ID: PMRREP24343| 193 Pages | 30 Sep 2025 | Format: PDF, Excel, PPT* | Healthcare

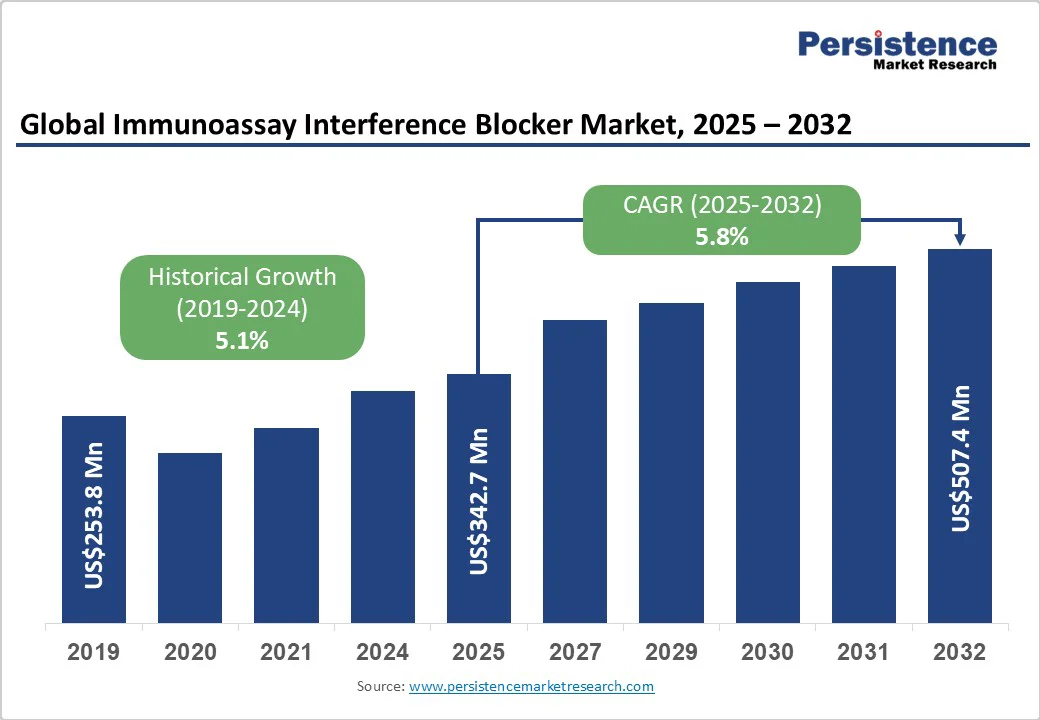

The global immunoassay interference blocker market size is likely to be valued at US$342.7 Mn in 2025. It is expected to reach US$507.4 million by 2032, growing at a CAGR of 5.8% during the forecast period from 2025 to 2032, driven by the increasing incidence of chronic diseases, including cancers, autoimmune diseases, and rare diseases. Immunoassay interference blockers are specialized reagents used to eliminate substances that can distort results in immunoassay tests.

| Key Insights | Details |

|---|---|

| Immunoassay Interference Blocker Market Size (2025E) | US$342.7 Mn |

| Market Value Forecast (2032F) | US$507.4 Mn |

| Projected Growth (CAGR 2025 to 2032) | 5.8% |

| Historical Market Growth (CAGR 2019 to 2024) | 5.1% |

The immunoassay interference blocker market is influenced by several factors, such as the growing incidence of chronic diseases (cancers, autoimmune diseases, and rare diseases).

The increasing clinical applications of interference blockers in the immunoassay-based diagnostic tests to detect specific biomarkers associated with disease progression, treatment response, and prognosis will drive market growth. A population-based study of 22 million people in the U.K. revealed that autoimmune disorders affect one in every ten individuals, as published in The Lancet (June 2023).

The market is experiencing growth as healthcare providers and researchers seek solutions to mitigate assay interference and improve the diagnostic performance of immunoassays. By ensuring the specificity and sensitivity of diagnostic tests, interference blockers contribute to more accurate disease diagnosis, better treatment decisions, and improved patient outcomes in the face of the growing burden of chronic diseases.

Immunoassays are essential tools for detecting biomarkers, infectious agents, hormones, and other molecules, making them invaluable in medical diagnosis, drug development, and basic research. In clinical diagnostics, immunoassays are routinely used for the diagnosis and monitoring of various diseases, including infectious diseases, autoimmune disorders, and hormonal imbalances.

They offer advantages such as rapid turnaround times, ease of use, and scalability, making them ideal for high-throughput screening and routine testing in clinical laboratories. As immunoassay technologies continue to evolve and expand, the role of interference blockers becomes increasingly critical in supporting the integrity and validity of immunoassay-based assays in diverse scientific and clinical settings.

Various endogenous substances, such as proteins, hormones, and lipids, present in biological samples, exogenous medications, and assay components, interfere with immunoassay detection methods. The composition and concentration of these endogenous substances can vary widely among individuals and even within the same individual over time, adding a layer of complexity to interference management.

Further, a wide variety of medications available, each with its chemical composition and pharmacological effects, complicates efforts to identify and mitigate potential interference effects. Such interferences exhibit cross-reactivity with assay components, leading to false positive or false negative results if not adequately addressed. Addressing these challenges requires a multifaceted approach encompassing rigorous assay design, validation studies, and the development of interference blockers tailored to specific interference mechanisms.

Delays in FDA approvals for immunoassay interference blocker kits and reagents are hindering market expansion. Molecular diagnostic reagents, including immunoassay interference blocker kits, do not have any clinical results on medical usage; thus, delays in FDA approvals for the immunoassay interference blockers have created potential complications.

The high cost of molecular testing continues to be a barrier for laboratories in developing and under-resourced regions. Apart from this, consumables and hardware investments are the major cost factors restricting the dissemination of molecular diagnosis in clinical diagnostic laboratories.

Despite their high cost, the increasing reliance on immunoassay technologies has driven demand for interference blocker kits in critical diagnostic settings. With this high adoption rate, the pricing of molecular testing and blocking reagents must go down to accommodate deficits in healthcare.

Interference blockers play a crucial role in ensuring the reliability and accuracy of point-of-care tests by minimizing the impact of interfering substances or factors that may compromise assay performance. Point-of-care testing offers several advantages over traditional laboratory-based testing, including reduced turnaround times, improved patient satisfaction, and enhanced clinical decision-making.

In POCT environments, where testing is often conducted in less controlled conditions compared to centralized laboratories, the risk of interference from endogenous substances, medications, or environmental factors is heightened. Interference blockers designed for POCT applications must be highly effective in mitigating these interferences while maintaining assay sensitivity and specificity.

As the adoption of POCT continues to expand across various healthcare settings, there arises a corresponding need for interference blockers tailored specifically to these settings, presenting a compelling opportunity for innovation and market growth.

Companies around the globe are investing significantly in research and development activities to undertake innovative approaches to leverage advancements in biotechnology and molecular biology. The use of monoclonal antibodies and recombinant proteins to develop highly specific blockers or the employment of genetic engineering and nanotechnology to produce blockers with tailored binding affinities and enhanced stability, offers exciting possibilities for interference blockers.

Investments in high-throughput screening technologies, computational modeling, and machine learning algorithms are further accelerating the discovery of novel blockers. This not only enhances diagnostic precision but also builds confidence among healthcare providers and patients, driving the adoption of advanced diagnostic technologies and contributing to better healthcare outcomes.

The antibody interference blockers segment is projected to account for more than 47% of the global market revenue in 2025 and is likely to maintain its dominance during the forthcoming years, recording a CAGR of 6.1%. Antibody interference blockers are the most preferred type due to their targeted mechanism, which effectively blocks interfering substances without compromising the binding of the analyte to its capture or detection antibodies.

Further, these blockers provide a wide spectrum of interference, including endogenous antibodies and exogenous substances, without impacting the sensitivity of the assay. They can also be utilized in a variety of immunoassay formats such as ELISA, western blotting, immunohistochemistry, and others. All these factors support the growing demand for antibody interference blockers in different experimental setups and applications.

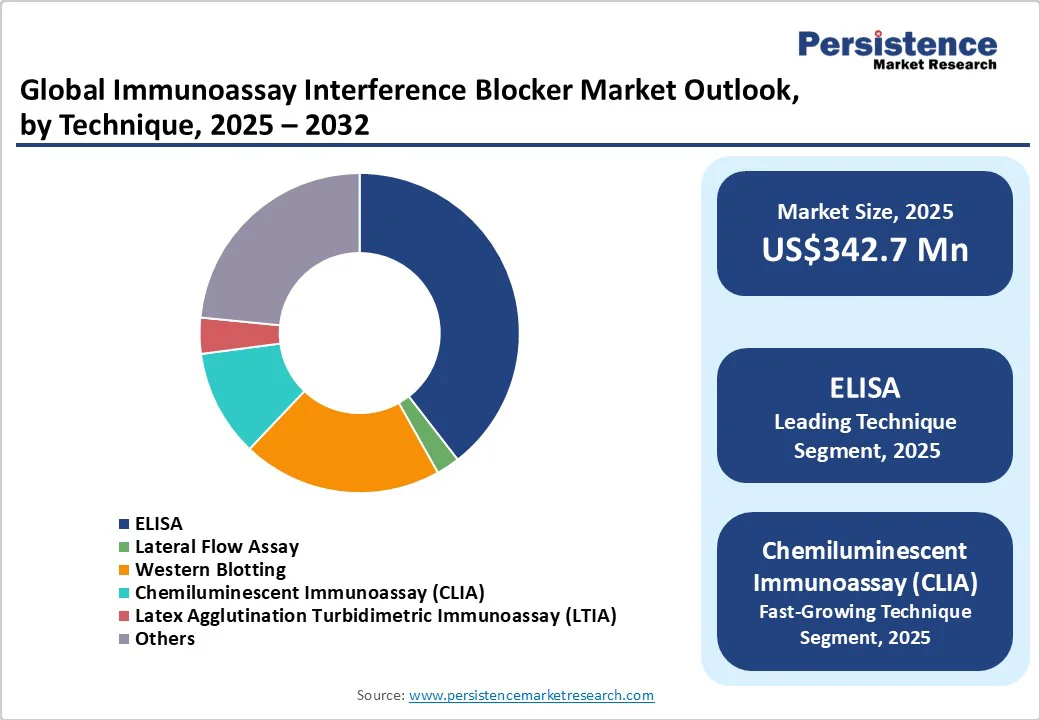

Among the different techniques employed in immunoassays, ELISA (enzyme-linked immunosorbent assay) is one of the most widely used due to its simplicity, cost-effectiveness, accuracy, and high sensitivity. ELISA assays have been extensively validated and standardized for use in clinical laboratories.

Accurate detection and quantification of analytes in low concentrations and even in the presence of interfering substances such as heterophilic antibodies or rheumatoid factors. This makes the technique crucial for making clinical decisions and monitoring disease progression. The ELISA technique is estimated to expand at a CAGR of 6.0% in terms of value in the forthcoming years.

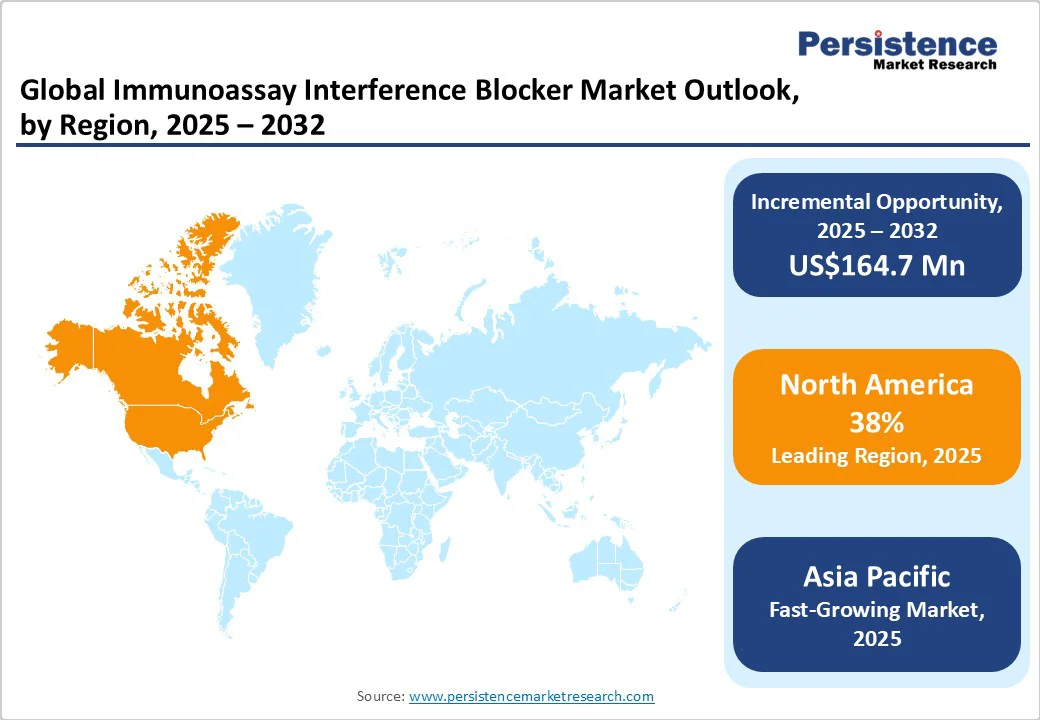

North America market is expanding rapidly, with the U.S. at its core, accounting for a 38% share in 2025. North America accounts for a notable share owing to the factors such as the presence of key players in the region and the growing adoption of immunoassay interference blockers across various applications, such as pharmaceutical research and clinical diagnostics. It is further expected to grow at a CAGR of 5.8% during the forecast period.

North America has a high prevalence of chronic diseases such as cardiovascular diseases, diabetes, and cancer. Detection and management of these diseases require detecting biomarkers specific to the disease without the interference of endogenous substances, to understand the disease progression, treatment response, and its prognosis. Interference blockers help block the interference of these substances during the assay procedure.

According to the Centers for Disease Control and Prevention, 2024, an estimated 129 million people in the U.S. have at least one chronic disease. An increasing proportion of people in America are dealing with multiple chronic conditions; 42% have two or more, and 12% have at least five.

Besides the personal impact, chronic disease has a substantial effect on the U.S. healthcare system. About 90% of the annual US$4.1 Tn healthcare expenditure is attributed to managing and treating chronic diseases and mental health conditions.

Europe is projected to witness steady growth, securing a CAGR of 5.6% between 2025 and 2032. The rising demand for accurate diagnostic testing, driven by the growing prevalence of chronic and infectious diseases, is a key driver.

Increased adoption of advanced immunoassay platforms in hospitals, diagnostic laboratories, and research centers further boosts market expansion. Regulatory emphasis on improving diagnostic accuracy, along with ongoing technological advancements in interference blockers, supports growth. Additionally, the surge in personalized medicine and rising healthcare investments across European countries strengthen the market outlook, creating opportunities for manufacturers and suppliers.

Asia Pacific is projected to secure a CAGR of 6.2% in the forecast period from 2025 to 2032. The rapid expansion of healthcare infrastructure and urban access to diagnostics in Asia Pacific is contributing significantly to market growth.

China recorded a significant share in terms of revenue in 2024, owing to the rising incidence of diseases such as respiratory diseases and cardiovascular diseases, and significant investment in the healthcare infrastructure and research and development capabilities, thereby fostering China's medical diagnostics ecosystem.

Japan, with a well-established biotechnology and pharmaceutical industry, has been focusing on developing innovative medical technologies. The demand for accurate diagnostic tools has led to the growing demand for immunoassay interference blockers across the academic and research sectors.

Several local players offering immunoassay technology-based services and products, including interference blockers, have been catering to the demands domestically, as well as competing with leading players at a global level.

The global immunoassay interference blocker market is marked by increasing product consolidation efforts, including strategic sales and service agreements, collaborative ventures, and heightened R&D initiatives. Key market players are actively pursuing partnerships and collaborations to drive innovation and expedite the global launch of new products.

Continuous investment in research and development is fueling the introduction of advanced and novel interference blockers. In addition, major strategic activities such as new product launches, joint ventures, patent licensing, and mergers & acquisitions are being widely adopted by both global and regional players to strengthen their market position.

The immunoassay interference blocker market is projected to be valued at US$342.7 Mn in 2025.

Increasing incidence of chronic diseases, increasing adoption of immunoassay techniques across diverse applications, and growing demand for healthcare services in the emerging nations are surging the demand for immunoassay interference blockers.

The immunoassay interference blocker market is poised to witness a CAGR of 5.8% between 2025 and 2032.

The increasing demand for fast and precise diagnostic solutions, along with rising investments in R&D for the development of innovative blockers, is expected to create significant opportunities for market players.

The key players operating in the market include F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific Inc., Merck KGaA, Surmodics, Inc., Scantibodies Laboratory, Inc., Abcam plc, Meridian Bioscience, Inc., Candor, and Creative Biolabs.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product

By Technique

By End-User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author