ID: PMRREP32697| 191 Pages | 6 Jan 2026 | Format: PDF, Excel, PPT* | Chemicals and Materials

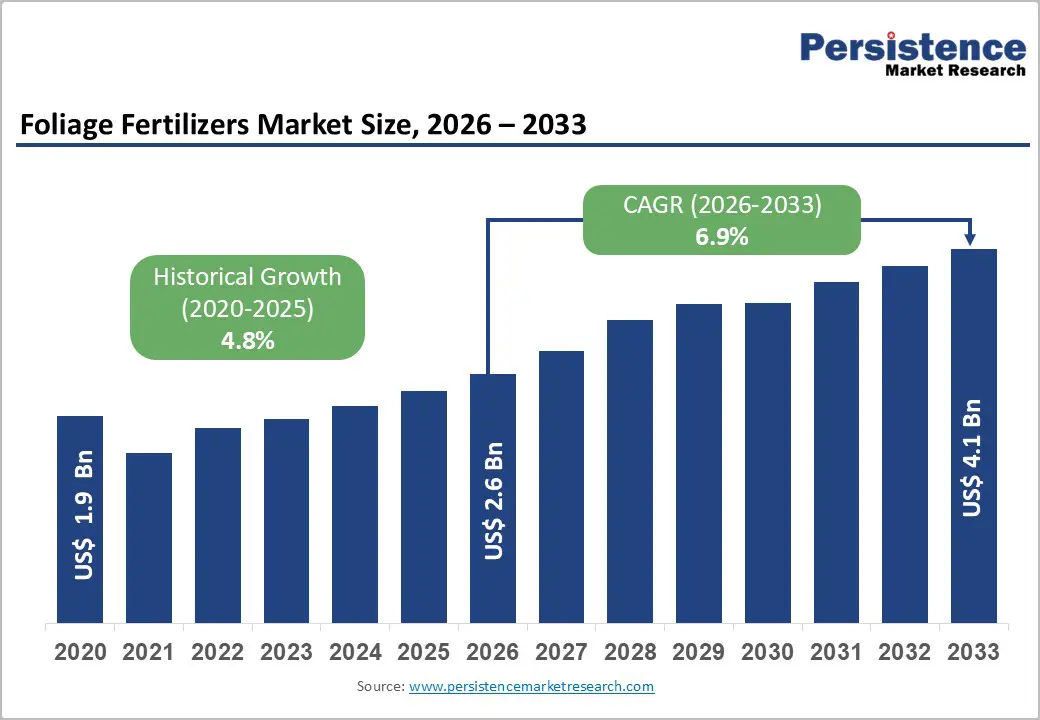

The global foliage fertilizers market size was valued at US$ 1.9 billion in 2020 and reached US$ 2.6 billion in 2026, projected to expand to US$ 4.1 billion by 2033, growing at a compound annual growth rate (CAGR) of 6.9% during the 2026-2033 forecast period. The market demonstrated a historical CAGR of 4.8% (2020-2025), indicating accelerating growth momentum driven by rising global agricultural productivity demands, increasing adoption of precision farming technologies, and heightened awareness of sustainable nutrient management practices. Intensifying pressure to maximize crop yields with optimized input costs, combined with shifting consumer preferences toward bio-based and organic fertilization methods, positions foliage fertilizers as a critical component of modern agricultural management strategies. Regulatory support for sustainable agriculture, particularly in developed economies, further catalyzes market expansion across diverse crop segments and geographic regions.

| Global Market Attributes | Key Insights |

|---|---|

| Foliage Fertilizers Market Size (2026E) | US$ 2.6 Bn |

| Market Value Forecast (2033F) | US$ 4.1 Bn |

| Projected Growth (CAGR 2026 to 2033) | 6.9% |

| Historical Market Growth (CAGR 2020 to 2025) | 4.8 |

Escalating Global Food Production Demands and Yield Optimization Pressures

The global population is projected to reach 9.7 billion by 2050, necessitating a 70% increase in food production according to United Nations Food and Agriculture Organization (FAO) estimates. This unprecedented demand trajectory compels agricultural stakeholders to adopt efficient nutrient delivery systems, positioning foliage fertilizers as a strategic solution for rapid nutrient absorption and enhanced crop productivity. Foliage application delivers nutrients directly to plant tissues, bypassing soil absorption inefficiencies and enabling nutrient utilization rates of 60-80%, compared to 20-40% for traditional soil application methods. The intensifying global crop productivity gap between developed and developing nations has stimulated widespread adoption of advanced fertilization technologies. Market analysis indicates that agricultural operations implementing foliage fertilization protocols achieve yield improvements of 10-25% across cereals, vegetables, and fruits, directly translating to revenue enhancement and competitive advantage in commodity-dependent agricultural regions, particularly across Asia-Pacific and North American markets.

Regulatory Complexity and Product Standardization Challenges Across Heterogeneous Markets

Foliage fertilizer product registration, labeling, and application protocols vary substantially across regulatory jurisdictions, creating compliance complexity for multinational manufacturers and distributors. European Union regulations impose stringent micronutrient concentration limits and heavy metal contamination thresholds, while emerging markets often lack standardized regulatory frameworks, creating uncertainty in market access and product liability. Inconsistent product standardization across regions complicates supply chain management and manufacturing optimization. Technical knowledge requirements for optimal product selection and application timing exceed capabilities of agricultural extension systems in many developing regions, limiting market education and customer acquisition efficiency. These structural regulatory and educational challenges constrain market growth particularly in regions with fragmented agricultural extension infrastructure and limited farmer technical capacity.

Emerging Market Penetration and Agricultural Modernization in ASEAN and Sub-Saharan Regions

Southeast Asian agricultural markets, including Vietnam, Thailand, and Indonesia, collectively cultivate 45+ million hectares of food crops with productivity levels 30-40% below potential yields. Agricultural modernization initiatives supported by World Bank and Asian Development Bank financing are systematically upgrading farmer adoption of productivity-enhancing technologies. Foliage fertilizer market penetration in ASEAN regions currently stands below 12%, compared to 38% in North America, representing a substantial market expansion opportunity. With farmer income growth and cooperative-based agricultural infrastructure development, addressable market in ASEAN is estimated at US$ 480-650 million by 2033, representing compound expansion opportunities. Similarly, sub-Saharan African agricultural regions cultivating 340+ million hectares face yield gaps exceeding 50%, creating market development opportunities contingent upon value-chain infrastructure and financial accessibility improvements.

Integrated Foliage Fertilizer Portfolio Expansion as Strategic Growth Opportunity

The foliage fertilizers market presents a compelling opportunity through an integrated portfolio strategy that balances scale, growth, and specialization across inorganic, bio-based, and organic product types. Inorganic foliage fertilizers currently dominate the market, accounting for over 55% of global revenue, driven by cost efficiency, rapid nutrient uptake, and proven performance across large-scale commercial farming systems. With the inorganic segment valued at approximately US$ 1.43 billion in 2026 and projected to reach US$ 2.26 billion by 2033, manufacturers can leverage established supply chains and technical maturity to secure stable cash flows and fund innovation.

Simultaneously, bio-fertilizers represent the fastest-growing opportunity, expanding at a 7.4% CAGR. Although they presently hold only 18–22% market share, their strong growth trajectory—supported by sustainability regulations, organic certification requirements, and premium crop pricing—positions them as a critical future growth engine. Market value is expected to nearly double from US$ 510–560 million in 2026 to over US$ 1.0 billion by 2033.

Organic foliage fertilizers further enhance opportunity depth as a specialized, high-margin segment aligned with chemical-free agriculture trends. With steady expansion in developed markets, this segment enables differentiation, premium branding, and long-term positioning within sustainable agricultural value chains.

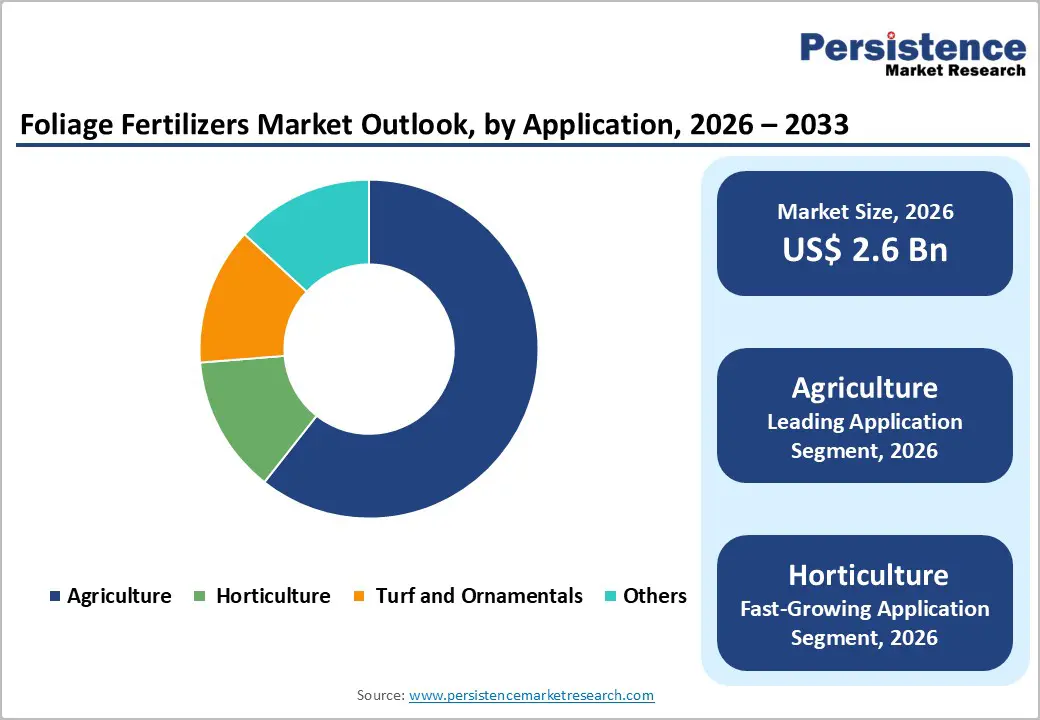

Expanding Crop Nutrition Opportunities Across Agriculture and Horticulture Segments

The foliage fertilizer market presents a compelling growth opportunity driven by the combined scale of broad-acre agriculture and the accelerating expansion of high-value horticulture. Agriculture remains the dominant application segment, contributing over 60% of global revenue, supported by the vast cultivation of cereals, oilseeds, and pulses across more than 1,500 million hectares worldwide. Rising global food security pressures and the need for yield optimization position foliage fertilizers as a strategic input, enabling efficient nutrient delivery and improved crop productivity. With the agricultural segment projected to grow from approximately US$ 1.56 billion in 2026 to US$ 2.46 billion by 2033 at a steady 6.4% CAGR, manufacturers and suppliers have a clear opportunity to scale volumes, strengthen distribution networks, and offer crop-specific formulations, particularly in Asia-Pacific where technology adoption among farmers is accelerating.

At the same time, horticulture represents the fastest-growing opportunity area, expanding at a robust 7.5% CAGR. Covering over 850 million hectares globally, horticulture focuses on fruits, vegetables, medicinal plants, and specialty crops that demand higher nutrient precision and quality outcomes. The segment’s projected growth toward nearly US$ 1.1 billion by 2033 reflects farmers’ willingness to invest in premium inputs, creating attractive margins and innovation-led opportunities for advanced foliage fertilizer solutions.

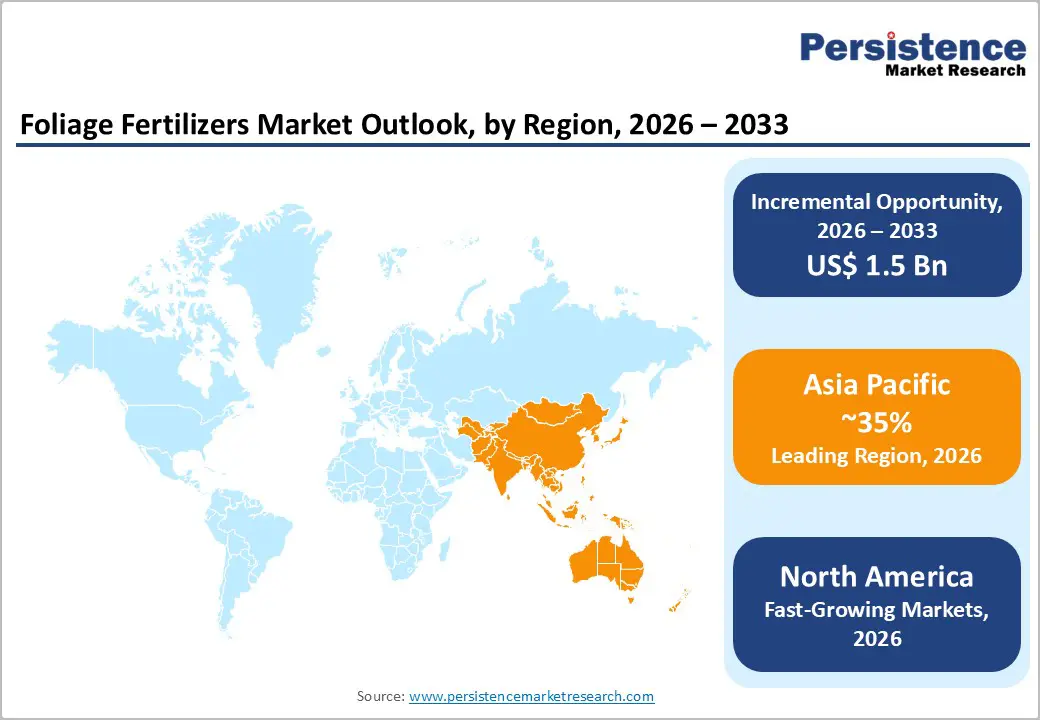

Asia-Pacific represents the most compelling growth opportunity in the global foliage fertilizers market, driven by scale, modernization, and policy support. The region accounts for over 35% of global demand in 2026, with market value of US$ 920–1,050 million, projected to nearly double to US$ 1,850–2,100 million by 2033, reflecting a robust 8.4% CAGR, well above the global average. China and India anchor this opportunity, together contributing more than 60% of regional demand, supported by intensive cultivation, yield optimization needs, and expanding agri-input infrastructure.

Country-level dynamics further strengthen the investment case. China’s high-intensity farming systems and environmental compliance focus drive steady adoption, while India offers the fastest growth trajectory (11.5% CAGR), fueled by rapid agricultural modernization and smallholder productivity programs. ASEAN markets such as Vietnam, Thailand, and Indonesia add incremental upside through mechanization and export-oriented farming.

Population-led food security pressures, requiring over 2% annual agricultural output growth, underpin sustained demand for nutrient-efficient solutions. Support from institutions such as the World Bank and the Asian Development Bank, alongside national incentive schemes, accelerates adoption of foliar nutrition and precision practices.

With a fragmented competitive structure (top five at 40–50%), expanding private investment, and strong momentum in bio-fertilizers, digital advisory, and cooperative distribution, Asia-Pacific offers US$ 800–1,200 million in incremental addressable opportunity through 2033.

North America represents a compelling growth opportunity for foliage fertilizer manufacturers, supported by scale, technology adoption, and regulatory alignment. Valued at US$ 510–560 million in 2026 and accounting for nearly 20% of global demand, the regional market is projected to reach US$ 850–950 million by 2033, expanding at a 7.3% CAGR. The United States anchors this opportunity with 75–80% regional share, driven by 915 million acres of cultivated land, high-input farming systems, and over 65% adoption of precision agriculture technologies, creating sustained demand for efficient foliar nutrient delivery.

Canada strengthens the opportunity through its premium horticultural segment, where foliage fertilizers show 42–48% penetration in fruit and vegetable production, favoring high-margin, specialty formulations. Mexico adds a fast-growing dimension, with agricultural modernization and the USMCA framework supporting cross-border supply chains and an estimated 7.8% CAGR, making it an attractive expansion market.

Regulatory emphasis on nutrient efficiency and environmental protection—reinforced by Environmental Protection Agency mandates and Clean Water Act compliance—positions foliage fertilizers as compliant, low-loss solutions. Coupled with US$ 2.1 billion in agri-tech funding and rising investment in bio-fertilizers, digital farming, and precision application systems, North America offers strong opportunities for innovation-led, premium market growth.

The global foliage fertilizers market demonstrates moderate fragmentation with top five companies commanding estimated 45-55% of global market share, indicating competitive market with opportunities for regional specialists and innovative product developers. Market leaders include multinational agrochemical corporations including Nutrien Limited, Yara International, K+S Group, and emerging specialty fertilizer manufacturers. Market concentration varies substantially by region, with North America demonstrating higher concentration (60-65% for top five) compared to Asia-Pacific (38-45% for top five) reflecting regional competitive dynamics. Market leadership positioning emphasizes product innovation, regulatory compliance, sustainability credentials, and integrated technical support ecosystems. Competitive differentiation focuses on product efficacy documentation, application technology development, organic and bio-fertilizer product portfolio expansion, and geographic market penetration strategies.

The Foliage Fertilizers market is estimated to be valued at US$ 2.6 Bn in 2026.

The key demand driver for the Foliage Fertilizers market is the growing need to maximize crop yields and nutrient-use efficiency amid limited arable land and rising food demand.

In 2026, the Asia Pacific region will dominate the market with an exceeding 35% revenue share in the global Foliage Fertilizers market.

Among applications, Agriculture has the highest preference, capturing beyond 60% of the market revenue share in 2026, surpassing other applications.

Yara International, Nutrien Ltd., The Mosaic Company, ICL Group Ltd., Haifa Group, EuroChem Group, CF Industries Holdings, Inc., OCI Nitrogen, and K+S Aktiengesellschaft. There are a few leading players in the Foliage Fertilizers market.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis Units | Value: US$ Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

| Customization and Pricing | Available upon request |

By Product Type

By Application

By Crop Type

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author