ID: PMRREP33528| 199 Pages | 25 Nov 2025 | Format: PDF, Excel, PPT* | Healthcare

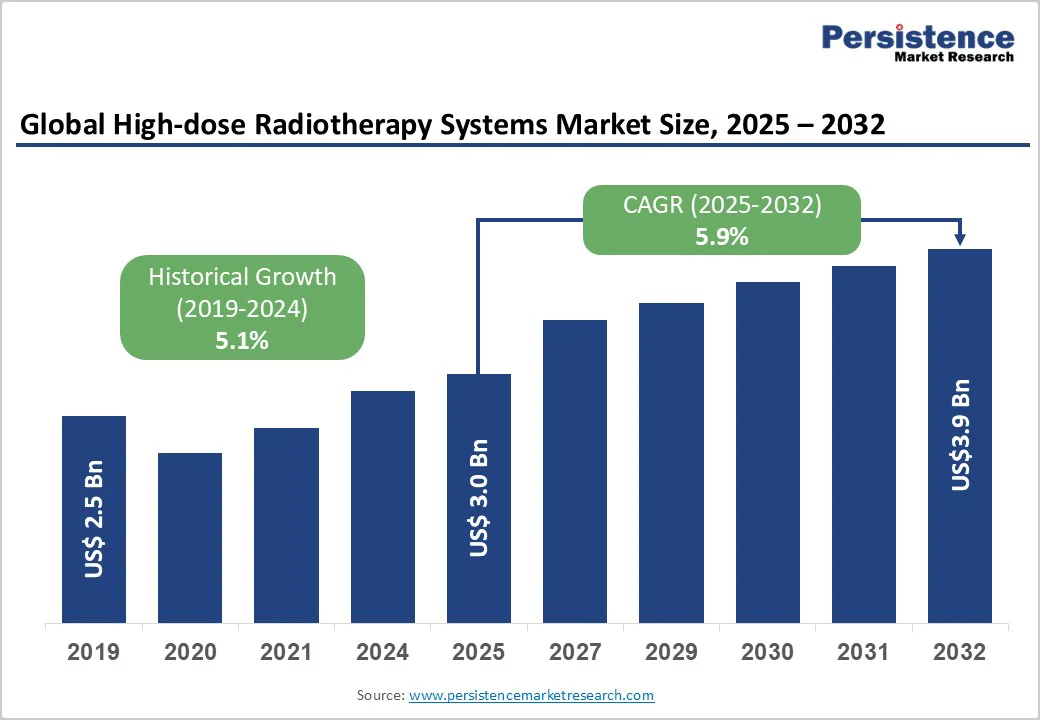

The global high-dose radiotherapy systems market size is likely to be valued at US$ 3.0 billion in 2025, and is projected to reach US$ 3.9 billion by 2032, growing at a CAGR of 5.9% during the forecast period 2025-2032. Technological innovation drives demand for high-dose radiotherapy systems by enhancing the precision and applicability of radiation therapy across an expanding range of cancer cases.

As a cornerstone of non-surgical lung cancer treatment, radiation therapy (RT) plays an integral role in the multidisciplinary management of thoracic cancers. Recent advancements in radiotherapy procedures and novel fractionation models have simultaneously improved long-term disease control while reducing radiation-related adverse effects. Intensity-modulated radiotherapy (IMRT), stereotactic radiotherapy, image-guided radiotherapy (IGRT), and particle therapy have made it easier to plan treatments, accurately delineate tumors, and estimate doses for successful, personalized treatment.

| Key Insights | Details |

|---|---|

|

High-dose Radiotherapy Systems Market Size (2025E) |

US$3.0 Bn |

|

Market Value Forecast (2032F) |

US$3.9 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

5.9% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.1% |

The global burden of cancer continues to rise rapidly, creating a strong demand for advanced and targeted treatment solutions. High-dose radiotherapy systems have emerged as a preferred option due to their ability to deliver concentrated radiation precisely to tumor sites while minimizing damage to surrounding healthy tissues.

As cancer profiles become more complex, particularly with the increasing incidence of lung, prostate, breast, liver, and brain cancers, healthcare providers are turning to specialized high-dose technologies such as stereotactic body radiotherapy (SBRT), stereotactic radiosurgery (SRS), and high-dose-rate (HDR) brachytherapy. These technologies offer higher tumor control rates and reduced treatment sessions, improving patient comfort and outcomes.

The rise in lifestyle-related diseases, the aging population, and improved screening programs are expanding the diagnosed patient base, further accelerating adoption. Growing awareness of the benefits of early treatment and the demand for minimally invasive procedures are also driving hospitals and oncology centers to upgrade from conventional radiotherapy systems to advanced high-dose platforms. Governments and private players are investing heavily in precision radiotherapy infrastructure to effectively manage the growing cancer burden.

The high cost of radiotherapy systems is a significant limiting factor for market growth. External beam radiation therapy (EBRT) machines cost around US$2.5 million, and proton therapy systems cost more than US$40 million. Along with equipment costs, a significant amount is spent on establishing a treatment room as well. Expenses associated with radiotherapy equipment increase service costs, rendering them inaccessible to a significant portion of patients, especially in low- and middle-income countries.

The availability of other cancer treatment types, such as chemotherapy and surgery, and the advancement in these procedures, also restricts the demand for radiation therapy. The effective advancement of alternative cancer treatments, such as immunotherapy, and improved efficacy of newly developed treatments or current medications can restrict the adoption of high-dose radiotherapy systems. Adding to this is the intensifying emphasis on developing personalized cancer treatments, which also limits market expansion.

Joint mergers and partnerships between market players offer lucrative opportunities for manufacturers of radiotherapy systems and software products. Both hardware and software companies are accelerating initiatives in this direction as part of their growth strategy to improve technologies, reduce costs, and expand their commercial reach. As a result of recent technological developments, radiotherapy is now more effective, improving the quality of life and enabling more effective management of cancer patients.

Various notable advancements have significantly improved tumor dose distribution and reduced toxicity to healthy tissue in radiation therapy. These include the introduction of the multileaf collimator, integration of imaging technologies such as computed tomography (CT) and positron emission tomography (PET), utilization of advanced dose calculation algorithms, and the development of advanced delivery techniques. Moreover, the integration of AI with radiotherapy systems is opening up novel profitable opportunities for high-dose radiotherapy system manufacturers, especially in improving the efficiency of treatment planning systems and analyzing huge patient datasets.

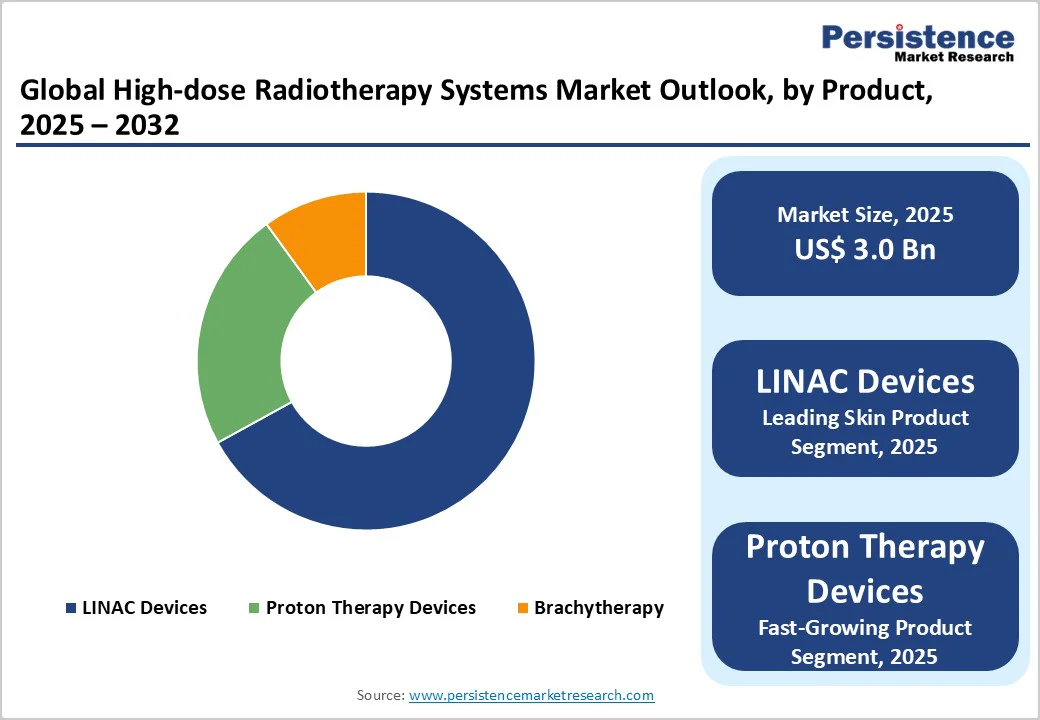

LINAC devices dominate in 2025, accounting for nearly 68% of the high-dose radiotherapy systems market revenue share in 2025. Linear accelerators remain the backbone of external beam radiotherapy, delivering precise and high-energy X-rays to target tumors while sparing surrounding healthy tissue.

Their versatility enables the delivery of multiple advanced treatment modalities, such as IMRT, VMAT, IGRT, SBRT, and SRS, making them suitable for treating a wide range of cancers across the brain, lungs, prostate, liver, and spine. Continuous technological advancements, including real-time image guidance and adaptive therapy capabilities, have further enhanced treatment accuracy and efficiency. The availability of LINAC systems in both developed and emerging regions also supports broader access to high-quality cancer care.

Proton therapy devices represent the fastest-growing segment due to their superior dose distribution and ability to treat tumors located near critical organs. Increasing establishment of compact and cost-efficient proton centers, along with growing clinical evidence supporting proton therapy’s efficacy in pediatric and complex cancers, is fueling rapid market growth.

Cancer treatment centers accounted for the largest market share of 47.5% in 2025, emerging as the primary end users of high-dose radiotherapy systems. These centers are dedicated facilities equipped with advanced technologies to deliver precise and effective radiation treatments, including SBRT, SRS, and proton therapy. The increasing global cancer burden has intensified the demand for such centers, particularly in regions with high cancer incidence rates. Their specialized infrastructure and skilled oncology teams enable comprehensive patient care, from diagnosis to post-treatment follow-up.

Favorable reimbursement frameworks in developed markets further encourage the adoption of advanced radiotherapy equipment, making high-dose treatments more accessible to patients. Dedicated investments toward upgrading treatment infrastructure and expanding cancer care networks in emerging economies are reinforcing their dominance. As cancer treatment centers remain the cornerstone of oncology care, their focus on precision therapy and patient-centric services continues to drive the widespread utilization of high-dose radiotherapy systems worldwide.

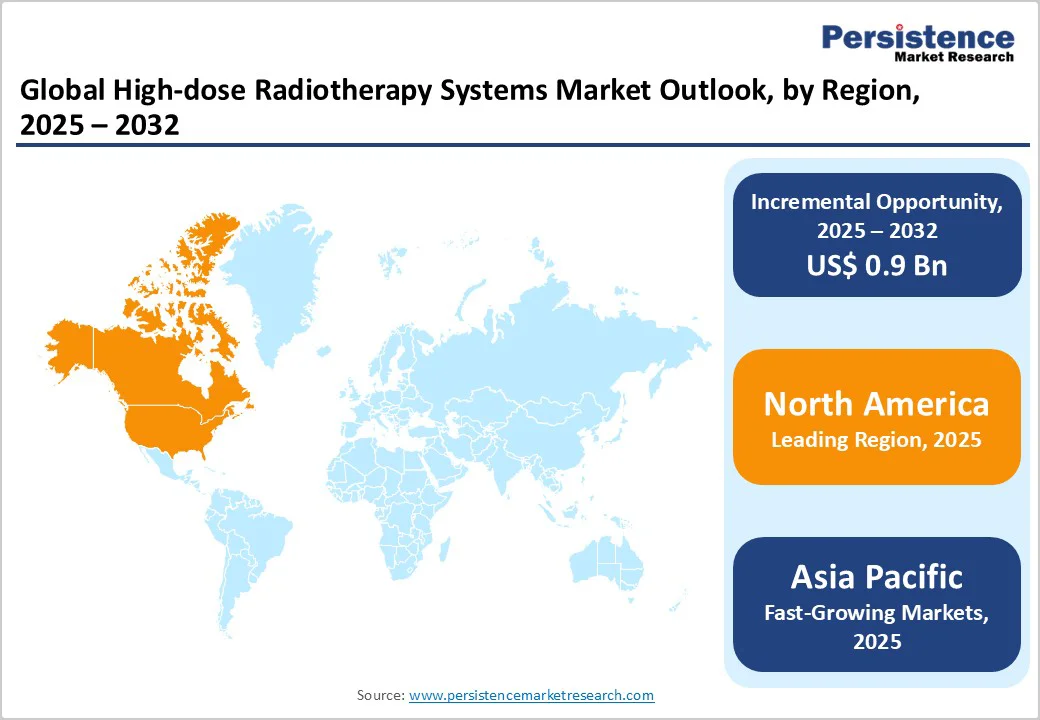

North America remains the dominant region in the high-dose radiotherapy systems market, driven by well-established healthcare infrastructure, early adoption of advanced equipment, such as SBRT-capable LINACs, MR-LINACs, and proton therapy systems, and favourable reimbursement frameworks. In the U.S., cancer centers are deploying adaptive radiotherapy, AI-based treatment planning, and high-dose delivery platforms to improve outcomes and efficiency. Canada is expanding regional cancer hubs and mobile LINAC solutions to reach underserved provinces.

The high installed base of equipment and strong capital expenditure among hospitals means growth in North America is primarily upgrade- and replacement-driven rather than green-field installations. However, the region also continues to be a testing ground for next-generation high-dose modalities such as proton therapy and FLASH radiotherapy.

Asia Pacific is witnessing strong growth in the high-dose radiotherapy systems market, driven by a rising cancer burden, growing healthcare investments, and increased access to advanced oncology care. With its large population and the world’s highest number of cancer cases, China remains the largest contributor to market demand. Common cancers such as lung, colorectal, and stomach cancers dominate the patient profile, creating a strong need for high-precision systems like SBRT, SRS, and IMRT. National health initiatives such as Healthy China 2030 are supporting large-scale modernization of cancer hospitals and adoption of advanced radiotherapy technologies.

India is emerging as one of the fastest-growing markets, boosted by expanding oncology infrastructure in tier-2 and tier-3 cities, public-private collaborations, and increased awareness of advanced treatment options. Japan and South Korea continue to invest in cutting-edge technologies such as proton therapy and AI-guided radiotherapy, reinforcing their positions as technology leaders in the region. As is evident, Asia Pacific offers vast opportunities for greenfield installations, equipment upgrades, and partnerships with global original equipment manufacturers (OEMs) to cater to the unmet need for effective and localized cancer treatment solutions.

The global high-dose radiotherapy systems market landscape is characterized by intense competition among a few major players, including Varian Medical Systems, Elekta AB, Accuray Incorporated, and Ion Beam Applications. These companies dominate the market through advanced technologies such as LINAC-based SBRT/SRS systems and proton therapy solutions.

Continuous product innovation, collaborations with healthcare institutions, and strategic partnerships are central to their growth strategies. Emerging companies such as Mevion and P-Cure are focusing on compact proton systems to strengthen their global presence. Technological advancements and geographic expansion remain key factors shaping the competitive landscape of this market.

The global high-dose radiotherapy systems market is projected to reach US$ 3.0 billion in 2025.

Rising cancer incidence, preference for non-invasive treatments, technological advancements, and increasing adoption of image-guided precision radiotherapy systems drive market growth.

The market is poised to witness a CAGR of 5.9% between 2025 and 2032.

Expanding proton therapy centers, emerging markets adoption, AI-based treatment planning, and government investments in advanced oncology infrastructure present key opportunities.

Varian Medical Systems, Elekta AB, Accuray Incorporated, and Mevion Medical Systems are some of the major players operating in the market.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product

By Application

By End-User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author