ID: PMRREP35850| 192 Pages | 14 Nov 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

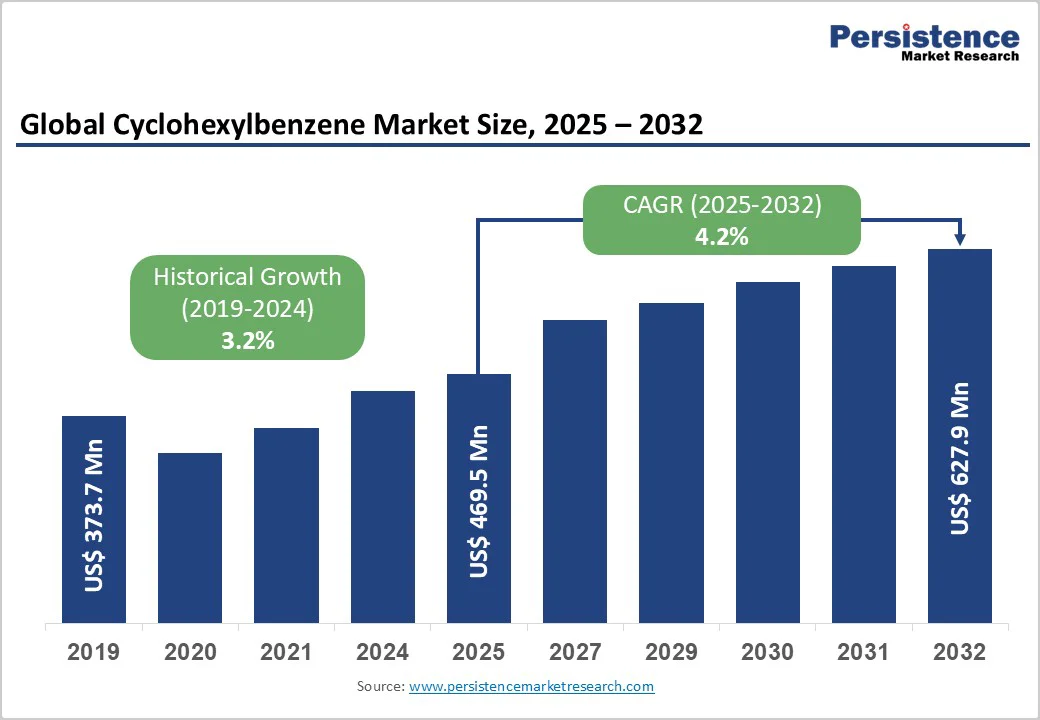

The global cyclohexylbenzene market size is likely to value US$ 469.5 million in 2025 and is expected to reach US$ 627.9 million, growing at a CAGR of 4.2% by 2032.

Market expansion is driven by demand from high-performance end uses. Rapidly expanding electronics (LCDs, semiconductors) and lithium-ion battery manufacturing require cyclohexylbenzene as a high-boiling solvent or intermediate. Growth in automotive and EV production (lightweight plastics, battery components) also encourages its use.

| Key Insights | Details |

|---|---|

| Cyclohexylbenzenes Market Size (2025E) | US$ 469.5 Mn |

| Market Value Forecast (2032F) | US$ 627.9 Mn |

| Projected Growth (CAGR 2025 to 2032) | 4.2% |

| Historical Market Growth (CAGR 2019 to 2024) | 3.2% |

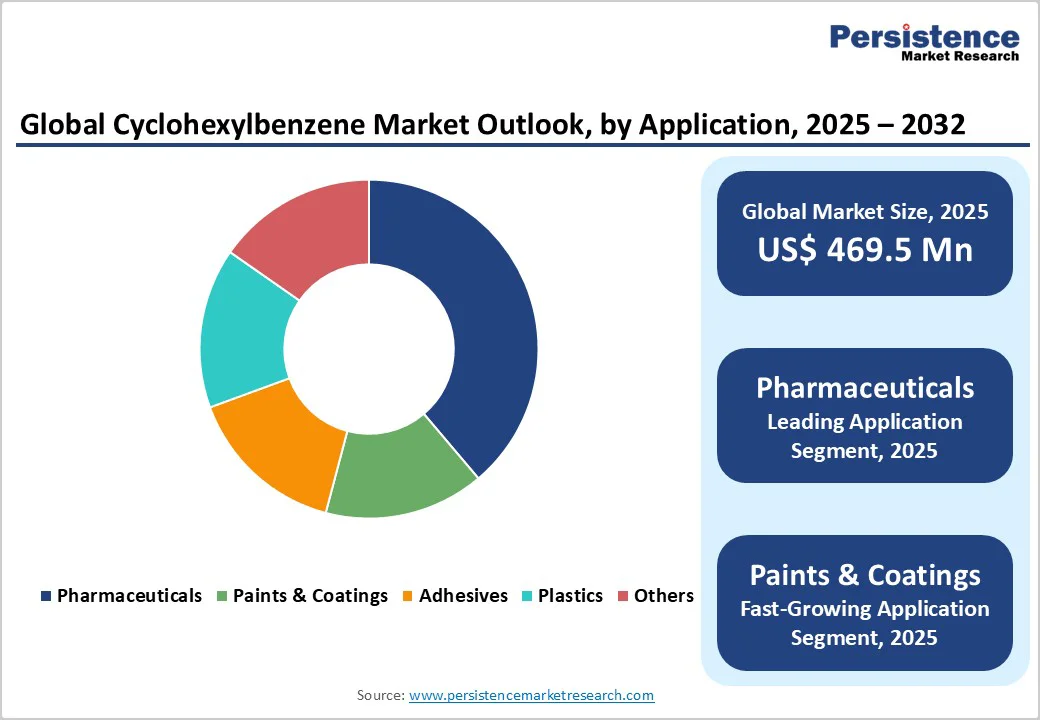

The pharmaceutical industry remains a key growth driver for the cyclohexylbenzene market, accounting for over 35% of total demand. This compound is widely used as an intermediate in the production of active pharmaceutical ingredients (APIs), particularly in formulations for analgesics and anti-inflammatory drugs.

With global pharmaceutical spending projected to exceed US$ 1.5 trillion by 2025 (IFPMA), demand for high-purity intermediates like cyclohexylbenzene continues to surge.

Technological advancements in catalytic synthesis and process optimization have enhanced production efficiency, reducing costs by up to 20% per unit (FDA). Moreover, increasing regulatory approvals for novel drug formulations and the rising elderly population across North America, Europe, and the Asia Pacific are intensifying consumption levels.

Collectively, these factors are expected to drive the segment at a CAGR of 4.5%, reinforcing cyclohexylbenzene’s critical role in supporting pharmaceutical innovation and large-scale drug manufacturing.

The paints and coatings industry represents the fastest-growing end-use segment for cyclohexylbenzene, driven by expanding infrastructure development and automotive production. The global paints market, valued at US$ 200 billion in 2023 (ACA), increasingly integrates cyclohexylbenzene as a solvent and additive in high-performance coatings.

These include corrosion-resistant, heat-stable, and UV-protective formulations essential for modern industrial and architectural applications.

Technological innovation and eco-friendly coating formulations, supported by strict environmental regulations from the ECHA, have boosted annual adoption by nearly 12%. Rapid urbanization across the Asia Pacific, particularly in China and India, continues to fuel construction and industrial activities, further strengthening demand.

With a projected CAGR of 5.2%, the paints and coatings segment is set to offer lucrative opportunities, positioning cyclohexylbenzene as a preferred chemical component for sustainable and durable coating solutions.

The cyclohexylbenzene market faces significant restraint from stringent regulatory and health-related concerns alongside raw material cost volatility. As a volatile aromatic hydrocarbon, cyclohexylbenzene poses health risks such as skin irritation and potential carcinogenicity, prompting strict oversight by agencies such as the U.S. Environmental Protection Agency (EPA) and the European Union (EU) under REACH directives.

These regulations impose tight controls on emissions, storage, and handling, compelling manufacturers to invest in costly protective infrastructure such as closed-loop systems and recovery technologies, thereby elevating operational expenses and constraining production scalability.

Simultaneously, the compound’s price remains highly sensitive to fluctuations in benzene and cyclohexane feedstock, which are directly influenced by crude oil market volatility. Such instability can compress profit margins, hinder long-term contract stability, and expose producers to financial risks.

Furthermore, the availability of cheaper alternative intermediates, such as xylene derivatives, intensifies cost-based competition. Collectively, these factors pose economic and regulatory hurdles that restrain market expansion and challenge consistent supply chain stability.

The cyclohexylbenzene market presents a strong opportunity through its emerging pharmaceutical and high-purity production applications. Ongoing research highlights the compound’s potential use as a drug stabilizer and hydrophobic carrier, which could open a new high-value market segment.

If commercialized, ultra-pure pharmaceutical grades (99%+) would command premium pricing, supported by rising investments in biologics manufacturing and drug R&D. Simultaneously, the transition toward green manufacturing technologies, including catalytic hydrogenation and closed-loop solvent recovery, offers dual benefits of sustainability and improved yield.

These innovations not only reduce VOC emissions but also enhance production efficiency, aligning with global sustainability goals and regulatory trends. Market players investing in eco-efficient production upgrades can achieve higher profit margins while appealing to environmentally conscious customers in the life sciences and electronics sectors.

Furthermore, expanding operations across high-growth regions such as Asia-Pacific, India, and the Middle East, where industrialization and government initiatives drive demand, can substantially increase market penetration. Collectively, these factors create a multi-dimensional opportunity for manufacturers and investors alike.

The standard grade of cyclohexylbenzene dominates the market, accounting for approximately 60% of total revenue. This grade, with around 97% purity, serves as a cost-effective solvent and chemical intermediate across large-scale manufacturing sectors such as plastics, resins, and adhesives.

Its affordability and ease of availability make it the preferred option for commodity and bulk chemical applications, particularly in paints, coatings, and polymer formulations. The segment’s strong market share reflects its price competitiveness and widespread industrial adoption, especially in cost-sensitive emerging economies, where cost optimization drives large-scale usage.

Conversely, the High-Purity Grade (>99%) represents the fastest-growing segment, driven by rising demand from pharmaceutical, electronic, and semiconductor industries that require stringent impurity control. Growth in high-performance polymers and advanced materials has pushed adoption of this grade, with sales rising at double-digit annual rates.

Leading manufacturers are investing in specialized purification technologies to achieve ultra-clean quality standards, as seen in Tosoh’s advanced refining processes, ensuring compliance with demanding electronic and pharmaceutical-grade specifications.

Cyclohexylbenzene serves as a versatile intermediate across several industries, with pharmaceuticals representing the leading application segment, accounting for 33% of total demand. Its use as a solvent and intermediate in drug formulation and synthesis underpins its significance, particularly in producing controlled-release drugs and specialty capsules.

The expansion of the global life sciences sector and increasing emphasis on high-purity raw materials have amplified its adoption. Pharmaceutical manufacturers now prefer low-impurity, high-performance cyclohexylbenzene grades, supporting stringent regulatory and quality standards in active pharmaceutical ingredient (API) production.

The paints and coatings industry is the fastest-growing application, driven by rapid infrastructure development, automotive production, and stricter environmental regulations. Cyclohexylbenzene functions as a solvent, stabilizer, and viscosity modifier in high-performance coatings, enabling low-VOC and corrosion-resistant formulations. Its integration in automotive and aerospace coatings enhances durability, UV stability, and compliance with sustainability norms.

Meanwhile, plastics and polymers remain a key application area, particularly for engineering plastics and resin production such as polycarbonates, epoxies, and nylon precursors. Its role in improving polymer stability and performance aligns with the growing demand for lightweight materials in EVs and electronics.

Additionally, adhesives and heat transfer fluids represent emerging applications, reflecting cyclohexylbenzene’s broad industrial versatility and long-term market relevance.

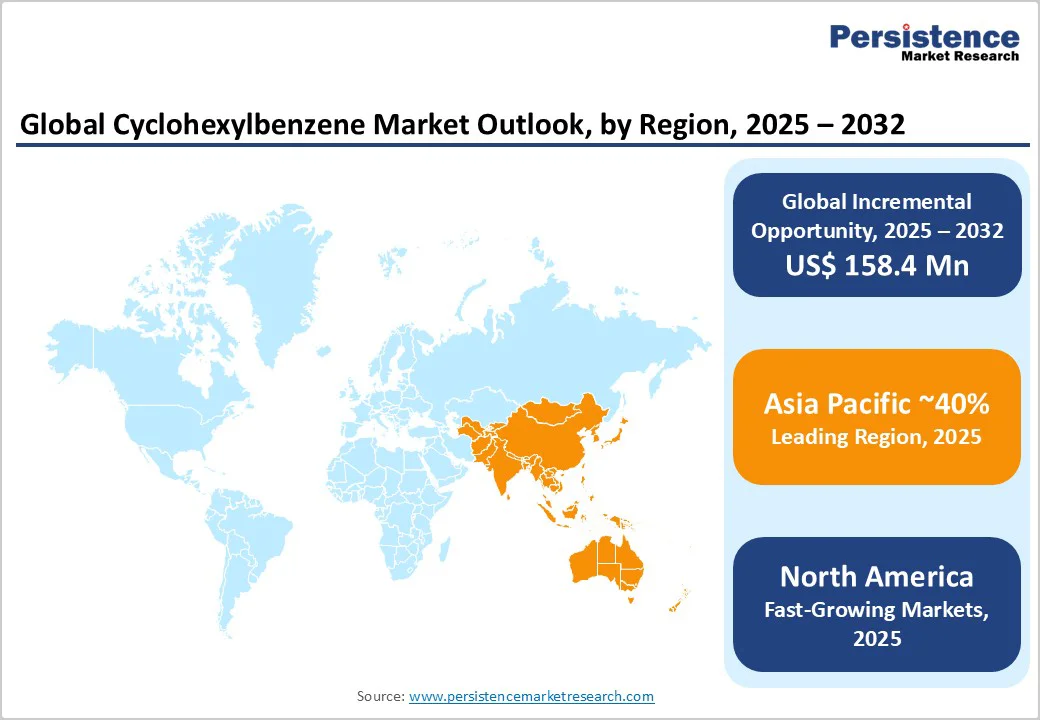

Asia Pacific dominates the global cyclohexylbenzene market, accounting for over 40% of global demand, and is projected to remain the fastest-growing region with a forecast CAGR of 5-6% through 2032.

The region’s leadership stems from the strong presence of China, Japan, India, and ASEAN countries, which collectively form the backbone of the global electronics, pharmaceutical, and chemical manufacturing industries. China and Japan host extensive production bases for high-purity chemicals, driven by applications in semiconductors, coatings, and polymers.

Investments such as Asahi Kasei’s 2025 expansion project in Jiangsu, China underscore the region’s capacity growth in advanced chemical processing. India’s “Make in India” initiative and expanding pharmaceutical and automotive sectors further enhance regional consumption of cyclohexylbenzene-based intermediates.

Additionally, rapid urbanization and infrastructure development across Southeast Asia are stimulating demand for paints, coatings, adhesives, and specialty materials.

Competitive advantages include low production costs, government incentives, and robust supply chains, though evolving environmental regulations such as China’s new VOC emission standards are accelerating the shift toward greener manufacturing. Supported by a vast phenol derivatives market and an expanding consumer economy, Asia Pacific continues to move up the value chain, solidifying China and India as pivotal hubs for both production and consumption.

North America, particularly the United States, represents a mature yet strategically important market for cyclohexylbenzene, supported by a robust chemical manufacturing ecosystem and advanced industrial base. The region accounts for approximately 20-25% of global market share, with the U.S. hosting over 14 active production facilities, as reported by the Environmental Protection Agency (EPA).

This strong domestic capacity enables a stable supply for key downstream industries, notably automotive, electronics, and pharmaceuticals. Demand is reinforced by the growth of lightweight automotive components, EV batteries, and high-value pharmaceutical intermediates.

Furthermore, the U.S. EPA's recent initiatives in 2025 aimed at emission reduction have accelerated the adoption of cleaner, energy-efficient production technologies, although stringent environmental compliance remains a challenge for producers. The region also benefits from high per-capita chemical consumption and a well-established R&D infrastructure that fosters innovation in customized high-purity grades and circular solvent recovery systems.

Regulatory frameworks such as TSCA, EPA, and OSHA shape investment strategies and encourage sustainable practices across the value chain. With a growing focus on reshoring specialty chemical production and strengthening supply chain integration with technology manufacturers, the North American cyclohexylbenzene market is poised for steady expansion at a positive CAGR, reflecting resilience and innovation-driven growth.

The global cyclohexylbenzene market is moderately fragmented, characterized by a mix of large multinational corporations and smaller specialty chemical producers. Leading companies such as Thermo Fisher Scientific and Sigma-Aldrich each hold single-digit to low double-digit market shares, indicating limited concentration and high competitive diversity. Major players like Mitsui Chemicals and Asahi Kasei compete alongside niche manufacturers offering high-purity or application-specific grades.

The market structure remains unconsolidated, as no single company commands global dominance. Entry barriers are moderate while process licensing enables new entrants, and scaling production remains capital-intensive.

Competitive strategies increasingly emphasize product differentiation, focusing on purity optimization, process sustainability, and regional integration rather than price competition. Strategic partnerships, joint ventures, and regional collaborations are common, allowing firms to strengthen distribution networks, enhance R&D capabilities, and ensure reliable supply continuity across diverse end-use industries.

The cyclohexylbenzenes market is estimated to be valued at US$ 469.5 Mn in 2025.

The key demand driver for the cyclohexylbenzene market is its extensive use as a chemical intermediate in the pharmaceutical industry, where it is essential for synthesizing active pharmaceutical ingredients (APIs) such as analgesics and anti-inflammatory drugs.

In 2025, the Asia Pacific region will dominate the market with an exceeding 40% revenue share in the global Cyclohexylbenzenes market.

Among product types, Standard Cyclohexylbenzenes holds the highest preference, capturing beyond 60% of the market revenue share in 2025, surpassing High Purity product type.

Thermo Fisher Scientific Inc., Sigma-Aldrich, Kishida Chemical Co., Ltd., Tokyo Chemical Industry Co., Ltd., China Qingdao Hong Jin Chemical Co., Ltd., Zhongneng Chemical Co., Ltd. , and Otto Chemie Pvt. Ltd. are a few leading players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author