ID: PMRREP5840| 336 Pages | 18 Apr 2025 | Format: PDF, Excel, PPT* | Healthcare

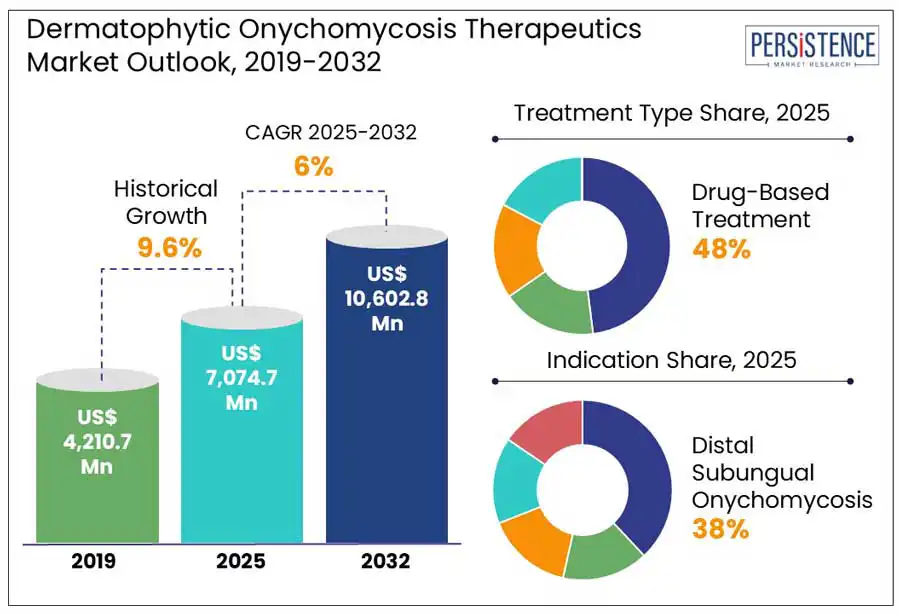

The global dermatophytic onychomycosis therapeutics market is projected to witness a CAGR of 6.0% from 2025 to 2032. It is anticipated to increase from US$ 7,074.7 Mn recorded in 2025 to a staggering US$ 10,602.8 Mn by 2032. The global dermatophytic onychomycosis therapeutics market is experiencing steady growth, driven by the rising prevalence of fungal nail infections and increased awareness about personal hygiene. Dermatophytic onychomycosis, primarily caused by dermatophytes, affects toenails and fingernails, leading to discoloration, thickening, and brittleness. The demand for effective treatment options, including oral antifungals, topical therapies, and combination treatments, is fueling innovation in the market.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Dermatophytic Onychomycosis Therapeutics Market Size (2025E) |

US$ 7,074.7 Mn |

|

Market Value Forecast (2032F) |

US$ 10,602.8 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

6.0% |

|

Historical Market Growth (CAGR 2019 to 2024) |

9.6% |

The global increase in the diabetic population is a major factor driving the growth of the antifungal treatment market. Diabetes weakens the immune system and impairs peripheral circulation, creating an ideal environment for fungal infections particularly toenail infections such as onychomycosis. According to the American Diabetes Association (ADA), fungal nail infections are often underdiagnosed in individuals with diabetes. However, if left untreated, they can lead to serious foot complications such as ulcers and even amputations. Research indicates that onychomycosis affects 22–35% of people with diabetes making them two to three times more likely to develop the condition compared to non-diabetics.

With a growing emphasis on preventing complications in diabetic patients, there has been increased innovation in antifungal treatments. Pharmaceutical companies are developing more effective and safer antifungal medications, both topical creams and oral pills, specifically designed to meet the needs of diabetic individuals. These treatments are easy to use, widely accessible, and tailored to address the unique challenges faced by the user. The rise in diabetes rates and the increased risk of fungal nail infections prompts healthcare systems to enhance their strategies for managing onychomycosis thereby driving demand for improved treatment solutions.

Dermatophytic onychomycosis, being a slow-progressing and deeply embedded nail infection, is difficult to completely cure. Even with prolonged antifungal therapy spanning several months, many patients experience only partial clearance of the infection. This is primarily due to poor drug penetration through the nail plate, suboptimal patient adherence, and the ability of dermatophytes to persist in the nail bed or surrounding skin unnoticed.

Relapses are common with recurrence rates ranging between 10% and 53% within a year post-treatment, depending on the drug used and the patient’s overall health. The high relapse rate not only frustrates patients but also diminishes trust in available therapeutics, leading to lower re-treatment rates and poor compliance with follow-up regimens. Additionally, repeated cycles of infection can result in more resistant fungal strains, further complicating treatment efforts.

The demand for antifungal treatments tailored to the unique needs of diabetic patients presents a high-potential market opportunity. Individuals with diabetes often experience impaired blood circulation, weakened immune responses, and delayed wound healing, making them significantly more vulnerable to chronic and recurring fungal infections such as dermatophytic onychomycosis. Traditional antifungal medications may not be optimal for this group, as they can carry systemic toxicity risks or lack the efficacy due to reduced absorption in compromised tissues.

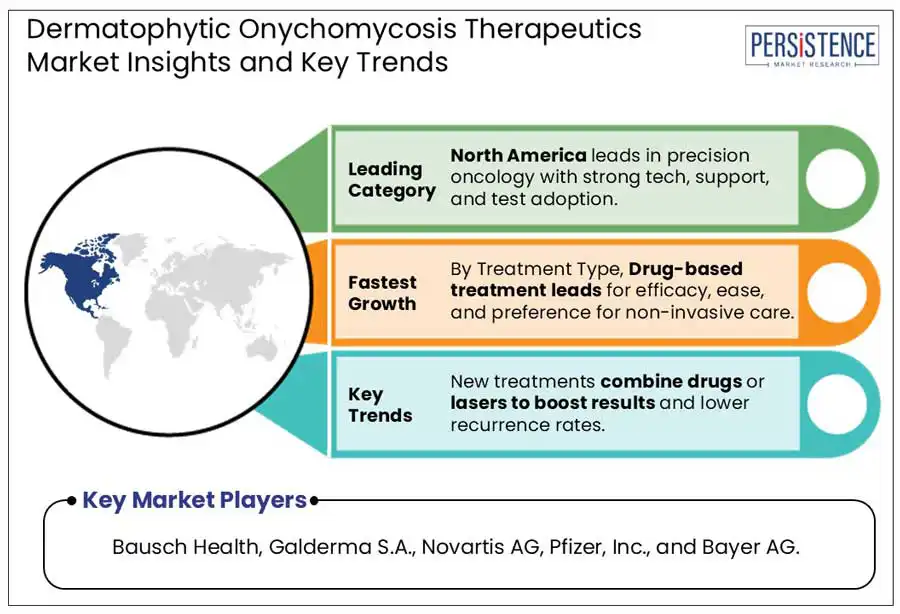

The drug-based treatment segment dominates due to its proven efficacy, broad clinical acceptance, and accessibility. Oral and topical antifungal medications, such as terbinafine and efinaconazole, remain the first-line choice for most healthcare providers, owing to decades of research, regulatory approvals, and real-world effectiveness. Laser therapy ranks next as an emerging, non-invasive alternative that appeals to patients seeking quicker, localized results without systemic side effects. While Photodynamic therapy (PDT) is a promising innovation, its adoption is constrained by complex treatment protocols and limited practitioner expertise. Combination therapy, which merges pharmacological and device-based approaches, is gaining traction, especially for recurrent or resistant infections.

Distal subungual onychomycosis (DSO) stands as the leading indication segment in the market owing to its overwhelming prevalence and clinical complexity. Representing approximately 85–90% of all dermatophyte-related nail infections, DSO primarily affects the toenails and originates at the nail bed near the tip of the nail. White superficial onychomycosis (WSO) and proximal subungual onychomycosis (PSO) are emerging segments, though less prevalent. WSO is more superficial and easier to treat but accounts for a smaller patient population. PSO, while rare, is clinically significant as it may signal underlying immune suppression, such as in HIV-positive patients. Candidal onychomycosis is more common in fingernails and is associated with chronic exposure to moisture, particularly in individuals with frequent handwashing or certain occupations. Total dystrophic onychomycosis is often the final stage of untreated cases and represents a niche but complex segment requires advanced therapy.

Retail sales dominate the market due to the high prevalence of self-treatment and easy accessibility of over-the-counter (OTC) antifungal products. Many individuals suffering from nail fungal infections tend to underestimate the condition’s severity, opting for convenient, non-prescription remedies available at pharmacies, supermarkets, and online platforms. This behavior is further supported by the social stigma associated with fungal infections, prompting patients to seek discreet, at-home solutions rather than visiting clinics.

The demand for advanced, fast-acting and minimally invasive treatment options such as topical agents, oral antifungals, and laser therapies, continues to drive innovation and growth. Moreover, strong pharmaceutical R&D, regulatory support for new drug approvals, and the presence of major market players contribute to the region’s dominance. Also, in the U.S., the dermatophytic onychomycosis therapeutics market is fueled by the rising cases of fungal nail infections, consumer preference for aesthetic nail health, and growing awareness around early diagnosis. The country also benefits from a highly commercialized healthcare system and the rapid adoption of new therapeutic technologies making it the primary revenue contributor in the region.

European consumers often prefer natural or non-invasive treatments, contributing to the popularity of herbal and alternative antifungal options. Additionally, public healthcare systems across Europe tend to emphasize cost-effective therapies, influencing prescription patterns toward generics and long-established medications. There is also a growing interest in pediatric care and preventive strategies across countries such as Germany and the U.K., reflecting a proactive stance on foot health.

The increasing use of traditional medicine systems such as Ayurveda and Traditional Chinese Medicine are integrated with modern therapeutics. The rapid digitalization in healthcare enables tele-dermatology services, improving diagnosis rates in remote areas. The youthful population is becoming more image-conscious, boosting demand for aesthetic nail treatments and external appearance.

The global dermatophytic onychomycosis therapeutics market is fragmented, marked by a mix of global pharmaceutical giants and emerging biotech firms. Competition is fueled by the demand for faster, more effective, and side-effect-free treatments. Strategic collaborations, product launches, and patent developments are common, while increasing interest in combination therapies and non-invasive treatments is shaping future competitive strategies.

The global dermatophytic onychomycosis therapeutics market is estimated to increase from US$ 7,074.7 Mn in 2025 to US$ 10,602.8 Mn in 2032.

Increasing cases of onychomycosis, especially among the elderly and diabetic populations, are driving demand for effective treatments.

The market is projected to record a CAGR of 6.0% during the forecast period from 2025 to 2032.

Tele-dermatology and mobile health platforms present new avenues for diagnosis, prescription, and patient monitoring.

Some leading players in the dermatophytic onychomycosis therapeutics market include Bausch Health, Galderma S.A., Novartis AG, Pfizer, Inc., Moberg Pharma AB, and others.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Mn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Treatment Type

By Indication

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author