ID: PMRREP32844| 200 Pages | 6 Jan 2026 | Format: PDF, Excel, PPT* | Semiconductor Electronics

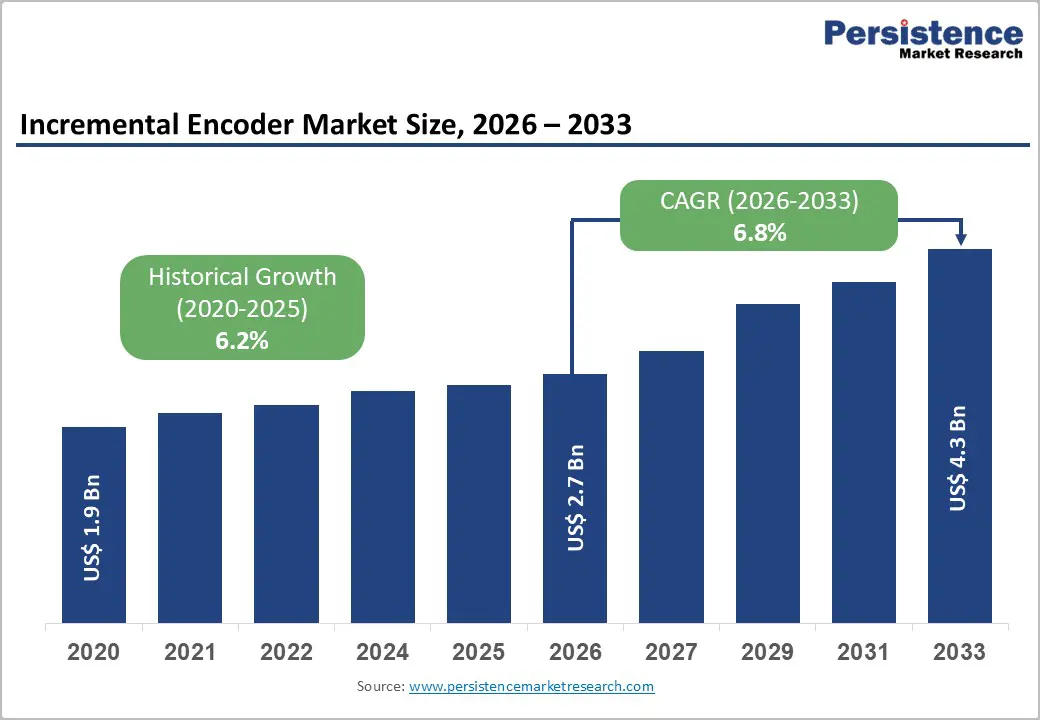

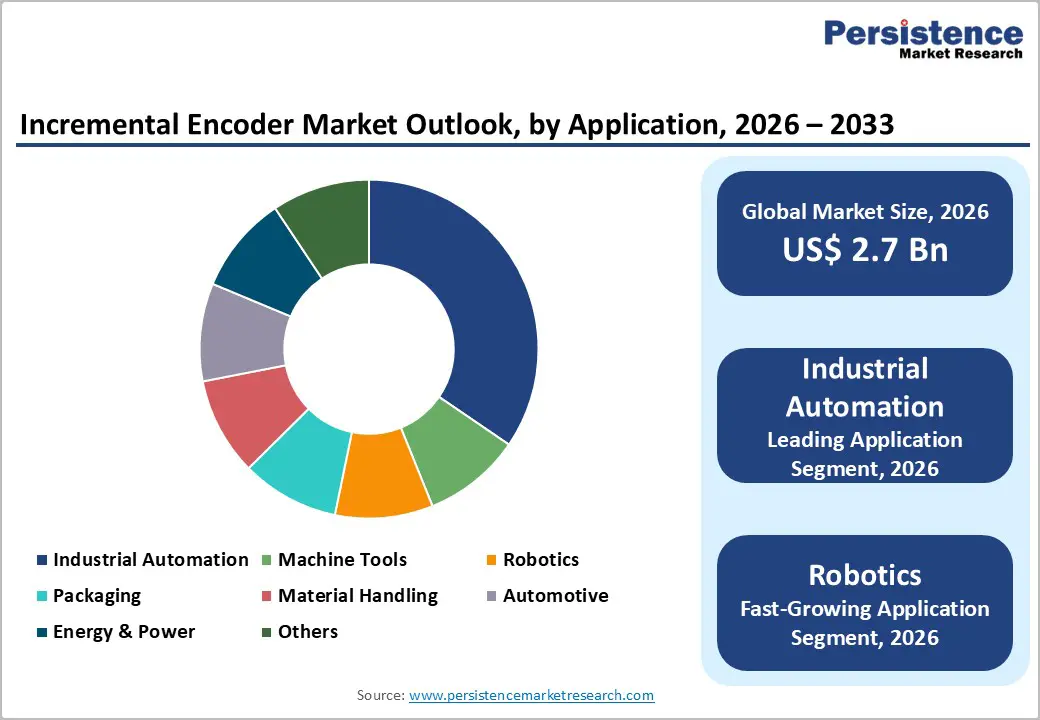

The global Incremental Encoder market size is expected to be valued at US$ 2.7 billion in 2026 and projected to reach US$ 4.3 billion by 2033, growing at a CAGR of 6.8% between 2026 and 2033.

The incremental encoder market is experiencing robust growth driven by escalating industrial automation adoption, widespread Industry 4.0 implementation, and surging demand for precision motion control across manufacturing, robotics, and semiconductor sectors. The global encoder market itself expanded from USD 2.12 billion in 2020 to USD 23.81 billion in 2024 with 35.30% year-over-year growth, reflecting unprecedented demand for sophisticated feedback systems supporting intelligent automation architectures. Incremental encoders maintain dominant positioning within encoder portfolios due to their cost-effectiveness, high resolution capabilities exceeding 68 million pulses per revolution, and seamless integration with servo amplifiers and motion control systems driving widespread adoption across diverse industrial applications.

| Global Market Attributes | Key Insights |

|---|---|

| Market Size (2026E) | US$ 2.7 Billion |

| Market Value Forecast (2033F) | US$ 4.3 Billion |

| Projected Growth CAGR (2026-2033) | 6.8% |

| Historical Market Growth (2020-2025) | 6.2% |

Accelerated Industrial Automation and Industry 4.0 Adoption

Industrial automation investments are expanding globally at unprecedented rates, with the global motion control market projected to grow at CAGR of 5.13% through 2033, creating substantial demand for incremental encoders serving as critical feedback components within motion control systems. Industry 4.0 implementation across manufacturing sectors necessitates sophisticated sensing infrastructure including incremental encoders providing real-time position and velocity feedback enabling predictive maintenance, dynamic process optimization, and seamless integration with cloud computing and edge computing platforms.

Major manufacturers including Siemens, Rockwell Automation, and Mitsubishi Electric are embedding incremental encoder capabilities directly into servo drives and integrated motion controllers, expanding total addressable market through deeper integration within automation ecosystems. The integration of artificial intelligence and machine learning into motion control systems enables advanced predictive capabilities, with encoders providing high-resolution feedback exceeding 68 million pulses per revolution enabling sophisticated algorithms to optimize equipment performance and prevent unexpected failures.

Rising Demand from Robotics and Semiconductor Manufacturing

Industrial robotics adoption is accelerating globally with Japan maintaining installed robot base exceeding 420 units per 10,000 workers, establishing the nation as global leader in robotic density and driving sustained demand for high-precision incremental encoders. Robotic arms and collaborative robots (cobots) require exceptional positional accuracy through integrated incremental encoders providing feedback on joint rotation angles, enabling closed-loop servo control systems delivering accuracy improvements of 70-80% compared to open-loop alternatives.

Semiconductor manufacturing represents fastest-growing encoder application segment, with wafer lithography stages and inspection systems requiring sub-micron positioning accuracy achievable only through advanced incremental encoder solutions integrated within precision motion platforms. Medical robotics including surgical robotic systems such as Johnson & Johnson’s OTTAVA™ platform require ultra-compact optical incremental encoders delivering submillimeter repeatability essential for precise surgical instrumentation. The global medical device market with substantial proportions allocated to robotic surgical systems and diagnostic equipment incorporating sophisticated incremental encoder solutions supporting enhanced clinical outcomes and surgical precision.

Supply Chain Vulnerabilities and Raw Material Constraints

Incremental encoder manufacturing depends on specialized optical components, magnetic materials, and precision mechanical components experiencing supply chain volatility due to geopolitical tensions and semiconductor shortages disrupting component procurement. Rare-earth materials used in magnetic encoders face concentrated supplier bases in select regions, creating procurement risks and pricing pressures constraining margins for encoder manufacturers lacking vertical integration or diversified sourcing strategies. Small and medium-sized enterprises face substantial barriers accessing secure supply chains and negotiating favorable component pricing, creating competitive disadvantages relative to large multinational manufacturers with established supplier relationships and economies of scale supporting cost-effective procurement.

Technology Transition Costs and Competitive Intensity

The shift toward absolute encoders and IoT-integrated feedback systems requires substantial research and development investments to maintain competitive positioning, with absolute encoder market commanding 62.3% of total encoder revenue despite incremental encoders remaining preferred for cost-sensitive applications. Intense competitive rivalry among established players including Renishaw, HEIDENHAIN, Baumer, OMRON, and emerging manufacturers from Asia-Pacific regions is compressing profit margins and forcing continuous innovation to differentiate offerings and maintain market share within increasingly commoditized segments.

Expansion of Linear Incremental Encoder Applications

Linear incremental encoders are experiencing accelerated adoption in precision measurement instruments, CNC machine tools, and semiconductor manufacturing equipment with projections indicating linear encoder growth at CAGR of 7.51% through 2030, outpacing rotary encoder expansion rates. Submicron precision requirements in semiconductor lithography and wafer inspection systems are driving specialized demand for linear incremental encoders capable of measuring infinitesimal displacement with nanometer-level accuracy. Additive manufacturing and 3D printing platforms increasingly utilize linear incremental encoders for nozzle positioning and build platform motion control, supporting expansion into emerging manufacturing technologies. Coordinate measuring machines (CMMs) used for quality control in aerospace, automotive, and medical device manufacturing depend entirely on high-precision linear incremental encoders providing accurate feedback for 3D dimensional measurement procedures. The integration of linear encoders with laser interference technology and glass scales enables manufacturers to achieve zero cyclic error specifications demanded by cutting-edge applications in metrology and precision manufacturing.

AI-Powered Predictive Maintenance and Intelligent Motion Control

Artificial intelligence integration into encoder signal processing enables real-time fault detection, vibration analysis, and predictive maintenance algorithms that reduce unplanned equipment downtime by 30-38% while decreasing maintenance costs by approximately 25%. Machine learning algorithms trained on massive datasets of encoder signals can identify anomalous patterns preceding component failures, enabling preventive maintenance scheduling optimizing equipment uptime and extending operational lifespan.

Edge computing platforms embedded within next-generation incremental encoder designs enable local signal processing and anomaly detection eliminating transmission latency and supporting real-time fault response. Wireless connectivity features integrated into modern incremental encoders enable remote monitoring capabilities and diagnostics supporting Condition-Based Maintenance (CBM) strategies reducing maintenance expenses while improving equipment reliability. Digital twin technologies powered by high-resolution encoder feedback enable manufacturers to create virtual representations of physical equipment supporting simulation-based optimization and predictive performance modeling.

Optical incremental encoders are the fastest-growing encoder type, projected to expand at a CAGR of 18.0% during 2026–2033, driven by rising adoption in aerospace, semiconductor manufacturing, and medical robotics applications requiring ultra-high precision. The segment was valued at approximately USD 850 million in 2025 and is expected to reach significantly higher levels by 2033 as precision automation gains momentum. Optical encoders provide non-contact position sensing using photoemissive discs and photodiode arrays, eliminating mechanical wear and contamination risks. Advancements in optical sensor resolution now enable detection exceeding 68 million counts per revolution, reinforcing their suitability for accuracy-critical environments such as CNC machining and advanced robotics.

Rotary incremental encoders dominate the technology landscape, accounting for approximately 73% of total incremental encoder market revenue in 2024, reflecting their extensive use in servo motors, industrial robots, and rotating machinery. Their dominance is supported by broad shaft-size availability, high compatibility with standard servo drives, and proven reliability across industrial platforms. Modular rotary designs enable deployment in space-constrained applications, including hollow-shaft robot joints. Integration of advanced digital interfaces enhances signal integrity in electromagnetically noisy environments, supporting real-time feedback. Dual-encoder configurations further improve closed-loop control accuracy, making rotary incremental encoders indispensable for precision motion control in high-performance manufacturing systems.

Industrial automation represents the largest application segment, capturing approximately 35% of total incremental encoder demand globally. Growth is driven by increasing deployment of automated production lines, CNC machine tools, robotic material handling systems, and AGVs. A typical factory automation project integrates 15–20 encoder feedback points, covering spindle drives, tool changers, conveyors, and positioning systems. High-speed packaging and assembly lines increasingly require sub-micron positioning accuracy while operating at high cycle rates, strengthening demand for reliable encoder feedback. As smart factory adoption accelerates worldwide, incremental encoders remain essential for synchronization, motion accuracy, and real-time process control across industrial environments.

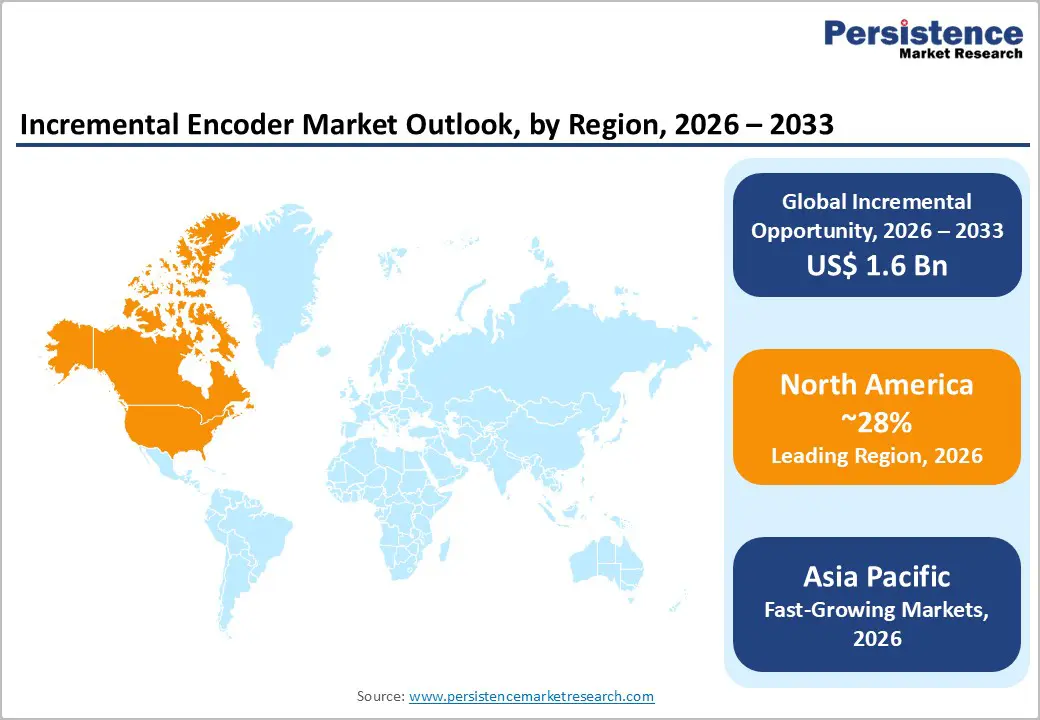

North America maintains significant market position with approximately 28% regional share, driven by advanced manufacturing infrastructure, stringent quality standards, and substantial adoption of precision machining and medical robotics applications. The United States aerospace industry centered in California, Texas, and Florida drives exceptional demand for high-resolution incremental encoders meeting MIL-STD specifications and functional safety certifications including SIL 2/3 ratings. Medical device manufacturers concentrated in Minnesota and Massachusetts prioritize incremental encoders for robotic surgical platforms and diagnostic imaging equipment where submillimeter accuracy is essential for clinical outcomes.

Rockwell Automation’s strong market presence in North America reflects region’s emphasis on motion control integration and industrial automation platforms supporting widespread adoption of closed-loop feedback systems. FDA regulatory requirements for medical devices drive incremental encoder adoption throughout medical device supply chains as manufacturers implement sophisticated quality assurance procedures. The region’s emphasis on collaborative robotics and human-machine interaction applications is spurring development of specialized incremental encoder solutions optimized for safety-critical applications requiring real-time position verification.

Europe represents a mature and technologically advanced incremental encoder market with approximately 26% regional share, characterized by stringent manufacturing standards, advanced precision engineering traditions, and strong emphasis on innovation. Germany maintains global leadership position as manufacturing technology center with companies including HEIDENHAIN, Siemens, and Bosch Rexroth driving innovation in incremental encoder technology and establishing Europe as global innovation hub. United Kingdom, France, and Switzerland contribute significant manufacturing capacity with specialized expertise in high-precision optical encoder design and laser measurement technologies supporting cutting-edge applications.

EU collaborative robot adoption is creating specialized demand for compact, high-accuracy incremental encoders optimized for cobots and safety-critical applications where functional safety compliance is mandatory. ISO/TS 15066 compliance requirements for collaborative robot operations are driving adoption of safety-rated incremental encoders certified for dependable operation in human-proximity environments. European aircraft manufacturing centered in France, Germany, and Spain requires specialized incremental encoder solutions meeting aerospace qualification standards and supporting critical flight control systems.

Asia Pacific emerges as the fastest-growing regional market with CAGR of 10% during 2026-2033, projected to capture approximately 45% global market share by 2033 driven by explosive manufacturing growth, government automation incentives, and leadership in electronics and semiconductor production. China dominates regional incremental encoder consumption with smart manufacturing initiatives driving adoption across automotive, electronics, and pharmaceutical sectors, with provincial subsidies for fully automated facilities accelerating encoder procurement. India’s PLI scheme is catalyzing exceptional growth in encoder demand through financing of new CNC, PCB, and medical device manufacturing facilities requiring advanced motion control infrastructure.

Japan maintains technological leadership through companies like OMRON, Panasonic, and Nidec developing next-generation incremental encoder solutions optimized for submicron precision and high-speed feedback. South Korea’s robotics and consumer electronics industries drive substantial incremental encoder demand supporting smart manufacturing initiatives and export-oriented production. ASEAN manufacturing expansion in Vietnam, Thailand, and Indonesia represents highest-growth opportunity subsegment with encoder consumption expanding at 12%+ annually supporting manufacturing relocations and supply chain diversification initiatives.

The incremental encoder market exhibits moderate fragmentation, with a limited group of global suppliers competing alongside regional and emerging players across multiple technology and application niches. Market structure is defined by differentiation rather than scale alone, as suppliers compete on performance, reliability, and system integration capabilities. Leading participants pursue premium positioning strategies by incorporating advanced digital interfaces, functional safety compliance, embedded diagnostics, and intelligent firmware to support predictive maintenance and higher-value automation use cases.

Vertical integration and solution bundling with motors, drives, and controllers are increasingly used to strengthen OEM relationships and reduce system complexity for end users. Precision engineering, particularly in optical and high-resolution encoder technologies, remains a key competitive lever in accuracy-critical applications. At the same time, cost-focused competitors are expanding their presence through localized manufacturing, flexible customization, and regional supply chain alignment, particularly in price-sensitive markets. Overall, competition is intensifying as suppliers balance technological sophistication with cost efficiency and ecosystem integration strategies.

The global Incremental Encoder Market is expected to reach approximately US$ 2.7 billion by 2026.

Key drivers include industrial automation, Industry 4.0 adoption, robotics growth, and rising demand for precision motion control.

North America is projected to lead the market with around 28% share during 2026–2033.

AI-enabled predictive maintenance and intelligent motion control present the largest growth opportunity.

Major players include Renishaw, HEIDENHAIN, Rockwell Automation, OMRON, Baumer, Dynapar, Honeywell, TE Connectivity, and Nidec.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis Units | Value: US$ Mn/Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author