ID: PMRREP36137| 264 Pages | 13 Feb 2026 | Format: PDF, Excel, PPT* | Industrial Automation

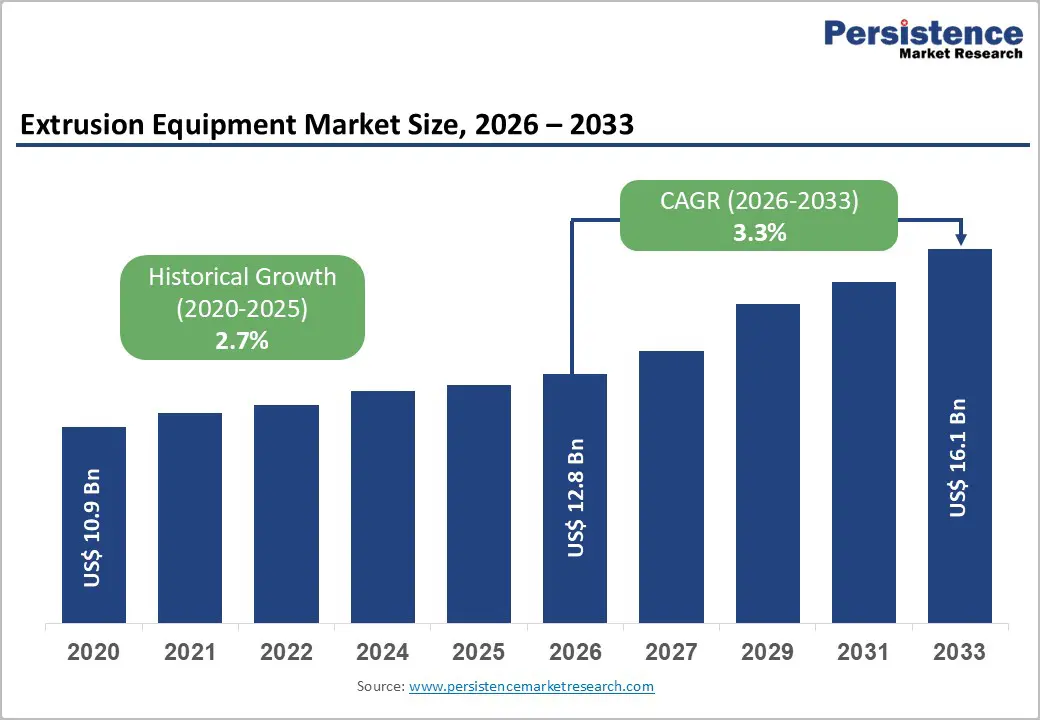

The global extrusion equipment market size is expected to be valued at US$ 12.8 billion in 2026 and projected to reach US$ 16.1 billion by 2033, growing at a CAGR of 3.3% between 2026 and 2033.

The market is witnessing strong growth due to robust demand from the packaging and construction industries, which require efficient production of films, profiles, and pipes. Rising infrastructure investments, especially across the Asia Pacific, are further supporting market expansion. Advancements in automation, energy-efficient systems, and sustainable manufacturing practices are also driving adoption. Additionally, the increasing use of lightweight materials in automotive applications is accelerating demand for advanced extrusion technologies globally.

| Key Insights | Details |

|---|---|

| Extrusion Equipment Size (2026E) | US$ 12.8 billion |

| Market Value Forecast (2033F) | US$ 16.1 billion |

| Projected Growth CAGR (2026 - 2033) | 3.3% |

| Historical Market Growth (2020 - 2025) | 2.7% |

The rapid expansion of e-commerce, consumer goods, and flexible packaging solutions is significantly boosting demand for extrusion equipment. Packaging remains one of the largest application areas, as manufacturers increasingly require high-speed extruders for producing films, sheets, and profiles. At the same time, the construction sector continues to rely on extruded pipes, panels, and insulation materials to support large-scale infrastructure and urban development projects. Strong investment in housing, roads, and utilities across Asia Pacific further strengthens this demand outlook.

Modern extrusion systems also offer higher throughput, improved material efficiency, and reduced waste, making them essential for meeting volume-driven requirements. As both packaging and construction industries grow steadily, extrusion equipment adoption is expected to remain strong across global manufacturing hubs.

Technological progress in automation is a key driver shaping the extrusion equipment market. The integration of IoT-enabled monitoring, smart process controls, and energy-efficient drives allows manufacturers to improve operational precision, reduce downtime, and lower overall energy consumption. Automated extrusion lines are increasingly preferred for high-volume production environments due to their consistency and productivity benefits.

In parallel, sustainability requirements are accelerating demand for recycling-compatible extrusion systems. Regulations promoting circular economy practices are encouraging the use of extruders designed for processing recycled plastics and bio-based materials. Twin-screw extruders, in particular, are widely adopted for compounding and high-quality recycled output, supporting both industrial and food-grade applications globally.

The extrusion equipment market faces restraints due to the high upfront costs associated with advanced extrusion systems. Modern extruders equipped with automation, precision controls, and energy-efficient drives require significantly larger investments compared to conventional models, making adoption difficult for small and mid-sized manufacturers. In addition, operating and maintaining these complex machines demands skilled technicians and trained operators, which remains a challenge in many emerging economies.

Labor shortages and limited technical expertise can lead to inefficiencies, downtime, and higher operational expenses. Furthermore, fluctuations in raw material prices, particularly in plastics and polymers, add financial pressure on manufacturers by squeezing profit margins and reducing willingness to invest in new extrusion capacity.

Stringent environmental regulations are another major restraint affecting extrusion equipment adoption. Governments and regulatory bodies, especially in Europe, are enforcing stricter emission standards, energy efficiency requirements, and waste management rules for industrial machinery. Compliance often requires manufacturers to invest in advanced filtration systems, low-emission designs, and recycling-compatible equipment, increasing overall production costs.

Additionally, older extrusion machines are increasingly restricted under sustainability policies, forcing companies to upgrade or retrofit existing systems. However, high retrofit and replacement expenses can slow modernization efforts, particularly in cost-sensitive regions. These regulatory burdens may delay equipment purchases despite growing demand across key industries.

The extrusion equipment market presents strong opportunities through expanding applications in the medical and automotive sectors. In healthcare, demand is rising for precision-extruded tubing used in catheters, IV lines, and advanced multi-lumen medical devices, where high accuracy and contamination-free production are critical. This trend is supported by continuous innovation in specialized polymer extrusion technologies.

In the automotive industry, manufacturers are increasingly adopting lightweight extruded components to improve fuel efficiency and support electric vehicle production. Extruded profiles, seals, and cable coatings are gaining importance in next-generation mobility systems. Asia Pacific, particularly India, is emerging as a key hub due to policy incentives and growing EV component manufacturing.

The increasing adoption of multi-layer extrusion technologies offers significant growth potential for the market. Multi-layer systems enable the production of high-barrier films and advanced packaging materials that improve shelf life, reduce food waste, and support sustainable consumption patterns. These solutions are especially valuable for e-commerce and food packaging, where durability and freshness are essential.

Industry 4.0 integration further strengthens this opportunity by enabling smarter process control, higher precision, and reduced material usage. Manufacturers are investing in co-extrusion and multi-layer capabilities to meet demand for recyclable and eco-friendly packaging formats. China and other Asia Pacific countries are actively leading pilot projects, accelerating commercial deployment globally.

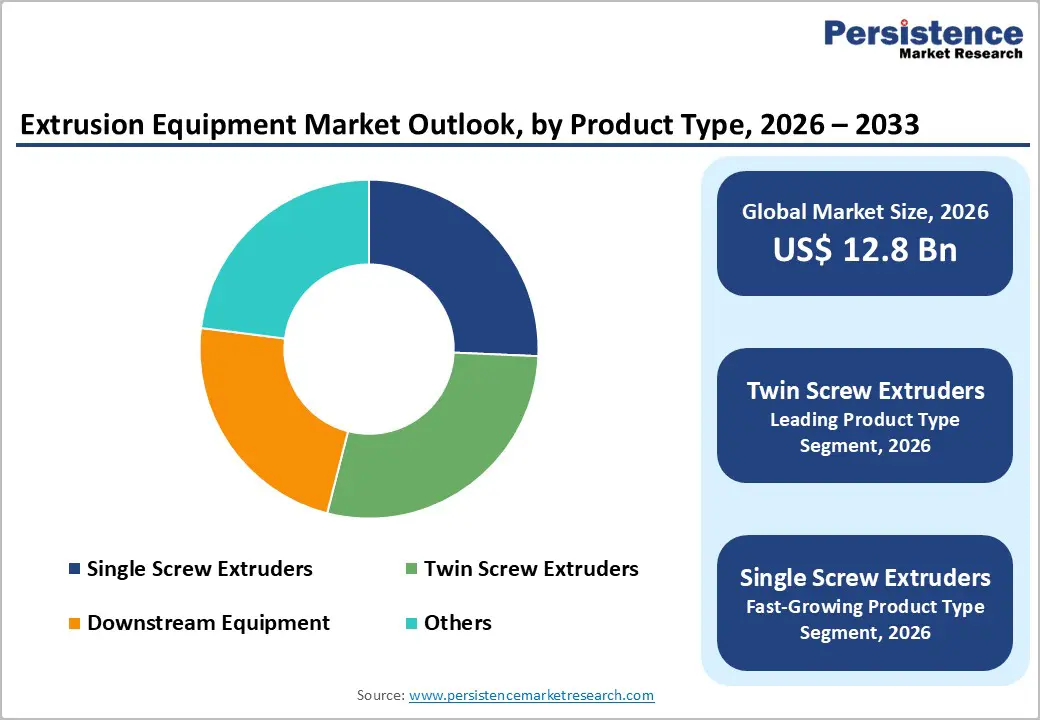

Twin screw extruders dominate the product type segment, holding nearly 43.5% market share in 2025, supported by their superior mixing efficiency and ability to process complex materials such as recycled polymers and specialty compounds. Co-rotating twin screw variants account for a significant portion of adoption, as they are widely preferred in plastics compounding for pharmaceuticals, food, and high-performance industrial applications. Their modular design and high throughput capabilities strengthen their leadership position.

Looking ahead, single screw extruders are expected to witness faster growth due to increasing demand for cost-effective extrusion solutions in standard packaging films, pipes, and consumer goods. Their simpler configuration, lower maintenance needs, and suitability for high-volume production make them attractive for emerging manufacturers expanding capacity globally.

Variable load extrusion systems lead the load type segment, capturing around 65% share in 2025, driven by their cost-effectiveness and broad applicability in conventional plastic and metal extrusion processes. These systems are widely adopted in high-volume packaging and industrial production lines, where consistent output and operational simplicity are critical. Their flexibility in handling standard billet and polymer processing further supports dominance across key end-use sectors.

In the coming years, specialized load configurations are expected to grow more rapidly as industries increasingly demand customized extrusion solutions. Advanced applications in automotive, medical tubing, and engineered profiles require higher precision and adaptive load handling, encouraging manufacturers to invest in more sophisticated extrusion setups.

Horizontal extrusion presses command the largest share of the press position segment, accounting for nearly 70% in 2025, primarily due to their suitability for producing long profiles used in construction, transportation, and industrial applications. These presses offer uniform output, scalability, and space-efficient installation, making them the preferred choice for large-scale production of aluminum beams, structural components, and extended polymer profiles.

Going forward, vertical press systems are anticipated to grow at a faster pace as demand rises for compact, high-precision extrusion in specialized industries. Applications requiring smaller footprint machinery, intricate shapes, and enhanced control such as aerospace and advanced manufacturing are creating new opportunities for vertical extrusion technologies.

Packaging remains the leading application segment, holding close to 40% market share in 2025, driven by the booming demand for films, flexible packaging, and lightweight materials supporting the global expansion of e-commerce. Construction follows strongly, accounting for a significant portion of demand through extruded pipes, panels, and insulation products used in infrastructure and urban development projects.

In the years ahead, automotive applications are expected to grow most rapidly as manufacturers increasingly adopt lightweight extruded profiles, seals, and cable coatings for electric vehicles and fuel-efficient transportation systems. Rising demand for customized and sustainable components is accelerating extrusion equipment adoption beyond traditional packaging and construction markets.

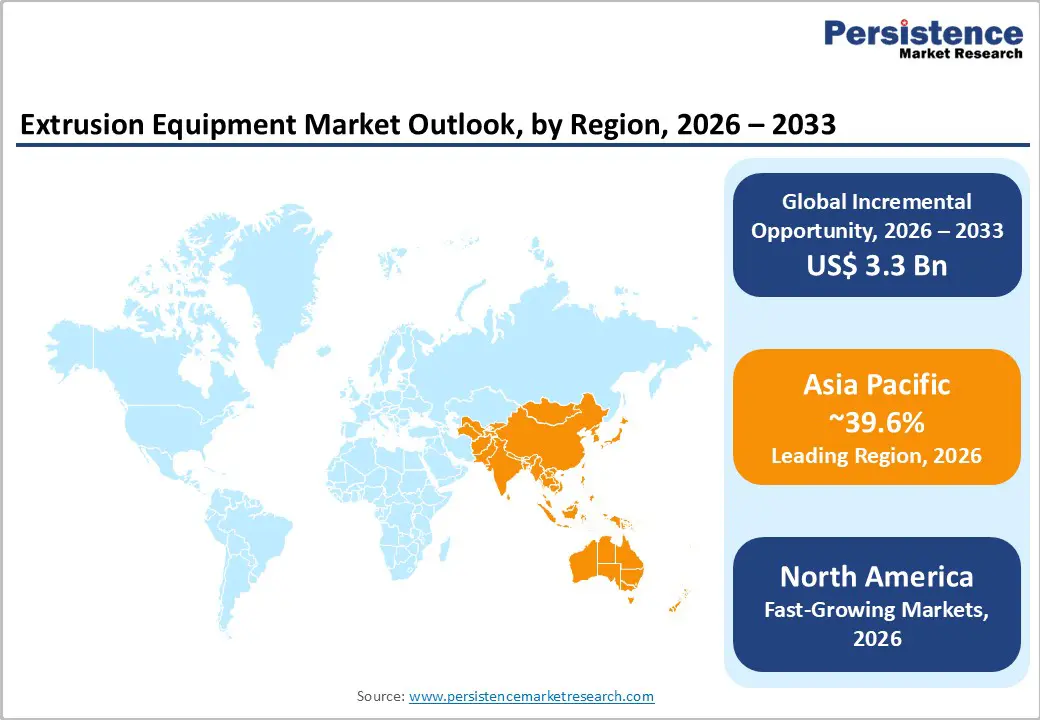

North America accounts for a significant position in the extrusion equipment market, supported by strong industrial demand across packaging, construction, and automotive applications. The region accounts for nearly 31.7% share, with the U.S. leading due to robust infrastructure investments and high consumption of flexible packaging materials. Advanced manufacturing capabilities and federal spending programs further support equipment modernization and capacity expansion across key industries.

Innovation remains a major strength, with twin screw extrusion technologies increasingly adopted for high-precision medical tubing and specialty polymers. Regulatory oversight from agencies such as the FDA ensures strict quality standards, driving demand for advanced and reliable extrusion systems. Sustainability initiatives are also accelerating adoption of energy-efficient machinery, reducing waste and supporting greener automotive and industrial production.

Europe represents a technologically advanced extrusion equipment market, driven by strong demand from automotive, chemical, food, and pharmaceutical industries. Germany leads regional performance through precision extrusion systems supporting engineered plastics and lightweight automotive components. France and the U.K. continue expanding food-grade and pharma extrusion applications, while harmonized regulatory frameworks such as REACH ensure high compliance standards across manufacturing sectors. Europe market is projected at a CAGR of 3.7%, supported by ongoing industrial upgrades.

Sustainability remains a key growth catalyst, with circular economy policies encouraging the adoption of recycling-focused and bio-based extrusion technologies. Italy is making notable progress in advanced recycling extrusion systems, while regional manufacturers increasingly invest in energy-efficient equipment to meet emissions targets. These trends enhance Europe’s competitiveness in sustainable extrusion solutions globally.

Asia Pacific dominates the global extrusion equipment market, accounting for nearly 39.6% market share, driven by large-scale manufacturing expansion and strong demand from packaging, construction, and consumer goods sectors. China leads the region through massive industrial output and investments in smart factory extrusion lines, while India’s growth is supported by infrastructure development and rising domestic polymer consumption. ASEAN countries also contribute significantly through expanding packaging production and export-oriented manufacturing advantages.

The region continues to witness rapid technological adoption, with Japan advancing high-tech extrusion applications in electronics, automotive, and specialty materials. Cost-efficient production capabilities, combined with increasing automation and government-backed industrial initiatives, are accelerating extrusion equipment deployment. Sustainability-driven upgrades, especially in recycling and lightweight materials, are further strengthening Asia Pacific’s leadership in global extrusion manufacturing.

The extrusion equipment market is moderately consolidated, with leading manufacturers maintaining strong positions through continuous investment in advanced engineering and automation-focused product development. Competitive differentiation is increasingly driven by modular system designs, higher throughput efficiency, and the ability to process recycled and specialty materials. Sustainability and energy optimization have become key factors shaping purchasing decisions across end-use industries.

Market participants are also strengthening their offerings through smart extrusion technologies, including IoT-enabled monitoring and predictive maintenance capabilities. These innovations improve operational reliability, reduce downtime, and support Industry 4.0 adoption. Emerging players are gaining traction by delivering customized, cost-effective solutions tailored to evolving packaging, construction, and automotive requirements.

The global Extrusion Equipment Market is expected to reach US$ 12.8 billion in 2026.

Rising packaging needs from e-commerce, accounting for 40% share in 2025, are driving extrusion equipment demand.

Asia Pacific leads with 39.6% market share in 2025, supported by strong manufacturing growth in China and India.

Medical and automotive applications offer strong opportunities through rising demand for precision tubing and lightweight extruded components.

Major manufacturers include Davis-Standard, Coperion, KraussMaffei, Reifenhäuser, and Leistritz, focusing on automation and sustainable extrusion solutions.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Load Type

By Press Position

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author