the risk of bacterial proliferation. Consequently, healthcare facilities and commercial building operators are increasingly implementing routine testing protocols to mitigate liability and protect public health, directly driving the demand for reliable diagnostic solutions.

While advanced testing methods like PCR offer speed and sensitivity, their adoption is hindered by higher costs than traditional methods. Establishing a molecular diagnostics laboratory requires substantial capital investment in specialized equipment, such as thermal cyclers and fluorescence detectors. Additionally, the recurring cost of reagents and maintenance for these systems can be prohibitive for smaller laboratories and healthcare facilities, particularly in developing regions. Traditional culture methods, although slower, remain a gold standard due to their cost-effectiveness and regulatory acceptance in many jurisdictions. This cost disparity creates a barrier to the widespread adoption of rapid testing solutions, limiting market penetration in price-sensitive segments.

Technical Limitations and Lack of Skilled Professionals

The accurate detection of Legionella is technically challenging. Culture methods, while definitive, can take up to 14 days to yield results and may be compromised by the overgrowth of competing flora. Rapid methods like Urine Antigen Testing (UAT) are highly specific for Legionella pneumophila serogroup 1 but often fail to detect other pathogenic serogroups and species, potentially leading to false negatives. Furthermore, the successful implementation of advanced testing techniques requires highly skilled laboratory personnel proficient in molecular biology and microbiological protocols. A global shortage of qualified laboratory technicians poses a significant operational challenge, potentially stalling the scaling of testing capacities in high-demand regions.

There is a significant opportunity for market players to innovate in the realm of rapid and user-friendly diagnostic tests. The development of next-generation PCR assays and automated systems that can detect multiple Legionella species simultaneously offers a competitive edge. Innovations such as isothermal amplification techniques promise to deliver PCR-like accuracy without the need for complex thermal cycling equipment, making molecular testing more accessible. Furthermore, advancements in biosensor technology are paving the way for real-time, on-site detection of Legionella in water systems. These technologies address the critical need for speed and ease of use, opening new markets in industrial water monitoring and point-of-care clinical diagnostics.

Expansion into Emerging Economies

Emerging economies in the Asia Pacific and Latin America represent untapped reservoirs of growth. Rapid industrialization, expanding healthcare infrastructure, and rising awareness of waterborne diseases in countries such as China, India, and Brazil are driving demand for Legionella testing. As these nations upgrade their public health standards and align their water safety regulations with international norms, the market for testing products is poised for substantial expansion. Strategic partnerships with local distributors and the introduction of cost-effective testing solutions tailored to these price-sensitive markets can enable global companies to capture significant market share in these high-growth regions.

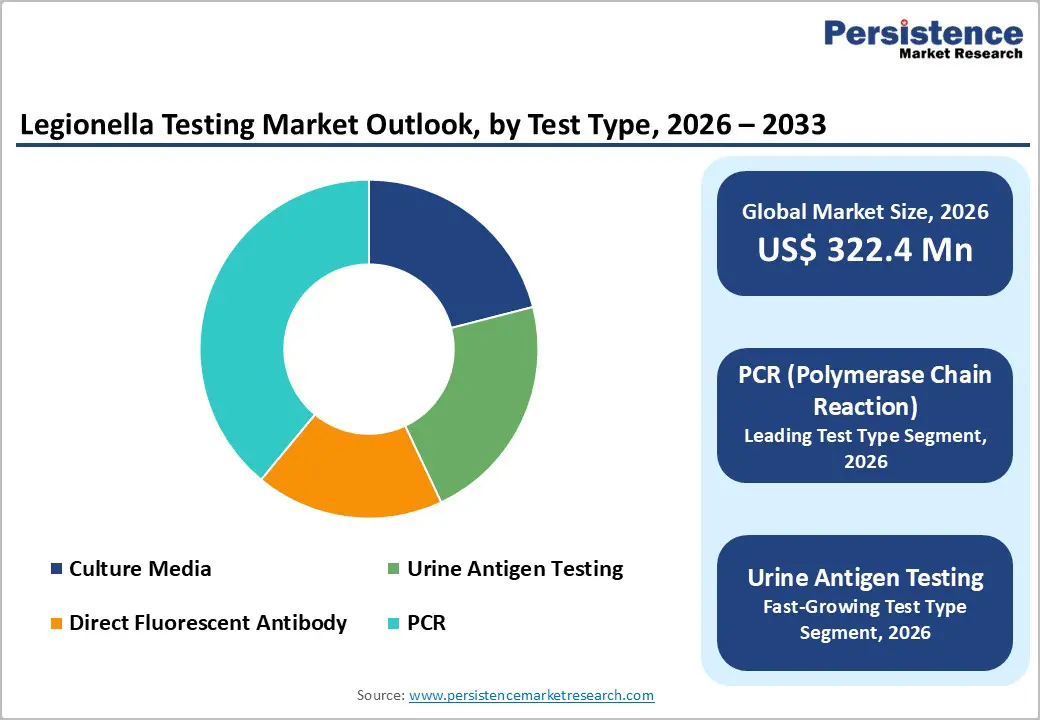

PCR (Polymerase Chain Reaction) is anticipated to be the leading segment, capturing approximately 43% of the market share in 2025. This dominance is attributed to PCR’s superior sensitivity and specificity, which enable the detection of minute amounts of Legionella DNA in both clinical and environmental samples. Unlike culture methods that require days for results, PCR can provide actionable data within hours, which is critical for outbreak management. Companies like Bio-Rad Laboratories and Thermo Fisher Scientific are at the forefront, offering comprehensive PCR kits such as the iQ-Check Legionella line. Conversely, Urine Antigen Testing is projected to be the fastest-growing segment. Its non-invasive nature and ability to provide rapid results (often within 15 minutes) make it highly favorable for initial clinical diagnosis. Although limited primarily to L. pneumophila serogroup 1, its speed and ease of use drive its accelerated adoption in emergency clinical settings.

Water Testing remains a critical application segment, driven by regulatory mandates to monitor water systems in public and industrial buildings. The risk of aerosolization from cooling towers, hot tubs, and decorative fountains necessitates rigorous environmental surveillance. Industries are increasingly adopting automated monitoring solutions to ensure compliance with standards like ISO 11731. IVD (In Vitro Diagnostic) Testing, which includes clinical testing of human samples (urine, sputum, blood), is also significant. The rising incidence of community-acquired and hospital-acquired pneumonia keeps the demand for clinical diagnostic tests robust. Hospitals rely heavily on IVD tests for the rapid triage and treatment of patients presenting with respiratory symptoms indicative of Legionnaires’ disease.

Hospitals and Clinics constitute the largest end-user segment. Healthcare facilities are high-risk environments for Legionella transmission due to complex water systems and vulnerable patient populations. Consequently, they are subject to the strictest regulatory oversight, compelling them to maintain rigorous testing schedules. Diagnostic Laboratories act as central hubs for processing both clinical and environmental samples, leveraging high-throughput systems to serve a broad client base. Water Treatment Industries are emerging as key users, integrating testing into their service offerings to provide comprehensive water management solutions to industrial and commercial clients. This sector is expanding as businesses seek to outsource compliance management to specialized service providers.

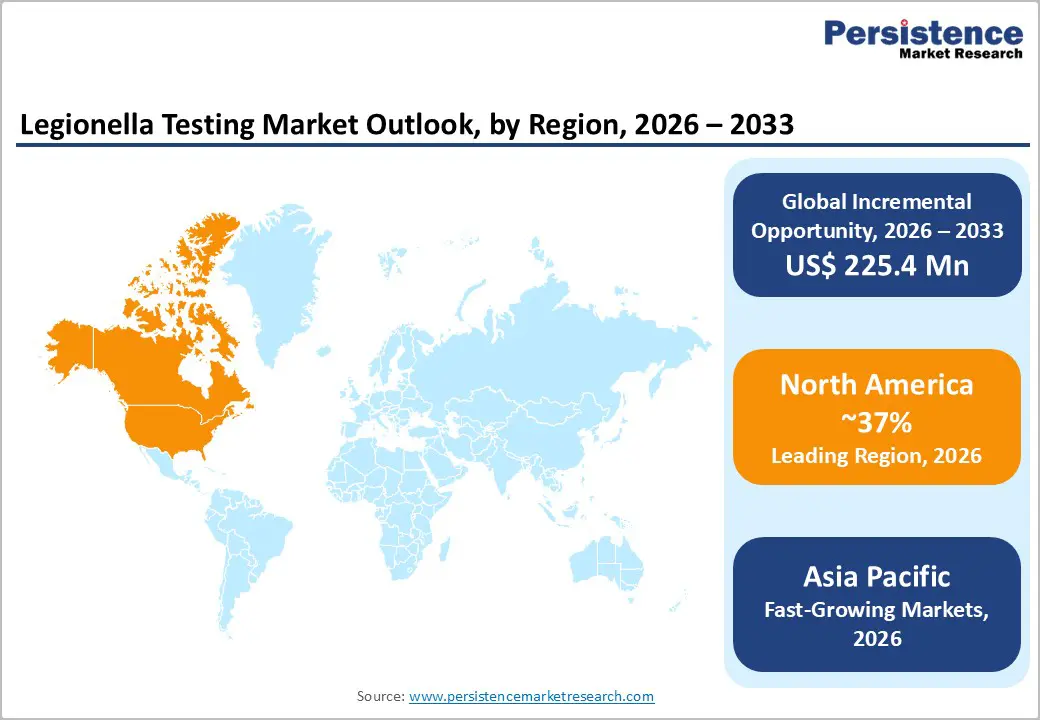

North America has consistently been the leading region in the Legionella testing market, accounting for the largest share of global revenue due to its stringent regulatory framework, advanced healthcare and public health infrastructure, and heightened awareness of Legionnaires’ disease. The United States, in particular, drives regional dominance through proactive public health policies, mandatory water safety regulations, and widespread adoption of advanced testing technologies such as PCR and culture methods. Routine monitoring in healthcare facilities, hospitality venues, and commercial water systems further reinforces demand for testing solutions. Canada also contributes significantly, supported by strong compliance standards and growing environmental surveillance initiatives. Robust investments in diagnostic R&D, coupled with strong enforcement by agencies such as the EPA and CDC, sustain North America’s leadership while ensuring high standards for Legionella detection and prevention across diverse settings.

The Asia Pacific region is emerging as one of the fastest-growing markets for Legionella testing, driven by rapid urbanization, expanding healthcare and commercial infrastructure, and rising awareness of waterborne diseases. Countries like China, India, Japan, and Australia are increasingly prioritizing water safety, leading to greater adoption of Legionella testing solutions in hospitals, hotels, industrial facilities, and public water systems. Rapid industrial growth and large-scale construction projects have amplified the need for routine water monitoring to prevent outbreaks, while government-led initiatives and public health campaigns are promoting regulatory compliance and awareness among facility managers. Investment in diagnostic laboratories and the entry of international testing providers are enhancing accessibility to advanced testing methods such as PCR and culture techniques. With increasing regulatory focus, improved healthcare infrastructure, and growing public health consciousness, the Asia Pacific is expected to maintain robust growth throughout the forecast period, making it a key region of opportunity for market players in Legionella testing.

The competitive landscape of the Legionella testing market is marked by a mix of global and regional participants offering culture-based, antigen, immunofluorescence, and molecular testing solutions. Competition is driven by test accuracy, turnaround time, regulatory compliance, and ease of use. Players focus on technological advancements, particularly rapid and PCR-based methods, to enhance sensitivity and reliability. Strategic initiatives such as product innovation, service expansion, partnerships with laboratories, and geographic outreach are commonly adopted to strengthen market presence. Pricing strategies and the ability to meet evolving regulatory standards also play a critical role.

The global legionella testing market size is expected to be valued at US$ 322.4 million in 2026.

The primary drivers include the rising incidence of Legionnaires’ disease globally, the aging of water infrastructure which promotes bacterial growth, and stringent government regulations mandating water safety management in healthcare and commercial facilities.

North America dominates the market, holding a significant share (projected 37% in 2025), due to advanced healthcare infrastructure and strict regulatory compliance requirements from agencies like the CDC and CMS.

A key opportunity lies in the development of advanced rapid diagnostic technologies such as automated PCR and biosensors, as well as expanding market presence in emerging economies where healthcare infrastructure and water safety awareness are rapidly growing.

Key players include Abbott, Bio-Rad Laboratories, Inc., Thermo Fisher Scientific Inc., BD, and BIOMÉRIEUX, among others who lead through innovation and global distribution capabilities.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Mn/Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Test Type

By Application

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author