ID: PMRREP35362| 200 Pages | 29 May 2025 | Format: PDF, Excel, PPT* | Consumer Goods

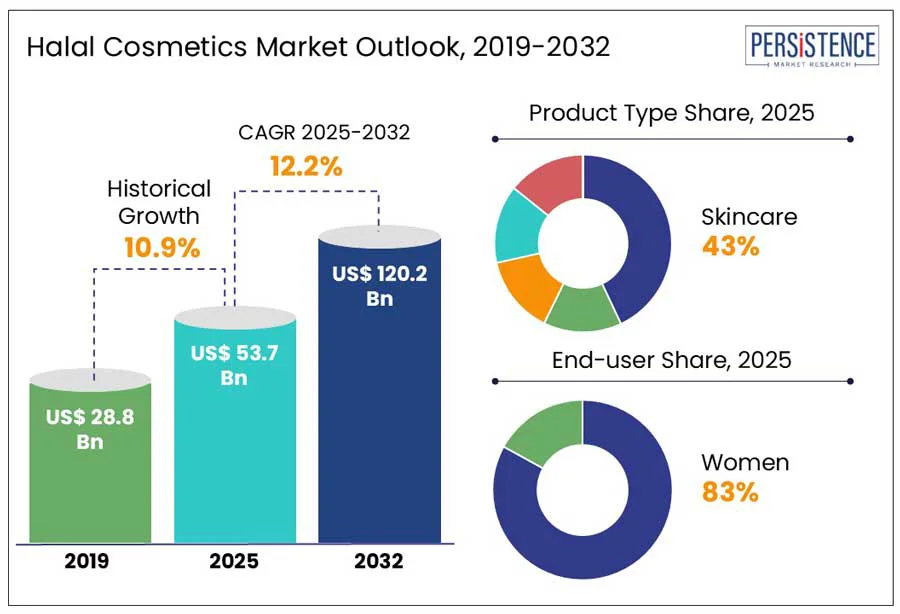

The global halal cosmetics market size is anticipated to rise from US$ 53.7 Bn in 2025 to US$ 120.2 Bn by 2032. It is projected to witness a CAGR of 12.2% from 2025 to 2032. According to the Persistence Market Research report, the industry is driven by rising ethical consumerism, growing Muslim population, and increasing awareness of halal certification. Consumers are seeking products free from harmful or non-permissible ingredients, aligning with religious and health-conscious values. The market spans skincare, haircare, makeup, and personal care across diverse distribution channels. As of May 2025, the global Muslim population accounts for over 25% of the world's total population.

|

Global Market Attribute |

Key Insights |

|

Halal Cosmetics Market Size (2025E) |

US$ 53.7 Bn |

|

Market Value Forecast (2032F) |

US$ 120.2 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

12.2% |

|

Historical Market Growth (CAGR 2019 to 2024) |

10.9% |

As consumers, particularly millennials and Gen Z, increasingly prioritize conscious consumption, the demand for halal-certified cosmetics is surging. These generations are more discerning about the ingredients, sourcing, and ethical practices behind their beauty products, seeking solutions that align with their values of sustainability, health, and environmental responsibility. Halal-certified products meet these criteria by being free from alcohol, animal-derived ingredients, and harmful chemicals, ensuring ethical sourcing and product safety. This growing shift towards clean beauty and sustainability motivates the beauty brands to meet higher standards, offering eco-friendly, cruelty-free, and transparent formulations that cater to the ethical expectations of today’s consumers. Korean brand KUNDAL launched its 'Refreshing Anti-Dandruff Hair Care Line' in January 2024. The products are certified halal by MUI and vegan authorities, catering to growing demand for halal-certified personal care items in Southeast Asia. The line includes shampoos and conditioners enriched with honey and macadamia ingredients.

Limited availability of halal-certified raw materials is a major restraint for the halal cosmetics market. Halal-certified ingredients must meet strict criteria, excluding alcohol, animal-derived substances, and harmful chemicals, which limits the pool of suitable raw materials. This shortage affects the supply chain, increasing production costs and hindering the ability of manufacturers to scale their operations. Additionally, sourcing halal-certified ingredients can be time-consuming and costly, particularly for niche formulations. As demand for halal products grows, the industry faces challenges in securing a consistent and reliable supply of certified materials, potentially slowing market growth and product availability.

While women’s halal beauty products currently dominate the market, there is a rapidly growing demand for halal-certified skincare, haircare, and personal care items specifically designed for men and children. Men, who are increasingly invested in their grooming routines look for high-quality, halal-certified products that align with their lifestyle and values. Simultaneously, parents are becoming more discerning about the safety and quality of products for their children, preferring chemical-free, gentle, and halal-certified alternatives.

By creating and marketing these tailored products, companies can tap expansion opportunities in these expanding consumer bases, increasing their market share and driving brand loyalty across diverse demographics.

Siraj Islamic Lifestyle, U.S.-based offers a variety of skincare and grooming products specifically designed for Muslim men who prefer natural and halal-certified ingredients. Their product line includes facial cleansers, moisturizers, and beard oils, all formulated to meet halal standards. Tamese & Jackson provides a variety of halal-certified personal care products, including options for men, focus on quality ingredients and ethical production practices. Their product line includes body washes, shampoos, and deodorants, all formulated to meet halal standards.

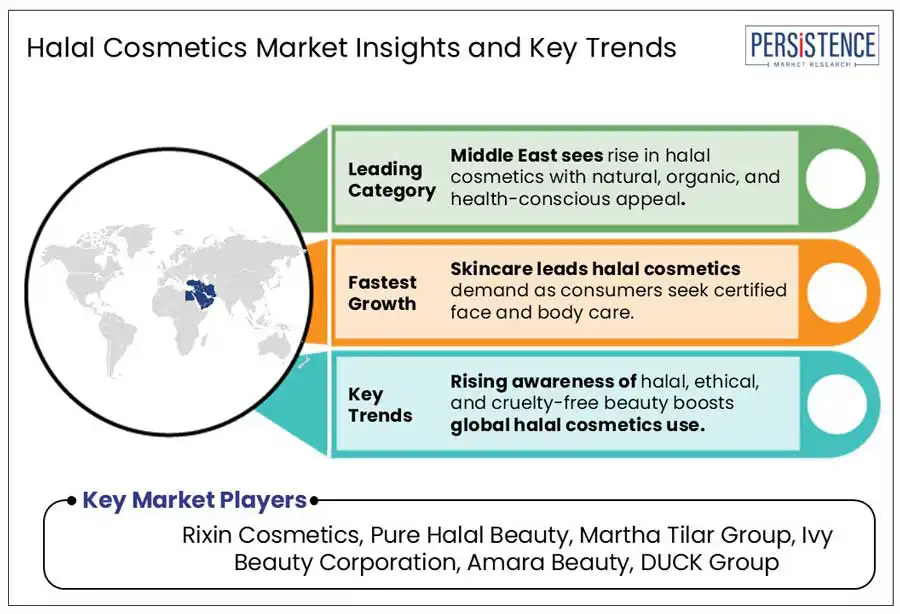

Skincare products lead the demand in the halal cosmetics market, driven by increasing consumer preference for halal-certified facial and body care solutions. Consumers, particularly in Muslim-majority regions, are becoming more conscious of the ingredients used in their skincare products, favoring those that adhere to halal standards. Halal skincare products, free from alcohol, harmful chemicals, and animal-derived ingredients, offer a safe and ethical alternative, aligning with consumer values of purity and sustainability. As awareness of halal beauty standards rises, the demand for halal skincare items such as cleansers, moisturizers, serums, and masks continues to expand, making it a key market segment.

In December 2024, Aykiz Cosmetics launched a Winter Skin Care Kit, featuring halal-certified, all-natural ingredients designed to nourish and protect the skin during colder months. This product targets growing consumer interest in effective, ethically produced skincare solutions.

In September 2023, TCT Nutraceuticals unveiled Malaysia's first durian pudding face mask at the Malaysia International Halal Showcase (MIHAS) 2023. This innovative product combines traditional ingredients with modern skincare technology, earning TCT an award and highlighting the industry's commitment to halal-certified skincare solutions.

In the Middle East, there is a notable shift towards natural and organic ingredients in halal cosmetics, reflecting a growing consumer preference for products that align with both religious guidelines and health-conscious values. Roughly 93% of the population in this region identifies as Muslim.

Consumers are becoming more discerning about the ingredients in their beauty products, opting for formulations that are free from harmful chemicals, parabens, and sulfates. The desire for purity and ethical sourcing is driving demand for halal-certified cosmetics that highly meets religious standards and also caters to the increasing focus on wellness and sustainability. This trend encourages the brands to innovate and offer more organic, eco-friendly halal products.

In 2024, Saie Beauty, a U.S.-based clean beauty brand, marked its entry into the Middle East market by launching in Sephora outlets across the Gulf region. This expansion includes major markets like the UAE, Saudi Arabia, Qatar, Bahrain, Kuwait, and Oman, catering to the growing demand for natural, ethical beauty products.

Lady K Malaysia introduced a new line of halal and vegan skincare products in 2024, focusing on natural ingredients sourced ethically. This product range is designed for consumers seeking cruelty-free and sustainable beauty solutions, aligning with the increasing demand for environmentally conscious cosmetics.

In Asia Pacific, the growing awareness surrounding ethical beauty and cruelty-free practices is playing a significant role in the rise of halal-certified beauty products. As more consumers across the region seek products that are not only halal but also ethically sourced, cruelty-free, and environmentally friendly, the demand for these items continues to surge. Additionally, the increasing Muslim population in the region is further propelling the need for halal cosmetics that adhere to Islamic principles.

Asia Pacific encompasses areas from Turkey to Indonesia, is home to a vast Muslim population, comprising approximately 62% of the world's Muslims. This trend is fostering the development of new halal beauty brands and encouraging existing companies to diversify their offerings, resulting in a robust market expansion.

Swiss halal skincare brand NUME-Lab expanded into Southeast Asian markets, including Singapore, Malaysia, and Hong Kong, through distributor partnerships. Their product line comprises face care items, serums, and cleansers, emphasizing the brand's dedication to authenticity and quality in halal skincare.

Japanese brand KIWABI reformulated its ROOT VANISH hair treatment to secure both vegan and halal certifications. This dual certification caters to Muslim and vegan consumers seeking ethical hair care solutions.

The global halal cosmetics market is highly competitive, driven by increasing consumer demand for ethical, safe, and religiously compliant beauty products. The competitive landscape includes a mix of established beauty conglomerates, niche halal-certified brands, and emerging local players focused on innovation and authenticity. Companies compete on factors such as product quality, ingredient transparency, halal certification, and alignment with sustainable and cruelty-free practices.

Several companies are leveraging digital marketing, celebrity endorsements, and influencer partnerships to capture the attention of younger, trend-conscious consumers. The market witnessed frequent product launches, regional expansion, and strategic collaborations to cater to a rapidly growing global Muslim population.

Key Industry Developments

The global halal cosmetics market is projected to value at 53.7 bn in 2025.

The halal cosmetics market is driven by increasing consumer awareness about ethical and sustainable beauty products for halal-certified cosmetics.

The halal cosmetics market is poised to witness a CAGR of 12.2% between 2025 and 2032

Expanding product offerings for men and children presents the key market opportunities.

Major players in the halal cosmetics market include Rixin Cosmetics, Pure Halal Beauty, Martha Tilar Group, Ivy Beauty Corporation, Amara Beauty, dUCk Group, and others.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 – 2024 |

|

Forecast Period |

2025 – 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By End-user

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author